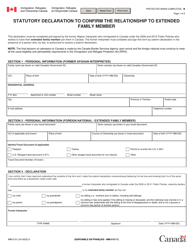

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1158

for the current year.

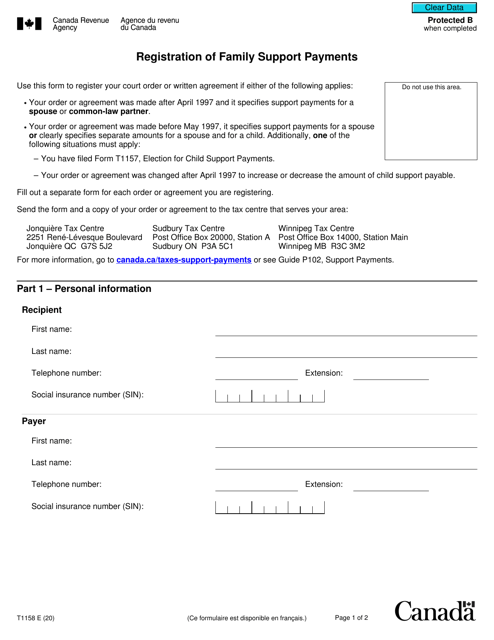

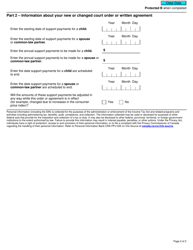

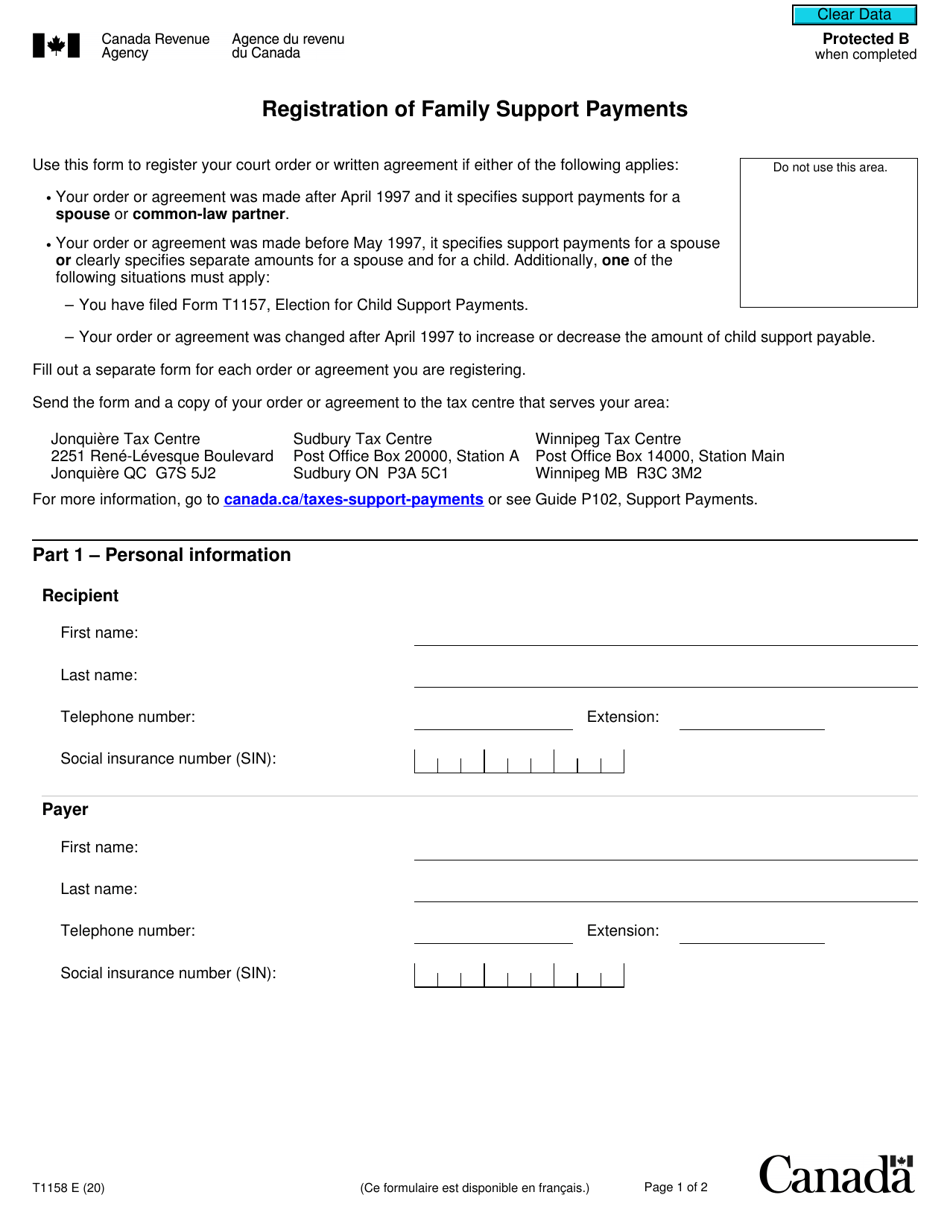

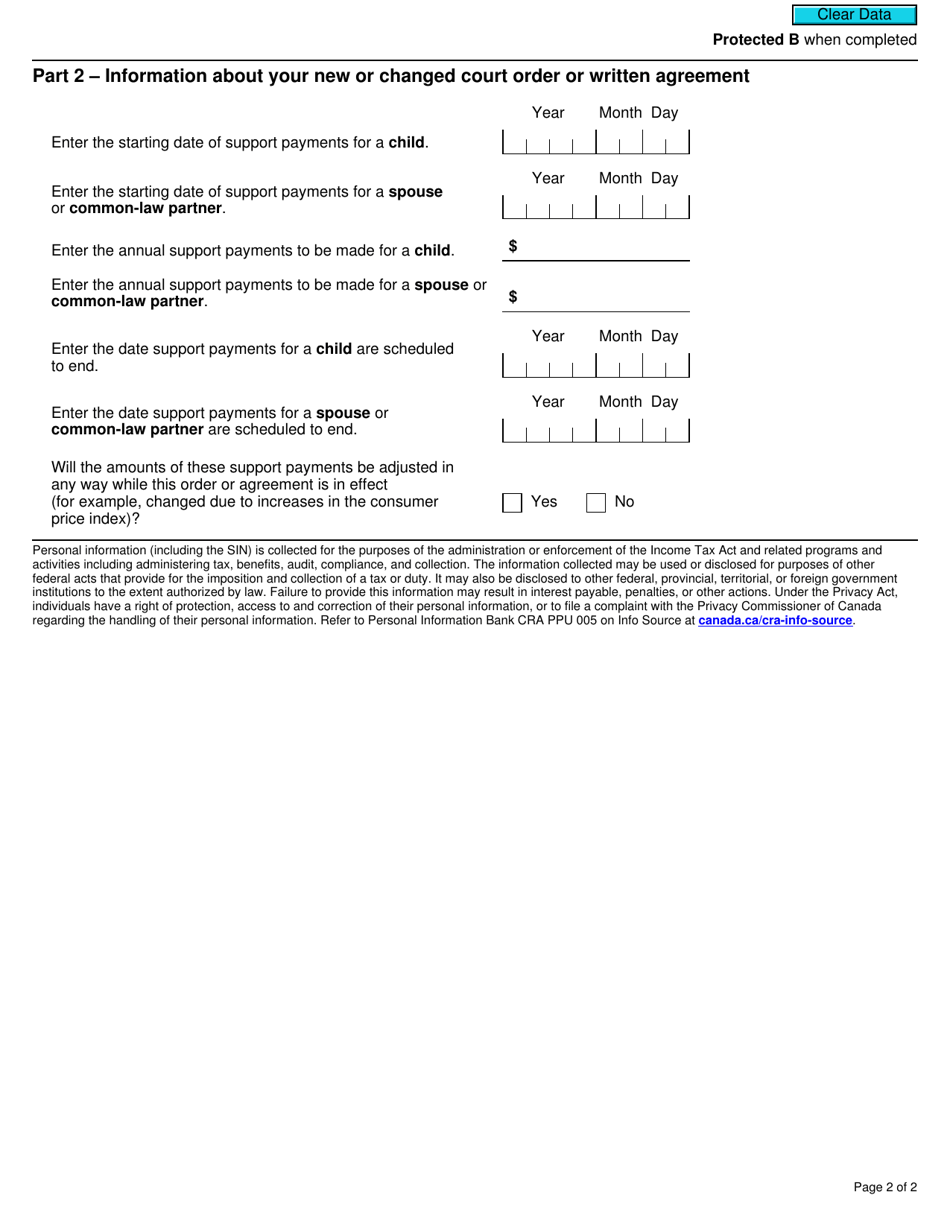

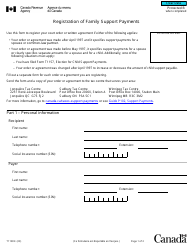

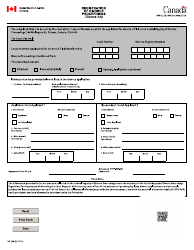

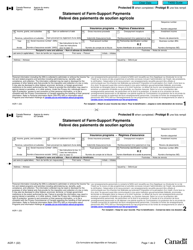

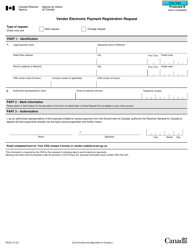

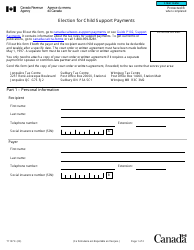

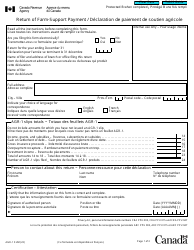

Form T1158 Registration of Family Support Payments - Canada

Form T1158, Registration of Family Support Payments, is used in Canada to report information about support payments made to a former spouse or common-law partner. It is filed by the person making the payments to claim a tax deduction or credit for those payments.

The person making the family support payments in Canada is responsible for filing the Form T1158 Registration of Family Support Payments.

FAQ

Q: What is Form T1158?

A: Form T1158 is the Registration of Family Support Payments form in Canada.

Q: What is the purpose of Form T1158?

A: The purpose of Form T1158 is to register for the simplified procedure for reporting family support payments.

Q: Who needs to file Form T1158?

A: Anyone who wishes to use the simplified procedure for reporting family support payments in Canada needs to file Form T1158.

Q: What are family support payments?

A: Family support payments are payments made by one spouse or common-law partner to another spouse or common-law partner for the support of their children or former children.

Q: What is the simplified procedure for reporting family support payments?

A: The simplified procedure allows individuals to report family support payments on their income tax return instead of through the separate support payment registration system.

Q: Are there any deadlines for filing Form T1158?

A: Yes, Form T1158 must be filed by the due date of your income tax return for the year in which you start using the simplified reporting procedure.

Q: What happens after I file Form T1158?

A: After filing Form T1158, you will receive a letter from the CRA confirming your registration for the simplified reporting procedure.

Q: Can I update or cancel my registration for the simplified reporting procedure?

A: Yes, you can update or cancel your registration for the simplified reporting procedure by contacting the CRA.