This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2033

for the current year.

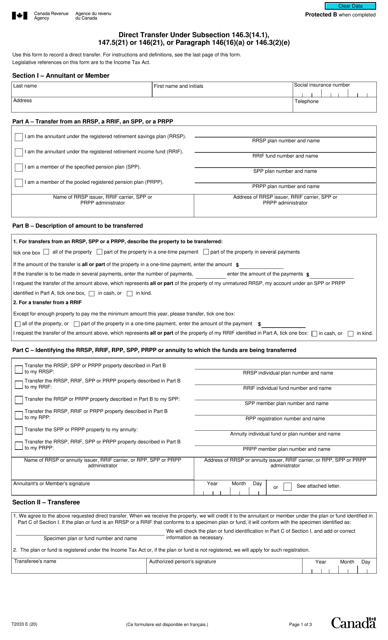

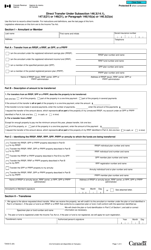

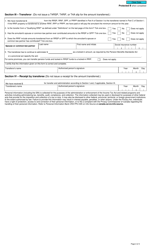

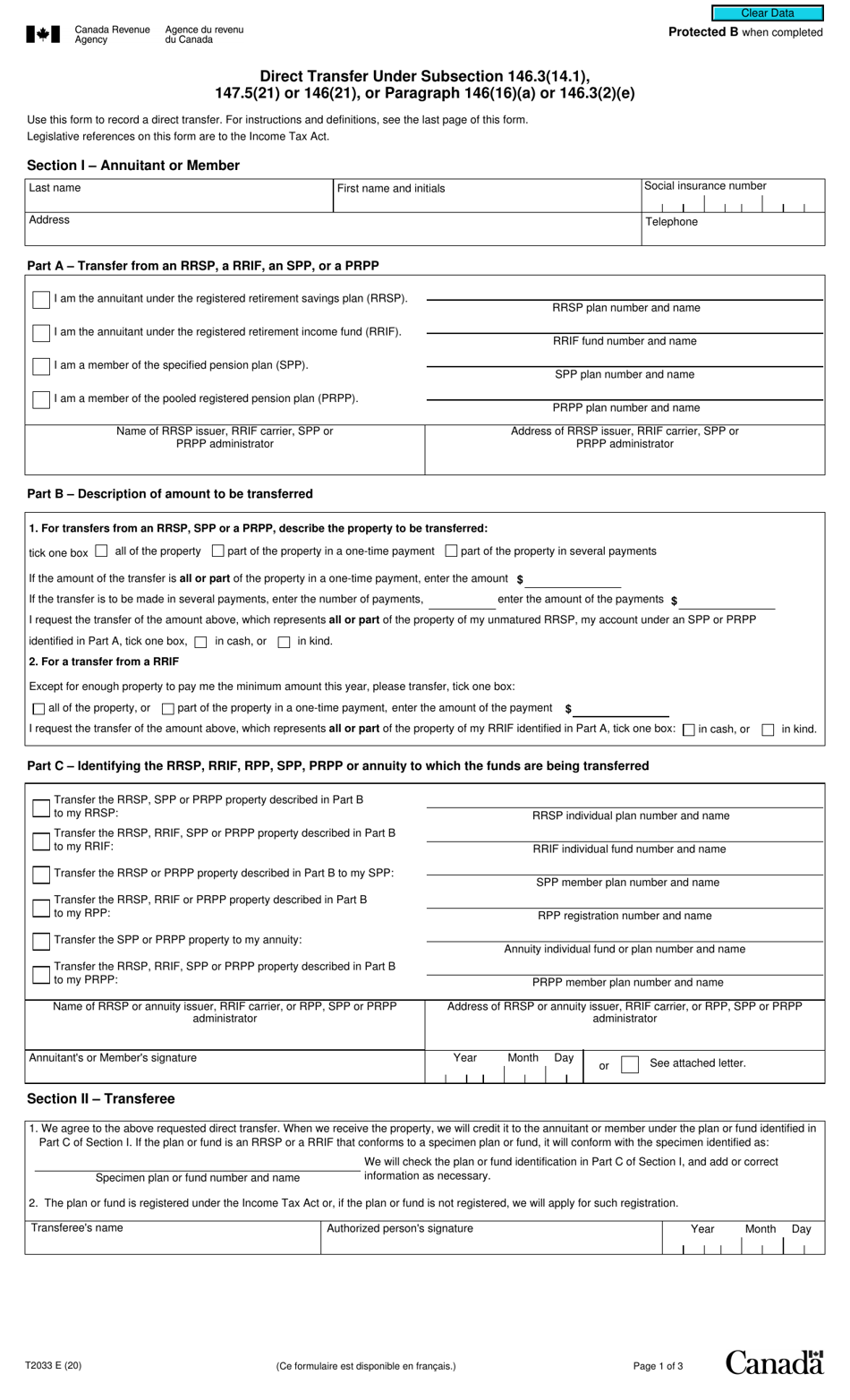

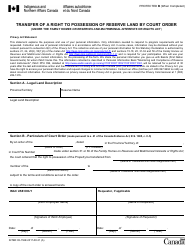

Form T2033 Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) - Canada

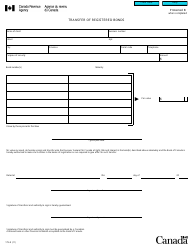

Form T2033 is used in Canada for the purpose of transferring funds from one registered retirement savings plan (RRSP) or registered retirement income fund (RRIF) to another, without tax implications. This form is utilized when a taxpayer wants to move their retirement savings from one financial institution to another, or to consolidate their retirement savings into a single account. The specific subsections and paragraphs mentioned in the form indicate the relevant provisions of the Canadian Income Tax Act that govern such transfers.

The individual or trustee filing the Form T2033 for a direct transfer under the mentioned subsections or paragraphs is responsible for filing.

FAQ

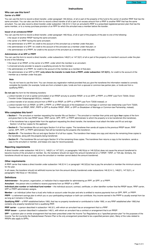

Q: What is Form T2033?

A: Form T2033 is a form used in Canada for direct transfers under specific subsections or paragraphs.

