This version of the form is not currently in use and is provided for reference only. Download this version of

Form TL2

for the current year.

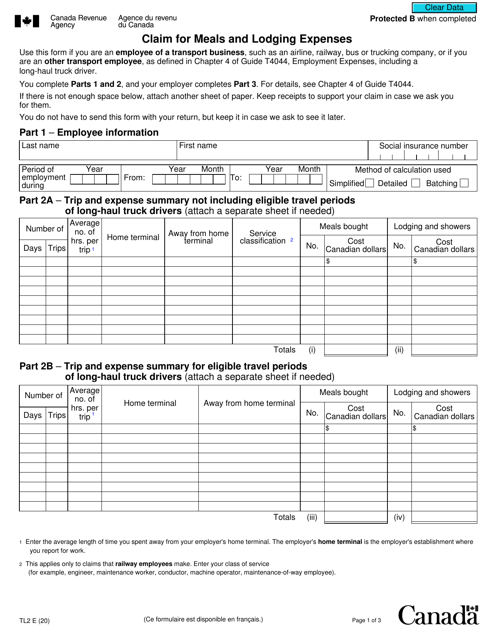

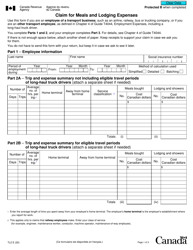

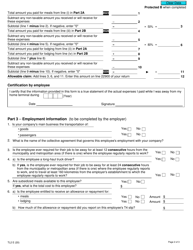

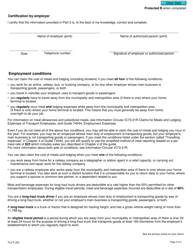

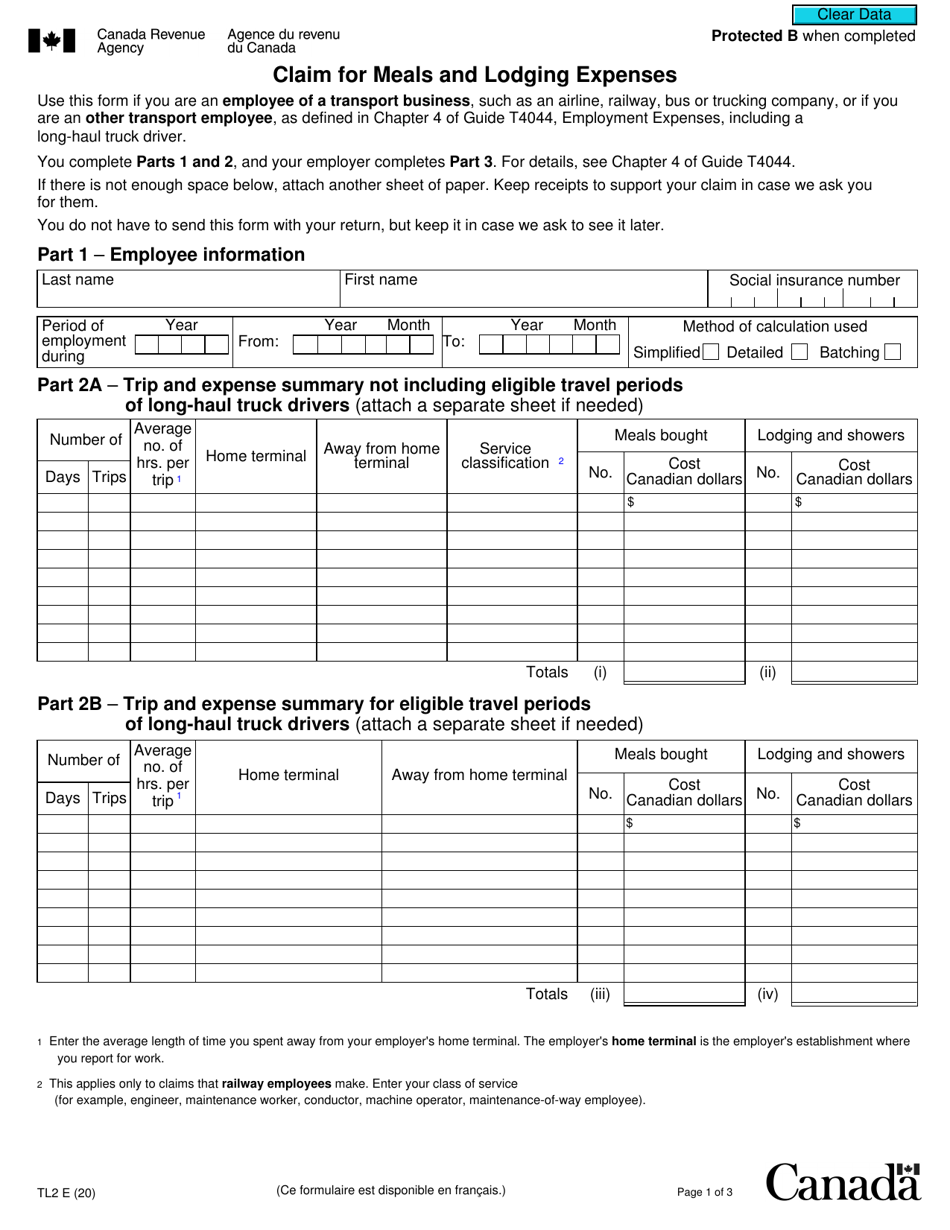

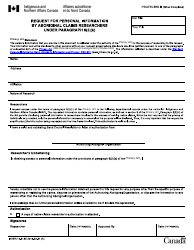

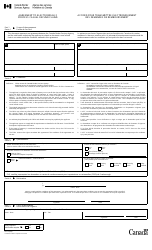

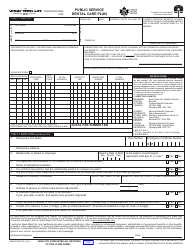

Form TL2 Claim for Meals and Lodging Expenses - Canada

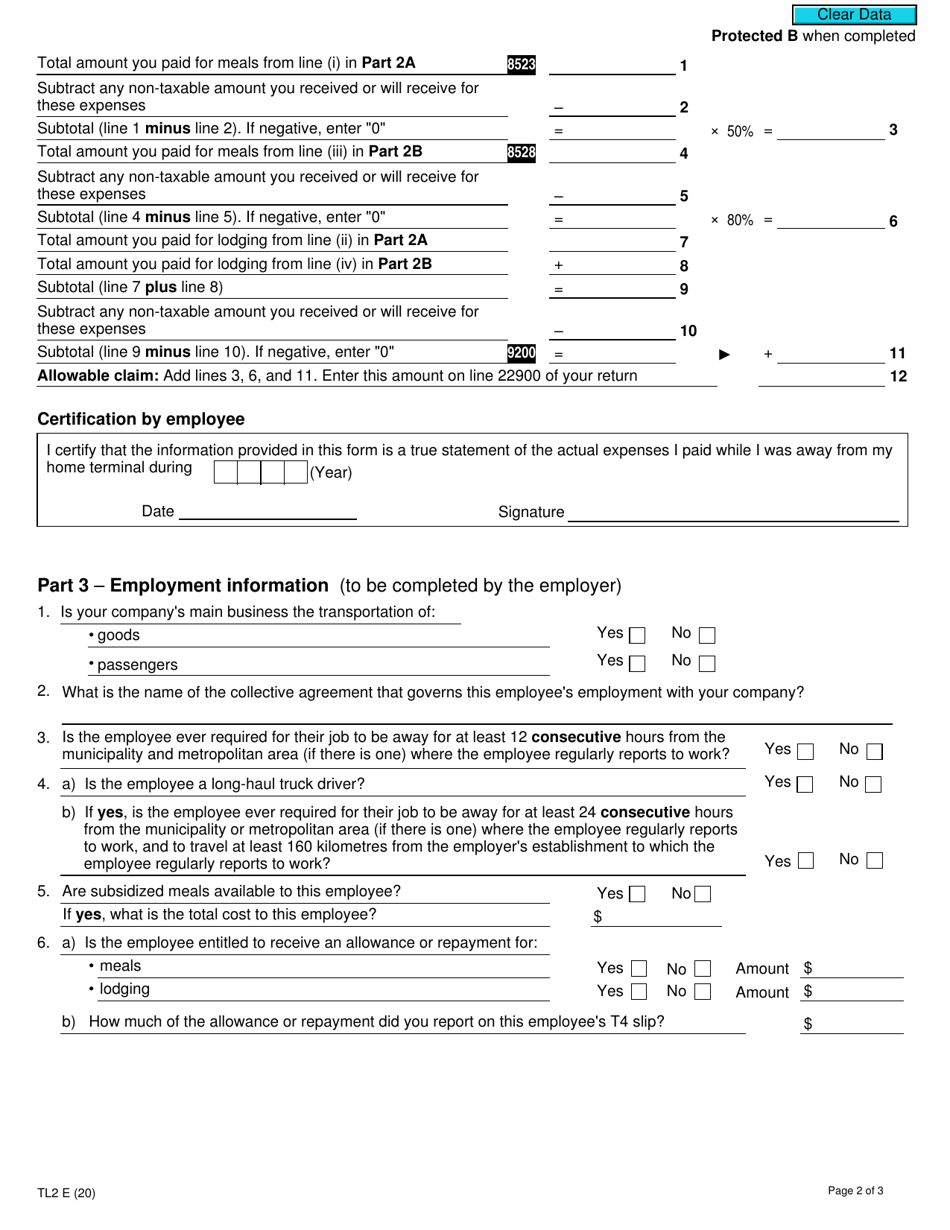

Form TL2, or the Claim for Meals and Lodging Expenses, is used in Canada to claim deductions for expenses related to meals and lodging. This form is typically used by employees who must travel for work purposes and incur these types of expenses. It allows them to seek reimbursement or claim tax deductions for eligible costs incurred while away from their usual place of work.

