This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC249

for the current year.

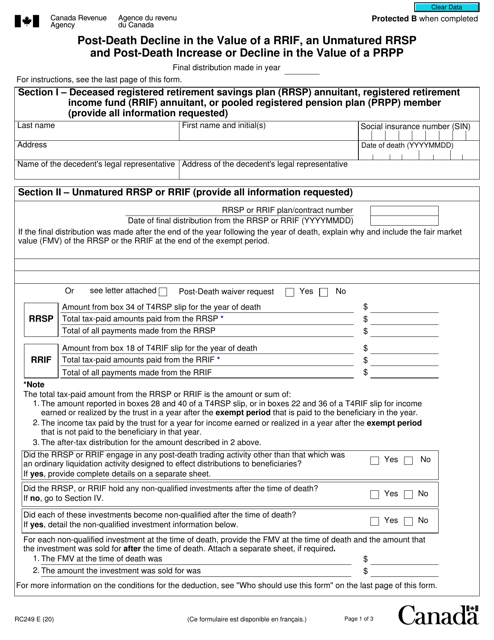

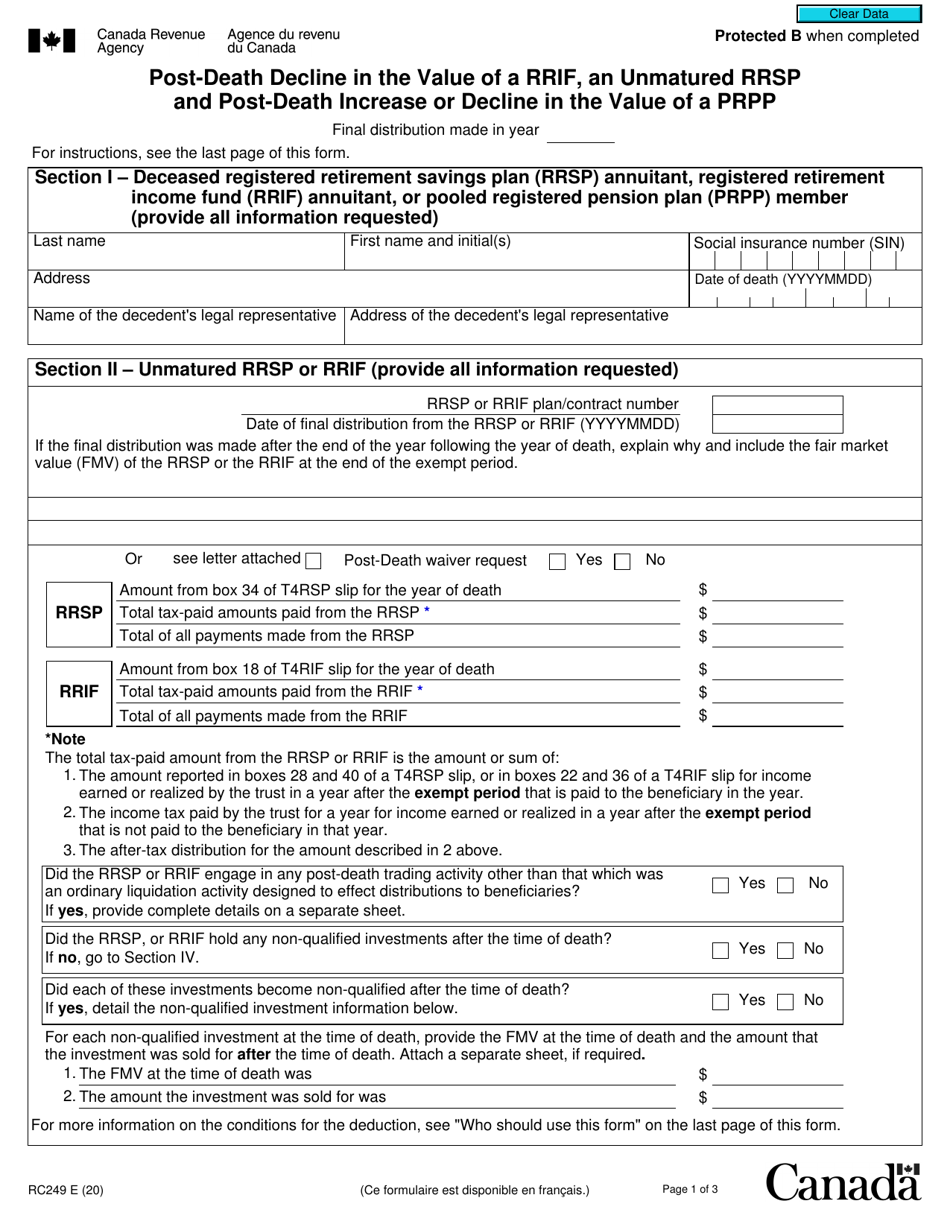

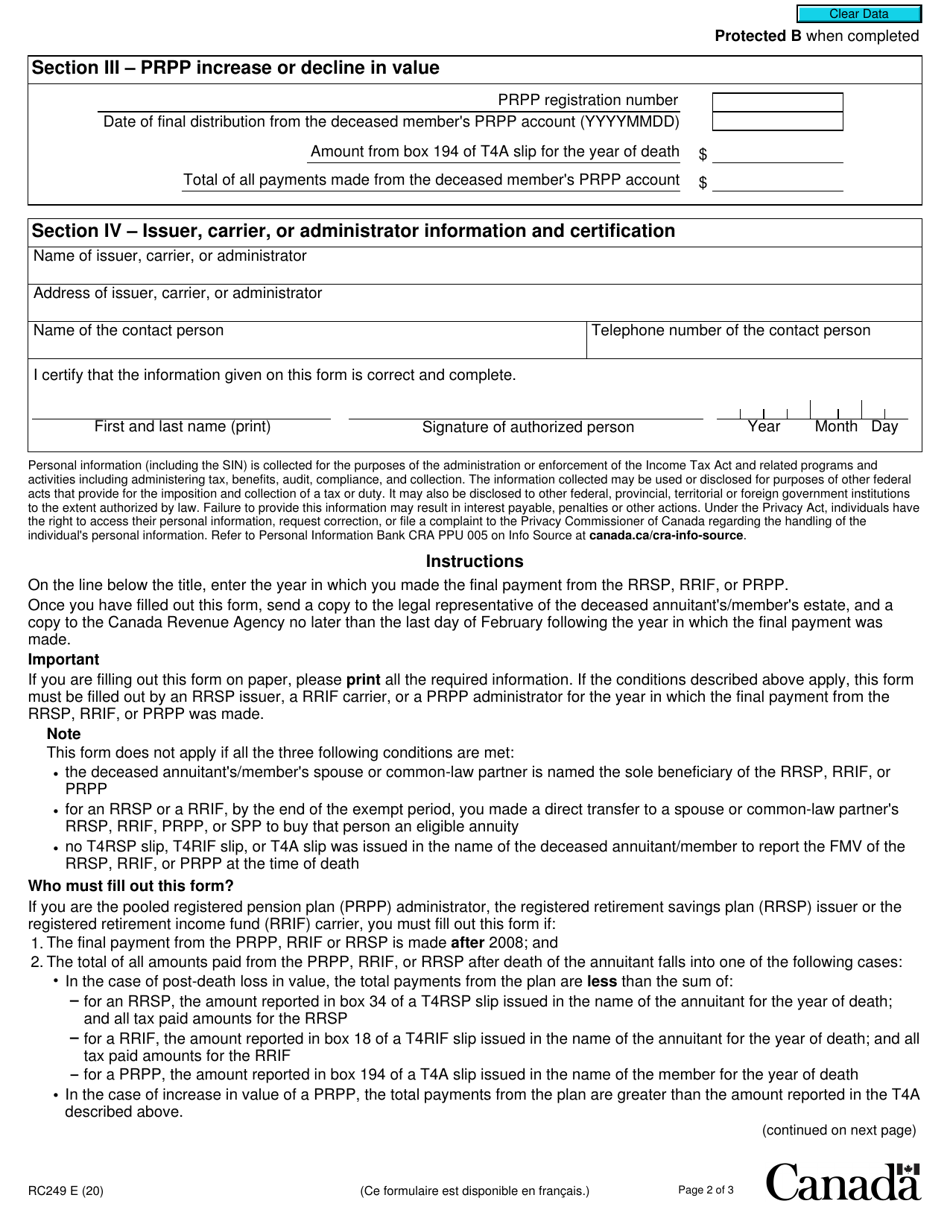

Form RC249 Post-death Decline in the Value of a Rrif, an Unmatured Rrsp and Post-death Increase or Decline in the Value of a Prpp - Canada

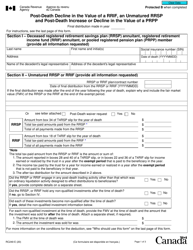

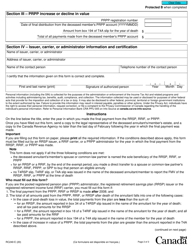

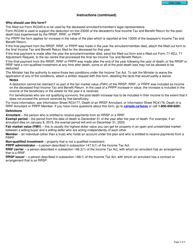

Form RC249 is used in Canada to report the post-death decline in the value of a Registered Retirement Income Fund (RRIF), an unmatured Registered Retirement Savings Plan (RRSP), and the post-death increase or decline in the value of a Pooled Registered Pension Plan (PRPP). It is utilized to calculate any possible tax implications related to these financial accounts after the account holder's death.

The beneficiary or the legal representative of the deceased person files the Form RC249 in Canada for post-death decline in the value of a RRIF, an unmatured RRSP, and post-death increase or decline in the value of a PRPP.

FAQ

Q: What is Form RC249?

A: Form RC249 is used in Canada to report a post-death decline in the value of a RRIF (Registered Retirement Income Fund), an unmatured RRSP (Registered Retirement Savings Plan), and post-death increase or decline in the value of a PRPP (Pooled Registered Pension Plan).

Q: When should Form RC249 be used?

A: Form RC249 should be used when there is a post-death decline in the value of a RRIF, an unmatured RRSP, or a post-death increase or decline in the value of a PRPP.

Q: What is a RRIF?

A: A RRIF is a retirement income plan in Canada that is registered with the government. It is used to hold and distribute retirement savings.

Q: What is an unmatured RRSP?

A: An unmatured RRSP refers to an RRSP that has not been converted into a retirement income option, such as a RRIF.

Q: What is a PRPP?

A: A PRPP is a Pooled Registered Pension Plan in Canada, which is a type of retirement savings plan available to individuals who do not have access to a workplace pension plan.

Q: Why would there be a post-death decline in the value of a RRIF, an unmatured RRSP, or a post-death increase or decline in the value of a PRPP?

A: The value of these plans may change after the death of the plan holder due to factors such as investment performance or beneficiary designations.