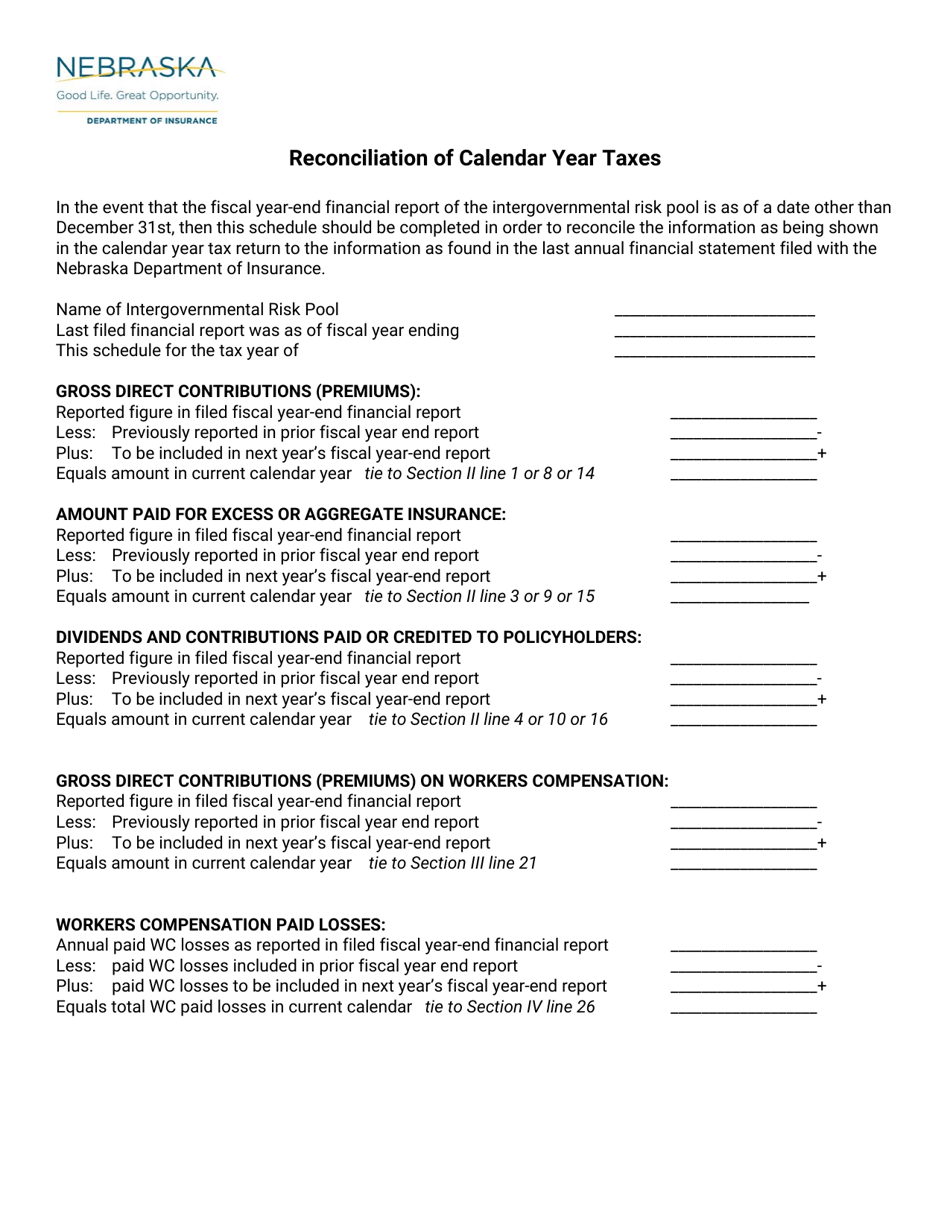

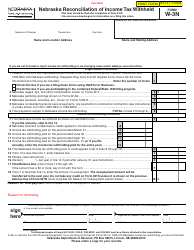

Reconciliation of Calendar Year Taxes - Nebraska

Reconciliation of Calendar Year Taxes is a legal document that was released by the Nebraska Department of Insurance - a government authority operating within Nebraska.

FAQ

Q: What is the reconciliation of calendar year taxes?

A: The reconciliation of calendar year taxes is the process of reviewing and reconciling your income, deductions, and credits for the entire year to ensure that you have correctly calculated your tax liability.

Q: Who needs to reconcile their calendar year taxes in Nebraska?

A: All individuals and businesses who file their taxes on a calendar year basis need to reconcile their taxes.

Q: When is the deadline for reconciling calendar year taxes in Nebraska?

A: The deadline for reconciling calendar year taxes in Nebraska is April 15th of the following year.

