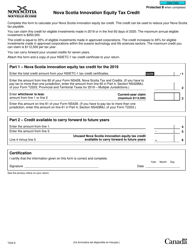

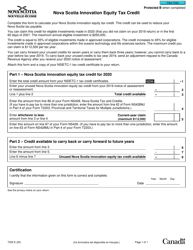

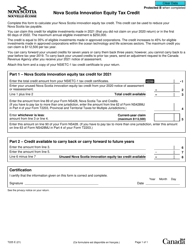

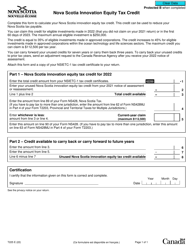

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1272

for the current year.

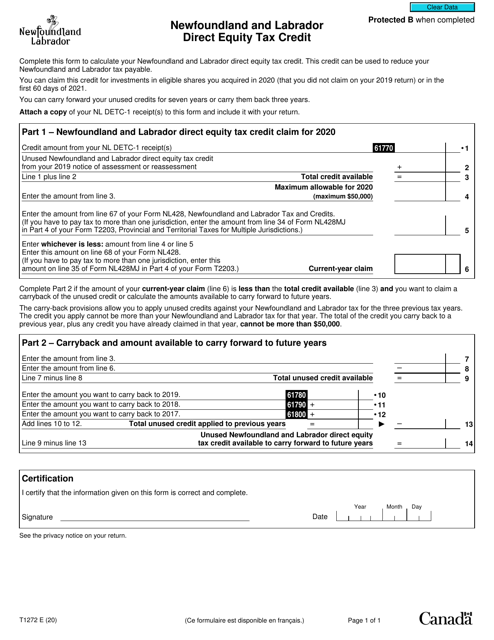

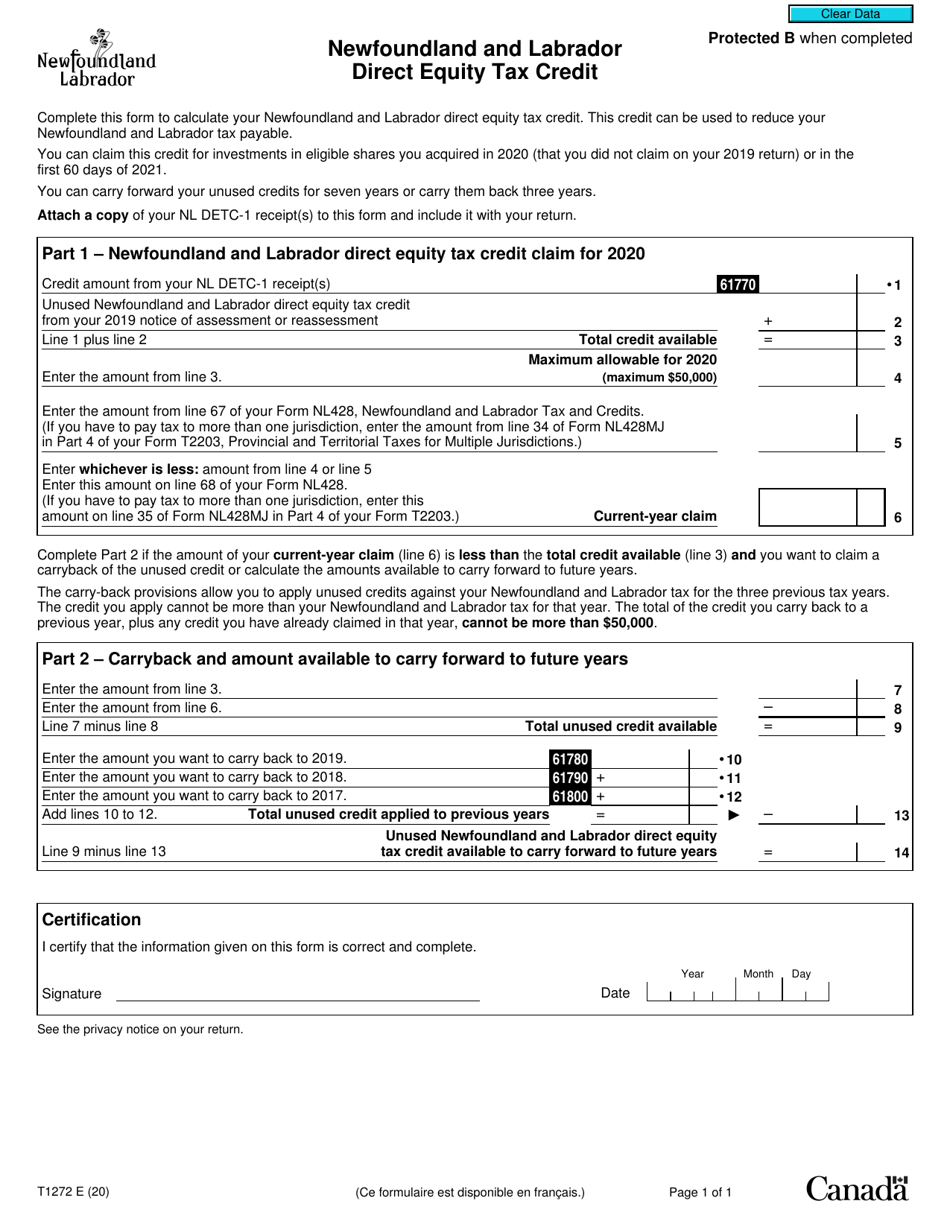

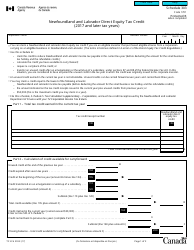

Form T1272 Newfoundland and Labrador Direct Equity Tax Credit - Canada

Form T1272 Newfoundland and Labrador Direct Equity Tax Credit is used in Canada to claim tax credits related to direct equity investments in Newfoundland and Labrador. It is specifically for individuals who have made eligible investments in businesses located in Newfoundland and Labrador and want to claim the tax credit for the investment.

The form T1272 Newfoundland and Labrador Direct Equity Tax Credit in Canada is typically filed by taxpayers who are residents of Newfoundland and Labrador and meet the eligibility criteria for claiming this specific tax credit.

FAQ

Q: What is Form T1272?

A: Form T1272 is a tax form used in Newfoundland and Labrador to claim the Direct Equity Tax Credit.

Q: What is the Direct Equity Tax Credit?

A: The Direct Equity Tax Credit is a provincial tax credit in Newfoundland and Labrador that allows individuals to claim a credit for investments made in eligible small businesses.

Q: Who is eligible for the Direct Equity Tax Credit?

