This version of the form is not currently in use and is provided for reference only. Download this version of

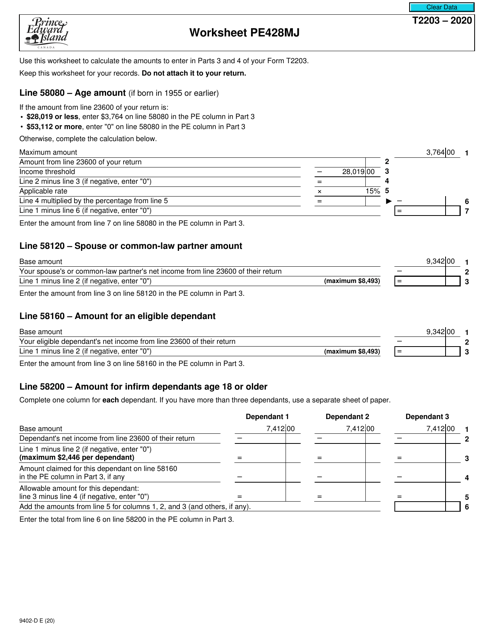

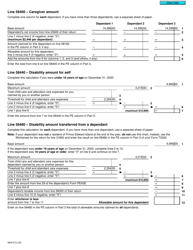

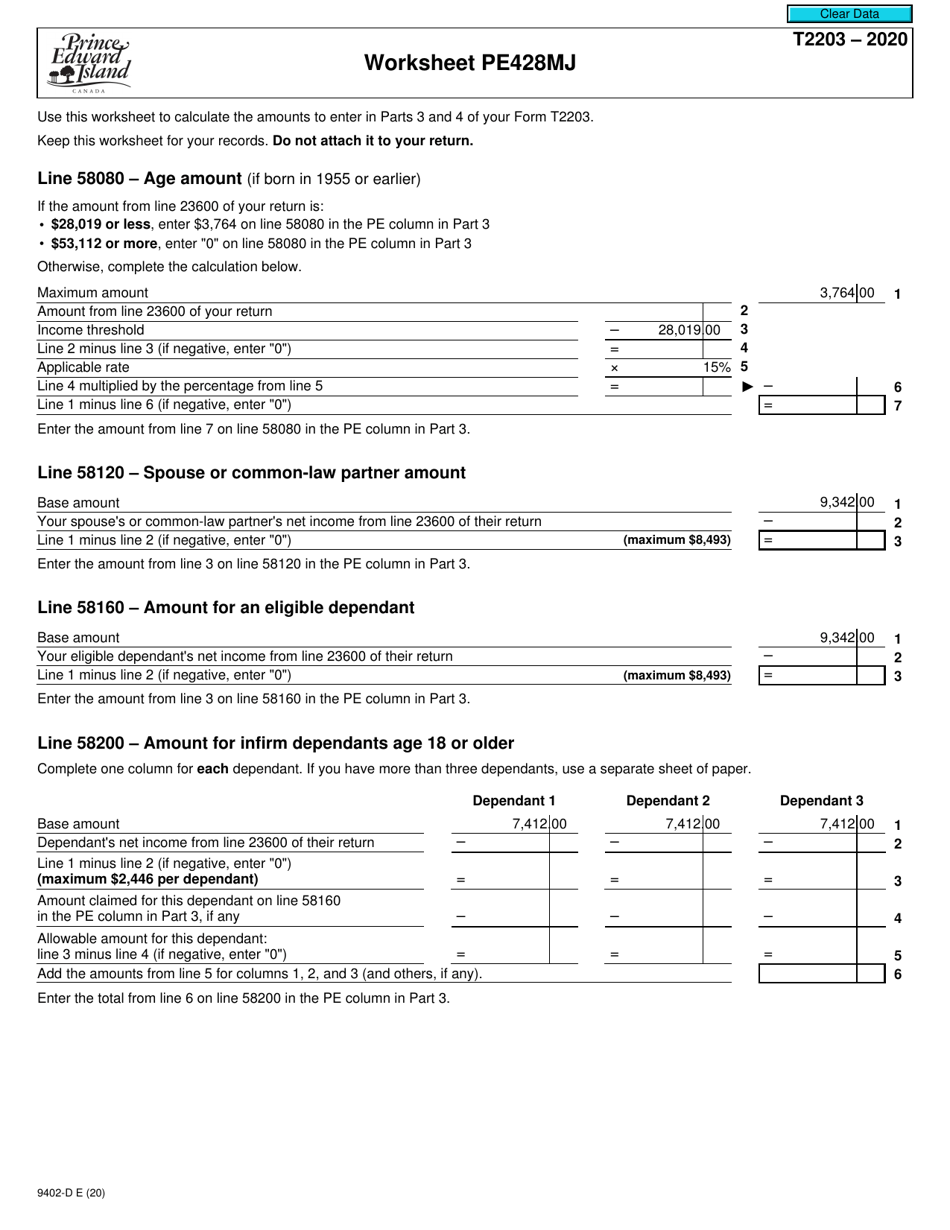

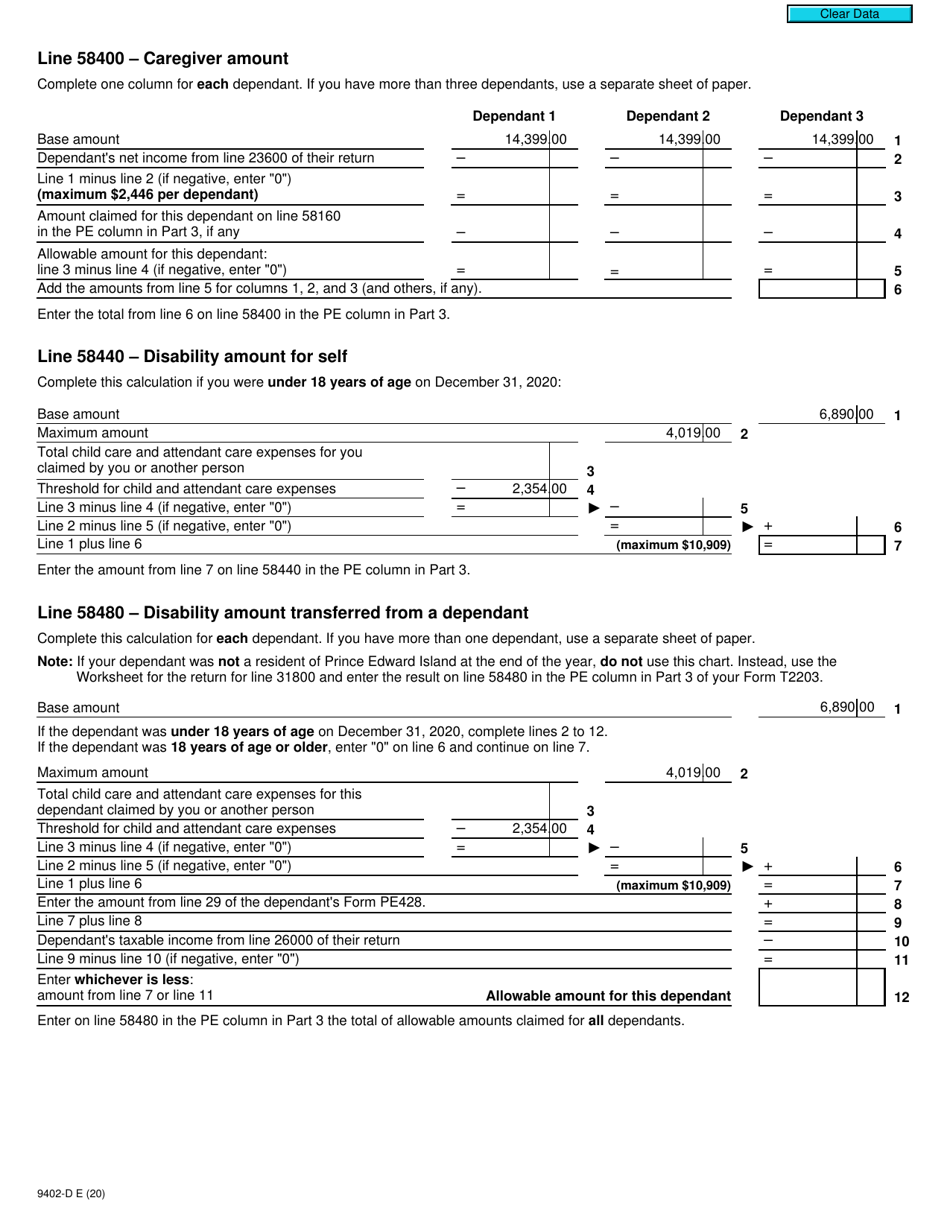

Form T2203 (9402-D) Worksheet PE428MJ

for the current year.

