This version of the form is not currently in use and is provided for reference only. Download this version of

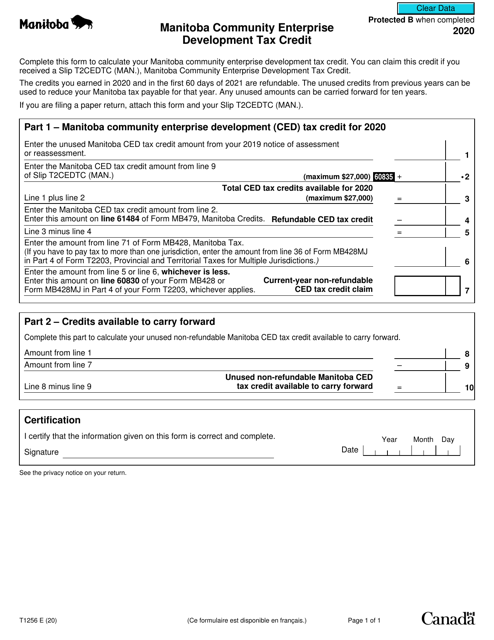

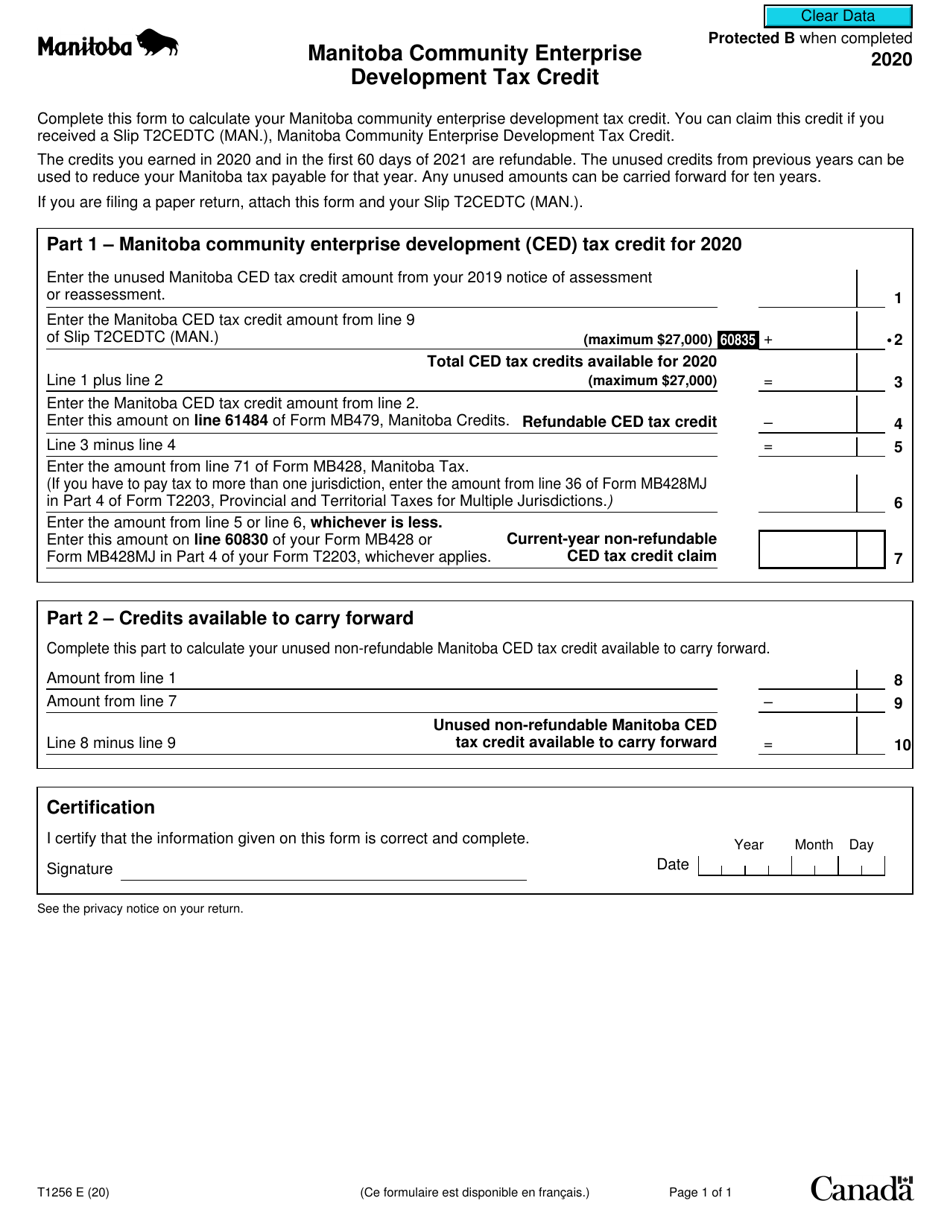

Form T1256

for the current year.

Form T1256 Manitoba Community Enterprise Development Tax Credit - Canada

Form T1256 is used to claim the Manitoba Community Enterprise Development Tax Credit in Canada. This tax credit is available to individuals or corporations that invest in eligible community enterprises in Manitoba. It helps promote economic development and create employment opportunities in the province.

The Form T1256 Manitoba Community Enterprise Development Tax Credit in Canada is filed by individual taxpayers who are eligible for the tax credit.

FAQ

Q: What is Form T1256?

A: Form T1256 is a tax form used in Canada.

Q: What is the Manitoba Community Enterprise Development Tax Credit?

A: The Manitoba Community Enterprise Development Tax Credit is a program that provides tax credits to individuals and corporations that invest in eligible community enterprises in Manitoba.

Q: Who is eligible for the Manitoba Community Enterprise Development Tax Credit?

A: Individuals and corporations who invest in eligible community enterprises in Manitoba are eligible for the tax credit.

Q: How much tax credit can I receive through this program?

A: The tax credit amount is equal to 45% of the investment made in an eligible community enterprise.

Q: What is the purpose of this tax credit program?

A: The program aims to encourage investment in community enterprises in Manitoba, which in turn promotes economic growth and job creation in the province.

Q: How do I apply for the Manitoba Community Enterprise Development Tax Credit?

A: To apply for the tax credit, individuals and corporations must complete and file Form T1256 with their tax return.

Q: Are there any deadlines for applying for this tax credit?

A: The deadline for filing Form T1256 is the same as the deadline for filing your annual tax return.

Q: Can I claim this tax credit if I do not reside in Manitoba?

A: No, only individuals and corporations that invest in eligible community enterprises in Manitoba are eligible for this tax credit.

Q: Can I carry forward any unused tax credits to future years?

A: Yes, any unused tax credits can be carried forward for up to 7 years.