This version of the form is not currently in use and is provided for reference only. Download this version of

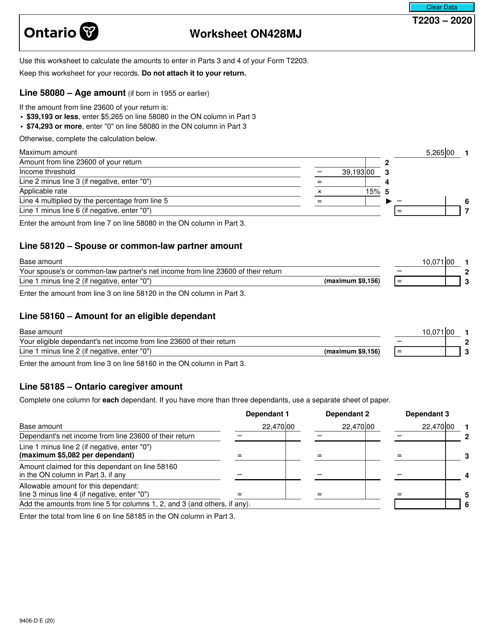

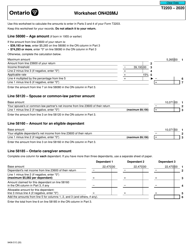

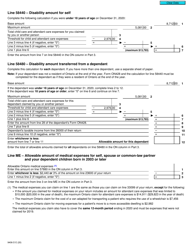

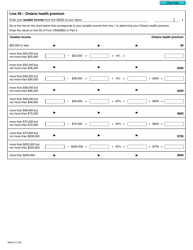

Form T2203 (9406-D) Worksheet ON428MJ

for the current year.

