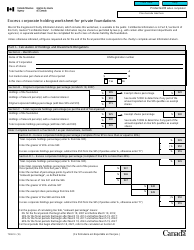

This version of the form is not currently in use and is provided for reference only. Download this version of

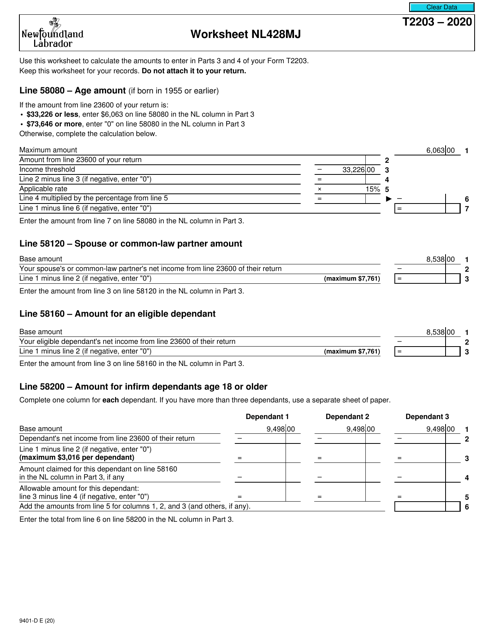

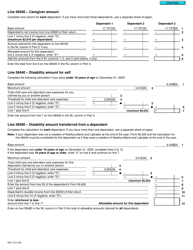

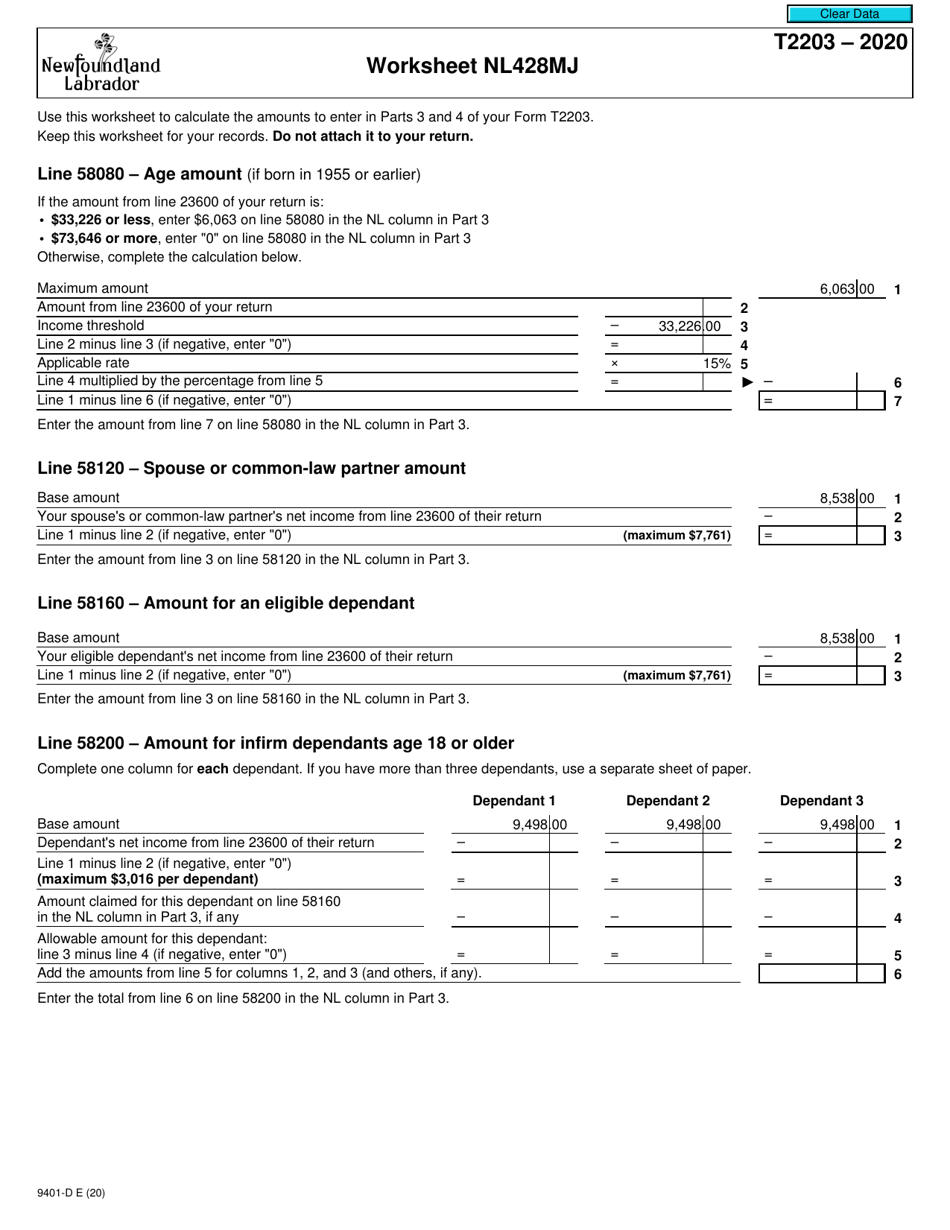

Form T2203 (9401-D) Worksheet NL428MJ

for the current year.

Form T2203 (9401-D) Worksheet NL428MJ Newfoundland and Labrador - Canada

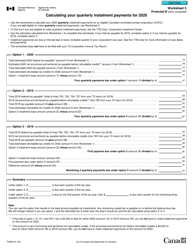

Form T2203 (9401-D) Worksheet NL428MJ is a tax form used in Canada, specifically for residents of Newfoundland and Labrador. It is used to calculate various deductions, credits, and benefits for individuals who are filing their tax return in that province.

The Form T2203 (9401-D) Worksheet NL428MJ for Newfoundland and Labrador - Canada is filed by individuals who are residents of Newfoundland and Labrador and have taxable income from sources within the province.

FAQ

Q: What is Form T2203?

A: Form T2203 is a worksheet used in Canada for residents of Newfoundland and Labrador.

Q: What is NL428MJ?

A: NL428MJ is the code used for Newfoundland and Labrador on Form T2203.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate the Newfoundland and Labrador tax credits that can be claimed.

Q: Who should use Form T2203?

A: Residents of Newfoundland and Labrador who want to claim tax credits specific to their province should use Form T2203.