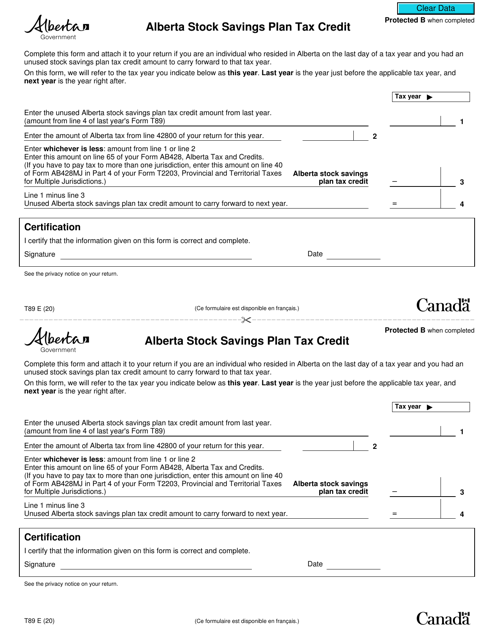

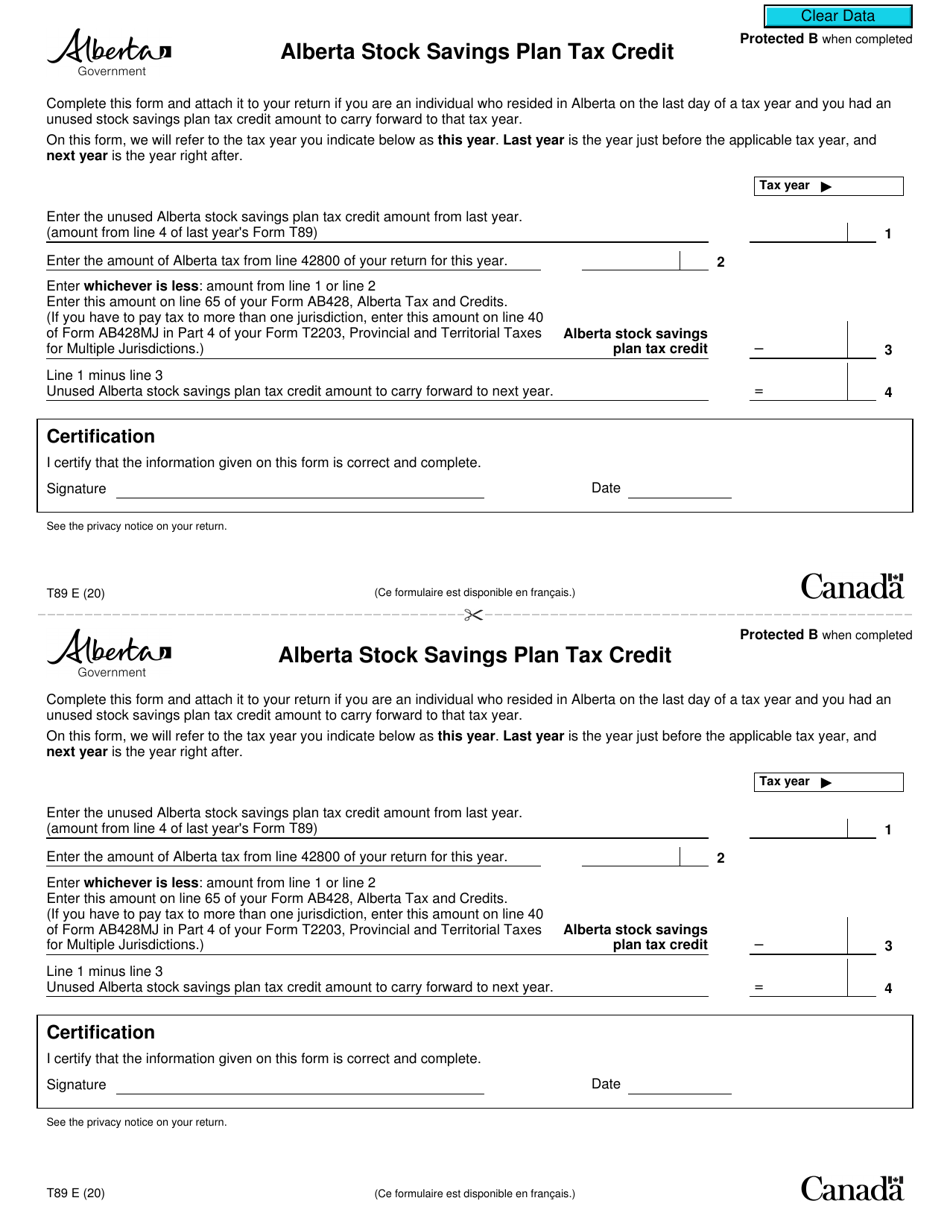

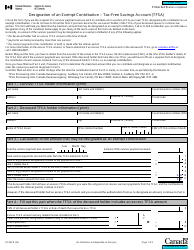

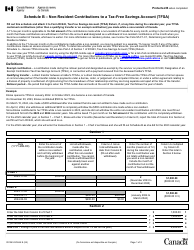

This version of the form is not currently in use and is provided for reference only. Download this version of

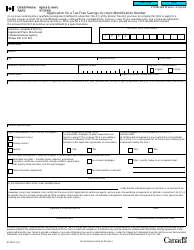

Form T89

for the current year.

Form T89 Alberta Stock Savings Plan Tax Credit - Canada

Form T89 is used in Alberta, Canada for claiming the Stock Savings Plan Tax Credit. This tax credit is available to residents of Alberta who have purchased stocks of a qualified Alberta business as part of their investments. The purpose of this tax credit is to encourage investment in local businesses and support economic growth in the province.

The individual who contributes to the Alberta Stock Savings Plan can file the Form T89 for the tax credit.

FAQ

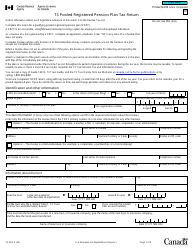

Q: What is Form T89?

A: Form T89 is a form used in Canada to claim the Alberta Stock Savings Plan Tax Credit.

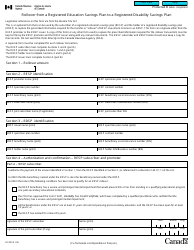

Q: What is the Alberta Stock Savings Plan Tax Credit?

A: The Alberta Stock Savings Plan Tax Credit is a tax credit available to individuals who invest in eligible shares of a qualifying Alberta small business corporation.

Q: Who is eligible to claim the Alberta Stock Savings Plan Tax Credit?

A: Individuals who have purchased eligible shares of a qualifying Alberta small business corporation are eligible to claim the tax credit.

Q: What is the purpose of the Alberta Stock Savings Plan Tax Credit?

A: The purpose of the tax credit is to encourage investment in small business corporations in Alberta.

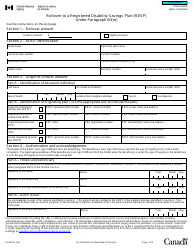

Q: How much is the Alberta Stock Savings Plan Tax Credit?

A: The tax credit is equal to 30% of the purchase price of eligible shares, up to a maximum credit of $60,000 per year.

Q: How do I claim the Alberta Stock Savings Plan Tax Credit?

A: To claim the tax credit, you need to complete and file Form T89 with your income tax return.

Q: Are there any restrictions on the Alberta Stock Savings Plan Tax Credit?

A: Yes, there are certain restrictions and eligibility criteria for claiming the tax credit. It is advisable to consult the official guidelines or seek professional advice.

Q: Is the Alberta Stock Savings Plan Tax Credit available in the United States?

A: No, the Alberta Stock Savings Plan Tax Credit is specific to Canada and is not applicable in the United States.