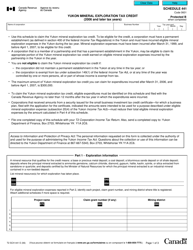

This version of the form is not currently in use and is provided for reference only. Download this version of

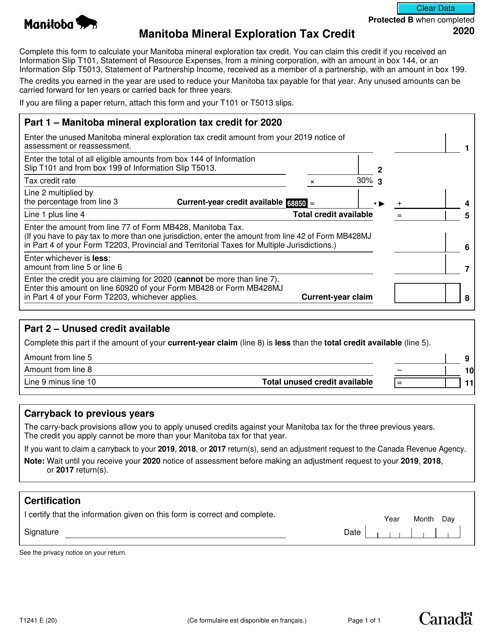

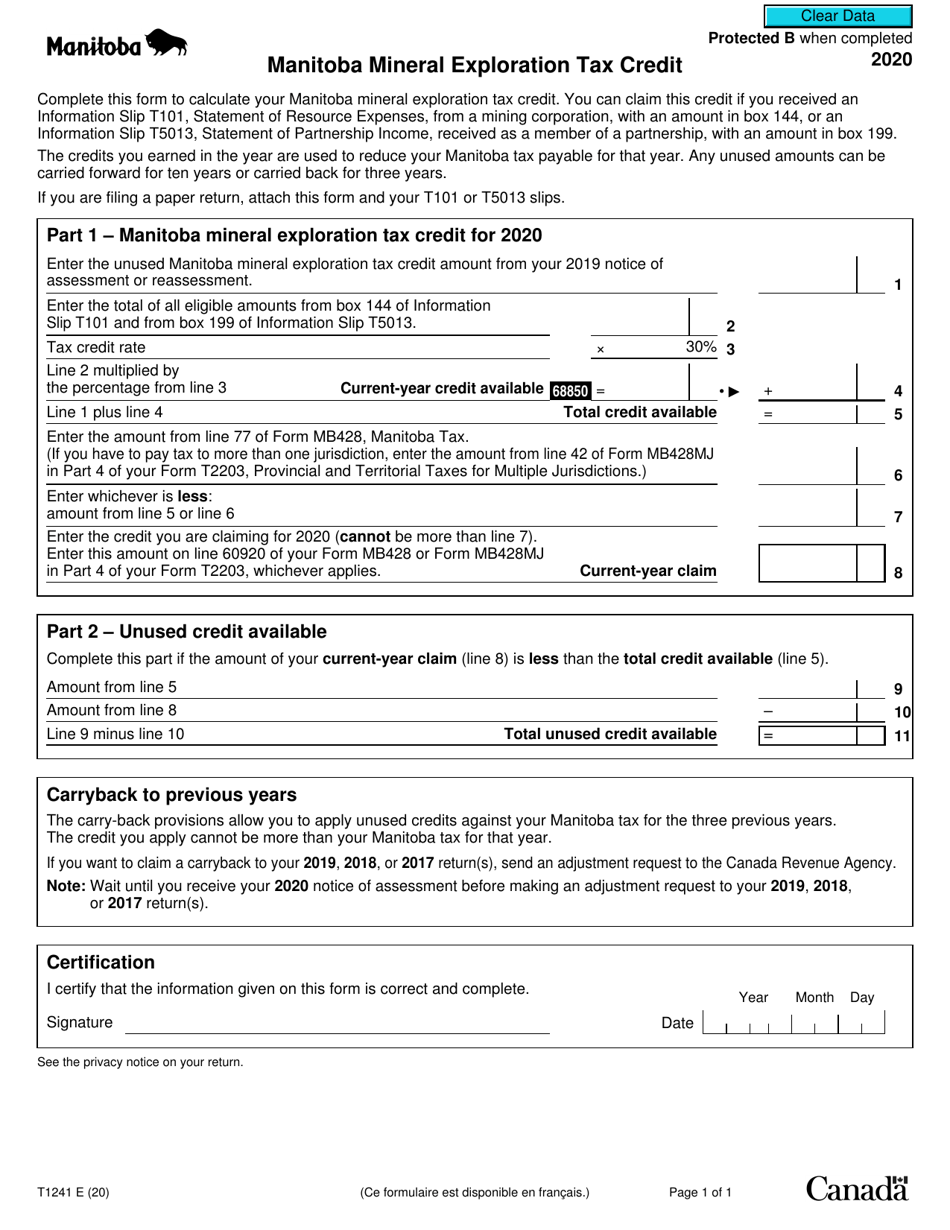

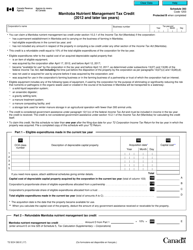

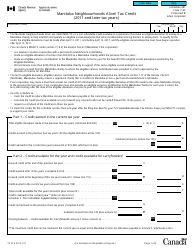

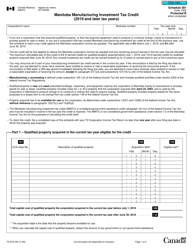

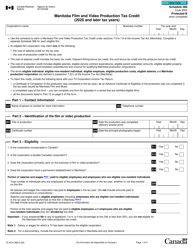

Form T1241

for the current year.

Form T1241 Manitoba Mineral Exploration Tax Credit - Canada

Form T1241, Manitoba Mineral Exploration Tax Credit, is a form used in Canada to claim tax credits for expenditures related to mineral exploration in the province of Manitoba. This form allows Canadian residents to reduce their taxes owed by claiming eligible exploration expenses.

The Form T1241 Manitoba Mineral Exploration Tax Credit in Canada is filed by individuals or corporations who are eligible for the tax credit for mineral exploration activities in the province of Manitoba.

FAQ

Q: What is Form T1241?

A: Form T1241 is a tax form in Canada used to claim the Manitoba Mineral Exploration Tax Credit.

Q: What is the Manitoba Mineral Exploration Tax Credit?

A: The Manitoba Mineral Exploration Tax Credit is a tax credit in Canada aimed at encouraging mineral exploration in the province of Manitoba.

Q: Who can claim the Manitoba Mineral Exploration Tax Credit?

A: Individuals and corporations who incur eligible mineral exploration expenses in Manitoba can claim the tax credit.

Q: What are eligible mineral exploration expenses?

A: Eligible mineral exploration expenses include expenses related to locating, drilling, and testing for minerals in Manitoba.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of eligible mineral exploration expenses.

Q: Can the tax credit be carried forward?

A: Yes, any unused tax credit can be carried forward for 20 years to offset future taxable income.

Q: When should Form T1241 be filed?

A: Form T1241 should be filed with your annual tax return.