This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1X

for the current year.

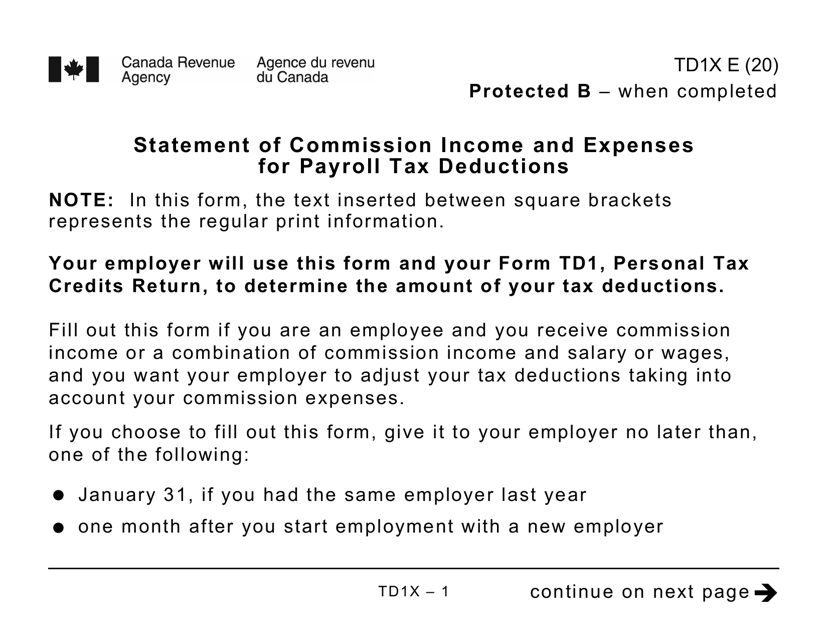

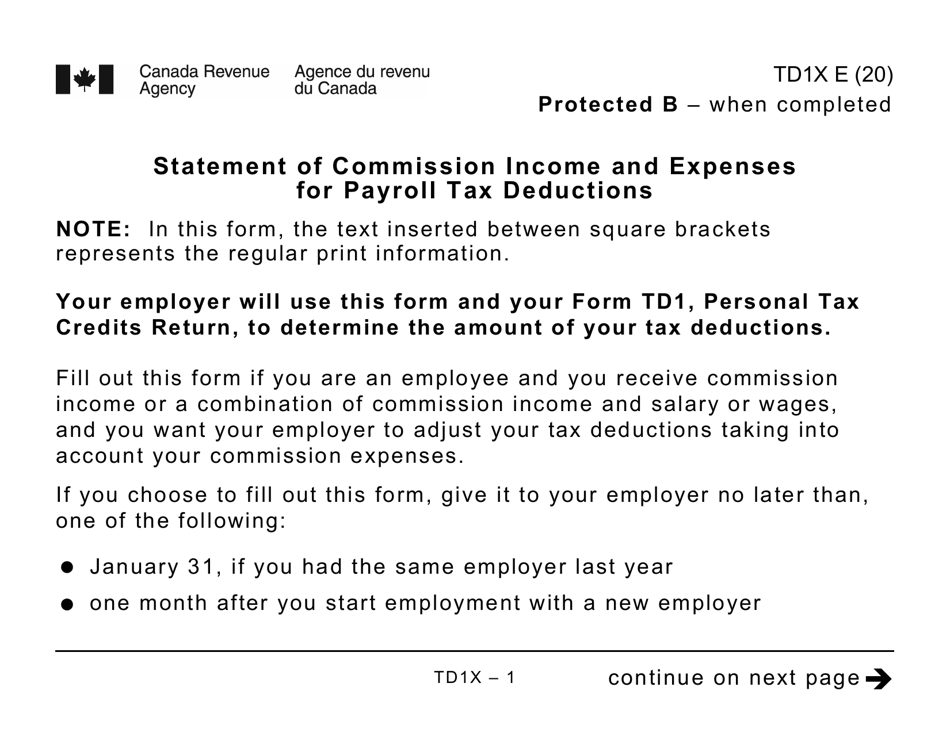

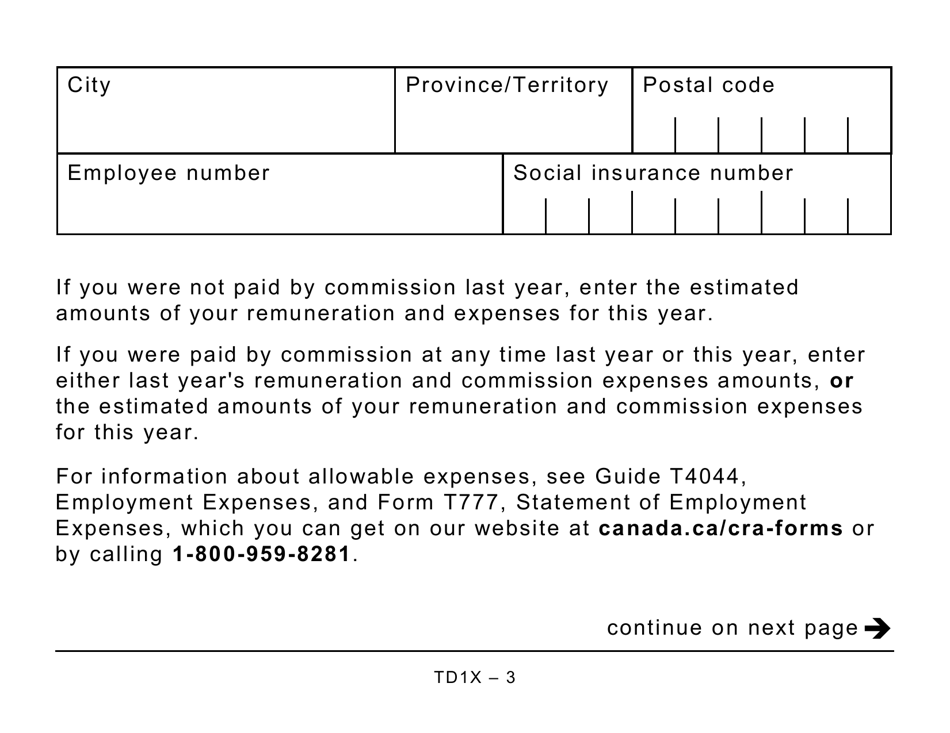

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions - Large Print - Canada

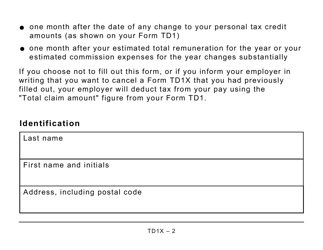

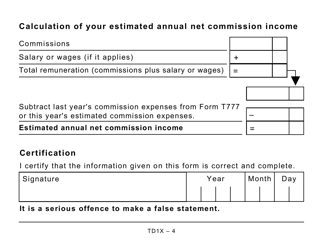

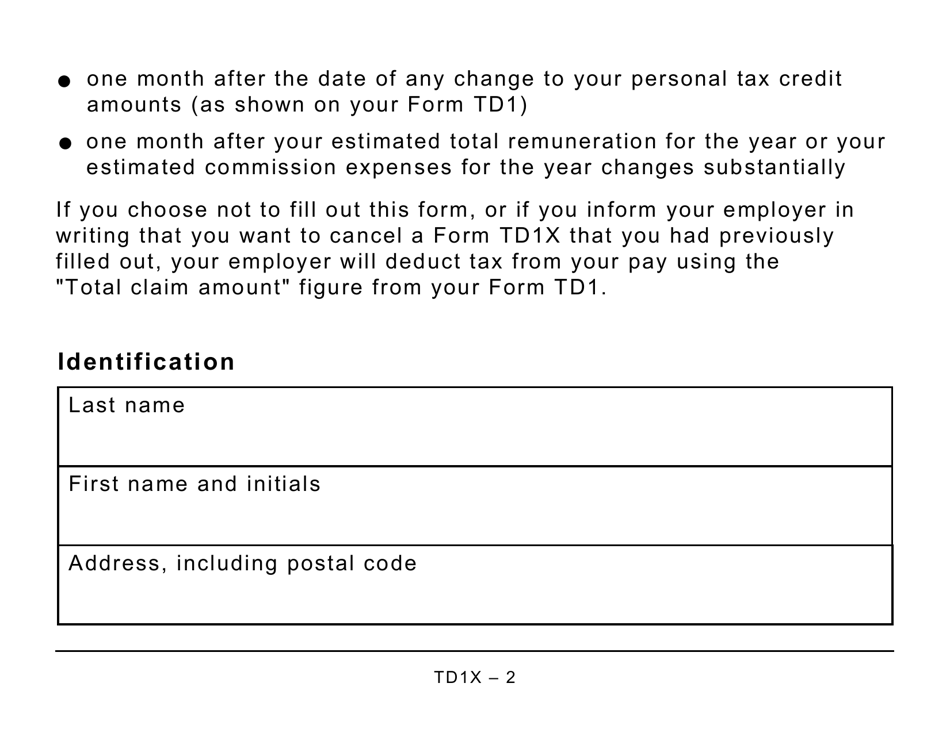

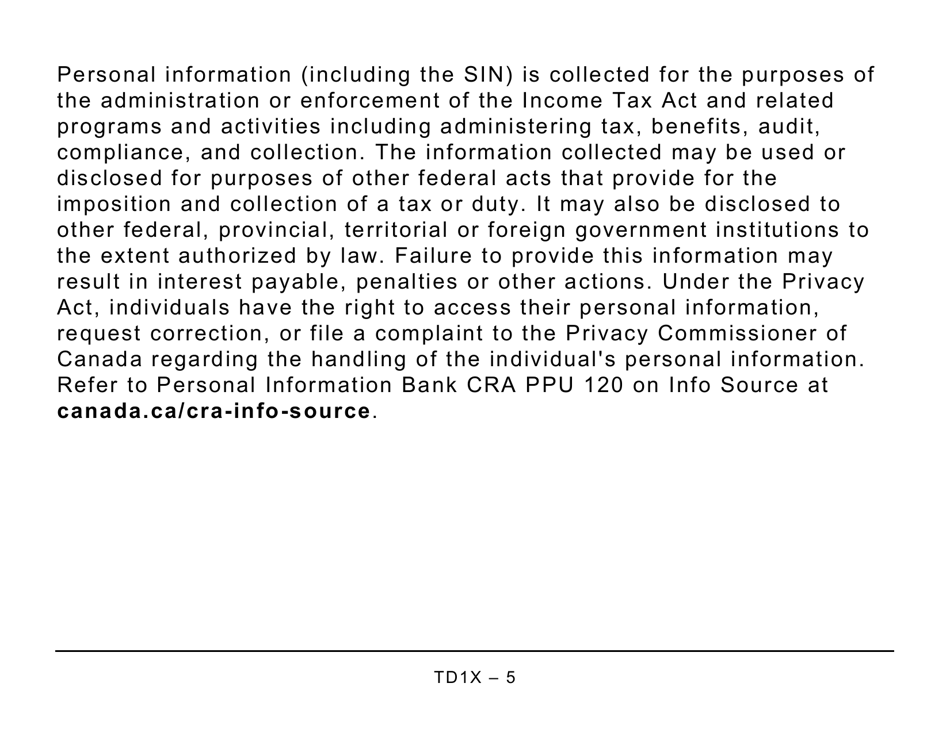

Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions - Large Print, is used in Canada by individuals who earn commission income and incur expenses related to their employment. This form helps calculate the correct income tax