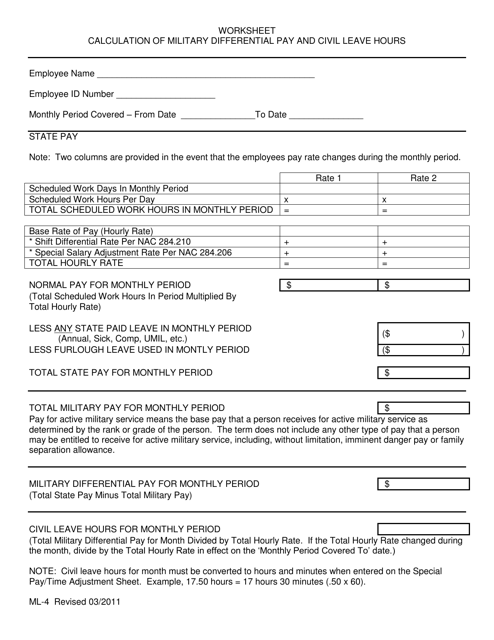

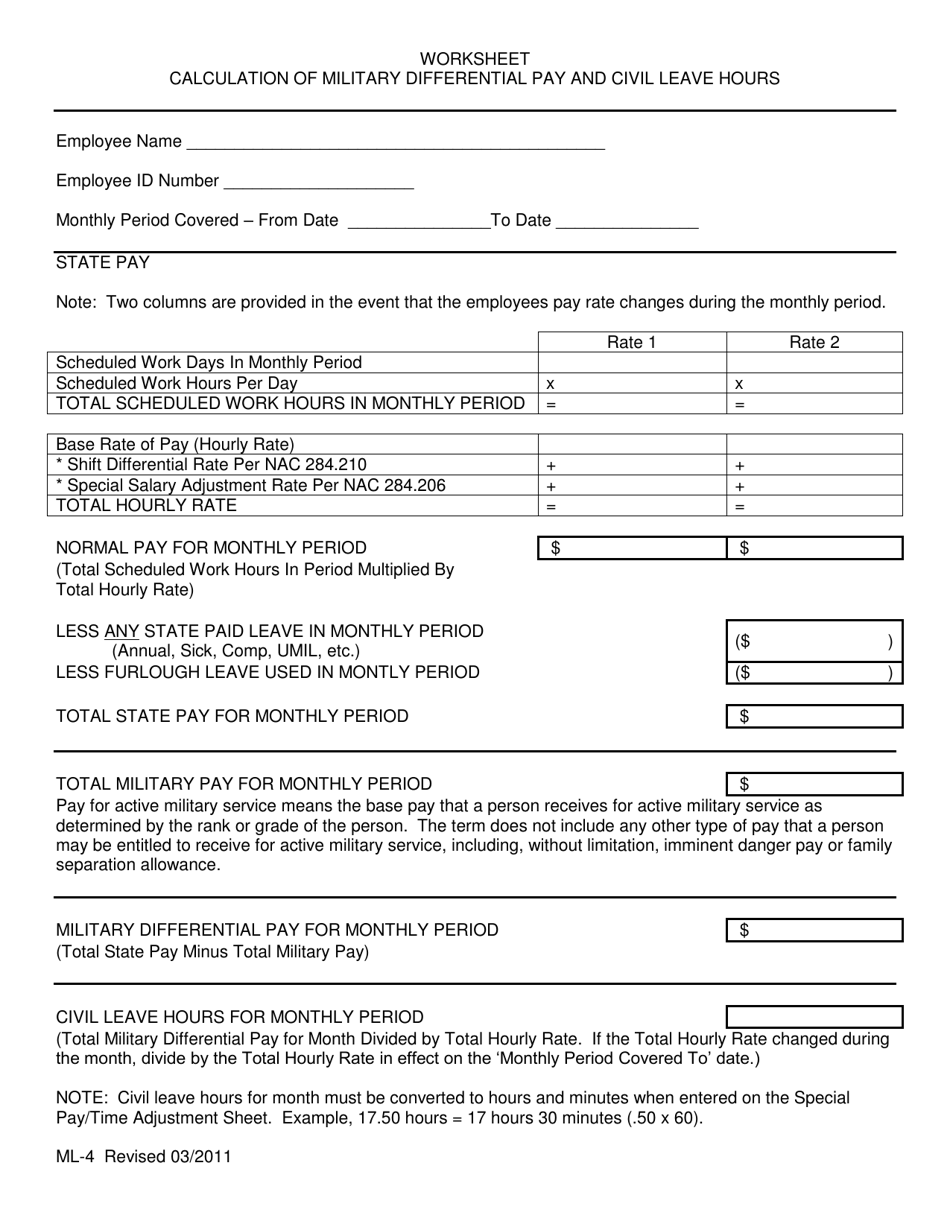

Worksheet ML-4 Calculation of Military Differential Pay and Civil Leave Hours - Nevada

What Is Worksheet ML-4?

This is a legal form that was released by the Nevada Department of Administration - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Worksheet ML-4 used for?

A: The Worksheet ML-4 is used for calculating Military Differential Pay and Civil Leave Hours in Nevada.

Q: What is Military Differential Pay?

A: Military Differential Pay is the additional compensation given to employees who are called to serve in the military reserves.

Q: How is Military Differential Pay calculated?

A: Military Differential Pay is calculated by multiplying the employee's regular hourly rate by the number of hours spent on military duty.

Q: What are Civil Leave Hours?

A: Civil Leave Hours are the hours of leave granted to employees who are called to serve in the military reserves.

Q: How are Civil Leave Hours calculated?

A: Civil Leave Hours are calculated based on the employee's average weekly hours of work.

Q: Is Military Differential Pay taxable?

A: Yes, Military Differential Pay is subject to federal incometax withholding.

Q: Are Civil Leave Hours paid?

A: No, Civil Leave Hours are not paid. They are a form of protected leave.

Q: Do all employers have to provide Military Differential Pay and Civil Leave Hours?

A: No, the requirement to provide Military Differential Pay and Civil Leave Hours varies by state and employer.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Nevada Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet ML-4 by clicking the link below or browse more documents and templates provided by the Nevada Department of Administration.