The individual taxpayer files the Form TL2 claim for meals and lodging expenses in Canada.

FAQ

Q: What is a TL2 claim?

A: A TL2 claim is a claim for meals and lodging expenses in Canada.

Q: Who can file a TL2 claim?

A: Anyone who has incurred meals and lodging expenses while on business travel in Canada can file a TL2 claim.

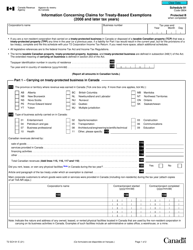

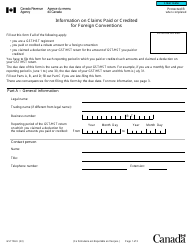

Q: What expenses can be claimed under TL2?

A: Under TL2, you can claim the cost of meals and lodging expenses incurred while on business travel in Canada.

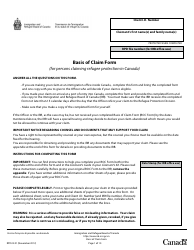

Q: What supporting documentation do I need for a TL2 claim?

A: You will need to provide receipts or other documentation that shows the details of your meals and lodging expenses, such as the date, location, and amount.

Q: Is there a limit to the amount that can be claimed under TL2?

A: Yes, there are specific limits for meals and lodging expenses that can be claimed under TL2. These limits are set by the CRA and may vary depending on the location and duration of your business travel.

Q: Can I claim expenses for meals and lodging outside of Canada under TL2?

A: No, TL2 is specifically for claiming meals and lodging expenses incurred within Canada while on business travel.

Q: How long does it take to get a TL2 claim processed?

A: The processing time for TL2 claims can vary, but it usually takes several weeks for the CRA to review and process the claim.

Q: What happens if my TL2 claim is denied?

A: If your TL2 claim is denied, you can request a review or appeal the decision with the CRA. It's important to provide any additional supporting documentation or information that may help support your claim.

Q: Are there any tax implications of filing a TL2 claim?

A: Yes, there may be tax implications when filing a TL2 claim. It's recommended to consult with a tax professional or the CRA for guidance on how it will affect your tax situation.