This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1170

for the current year.

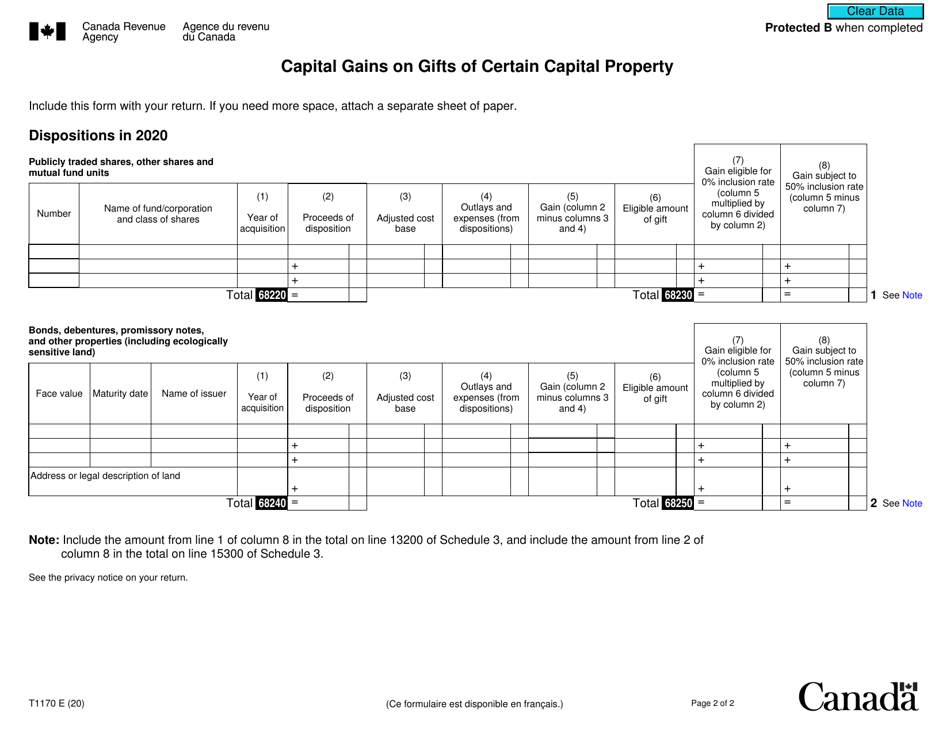

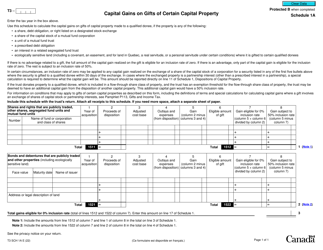

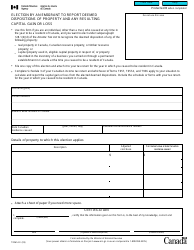

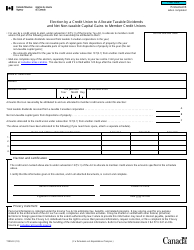

Form T1170 Capital Gains on Gifts of Certain Capital Property - Canada

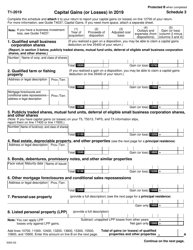

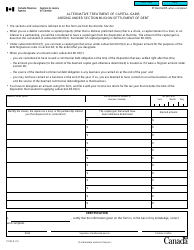

Form T1170, Capital Gains on Gifts of Certain Capital Property, is used in Canada to report any capital gains or losses that arise from the gifting of certain capital properties. This form is required when a taxpayer donates eligible investments or other types of capital properties to a qualified donee, such as a registered charity or a government organization. The form helps calculate the capital gains or losses that may be subject to taxation or eligible for any related tax benefits.

The taxpayer who makes the gift of certain capital property is responsible for filing Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada.

FAQ

Q: What is Form T1170?

A: Form T1170 is a tax form used in Canada to report capital gains on gifts of certain capital property.

Q: What is a capital gain?

A: A capital gain is the profit earned from the sale of a capital asset.

Q: What is considered a gift of certain capital property?

A: A gift of certain capital property refers to the transfer of ownership of an eligible property from one individual to another as a gift.

Q: What is the purpose of Form T1170?

A: The purpose of Form T1170 is to calculate and report any capital gains realized from the gift of certain capital property.

Q: Is there any tax liability on gifts of certain capital property?

A: Yes, there may be tax liability on gifts of certain capital property if there is a capital gain.

Q: Who is required to file Form T1170?

A: The individual who received the gift of certain capital property is required to file Form T1170.

Q: When should Form T1170 be filed?

A: Form T1170 should be filed with the individual's annual income tax return for the year in which the gift was received.

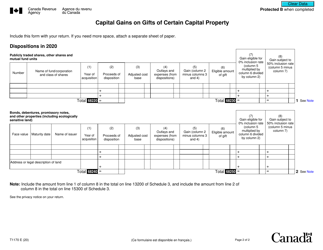

Q: What information is required to complete Form T1170?

A: To complete Form T1170, you will need information about the gifted property, including its adjusted cost base and fair market value at the time of the gift.

Q: Are there any deductions or credits available for gifts of certain capital property?

A: Yes, there may be deductions or credits available, such as the capital gains exemption, for gifts of certain capital property. It is important to consult with a tax professional for advice specific to your situation.