This version of the form is not currently in use and is provided for reference only. Download this version of

Form T936

for the current year.

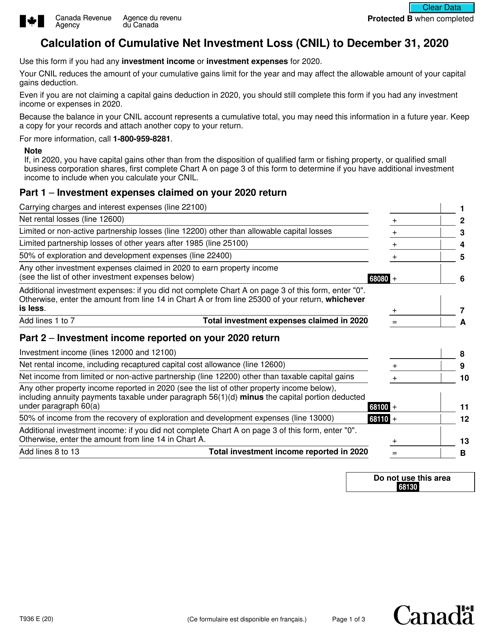

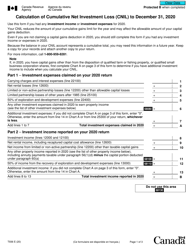

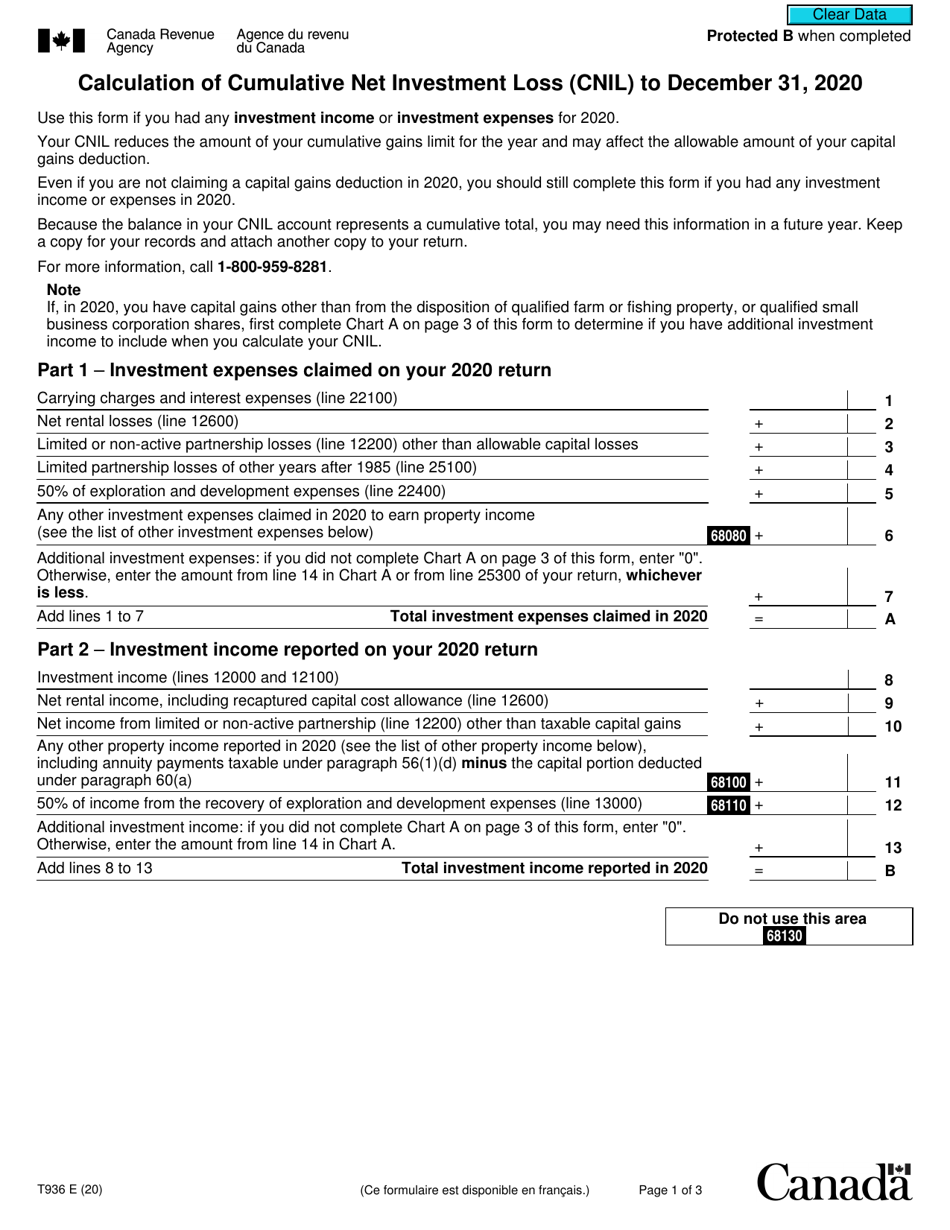

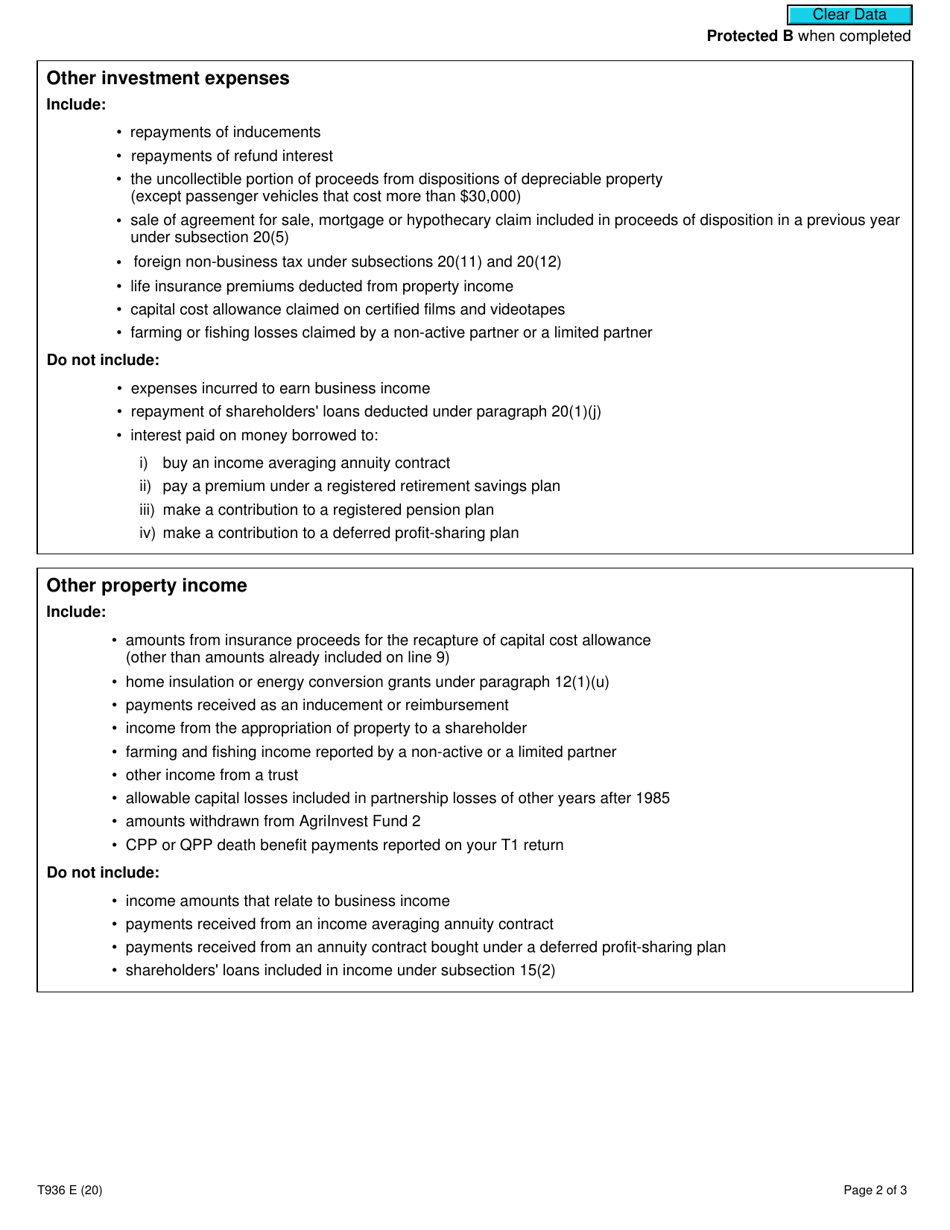

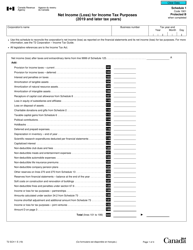

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) - Canada

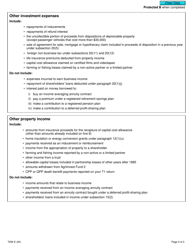

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) is used in Canada to calculate the cumulative net investment loss for an individual or a trust. The CNIL is an important figure needed to determine the allowable deduction of investment expenses against investment income.

The Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is filed by individuals and corporations who have incurred net investment losses.

FAQ

Q: What is Form T936?

A: Form T936 is a form used in Canada to calculate the Cumulative Net Investment Loss (CNIL).

Q: What is Cumulative Net Investment Loss (CNIL) in Canada?

A: Cumulative Net Investment Loss (CNIL) is a calculation done to determine the amount of investment losses that can be carried forward and applied against future investment income in Canada.