deductions to be withheld from their paychecks. It allows employees to claim eligible expenses against their commission income, which can reduce their taxable income.

The Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions - Large Print in Canada is usually filed by individuals who earn commission income and want to claim deductions for tax purposes.

FAQ

Q: What is Form TD1X?

A: Form TD1X is a statement of commission income and expenses for payroll tax deductions in Canada.

Q: Who is required to fill out Form TD1X?

A: Individuals who earn commission income and want to claim deductions for payroll tax purposes in Canada need to fill out Form TD1X.

Q: Is Form TD1X specifically for large print?

A: Yes, Form TD1X is available in large print format.

Q: What kind of income is considered commission income?

A: Commission income refers to earnings received as a result of sales or services performed on a commission basis.

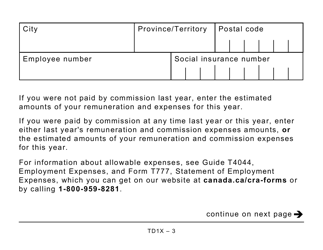

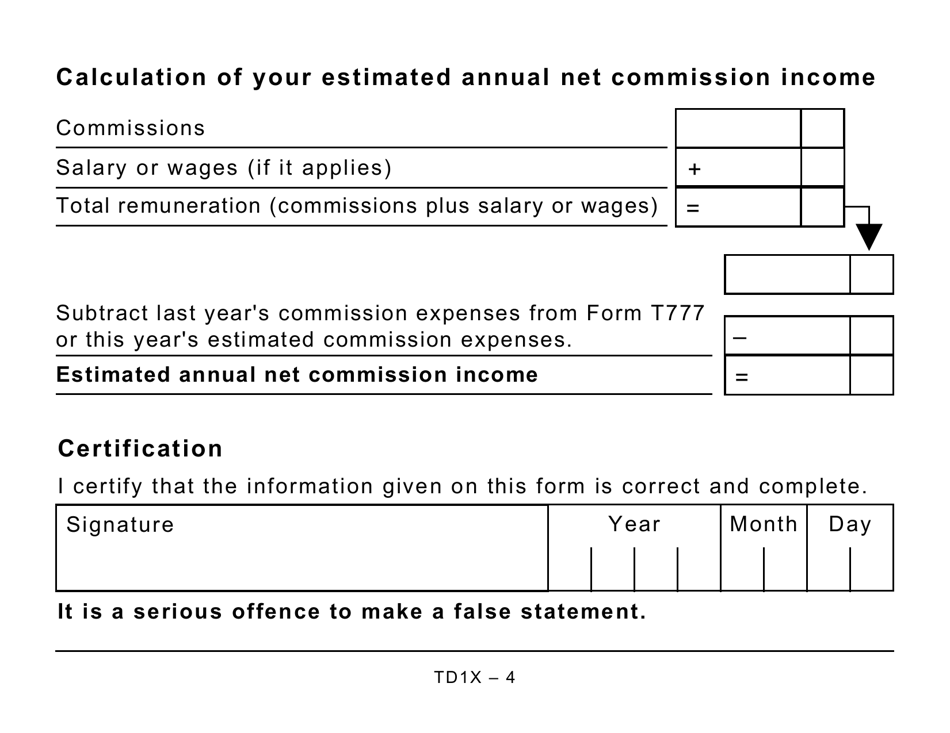

Q: What expenses can be claimed on Form TD1X?

A: Expenses related to earning commission income, such as advertising costs and travel expenses, can be claimed on Form TD1X.

Q: Why do individuals need to fill out Form TD1X?

A: Filling out Form TD1X helps individuals calculate the correct amount of taxes that need to be deducted from their commission income.