This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT20

for the current year.

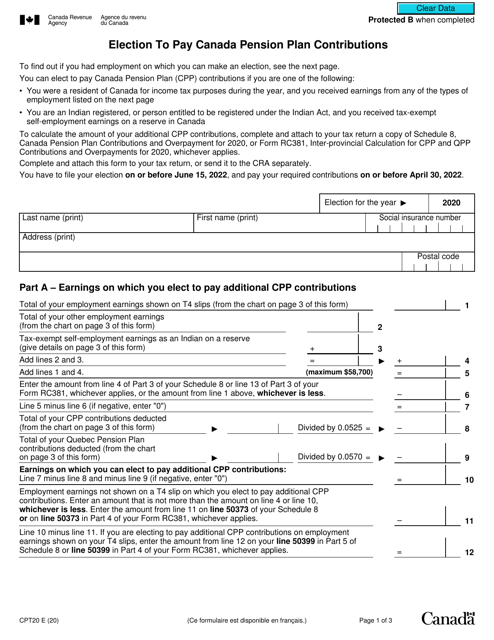

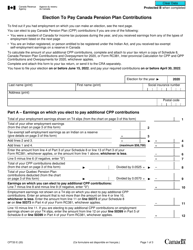

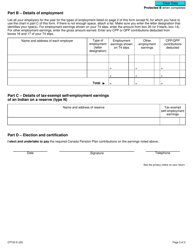

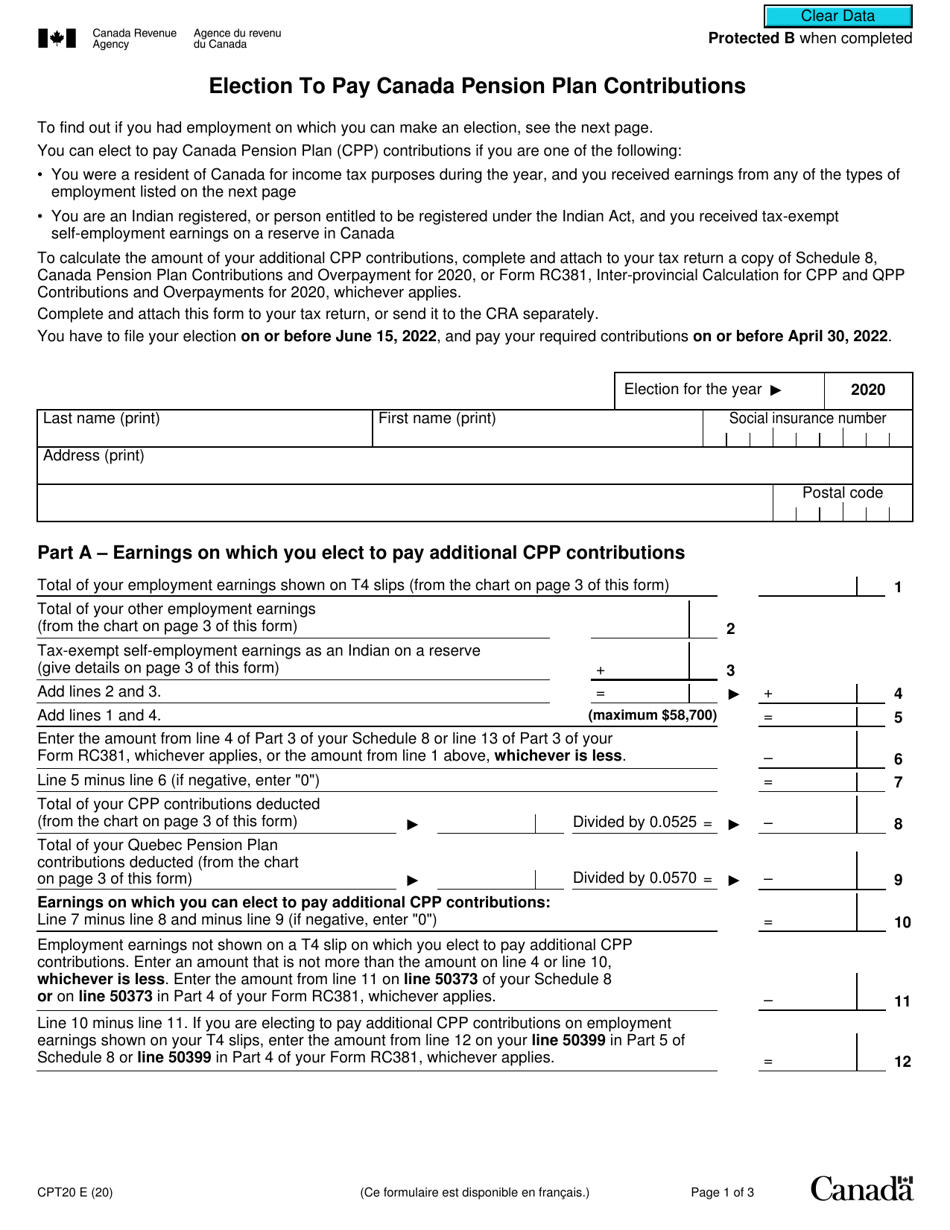

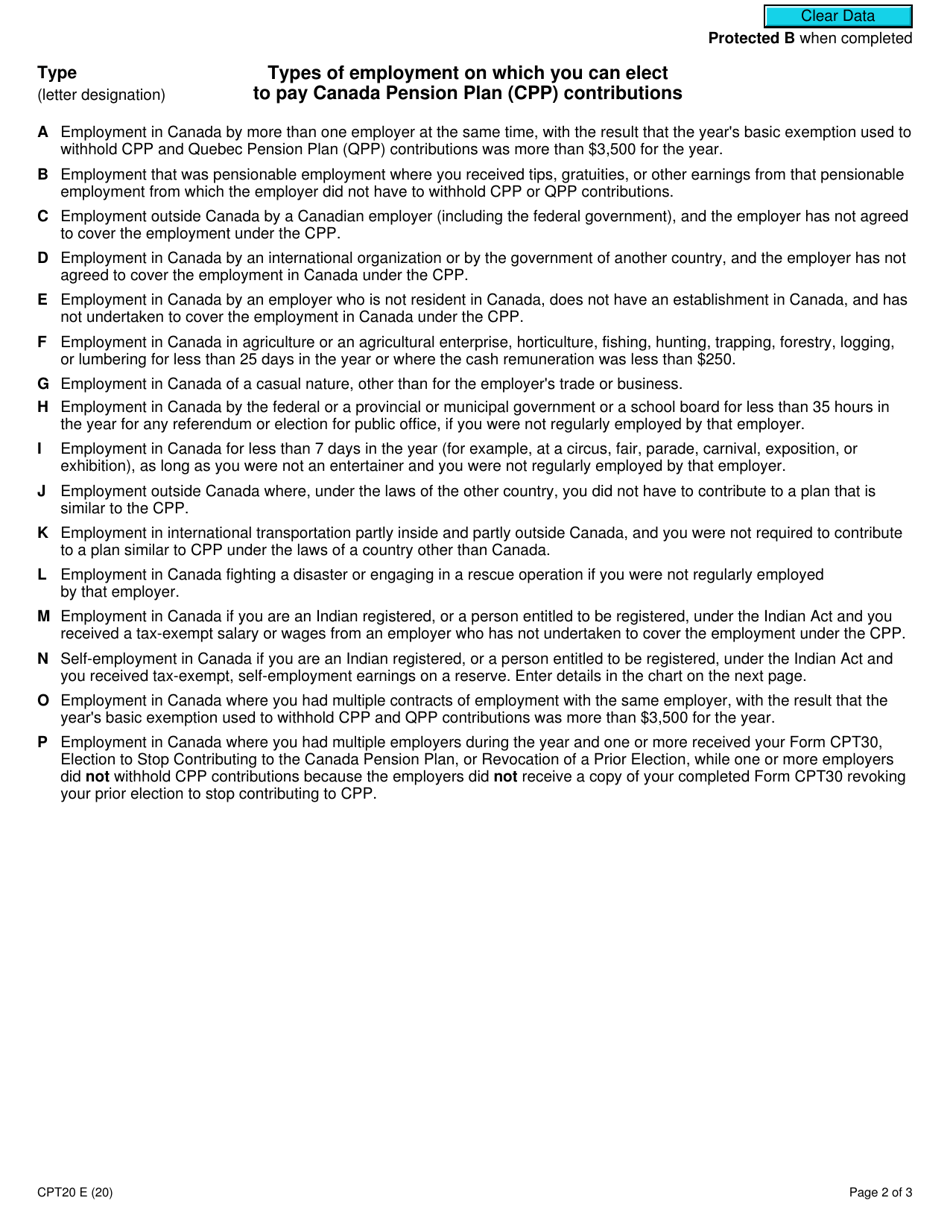

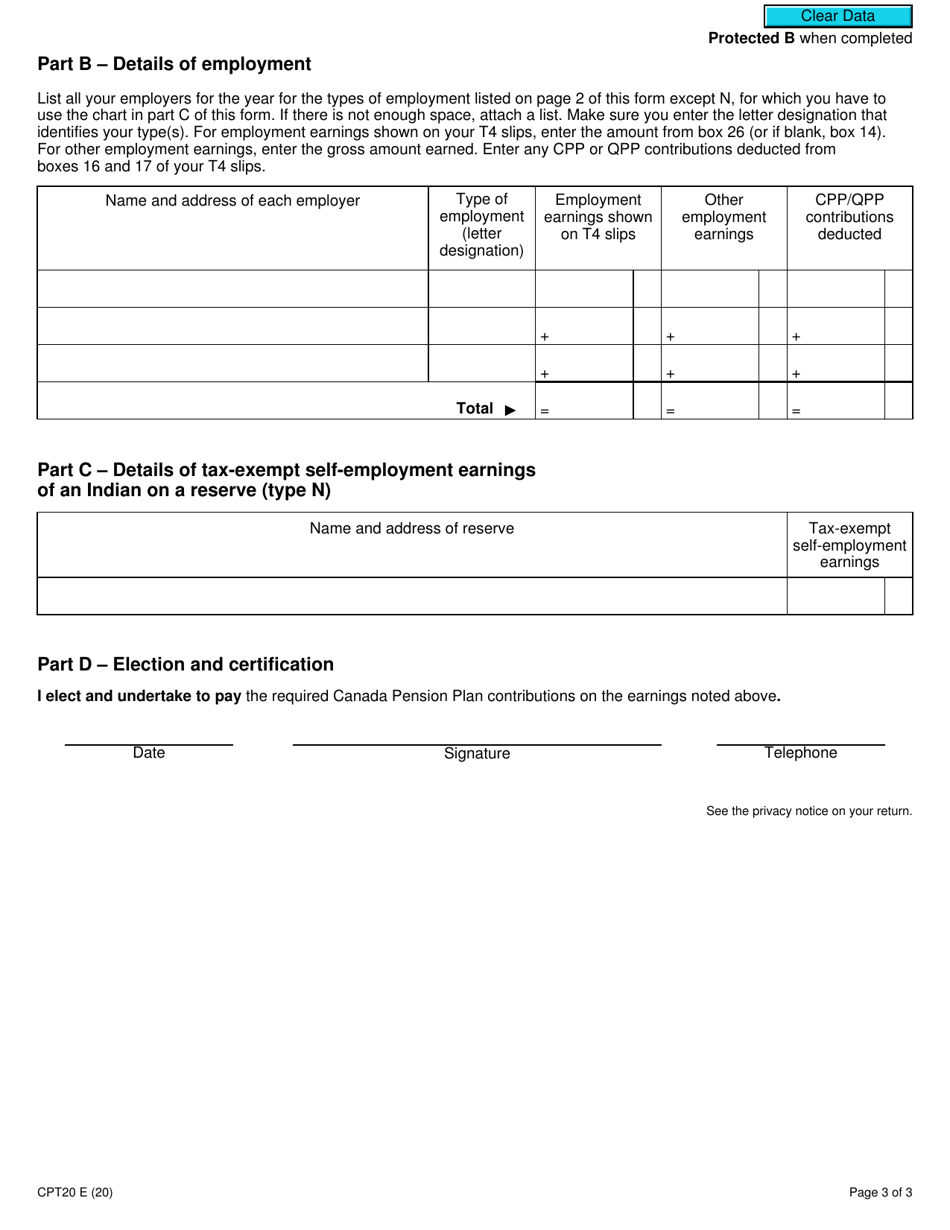

Form CPT20 Election to Pay Canada Pension Plan Contributions - Canada

Form CPT20, Election to Pay Canada Pension Plan Contributions, is used by individuals who want to voluntarily contribute to the Canada Pension Plan (CPP) even if they are not required to do so. This form allows individuals to elect to pay CPP contributions, which can provide them with additional CPP benefits in the future.

The Form CPT20 Election to Pay Canada Pension Plan Contributions in Canada is filed by self-employed individuals or employers who have employees working in Canada and are subject to the Canada Pension Plan.

