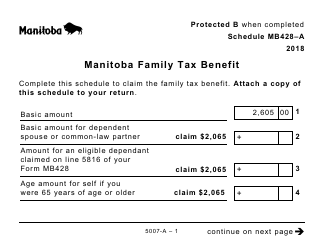

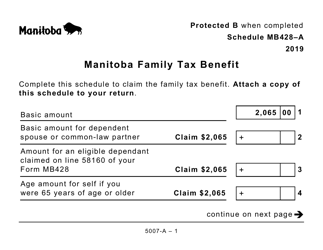

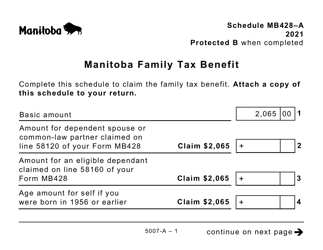

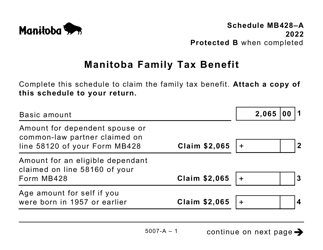

This version of the form is not currently in use and is provided for reference only. Download this version of

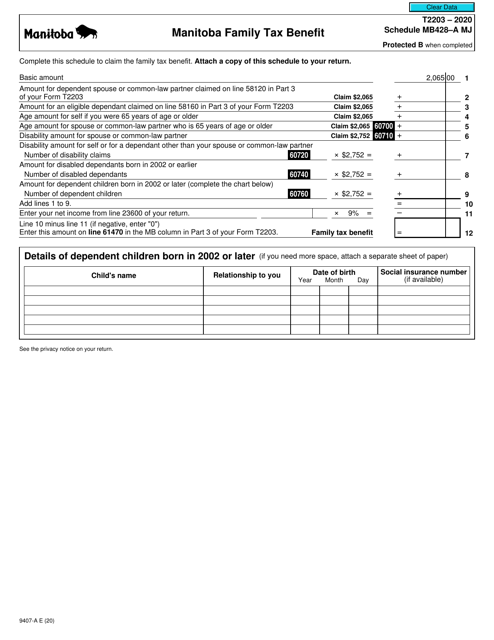

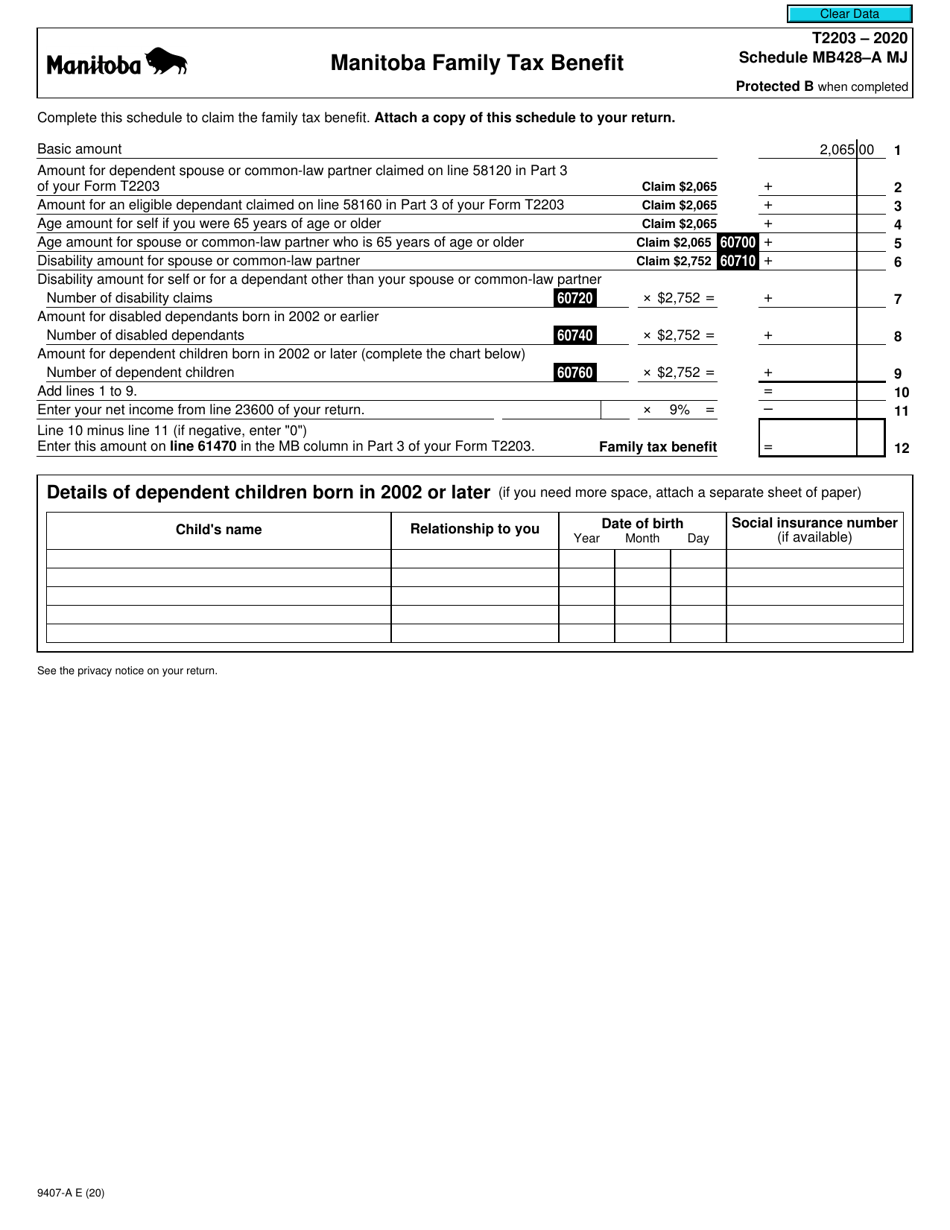

Form T2203 (9407-A) Schedule MB428-A MJ

for the current year.

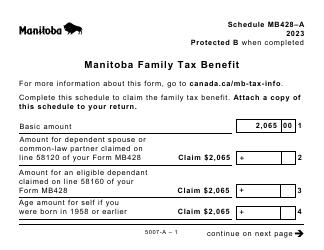

Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit - Canada

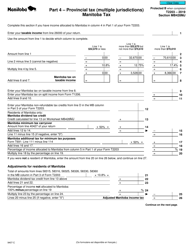

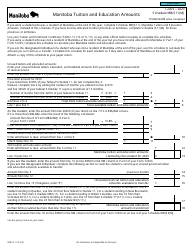

Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit is used in Canada by taxpayers who reside in the province of Manitoba and are eligible for the Manitoba Family Tax Benefit. This form is used to calculate the amount of benefit that the taxpayer is entitled to claim, based on their family income and number of eligible dependents.

The primary caregiver of the child in Manitoba files the Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit in Canada.

FAQ

Q: What is Form T2203?

A: Form T2203 is a schedule used to calculate the Manitoba Family Tax Benefit (MFTB) in Canada.

Q: What is the purpose of the Manitoba Family Tax Benefit (MFTB)?

A: The Manitoba Family Tax Benefit (MFTB) is a tax credit provided by the government of Manitoba to assist eligible families with low to moderate income.

Q: What is Schedule MB428-A?

A: Schedule MB428-A is a part of the Manitoba provincial tax return where you report the calculations for the Manitoba Family Tax Benefit (MFTB).

Q: Who is eligible for the Manitoba Family Tax Benefit?

A: Eligibility for the Manitoba Family Tax Benefit (MFTB) is based on factors such as family income, number of children, and age of children.

Q: How do I claim the Manitoba Family Tax Benefit?

A: To claim the Manitoba Family Tax Benefit (MFTB), you need to complete Form T2203 and include it with your Manitoba provincial tax return.

Q: Is the Manitoba Family Tax Benefit taxable?

A: No, the Manitoba Family Tax Benefit (MFTB) is not taxable.

Q: Is the Manitoba Family Tax Benefit the same as the Canada Child Benefit?

A: No, the Manitoba Family Tax Benefit (MFTB) is specific to the province of Manitoba, while the Canada Child Benefit (CCB) is a federal program available across Canada.