Form T2203 (9406-D) Worksheet ON428MJ Ontario - Canada

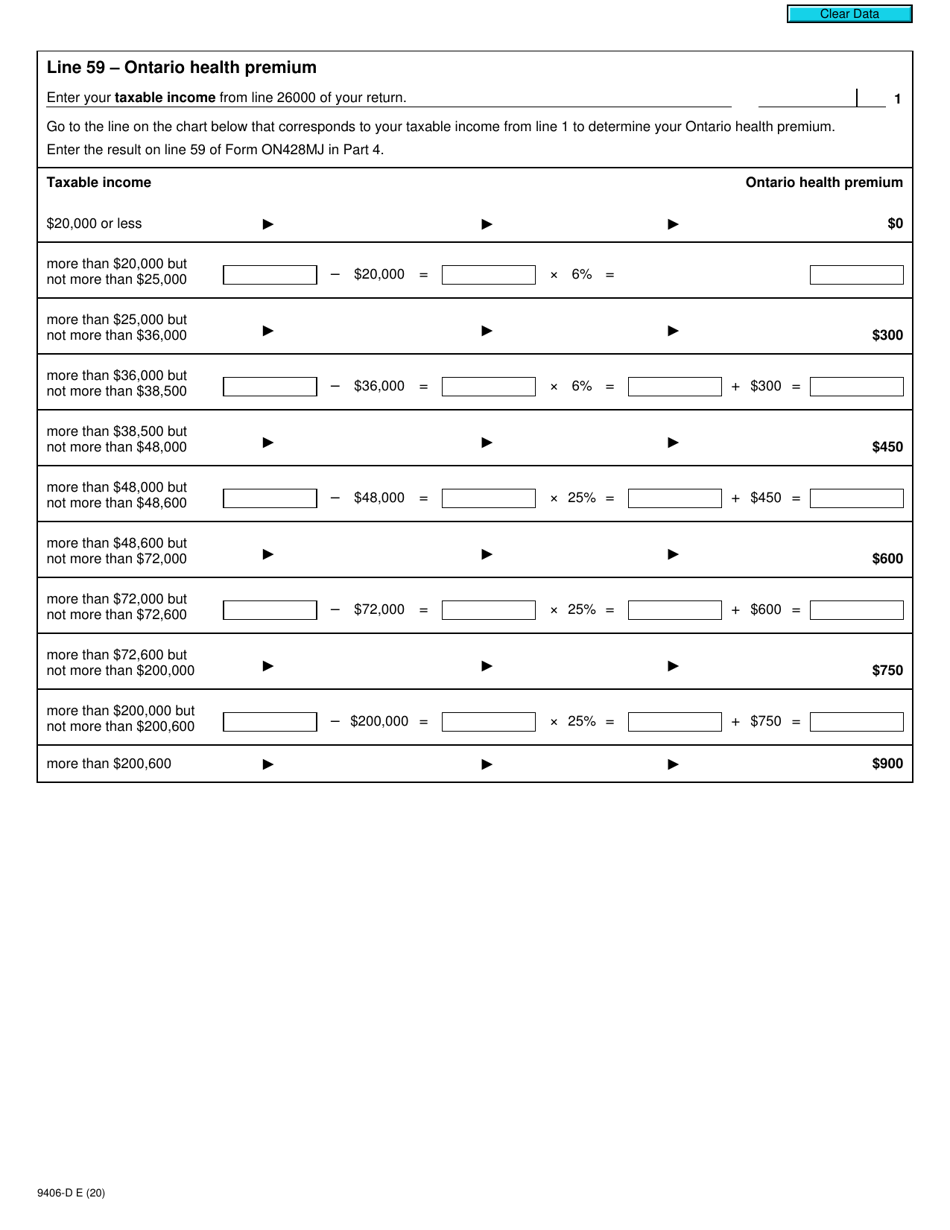

Form T2203 is used by residents of Ontario, Canada to calculate their Ontario non-refundable tax credits for the taxation year. It is specifically designed for residents who had income from sources in Canada and outside of Canada during the year.

The Form T2203 (9406-D) Worksheet ON428MJ in Ontario, Canada is filed by individuals who are non-residents of Canada but earn income in Ontario.

