This version of the form is not currently in use and is provided for reference only. Download this version of

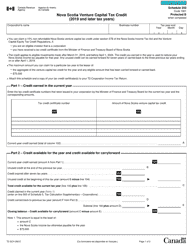

Form T1237

for the current year.

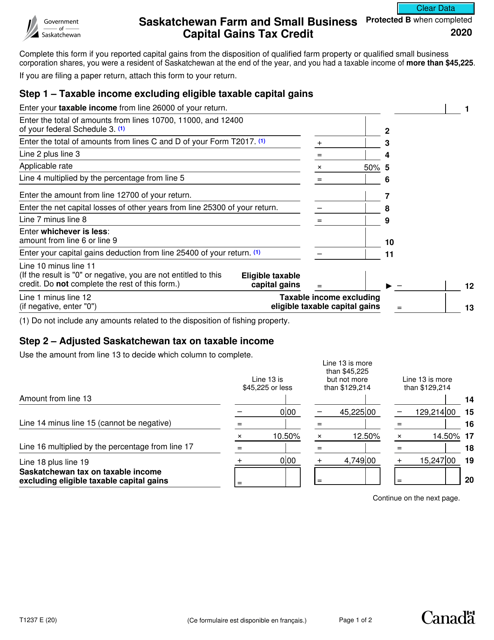

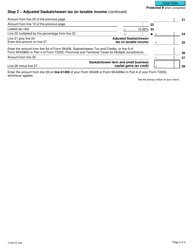

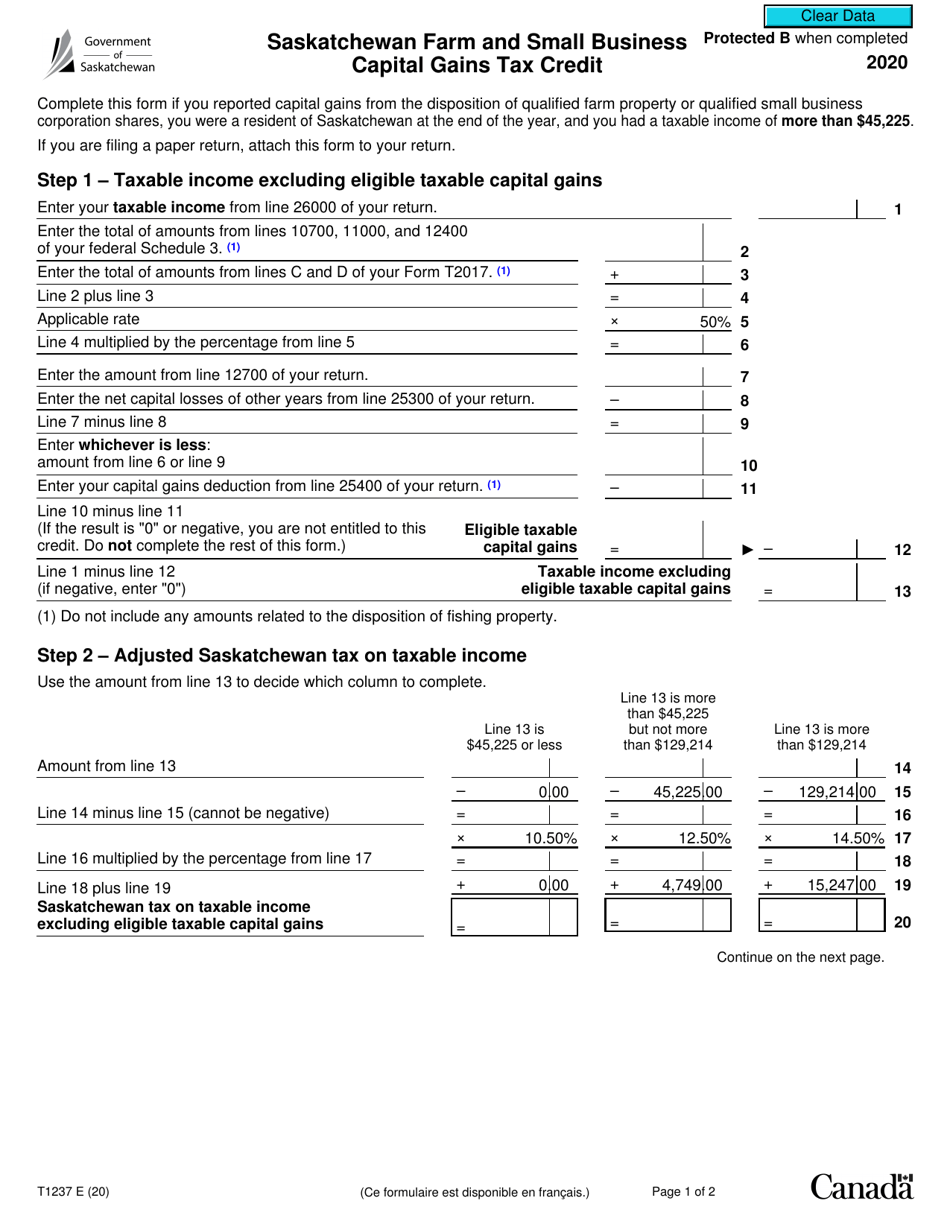

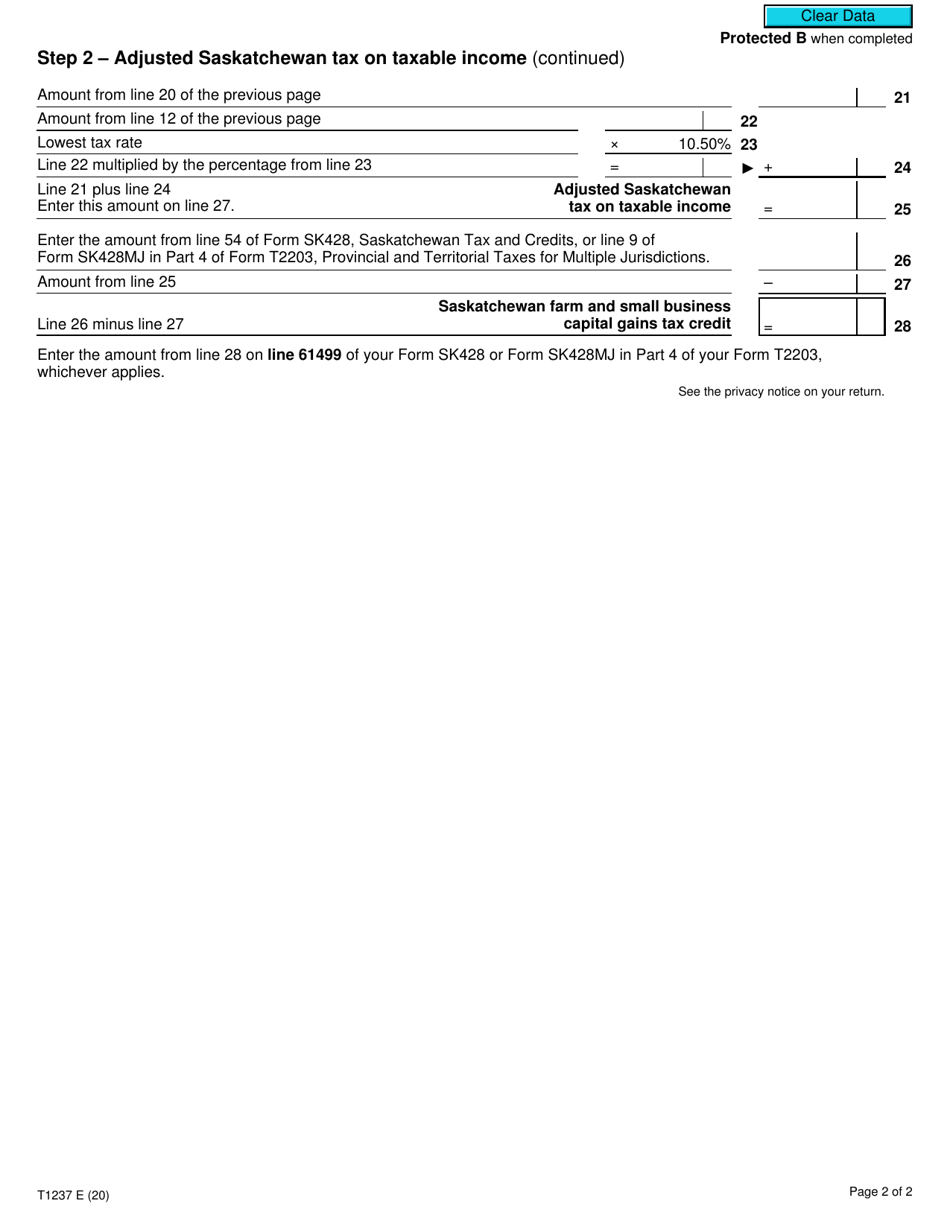

Form T1237 Saskatchewan Farm and Small Business Capital Gains Tax Credit - Canada

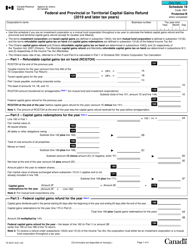

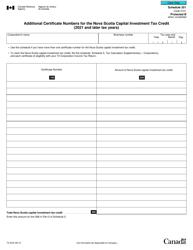

Form T1237 is used in Canada to calculate and claim the Saskatchewan Farm and Small Business Capital Gains Tax Credit. This credit is available to individuals who sell eligible farm or small business assets in Saskatchewan and helps to reduce the amount of capital gains tax that they owe.

The Form T1237 Saskatchewan Farm and Small Business Capital Gains Tax Credit is filed by individuals who are eligible for this tax credit in Canada.

FAQ

Q: What is Form T1237?

A: Form T1237 is the Saskatchewan Farm and Small Business Capital Gains Tax Credit form in Canada.

Q: What is the purpose of Form T1237?

A: The purpose of Form T1237 is to claim the capital gains tax credit for Saskatchewan farm and small business owners.

Q: Who is eligible for the Saskatchewan Farm and Small Business Capital Gains Tax Credit?

A: Saskatchewan residents who sold a qualified farm or small business property are eligible for this tax credit.

Q: What is the amount of the tax credit?

A: The tax credit is equal to 10% of the capital gains from the sale of a qualified farm or small business property.

Q: How can I claim the tax credit?

A: To claim the tax credit, you must complete and submit Form T1237 along with your federal tax return.

Q: Is there a deadline for filing Form T1237?

A: Yes, Form T1237 must be filed by the tax return filing deadline, which is usually April 30th of the following year.

Q: Can I claim the tax credit if I didn't sell a farm or small business property?

A: No, the tax credit is only available to individuals who sold a qualified farm or small business property in Saskatchewan.

Q: Are there any other requirements to be eligible for the tax credit?

A: Yes, you must meet additional criteria, such as being a Saskatchewan resident at the time of the property sale and having both federal and provincial tax payable.