This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

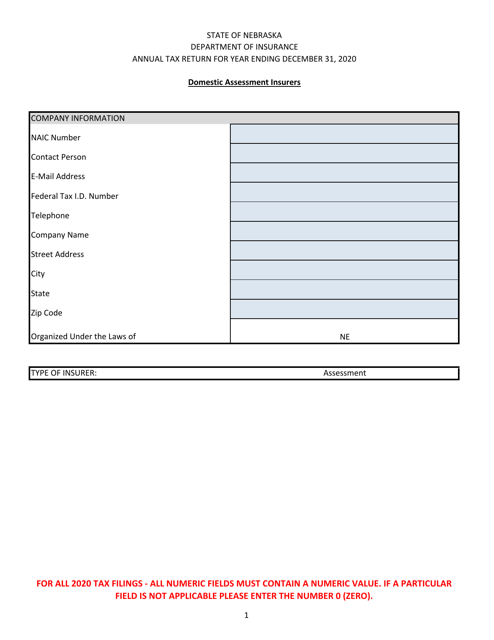

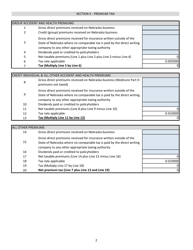

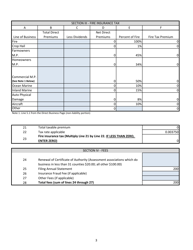

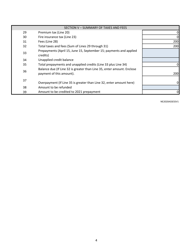

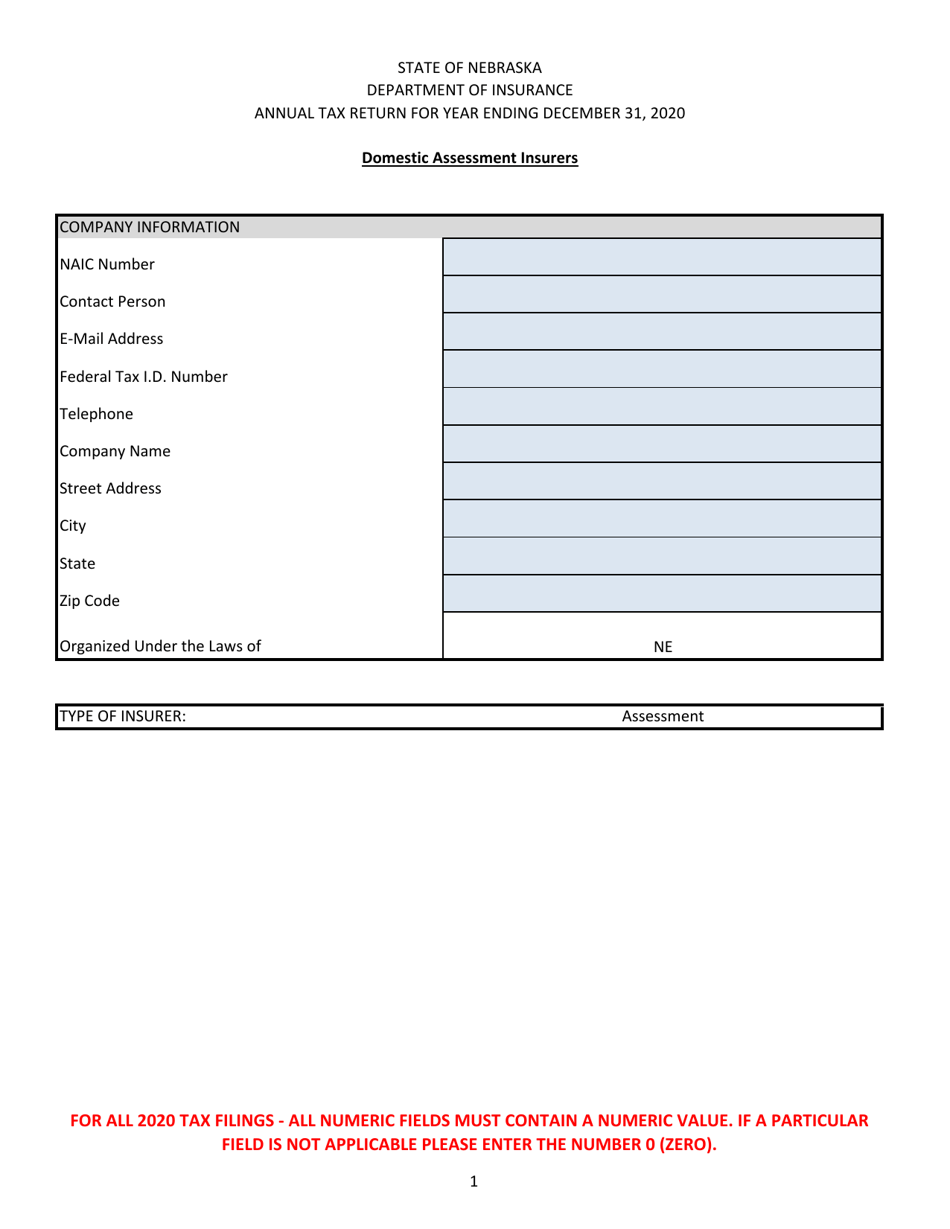

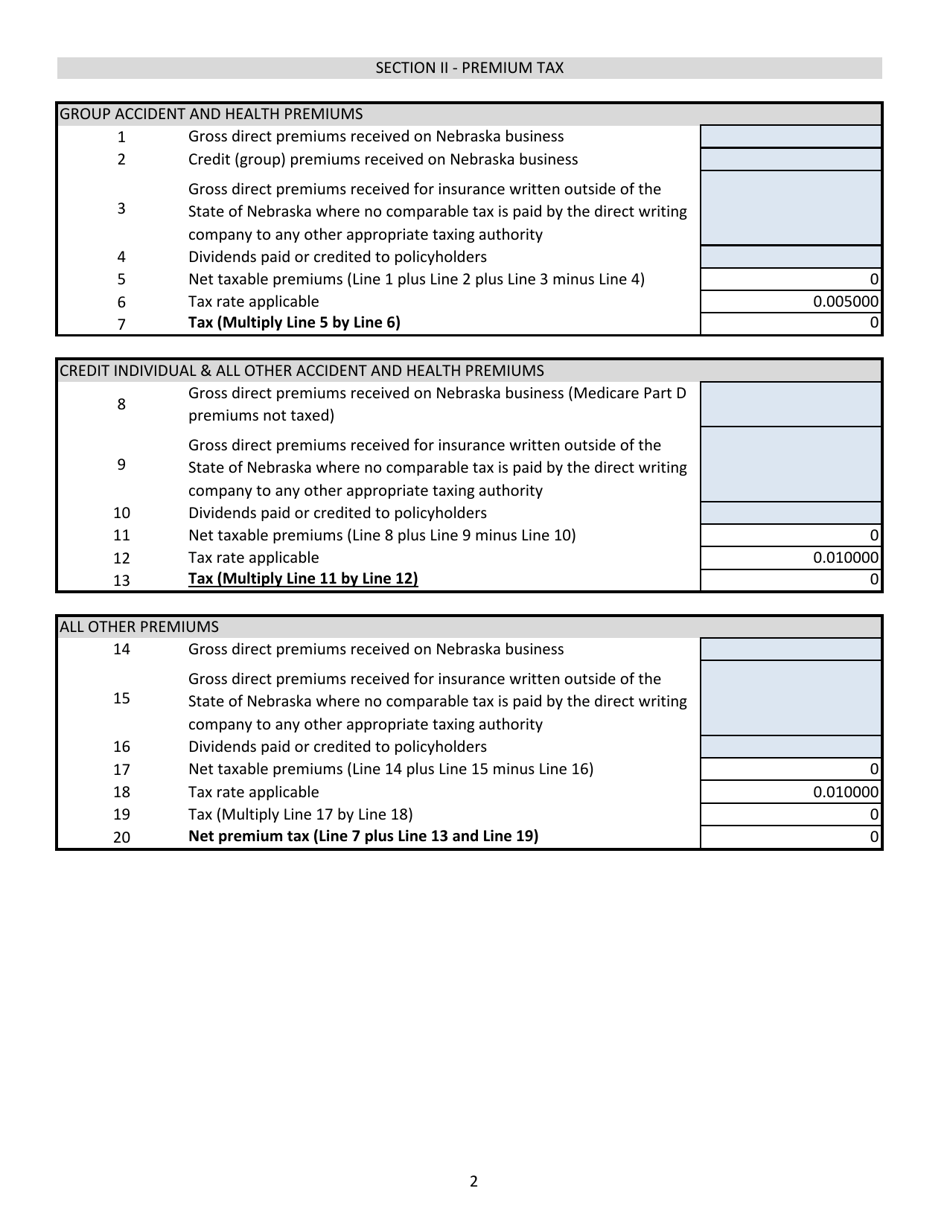

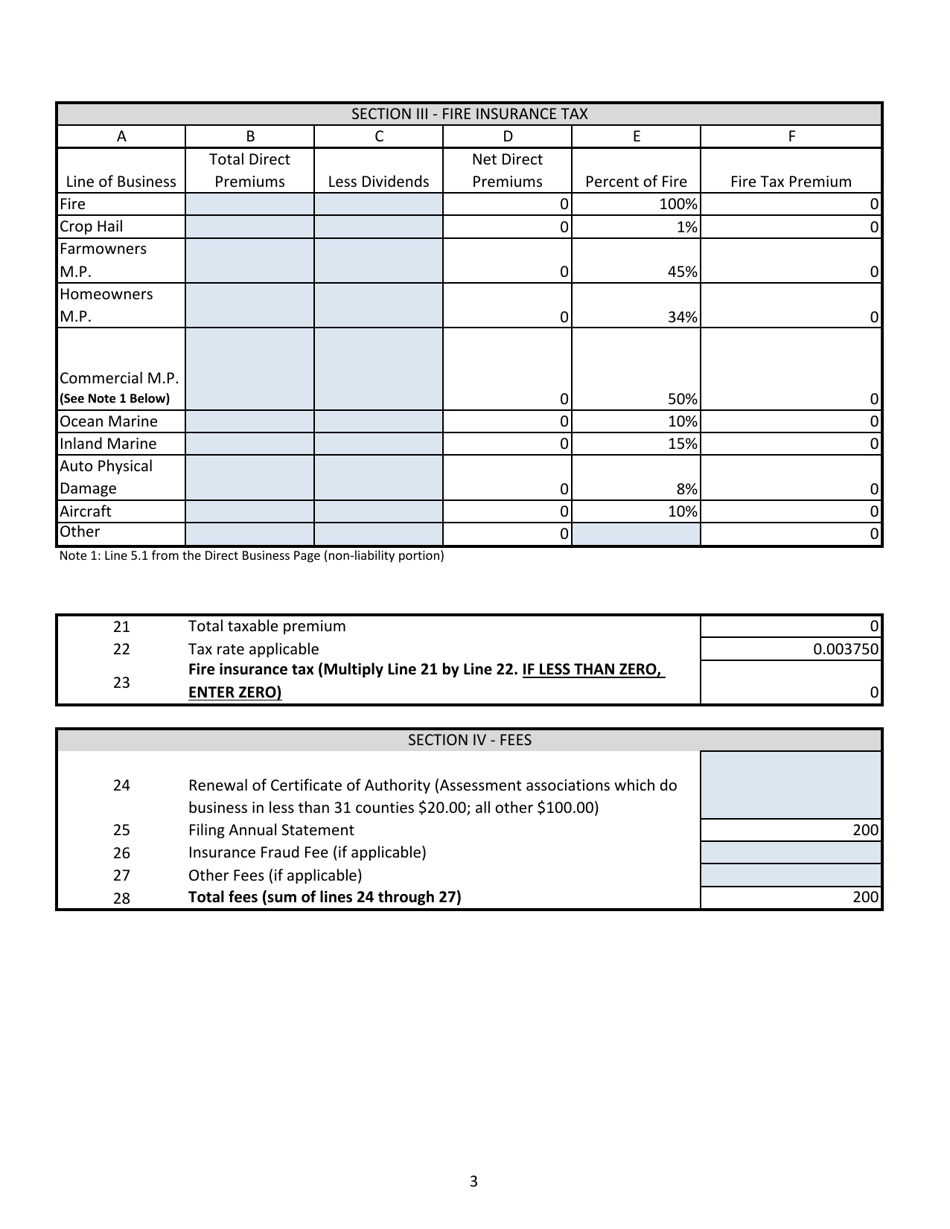

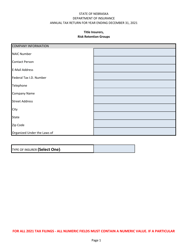

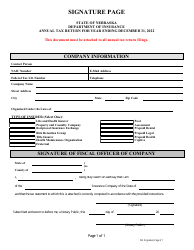

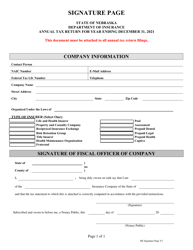

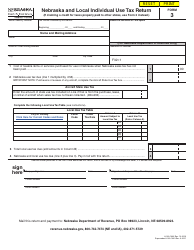

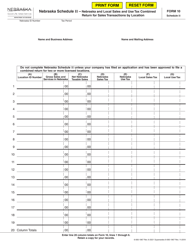

Annual Tax Return - Domestic Assessment Insurers - Nebraska

Annual Tax Return - Domestic Assessment Insurers is a legal document that was released by the Nebraska Department of Insurance - a government authority operating within Nebraska.

FAQ

Q: Who needs to file an annual tax return in Nebraska?

A: Domestic Assessment Insurers need to file an annual tax return in Nebraska.

Q: What is a Domestic Assessment Insurer?

A: A Domestic Assessment Insurer is an insurance company that operates in Nebraska.

Q: What is an annual tax return?

A: An annual tax return is a form that individuals and businesses use to report their income and calculate the amount of tax they owe.

Q: What is the purpose of filing an annual tax return?

A: The purpose of filing an annual tax return is to report income, deductions, and credits to determine the amount of tax owed or refund due.

Q: Are there any penalties for not filing an annual tax return?

A: Yes, there may be penalties for not filing an annual tax return, including fines and interest charges.

Form Details:

- The latest edition currently provided by the Nebraska Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Insurance.