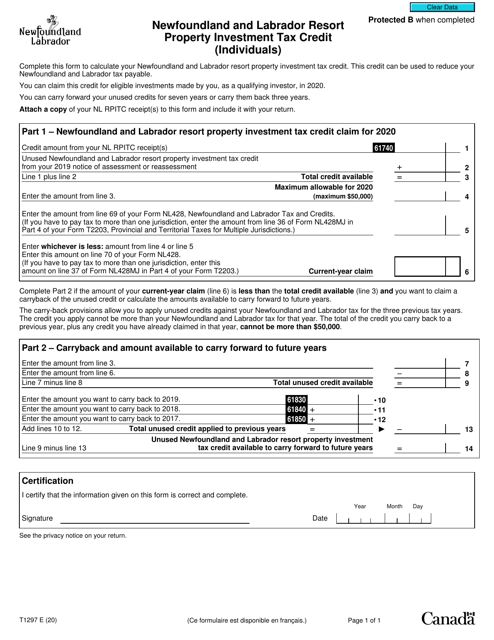

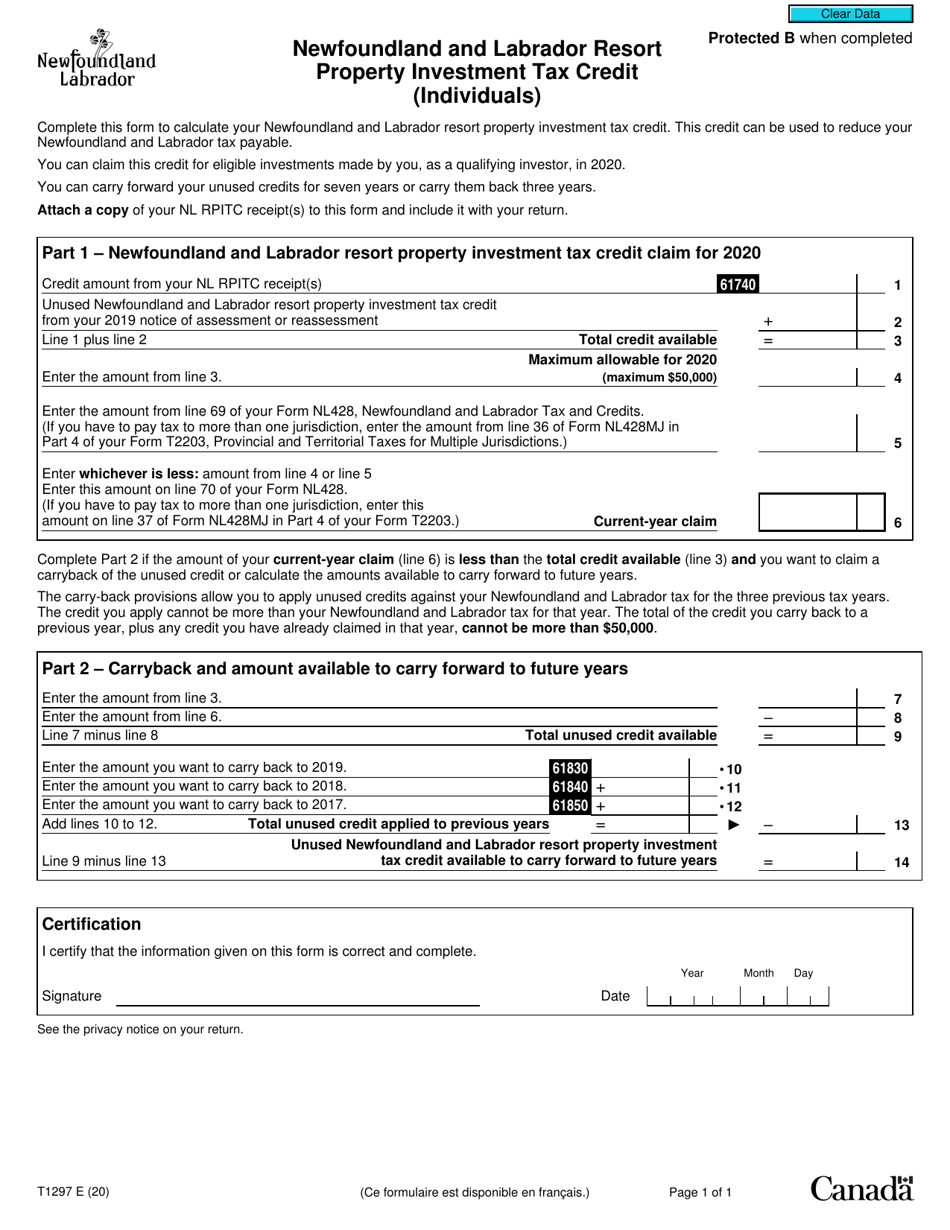

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1297

for the current year.

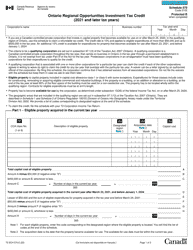

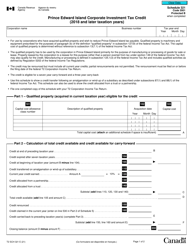

Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit (Individuals) - Canada

Form T1297, Newfoundland and Labrador Resort PropertyInvestment Tax Credit (Individuals) in Canada, is a tax credit available to individuals who have invested in qualified resort properties in Newfoundland and Labrador. This tax credit encourages investment in the province's tourism sector and provides individuals with a credit against their provincial income tax.

Individual taxpayers would file the Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit in Canada.

FAQ

Q: What is Form T1297?

A: Form T1297 is a tax form used in Canada.

Q: What is the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: The Newfoundland and Labrador Resort Property Investment Tax Credit is a tax credit available to individuals.

Q: Who is eligible for the tax credit?

A: Individuals who invest in resort properties in Newfoundland and Labrador may be eligible for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to encourage investment in resort properties in Newfoundland and Labrador.

Q: How much is the tax credit?

A: The tax credit can be up to 20% of the cost of eligible resort properties.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete Form T1297 and include it with your income tax return.

Q: Are there any restrictions on the tax credit?

A: Yes, there are certain restrictions and eligibility criteria that must be met to qualify for the tax credit.

Q: Is the tax credit available to businesses?

A: No, the tax credit is only available to individuals.

Q: Can the tax credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward to future years or transferred to another person.