This version of the form is not currently in use and is provided for reference only. Download this version of

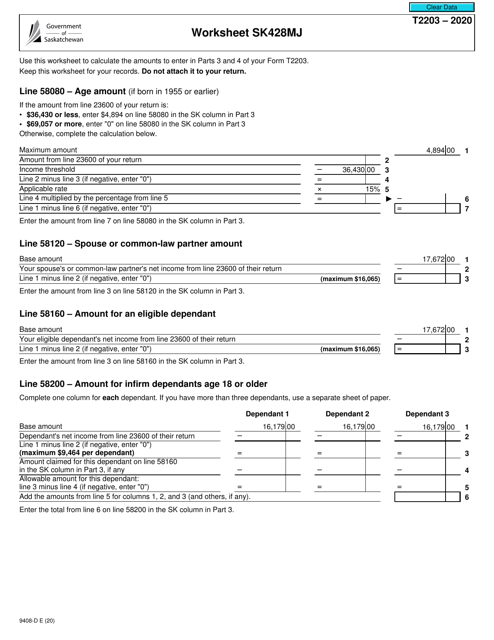

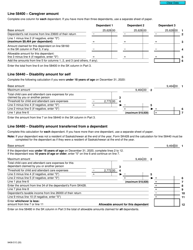

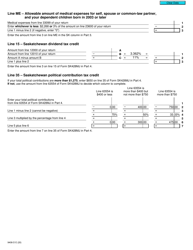

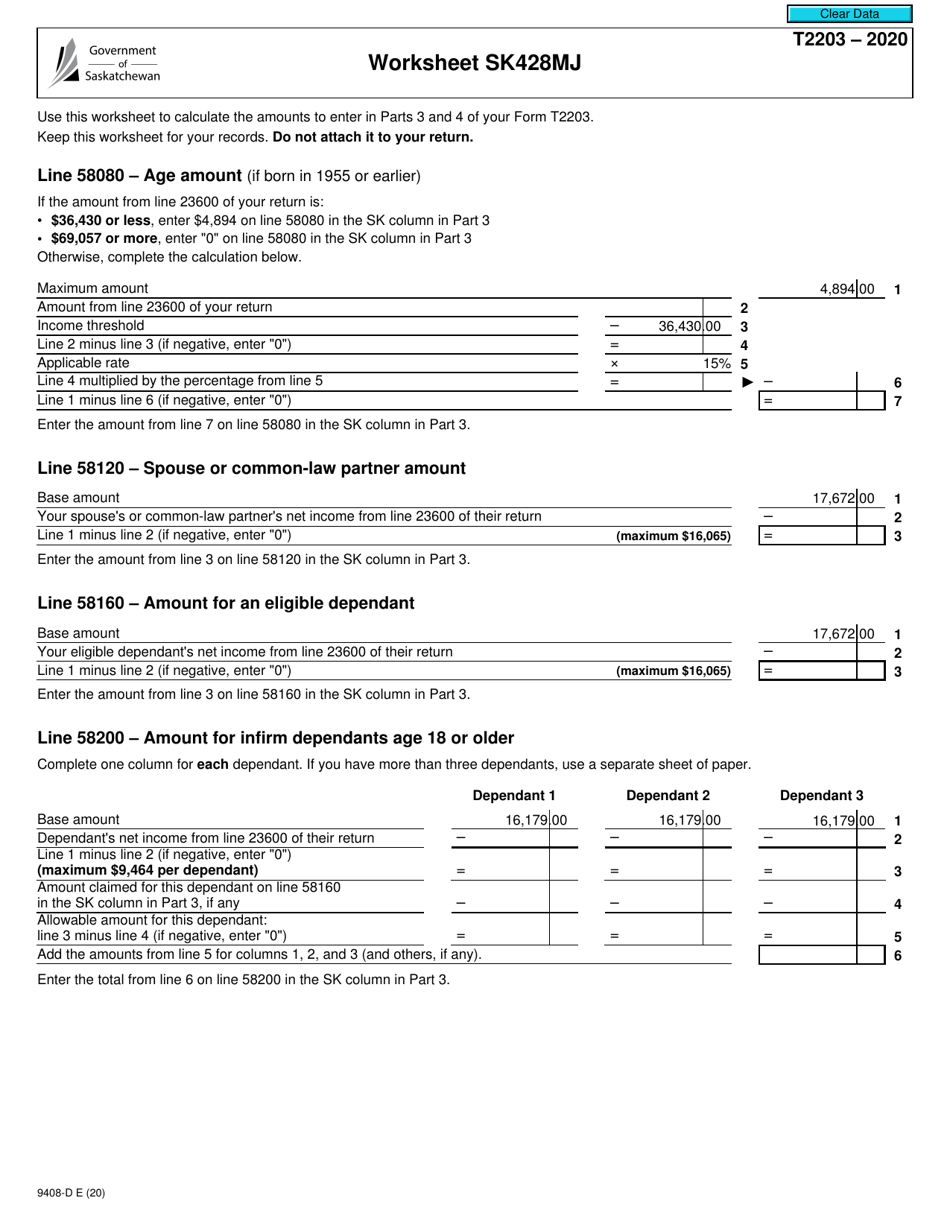

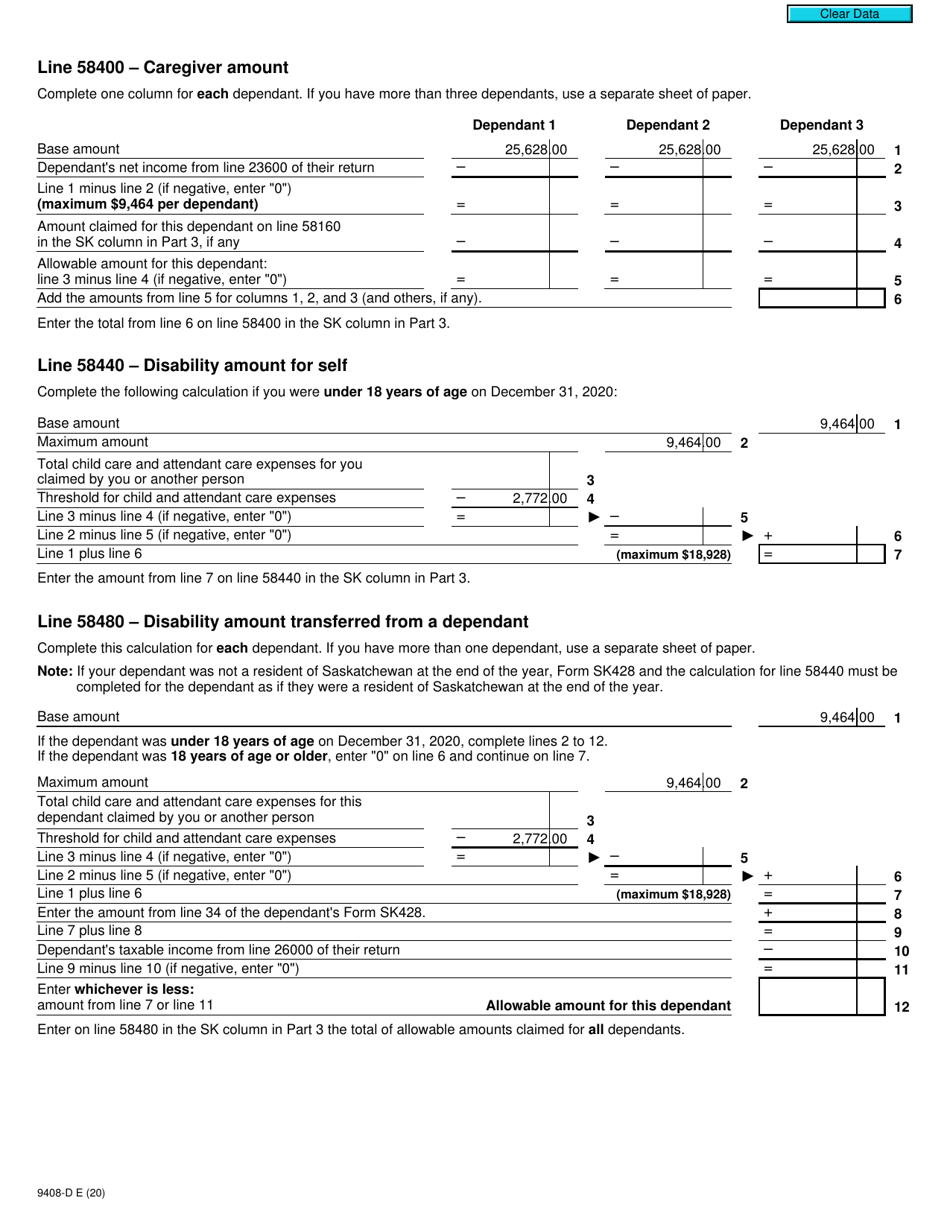

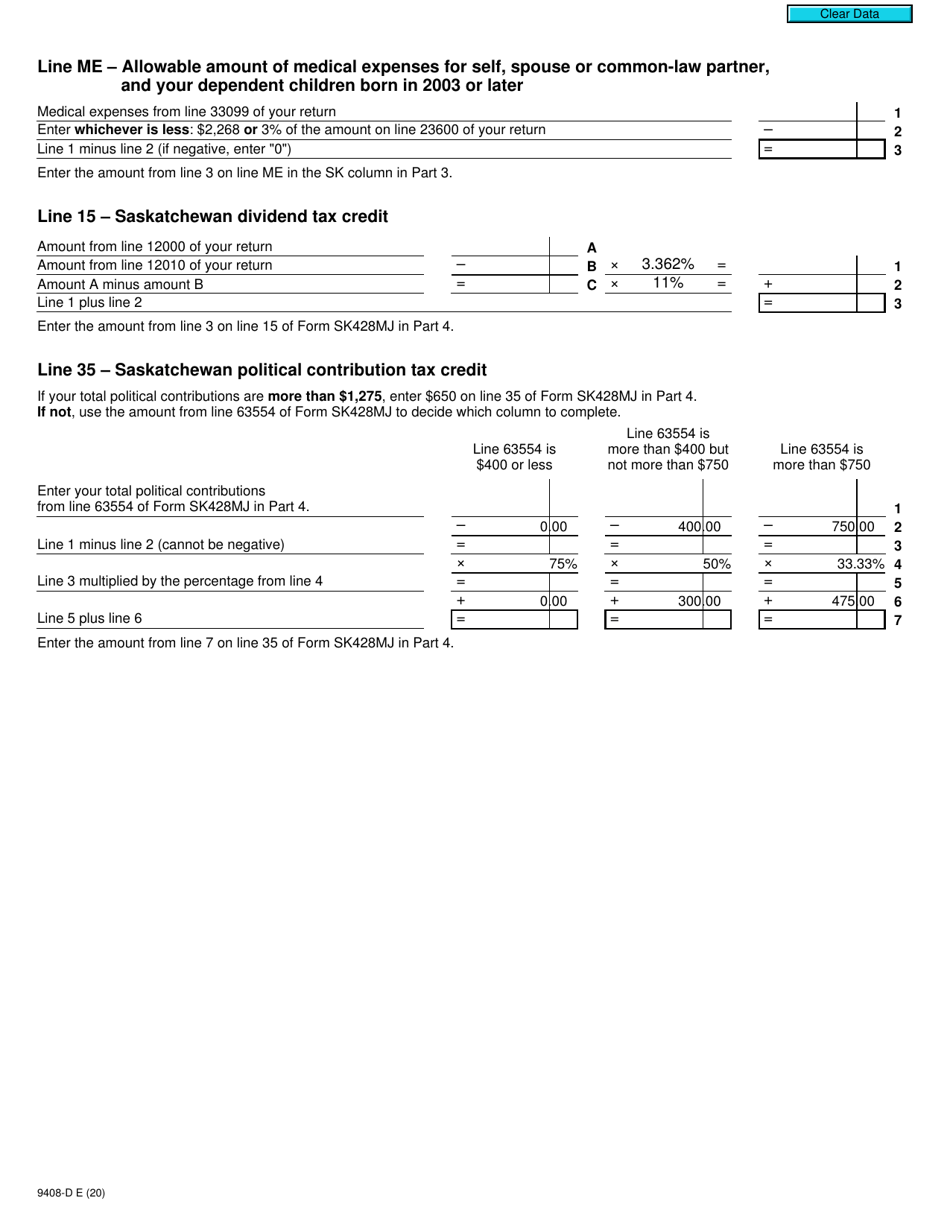

Form T2203 (9408-D) Worksheet SK428MJ

for the current year.

Form T2203 (9408-D) Worksheet SK428MJ Saskatchewan - Canada

Form T2203 (9408-D) Worksheet SK428MJ is used by residents of Saskatchewan, Canada to calculate the provincial tax credits for the Saskatchewan Graduate Retention Program (GRP). The GRP allows eligible graduates to claim tax credits for tuition fees paid to an eligible educational institution in Saskatchewan. This form helps individuals calculate the amount of tax credit they can claim under this program.

The Form T2203 (9408-D) Worksheet SK428MJ in Saskatchewan, Canada is usually filed by individuals who are residents of Saskatchewan and have income from employment or self-employment within the province. This form helps to calculate the tax payable or refundable for Saskatchewan residents.

FAQ

Q: What is Form T2203 (9408-D)?

A: Form T2203 (9408-D) is a worksheet specific to residents of Saskatchewan, Canada, used to calculate provincial taxcredits and deductions.

Q: Why do I need Form T2203 (9408-D)?

A: You need Form T2203 (9408-D) if you are a resident of Saskatchewan and want to claim certain provincial tax credits and deductions on your income tax return.

Q: What types of information does Form T2203 (9408-D) require?

A: Form T2203 (9408-D) requires information such as your personal details, income details, eligible tax credits and deductions, and calculations for determining the final tax credit amount.

Q: How do I fill out Form T2203 (9408-D)?

A: To fill out Form T2203 (9408-D), follow the instructions provided on the form. Ensure to enter accurate information, complete all relevant sections, and perform the necessary calculations.