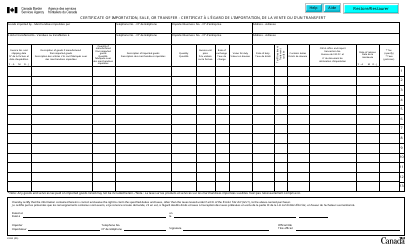

Q: What is a direct transfer?

A: A direct transfer refers to the transfer of funds or assets from one registered plan or account to another, without any tax consequences.

Q: What subsections or paragraphs does Form T2033 cover?

A: Form T2033 covers direct transfers under subsections 146.3(14.1), 147.5(21), or 146(21), as well as paragraph 146(16)(A) or 146.3(2)(E).

Q: What is subsection 146.3(14.1)?

A: Subsection 146.3(14.1) is a provision in the tax law of Canada that allows for direct transfers under specific conditions.

Q: What is subsection 147.5(21)?

A: Subsection 147.5(21) is another provision in the tax law of Canada that allows for direct transfers under specific conditions.

Q: What is subsection 146(21)?

A: Subsection 146(21) is yet another provision in the tax law of Canada that allows for direct transfers under specific conditions.

Q: What is paragraph 146(16)(A)?

A: Paragraph 146(16)(A) is a specific clause in the tax law of Canada that allows for direct transfers under certain circumstances.

Q: What is paragraph 146.3(2)(E)?

A: Paragraph 146.3(2)(E) is a specific clause in the tax law of Canada that allows for direct transfers under certain circumstances.