FAQ

Q: What is Form CPT20?

A: Form CPT20 is an election form used to choose to pay Canada Pension Plan (CPP) contributions in Canada.

Q: Who is eligible to use Form CPT20?

A: Individuals who are residing in the United States but have Canadian citizenship and are covered under the U.S. Social Security system are eligible to use Form CPT20.

Q: What is the purpose of Form CPT20?

A: The purpose of Form CPT20 is to allow individuals to continue making contributions to the Canada Pension Plan while working in the United States.

Q: How do I complete Form CPT20?

A: To complete Form CPT20, you will need to provide your personal information, employment details, and indicate your choice to pay CPP contributions in Canada.

Q: When should I submit Form CPT20?

A: Form CPT20 should be submitted to the CRA before the start of the calendar year in which you wish to start paying CPP contributions in Canada.

Q: What are the benefits of using Form CPT20?

A: Using Form CPT20 allows you to continue building your CPP benefits while working in the United States, ensuring that you have a source of income for retirement.

Q: Is there a deadline to submit Form CPT20?

A: Yes, Form CPT20 must be submitted to the CRA before the start of the calendar year in which you wish to start paying CPP contributions in Canada.

Q: Can I change my election after submitting Form CPT20?

A: No, once you have made your election on Form CPT20, it cannot be changed for that calendar year. You can make changes for subsequent years.

Q: Do I need to file taxes in Canada if I use Form CPT20?

A: Yes, if you choose to pay CPP contributions in Canada using Form CPT20, you will need to file taxes in Canada and report your income.