FAQ

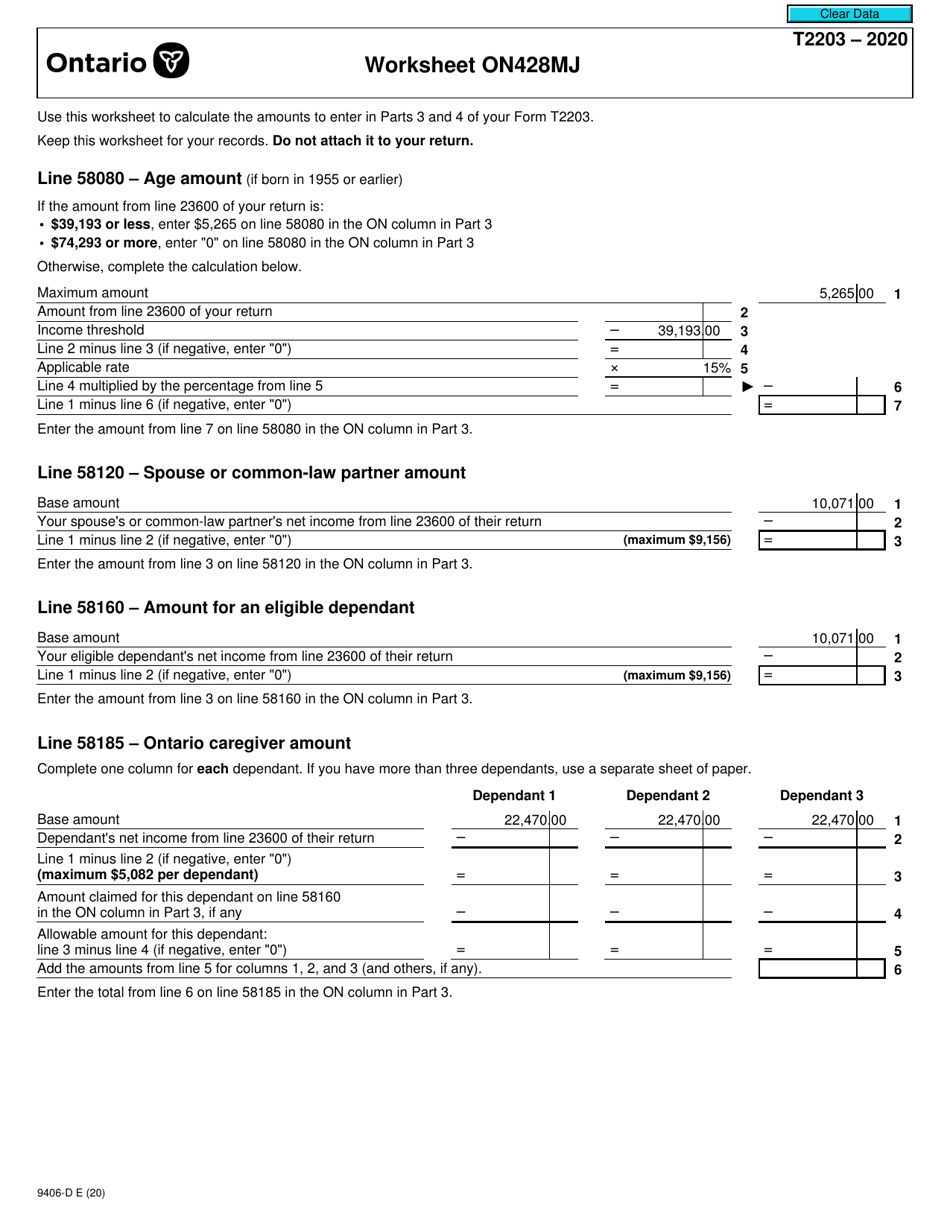

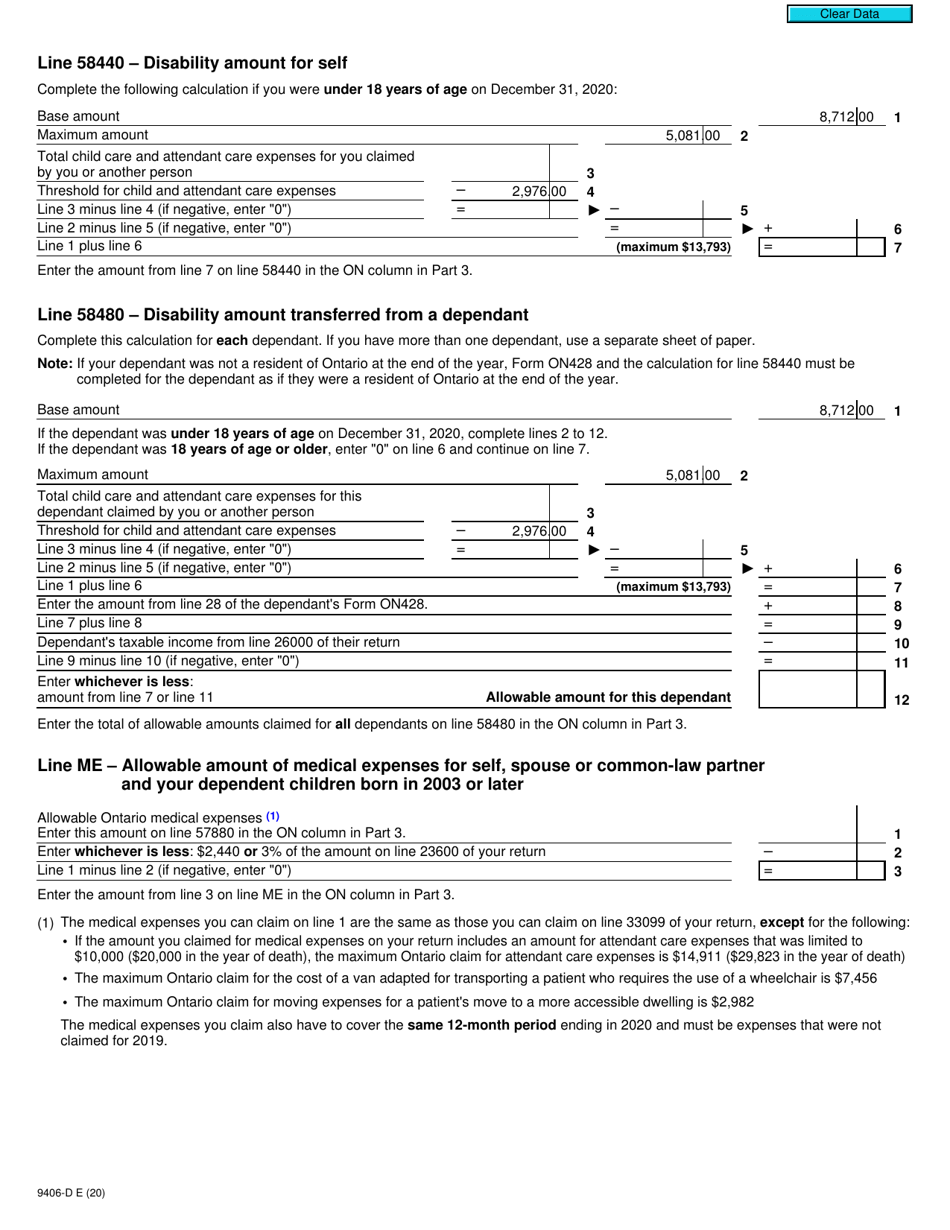

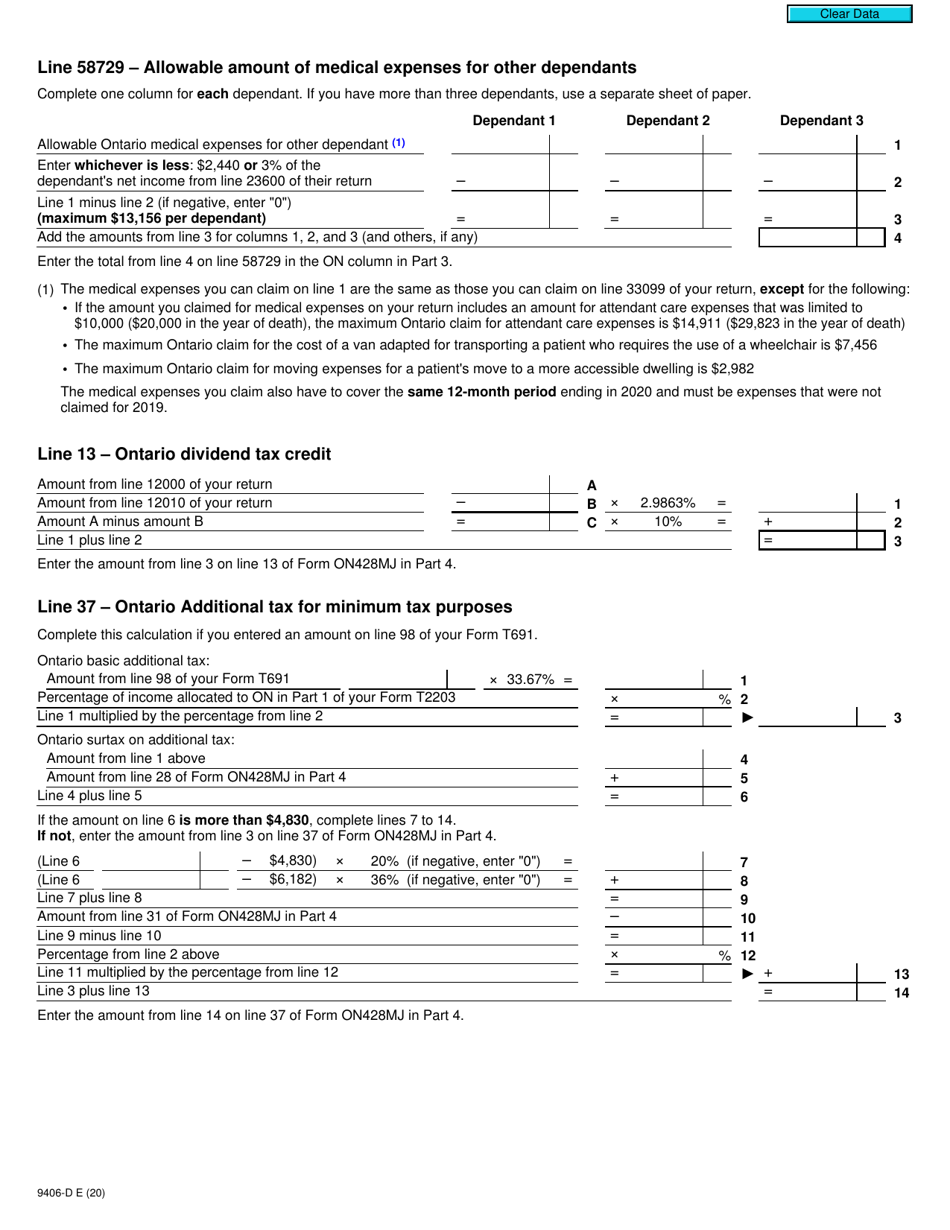

Q: What is Form T2203 (9406-D)?

A: Form T2203 (9406-D) is a worksheet used for residents of Ontario, Canada to calculate their provincial tax credits.

Q: Who needs to complete this form?

A: Residents of Ontario, Canada who want to claim provincial tax credits on their income tax return need to complete this form.

Q: What is ON428MJ?

A: ON428MJ refers to the provincial tax form for residents of Ontario, Canada.

Q: What is the purpose of the worksheet?

A: The purpose of the worksheet is to help residents of Ontario calculate and claim their provincial tax credits.

Q: When is the deadline to submit Form T2203 (9406-D)?

A: The deadline to submit Form T2203 (9406-D) is the same as the deadline for filing your federal income tax return, which is usually April 30th of the following year.

Q: What happens if I don't complete this form?

A: If you are a resident of Ontario and do not complete this form, you may miss out on potential provincial tax credits that you are eligible for.

Q: Can I claim provincial tax credits without completing this form?

A: No, you need to complete Form T2203 (9406-D) in order to claim provincial tax credits.

Q: Are there any other provincial tax forms for Ontario residents?

A: Yes, in addition to Form T2203 (9406-D), residents of Ontario may need to complete other provincial tax forms depending on their specific circumstances.