This version of the form is not currently in use and is provided for reference only. Download this version of

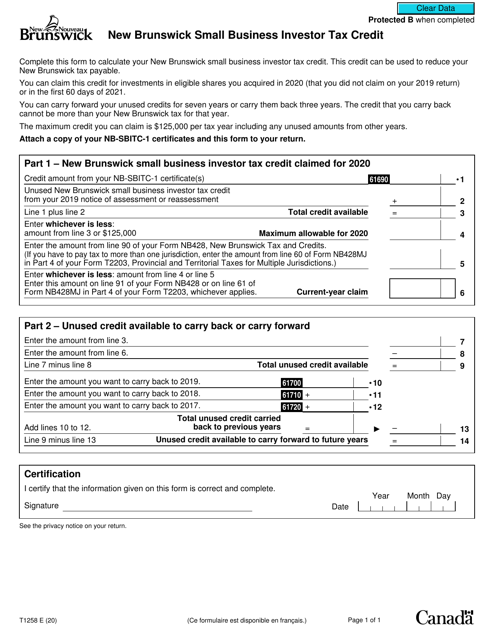

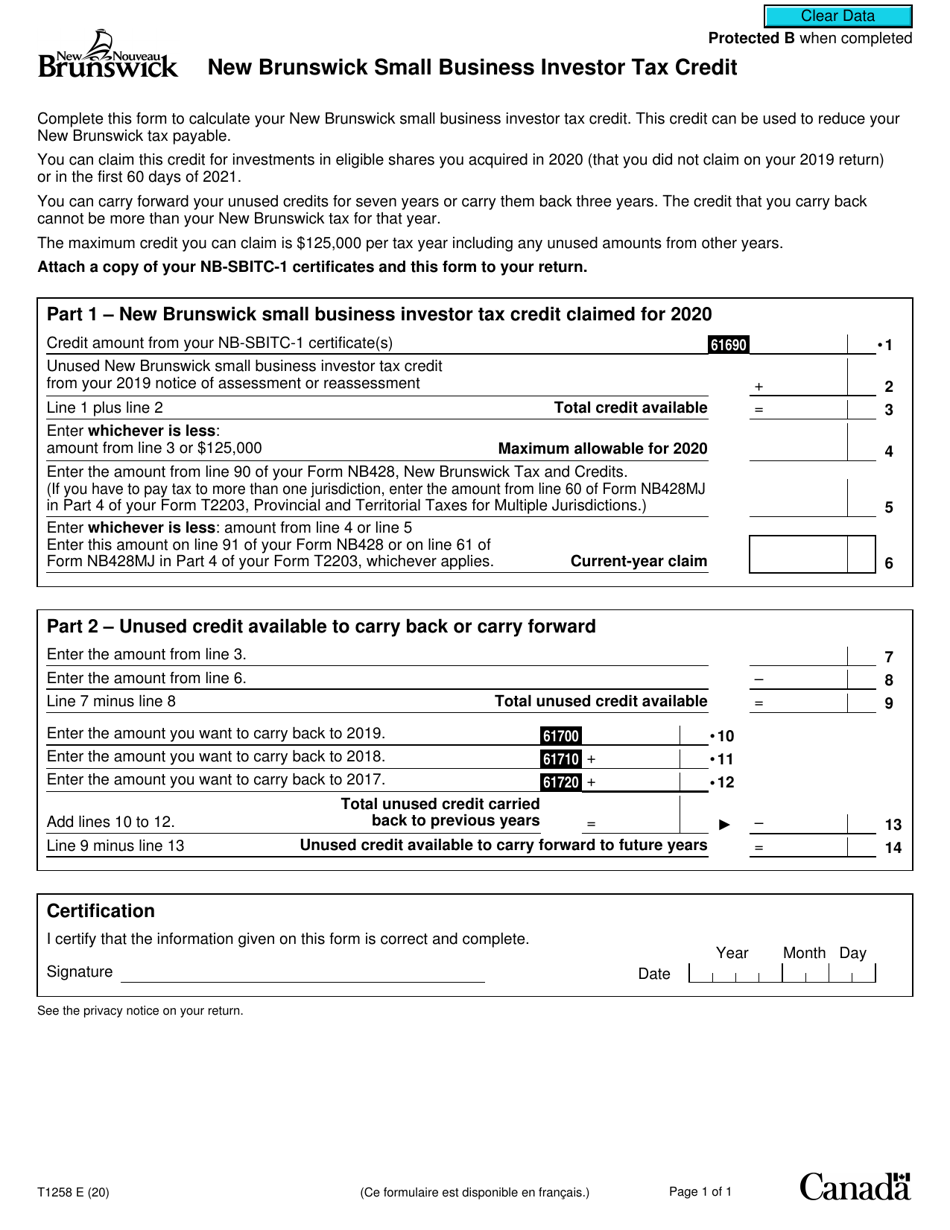

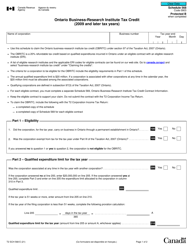

Form T1258

for the current year.

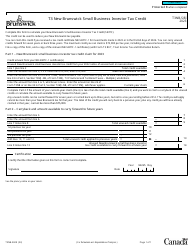

Form T1258 New Brunswick Small Business Investor Tax Credit - Canada

Form T1258 is used for claiming the New Brunswick Small Business Investor Tax Credit in Canada. This credit is available to individuals or corporations who have invested in eligible small businesses in New Brunswick. It allows them to reduce their provincial income tax owing by a certain percentage of their investment. The purpose of this credit is to encourage investment in small businesses in New Brunswick and support economic growth in the province.

The form T1258 for the New Brunswick Small Business Investor Tax Credit in Canada is filed by individual investors who have invested in eligible small businesses in New Brunswick.

FAQ

Q: What is Form T1258?

A: Form T1258 is a tax form used in Canada.

Q: What is the New Brunswick Small Business Investor Tax Credit?

A: The New Brunswick Small Business Investor Tax Credit is a tax credit available in New Brunswick, Canada.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage individuals to invest in small businesses in New Brunswick.

Q: Who is eligible for the tax credit?

A: Eligibility for the tax credit depends on certain criteria set by the government of New Brunswick.

Q: How much is the tax credit?

A: The amount of the tax credit varies and is based on the amount invested in eligible small businesses.

Q: How can I claim the tax credit?

A: To claim the tax credit, you must fill out Form T1258 and submit it with your tax return.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, there are specific deadlines for claiming the tax credit. It is important to check the current year's tax guidelines or consult with a tax professional for the most up-to-date information.

Q: Is the tax credit refundable?

A: Yes, the New Brunswick Small Business Investor Tax Credit is refundable, meaning that if the credit exceeds the amount of tax owing, you may receive a refund.

Q: Are there any restrictions on the tax credit?

A: Yes, there may be certain restrictions and limitations on the tax credit. It is advisable to review the tax guidelines or consult with a tax professional for detailed information.