Q: Why is Form T936 used?

A: Form T936 is used to calculate the CNIL and determine the amount of investment losses that can be carried forward.

Q: Who needs to use Form T936?

A: Individuals and corporations in Canada who have incurred investment losses and want to carry them forward to offset future investment income need to use Form T936.

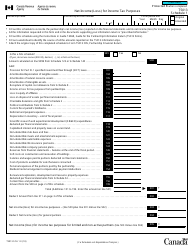

Q: How is CNIL calculated?

A: CNIL is calculated by taking the lesser of your cumulative investment losses or your cumulative taxable capital gains.

Q: What can CNIL be applied against?

A: CNIL can be applied against future taxable capital gains that you may have in Canada.

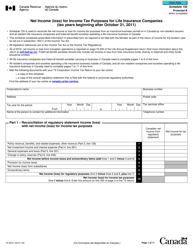

Q: Is Form T936 the only form used to calculate CNIL?

A: No, Form T936 is used to calculate CNIL for individuals. Corporations use Form T3SCH6 to calculate CNIL.

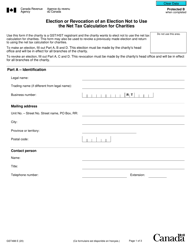

Q: When is Form T936 due?

A: Form T936 is due on or before your personal incometax filing deadline, which is usually April 30th for individuals in Canada.

Q: Can I carry forward CNIL indefinitely?

A: Yes, you can carry forward CNIL indefinitely until it is fully utilized to offset future taxable capital gains.