This version of the form is not currently in use and is provided for reference only. Download this version of

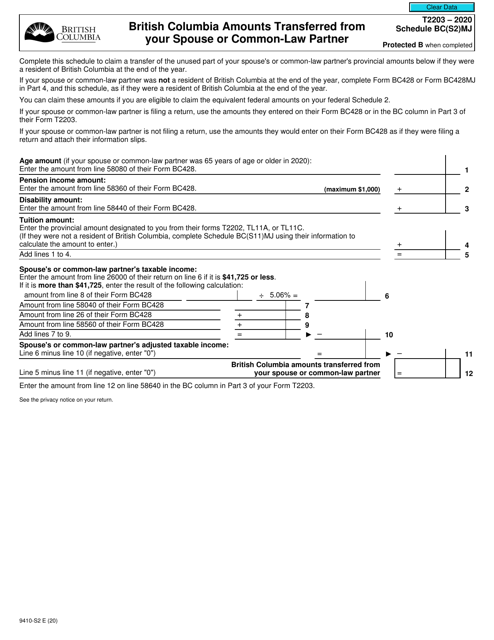

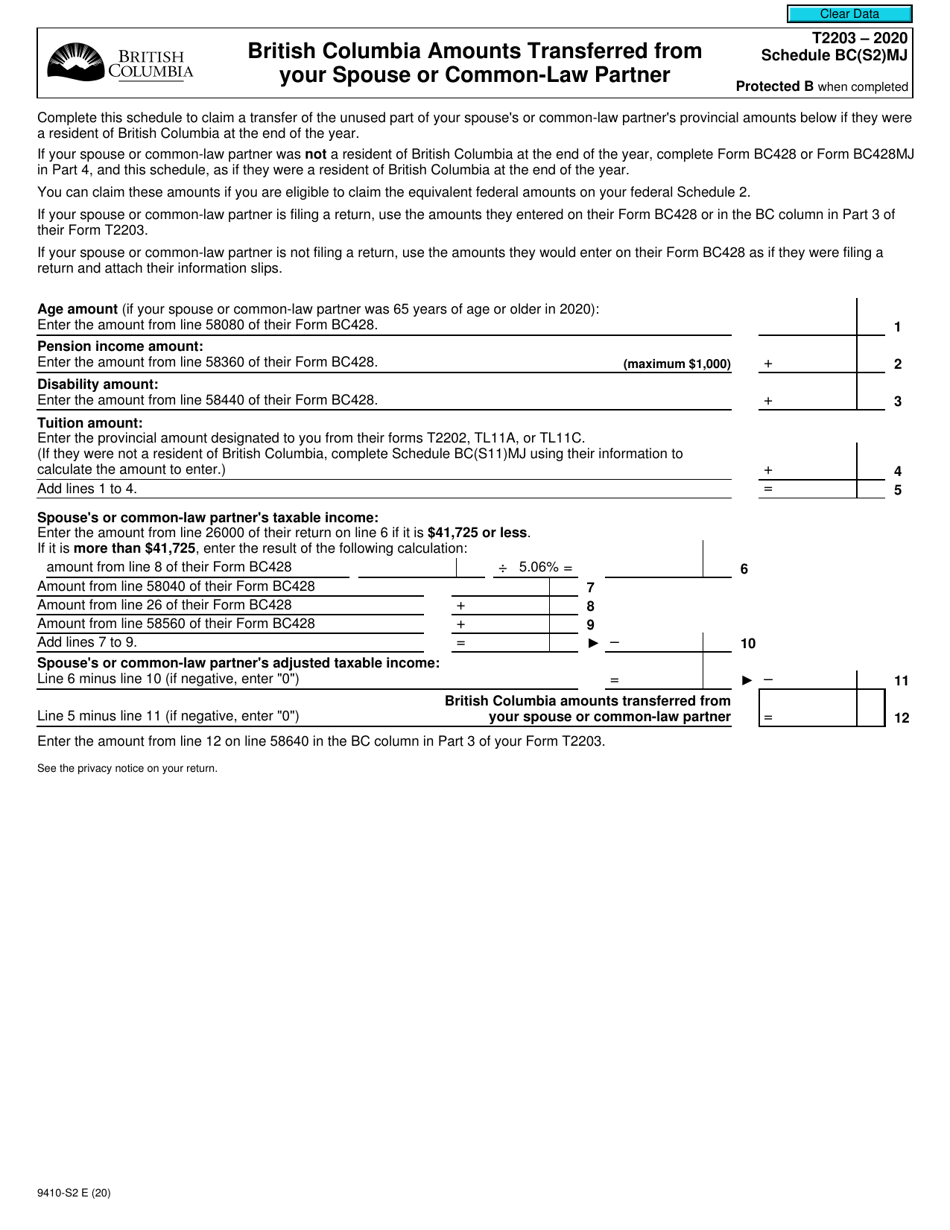

Form T2203 (9410-S2) Schedule BC(S2)MJ

for the current year.

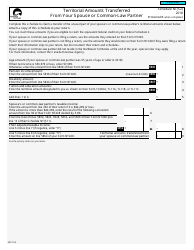

Form T2203 (9410-S2) Schedule BC(S2)MJ British Columbia Amounts Transferred From Your Spouse or Common-Law Partner - Canada

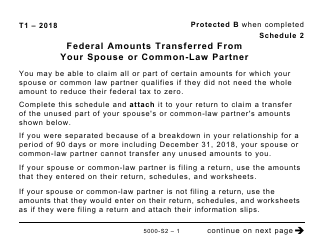

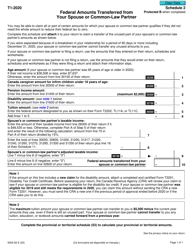

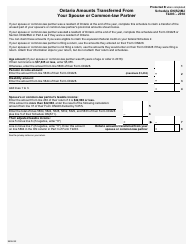

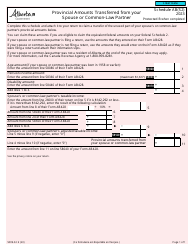

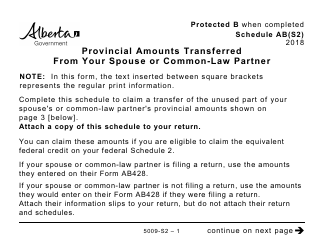

Form T2203 (9410-S2) Schedule BC (S2)MJ is a specific form used in Canada for reporting amounts transferred from your spouse or common-law partner in the province of British Columbia. This form is used when claiming certain tax credits or deductions that can be transferred between spouses or common-law partners in order to optimize their overall tax situation. By completing this form, individuals in British Columbia can transfer specific amounts from their spouse or common-law partner that may help reduce their tax liability or maximize their tax benefits. The form ensures that both individuals can effectively utilize applicable tax credits or deductions, resulting in potential tax savings.

The Form T2203 (9410-S2) Schedule BC(S2)MJ is filed by residents of British Columbia, Canada, who have amounts transferred from their spouse or common-law partner.

FAQ