A: Individuals who reside in Newfoundland and Labrador and have made investments in eligible small businesses may be eligible for the Direct Equity Tax Credit.

Q: What is the purpose of the Direct Equity Tax Credit?

A: The purpose of the Direct Equity Tax Credit is to encourage investment in small businesses in Newfoundland and Labrador, thereby stimulating economic growth and job creation.

Q: How do I claim the Direct Equity Tax Credit?

A: To claim the Direct Equity Tax Credit, you need to complete Form T1272 and include it with your annual income tax return. The form requires you to provide details of your investments in eligible small businesses.

Q: What is the deadline for claiming the Direct Equity Tax Credit?

A: The deadline for claiming the Direct Equity Tax Credit is usually the same as the deadline for filing your annual income tax return, which is April 30th of the following year.

Q: Are there any limitations or restrictions on the Direct Equity Tax Credit?

A: Yes, there are limitations and restrictions on the Direct Equity Tax Credit. It is important to review the eligibility criteria and guidelines provided by the Newfoundland and Labrador government.

Q: Can I carry forward any unused Direct Equity Tax Credit?

A: Yes, any unused Direct Equity Tax Credit can be carried forward for up to three years and applied against future tax liabilities.

Q: Is the Direct Equity Tax Credit refundable?

A: No, the Direct Equity Tax Credit is non-refundable. It can only be used to reduce your provincial tax liability in Newfoundland and Labrador.