This version of the form is not currently in use and is provided for reference only. Download this version of

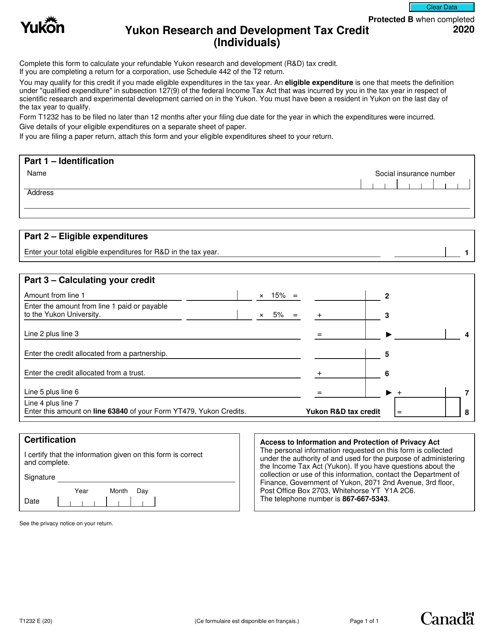

Form T1232

for the current year.

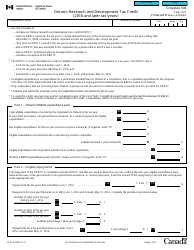

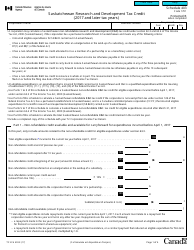

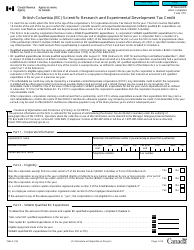

Form T1232 Yukon Research and Development Tax Credit (Individuals) - Canada

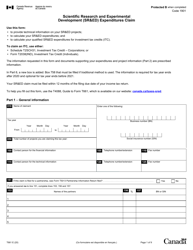

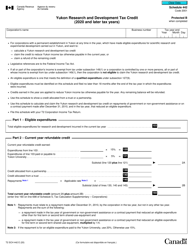

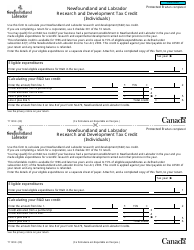

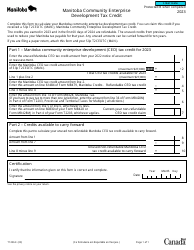

Form T1232 Yukon Research and Development Tax Credit (Individuals) is used in Canada for individuals to claim tax credits related to research and development activities conducted in the Yukon territory. This form helps individuals reduce their taxable income and potentially receive a tax refund.

The Form T1232 Yukon Research and Development Tax Credit (Individuals) in Canada is filed by individuals who are claiming the research and development tax credit in the Yukon territory.

FAQ

Q: What is Form T1232?

A: Form T1232 is a tax form for claiming the Yukon Research and Development Tax Credit for individuals in Canada.

Q: Who can use Form T1232?

A: Individuals residing in Yukon, Canada, who have incurred eligible research and development expenses can use Form T1232.

Q: What is the Yukon Research and Development Tax Credit?

A: The Yukon Research and Development Tax Credit is a tax credit that provides financial assistance to individuals who engage in scientific research and experimental development in Yukon, Canada.

