This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9410-C; BC428MJ) Part 4

for the current year.

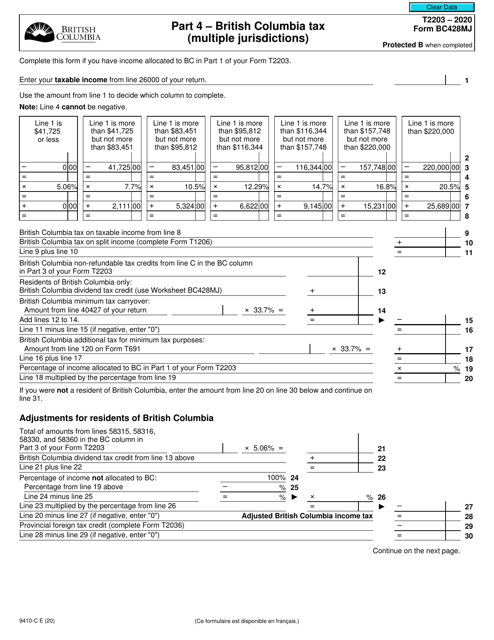

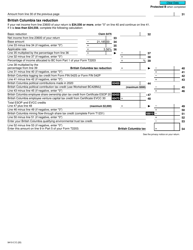

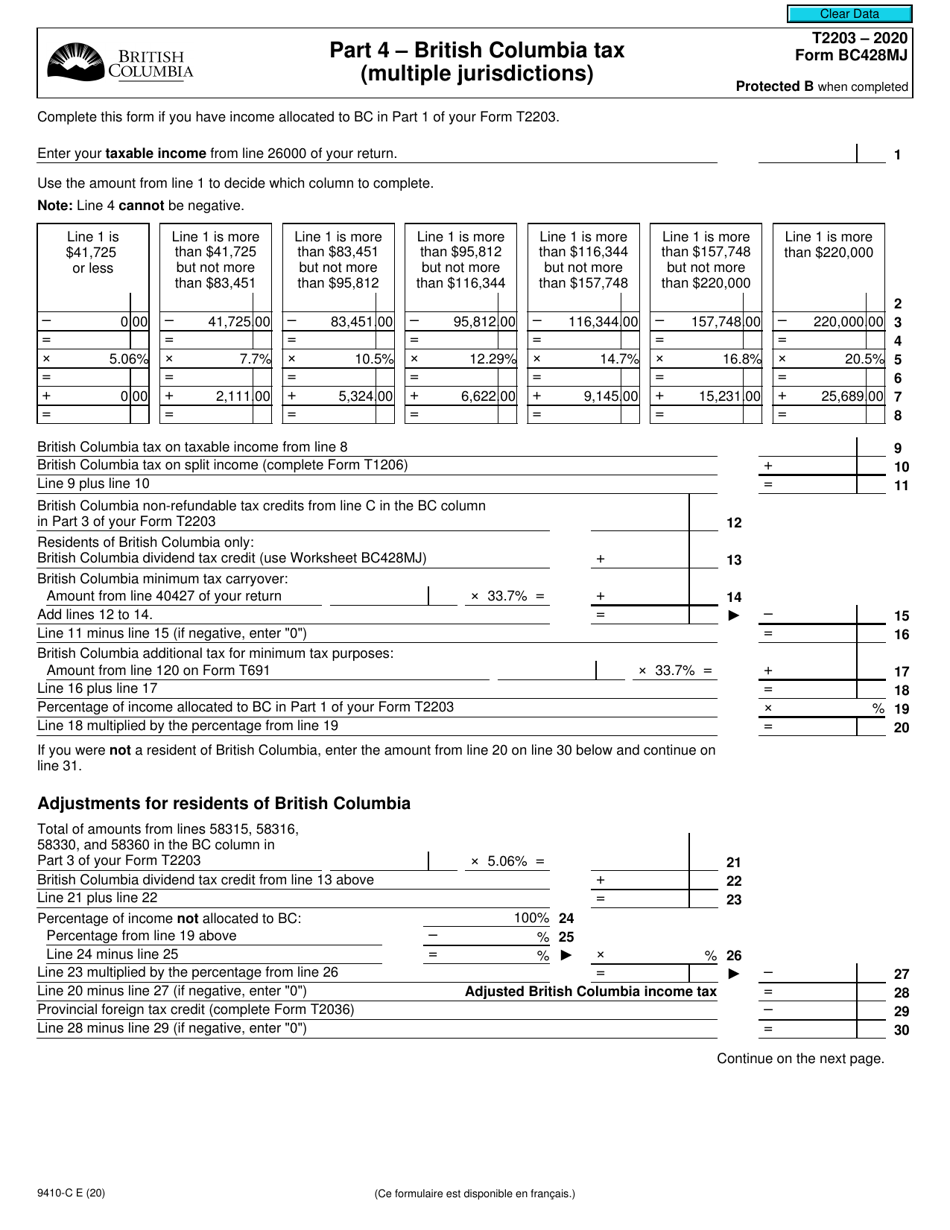

Form T2203 (9410-C; BC428MJ) Part 4 British Columbia Tax (Multiple Jurisdictions) - Canada

Form T2203 (9410-C; BC428MJ) Part 4 is used for reporting British Columbia Tax (Multiple Jurisdictions) in Canada. It is specifically used to calculate the provincial tax payable by individuals who have resided and earned income in British Columbia, but also have income from other Canadian provinces or territories. This form helps determine the amount of provincial tax owed to British Columbia in such cases.

The Form T2203 (9410-C; BC428MJ) Part 4 for British Columbia tax (multiple jurisdictions) in Canada is usually filed by individual taxpayers who reside in British Columbia and have income from multiple jurisdictions within Canada.

FAQ

Q: What is Form T2203?

A: Form T2203 is a form used to calculate and report British Columbia tax for individuals who live in multiple jurisdictions in Canada.

Q: What are the other names for Form T2203?

A: Form T2203 is also known as 9410-C and BC428MJ.

Q: What is Part 4 of Form T2203?

A: Part 4 of Form T2203 is specifically for calculating and reporting British Columbia tax.

Q: Who needs to use Form T2203?

A: Individuals who live in multiple jurisdictions in Canada and need to calculate and report their British Columbia tax.

Q: What is British Columbia tax?

A: British Columbia tax refers to the taxes imposed by the provincial government of British Columbia.

Q: Why is there a specific section for British Columbia tax on this form?

A: Because individuals who live in multiple jurisdictions may be subject to different tax rates and rules, so this section allows for the calculation and reporting of British Columbia tax separately.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to accurately calculate and report the amount of British Columbia tax owed by individuals who live in multiple jurisdictions in Canada.