This version of the form is not currently in use and is provided for reference only. Download this version of

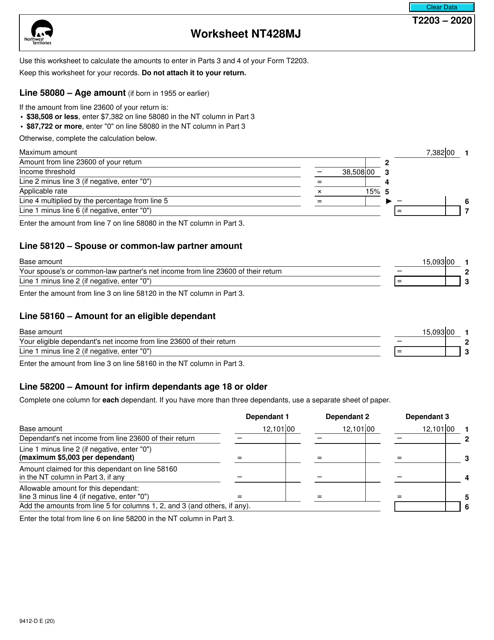

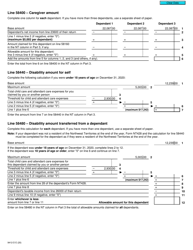

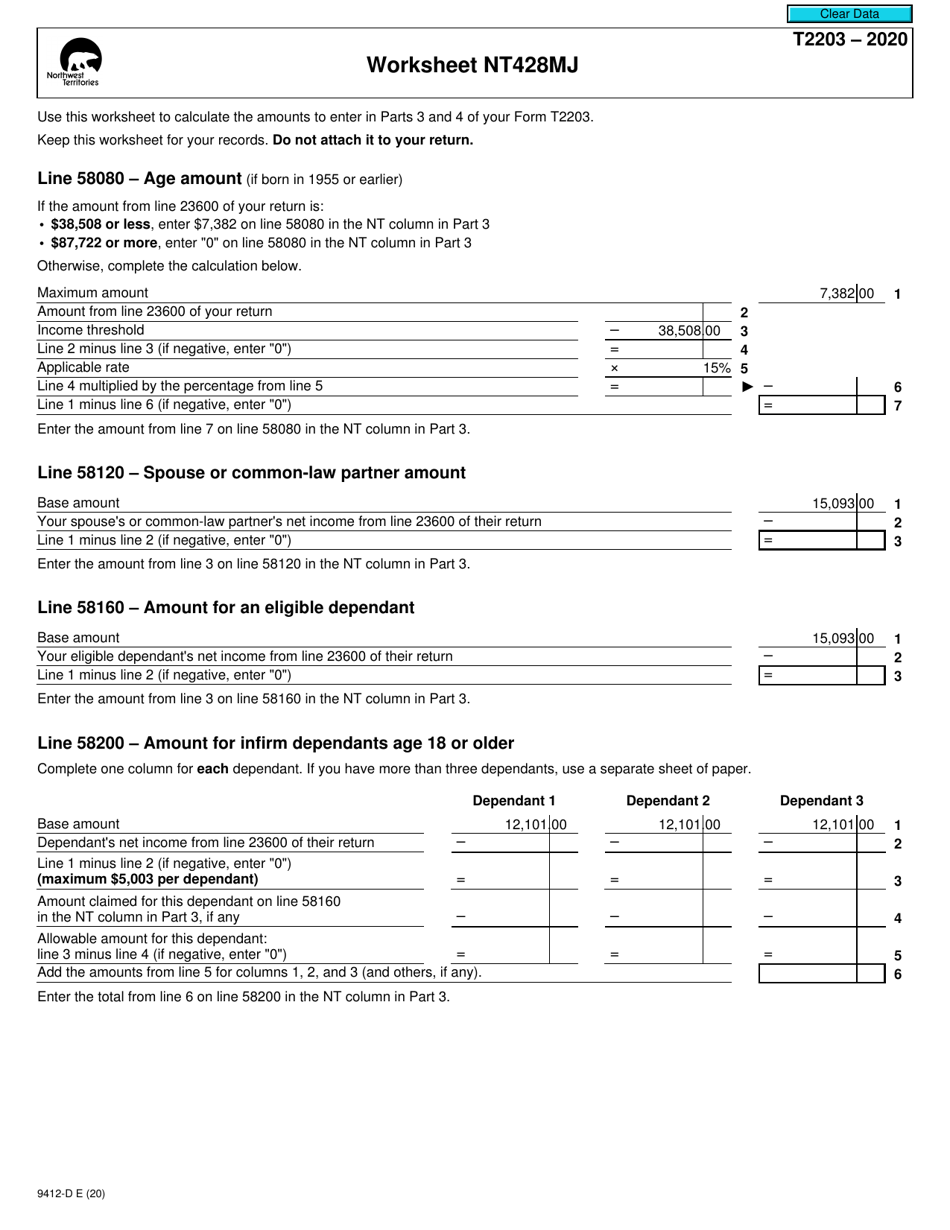

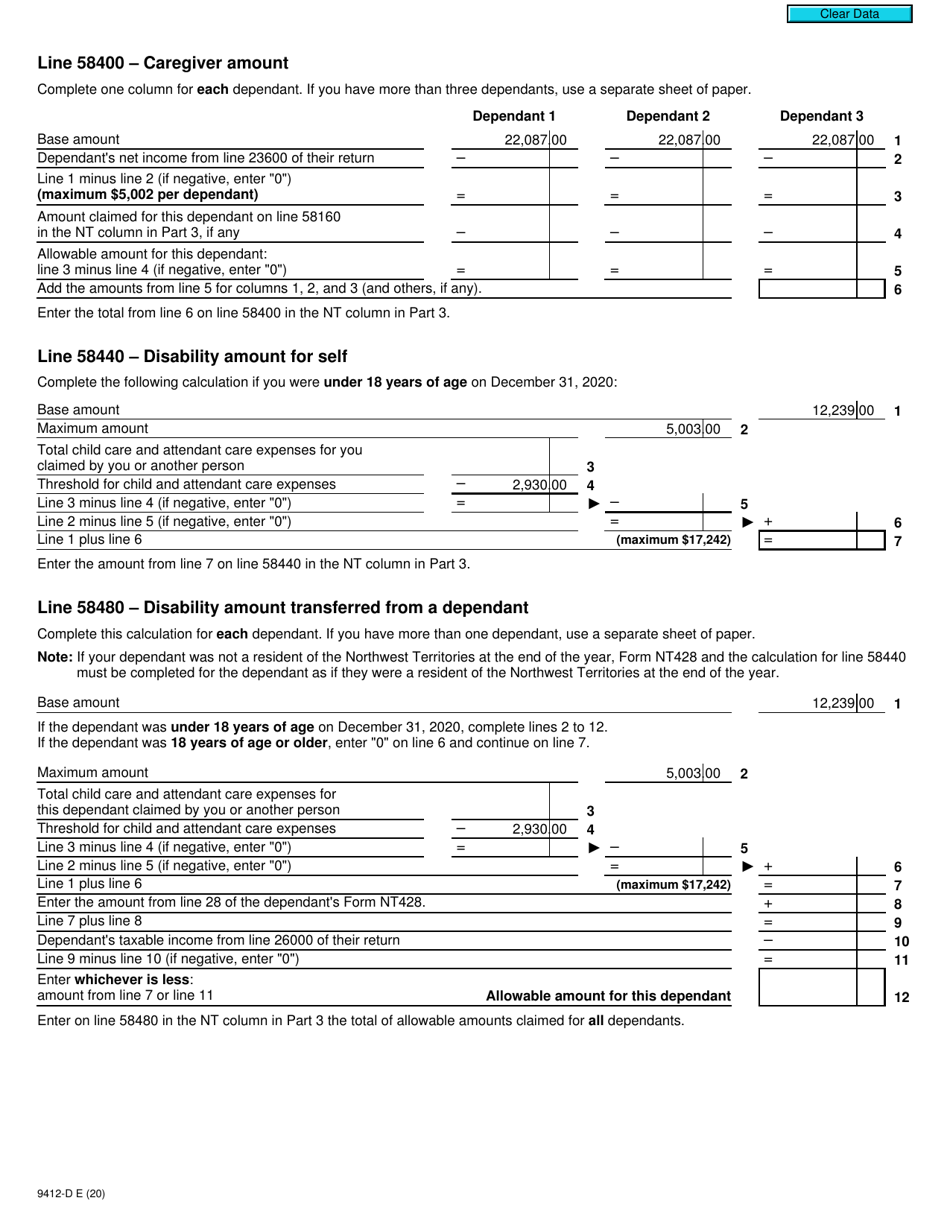

Form T2203 (9412-D) Worksheet NT428MJ

for the current year.