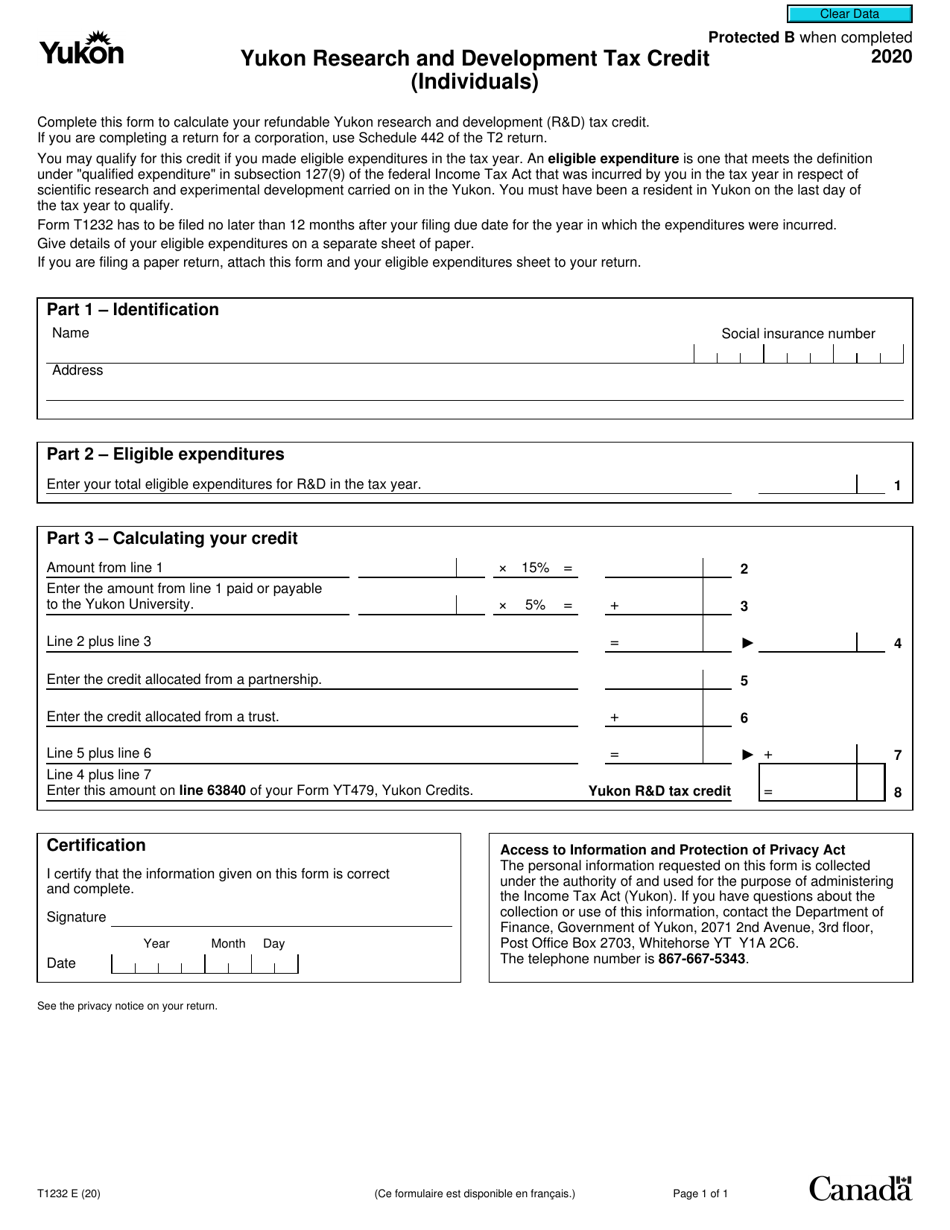

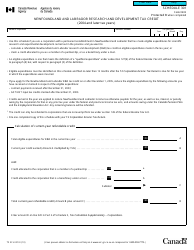

Q: What expenses are eligible for the tax credit?

A: Expenses related to scientific research and experimental development conducted in Yukon, including wages, materials, and contracted services, may be eligible for the tax credit.

Q: How do I claim the tax credit?

A: To claim the Yukon Research and Development Tax Credit, individuals need to complete Form T1232 and submit it along with their income tax return to the Canada Revenue Agency (CRA).

Q: Is there a deadline for claiming the tax credit?

A: Yes, individuals must submit Form T1232 by the same deadline as their income tax return, which is usually April 30th of the following year.

Q: Are there any other requirements for claiming the tax credit?

A: Yes, individuals must meet certain criteria, such as being a resident of Yukon, having paid eligible expenses, and having documentation to support their claim.

Q: What is the benefit of claiming the tax credit?

A: By claiming the Yukon Research and Development Tax Credit, individuals can reduce their tax liability and potentially receive a refund.

Q: Can the tax credit be transferred or carried forward?

A: No, the Yukon Research and Development Tax Credit cannot be transferred to another person or carried forward to future years.

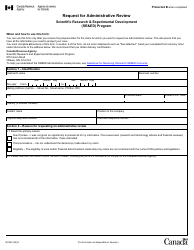

Q: What if I have more questions or need assistance?

A: If you have more questions or need assistance, you can contact the Canada Revenue Agency (CRA) or seek advice from a tax professional.