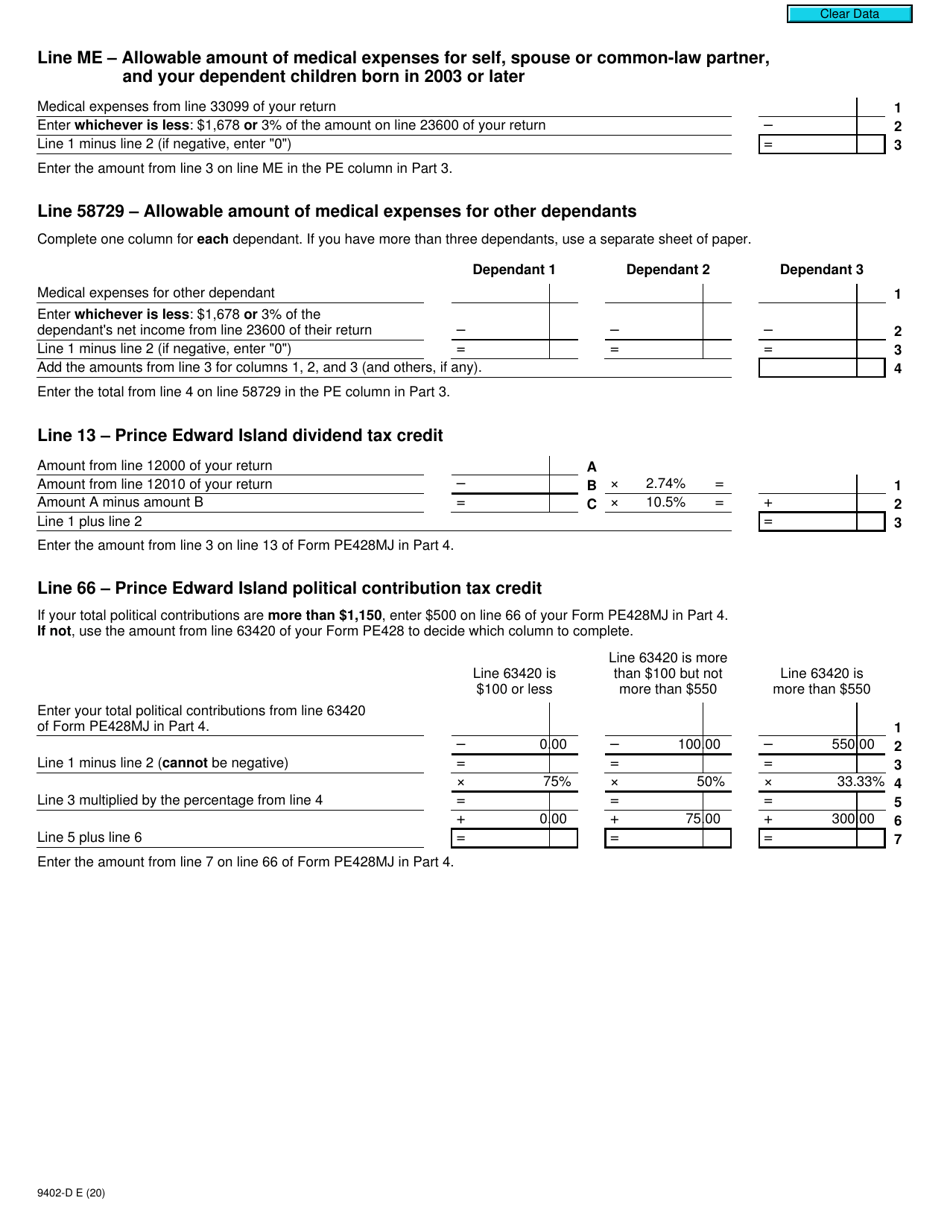

Form T2203 (9402-D) Worksheet PE428MJ Prince Edward Island - Canada

Form T2203 (9402-D) Worksheet PE428MJ is used by residents of Prince Edward Island, Canada, to calculate their provincial tax credits. This form helps taxpayers determine the amount of provincial tax they owe or the refund they are eligible for.

The employer files the Form T2203 (9402-D) Worksheet PE428MJ in Prince Edward Island, Canada.

FAQ

Q: What is Form T2203 (9402-D)?

A: Form T2203 (9402-D) is the worksheet used for calculating the provincial tax deductions for Prince Edward Island (PEI) in Canada.

Q: Who uses Form T2203?

A: Residents of Prince Edward Island (PEI) in Canada use Form T2203 to calculate their provincial tax deductions.

Q: What is PE428MJ?

A: PE428MJ is the specific code for the worksheet related to Prince Edward Island (PEI) on the Form T2203 (9402-D) form.

Q: What is the purpose of the PE428MJ worksheet?

A: The PE428MJ worksheet is used to determine the amount of provincial tax deductions for residents of Prince Edward Island (PEI) in Canada.

Q: Do I need to file Form T2203 (9402-D) if I live in Prince Edward Island (PEI)?

A: If you are a resident of Prince Edward Island (PEI) in Canada and have provincial tax deductions, you will need to file Form T2203 (9402-D) to claim these deductions.

Q: Can I claim federal tax deductions on Form T2203?

A: No, Form T2203 is specifically used for calculating provincial tax deductions. Federal tax deductions are claimed on other forms, such as the T1 General form.

Q: Is Form T2203 (9402-D) applicable for other provinces or territories in Canada?

A: No, Form T2203 (9402-D) is specific to Prince Edward Island (PEI) and cannot be used for other provinces or territories in Canada.