This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9401-C; NL428MJ) Part 4

for the current year.

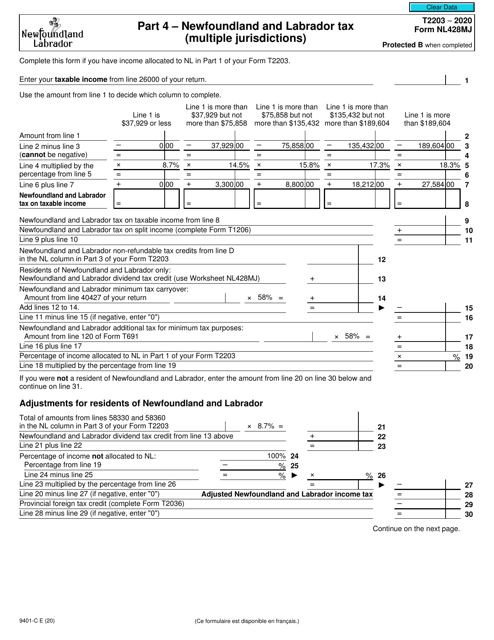

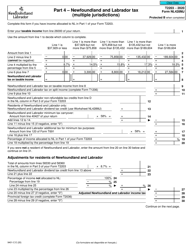

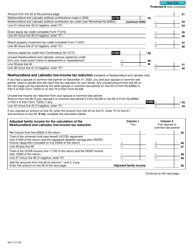

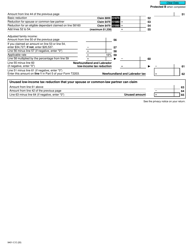

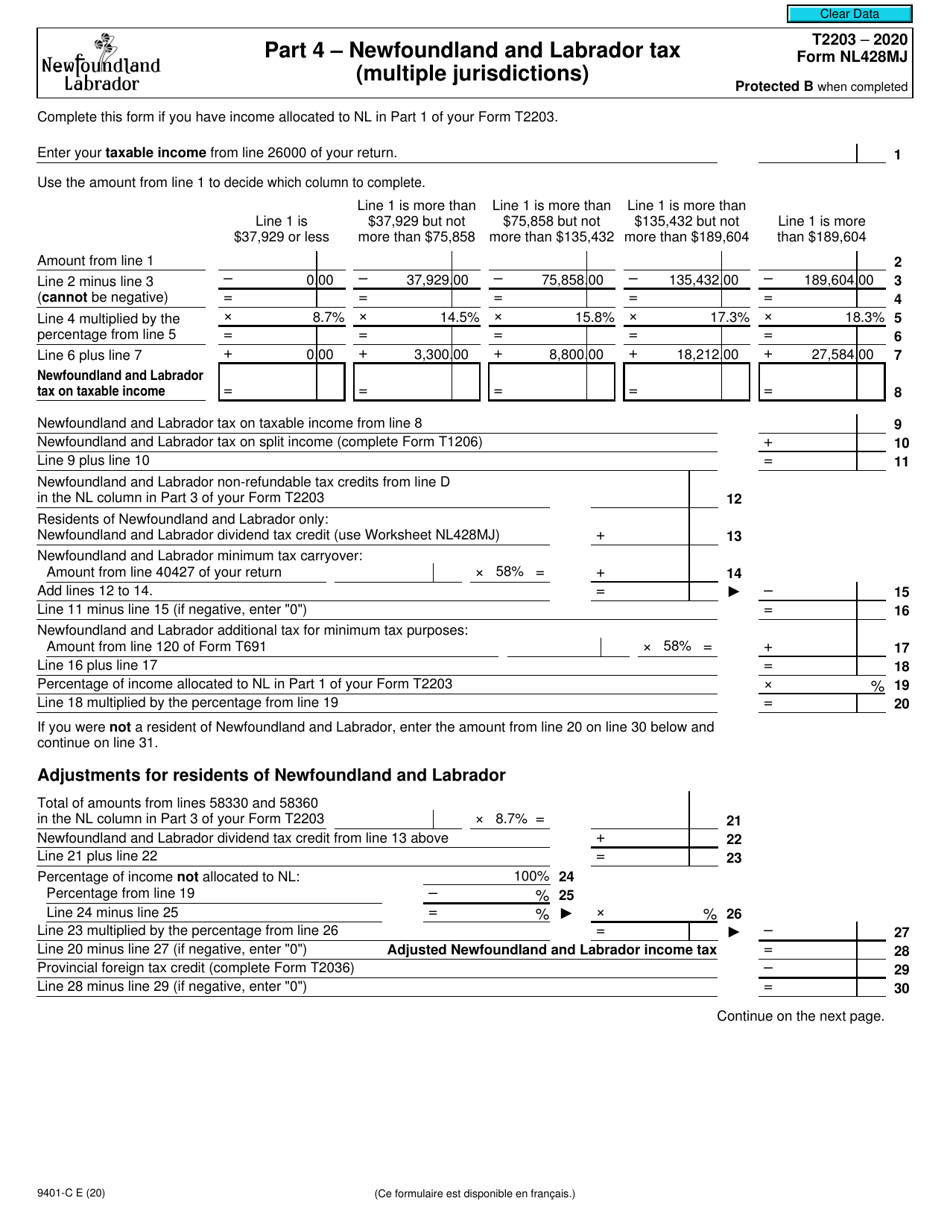

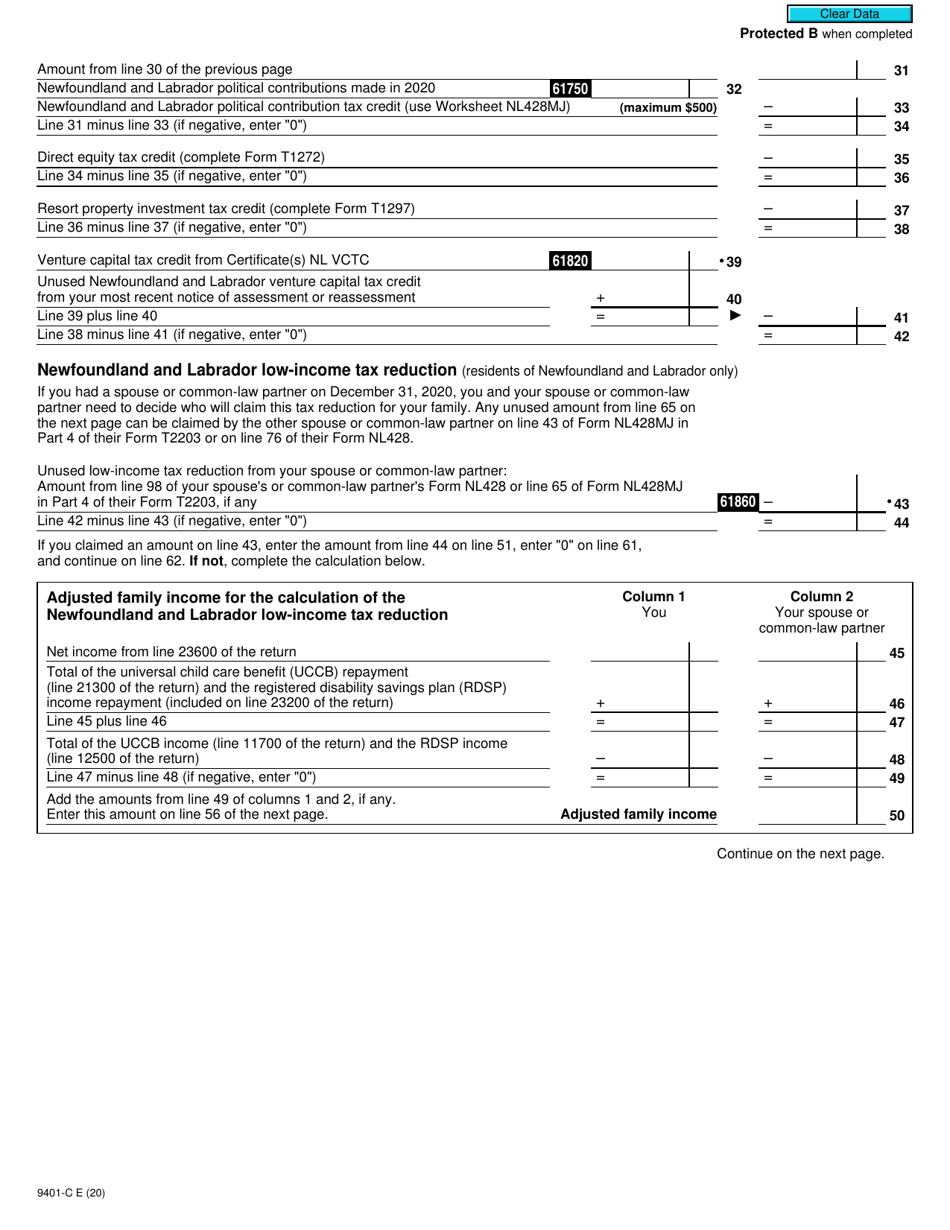

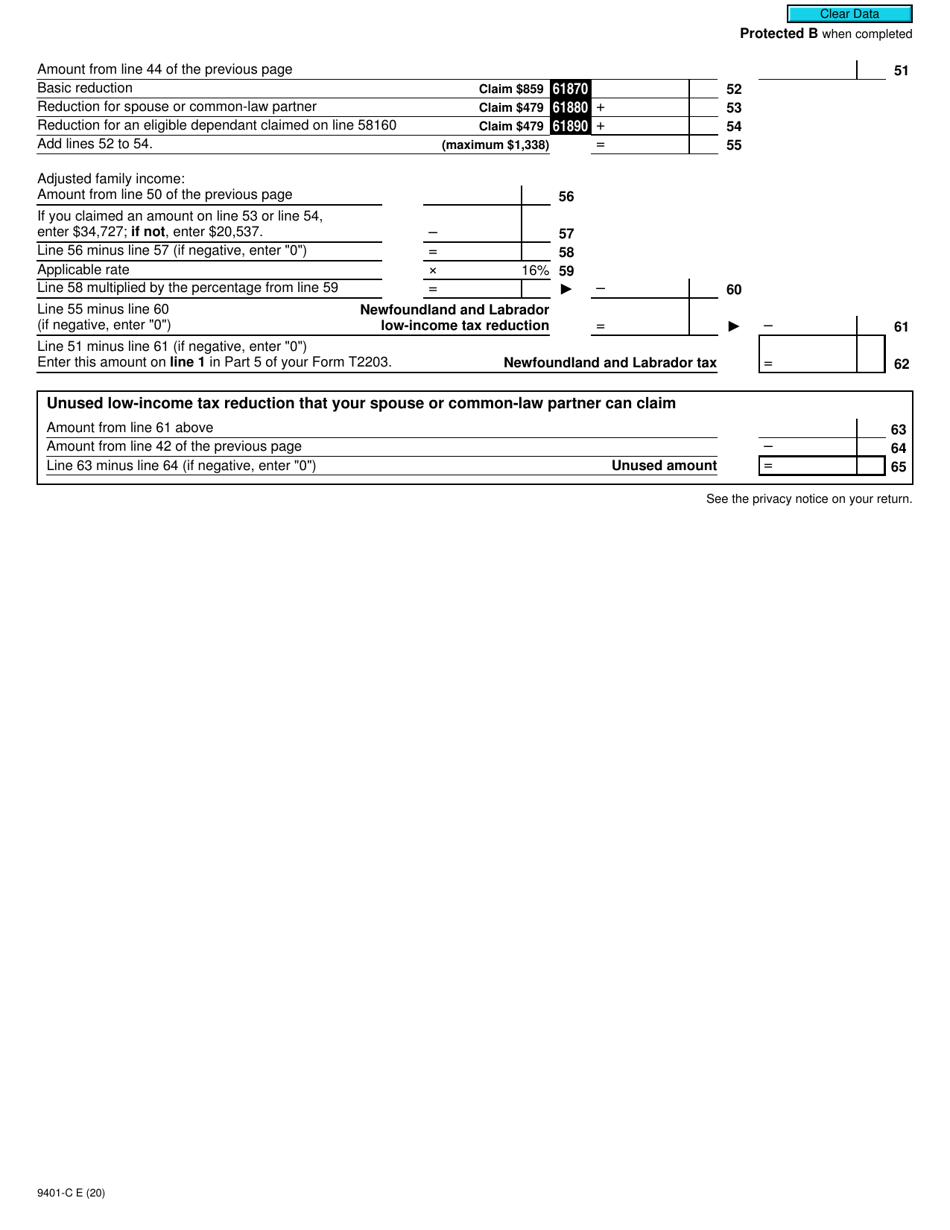

Form T2203 (9401-C; NL428MJ) Part 4 Newfoundland and Labrador Tax (Multiple Jurisdictions) - Canada

Form T2203 (9401-C; NL428MJ) Part 4 Newfoundland and Labrador Tax (Multiple Jurisdictions) - Canada is a tax form used to report Newfoundland and Labrador tax liabilities in cases where an individual or business has income from multiple Canadian jurisdictions. It helps calculate and determine the amount of tax owed to the province of Newfoundland and Labrador.

Employers in Newfoundland and Labrador, Canada file the Form T2203 (9401-C; NL428MJ) Part 4 for Newfoundland and Labrador Tax (Multiple Jurisdictions).

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is the purpose of Form T2203?

A: Form T2203 is used to calculate Newfoundland and Labrador tax in multiple jurisdictions in Canada.

Q: What is Newfoundland and Labrador Tax?

A: Newfoundland and Labrador Tax is a provincial tax imposed in the province of Newfoundland and Labrador in Canada.

Q: Who needs to fill out Form T2203?

A: Individuals who are residents of Newfoundland and Labrador and have income from multiple jurisdictions in Canada need to fill out Form T2203.

Q: What information is required in Part 4 of Form T2203?

A: Part 4 of Form T2203 requires information related to Newfoundland and Labrador tax, including the amount of income earned in Newfoundland and Labrador, tax credits, and other deductions.