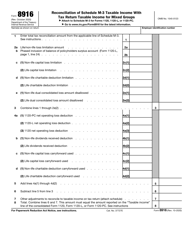

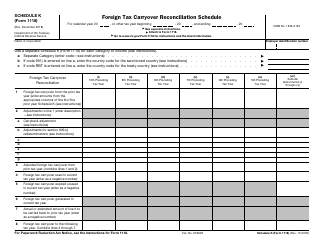

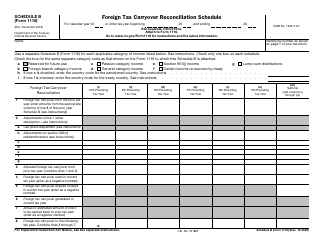

Q: What documents do I need to reconcile my calendar year taxes in Nebraska?

A: You will need your W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant tax documents.

Q: Are there any penalties for not reconciling calendar year taxes in Nebraska?

A: Yes, if you fail to reconcile your calendar year taxes in Nebraska, you may be subject to penalties and interest.

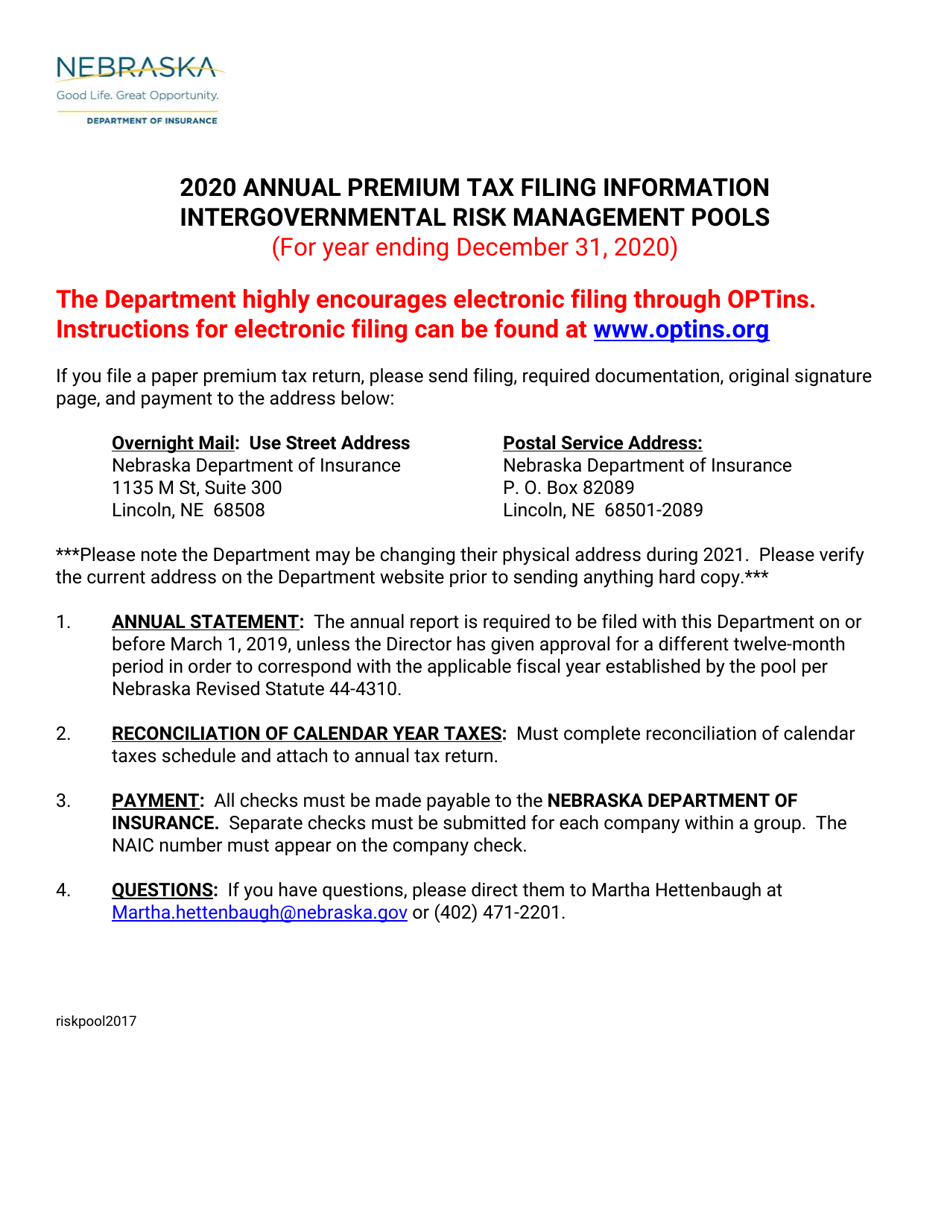

Form Details:

- The latest edition currently provided by the Nebraska Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Insurance.