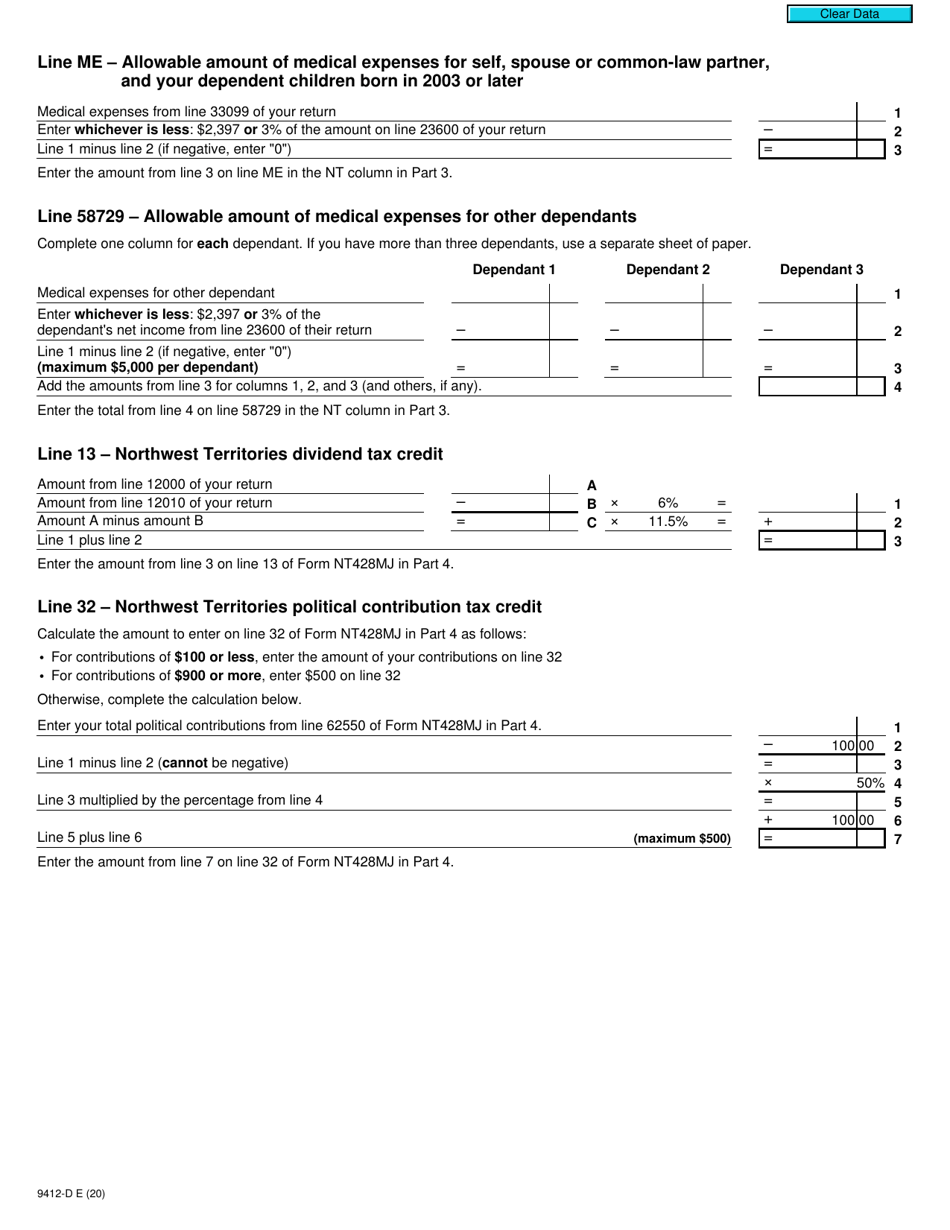

Form T2203 (9412-D) Worksheet NT428MJ Northwest Territories - Canada

Form T2203 (9412-D) Worksheet NT428MJ is a tax form used by individuals or businesses in the Northwest Territories of Canada to calculate the provincial tax credits and deductions they are eligible for. This form is specifically designed for residents of the Northwest Territories to supplement their federal tax return. It helps taxpayers determine the amount of provincial credits and deductions they can claim, which can help minimize their overall tax liability.

The Form T2203 (9412-D) Worksheet NT428MJ for the Northwest Territories, Canada, is filed by individual taxpayers who are residents of the Northwest Territories and need to report their income and claim various tax credits and deductions.

FAQ

Q: What is Form T2203?

A: Form T2203 is a worksheet specific to the Northwest Territories in Canada for calculating your territorial tax payable or refundable.

Q: Who needs to use Form T2203?

A: Residents of the Northwest Territories who are completing their Canadian income tax return and have income from the Northwest Territories.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to help calculate your territorial tax payable or refundable for the Northwest Territories.

Q: How do I complete Form T2203?

A: To complete Form T2203, follow the instructions provided on the form. You will need to fill in your personal information, report your income from the Northwest Territories, and calculate your territorial tax.

Q: What income should be reported on Form T2203?

A: You should report any income you earned from the Northwest Territories, such as employment income, business income, or rental income.

Q: What expenses can be deducted on Form T2203?

A: Certain expenses related to earning income in the Northwest Territories may be deductible. It is recommended to consult the instructions on Form T2203 or seek professional tax advice for specific deductions.

Q: When is Form T2203 due?

A: Form T2203 is usually due on or before April 30th of the following year for most taxpayers, or June 15th for self-employed individuals.

Q: Can Form T2203 be filed electronically?

A: Yes, Form T2203 can be filed electronically using the Canada Revenue Agency's NETFILE or EFILE services, if available.

Q: What should I do with Form T2203 after completing it?

A: After completing Form T2203, you should keep a copy for your records and submit it along with your Canadian income tax return, either electronically or by mail.