Q: What is Form T2203 (9410-S2) Schedule BC(S2)MJ?

A: Form T2203 (9410-S2) Schedule BC(S2)MJ is a tax form used in Canada to report the amounts transferred from your spouse or common-law partner in the province of British Columbia.

Q: Why do I need to file Form T2203 (9410-S2) Schedule BC(S2)MJ?

A: You need to file Form T2203 (9410-S2) Schedule BC(S2)MJ if you want to claim any amounts transferred from your spouse or common-law partner in British Columbia on your Canadian tax return.

Q: How do I fill out Form T2203 (9410-S2) Schedule BC(S2)MJ?

A: To fill out Form T2203 (9410-S2) Schedule BC(S2)MJ, you will need to provide information about your spouse or common-law partner, including their social insurance number, and report the amounts transferred from them to you in British Columbia.

Q: When is the deadline to file Form T2203 (9410-S2) Schedule BC(S2)MJ?

A: The deadline to file Form T2203 (9410-S2) Schedule BC(S2)MJ is the same as the deadline for your Canadian tax return, which is generally April 30th of the following year. However, if you or your spouse or common-law partner are self-employed, the deadline is June 15th.

Q: What happens if I don't file Form T2203 (9410-S2) Schedule BC(S2)MJ?

A: If you are eligible to claim amounts transferred from your spouse or common-law partner in British Columbia but fail to file Form T2203 (9410-S2) Schedule BC(S2)MJ, you will not be able to claim those amounts on your Canadian tax return, potentially resulting in a higher tax liability.