This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

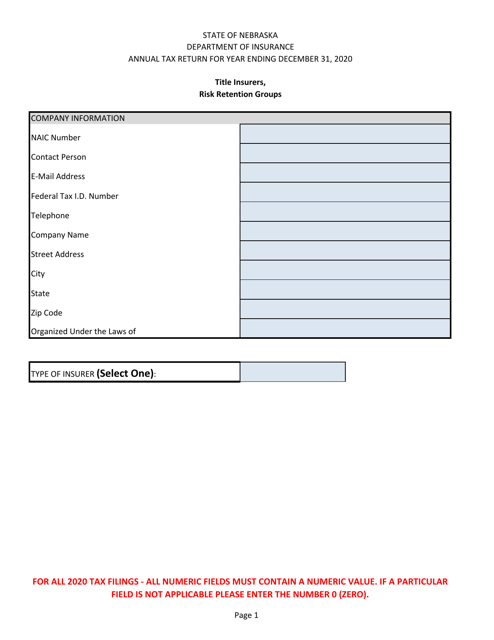

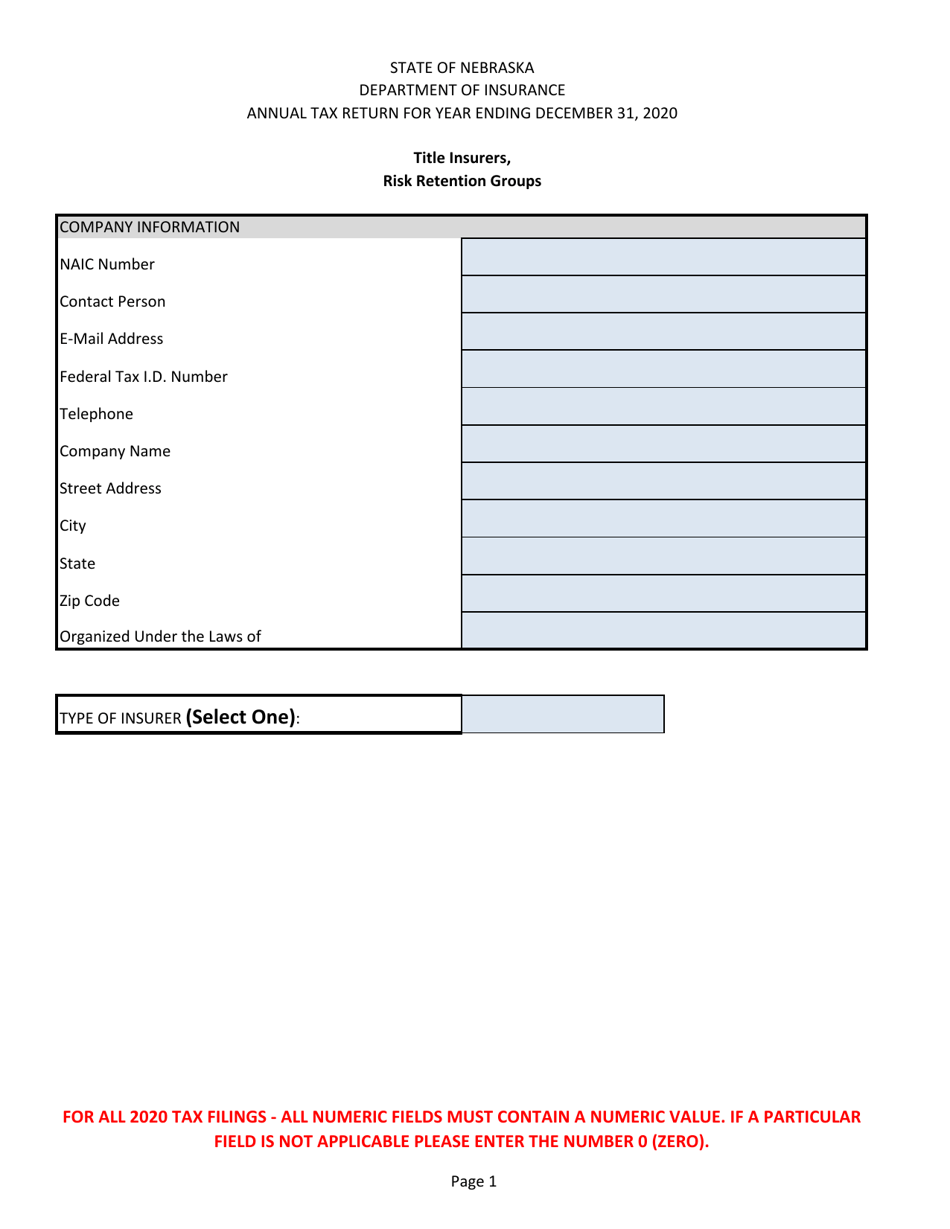

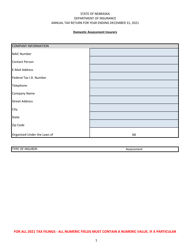

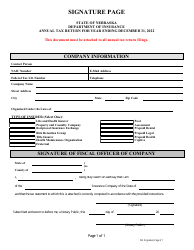

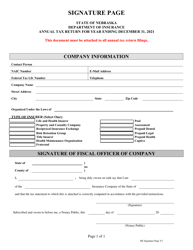

Annual Tax Return - Title Insurers, Risk Retention Groups - Nebraska

Annual Tax Return - Risk Retention Groups is a legal document that was released by the Nebraska Department of Insurance - a government authority operating within Nebraska.

FAQ

Q: Do title insurers and risk retention groups need to file an annual tax return in Nebraska?

A: Yes, title insurers and risk retention groups are required to file an annual tax return in Nebraska.

Q: What is the deadline for filing the annual tax return for title insurers and risk retention groups in Nebraska?

A: The deadline for filing the annual tax return for title insurers and risk retention groups in Nebraska is April 15th.

Q: What information is required to be included in the annual tax return for title insurers and risk retention groups in Nebraska?

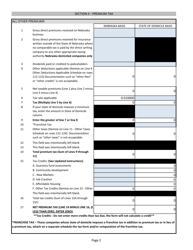

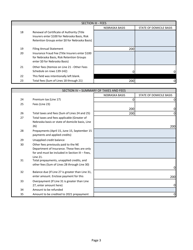

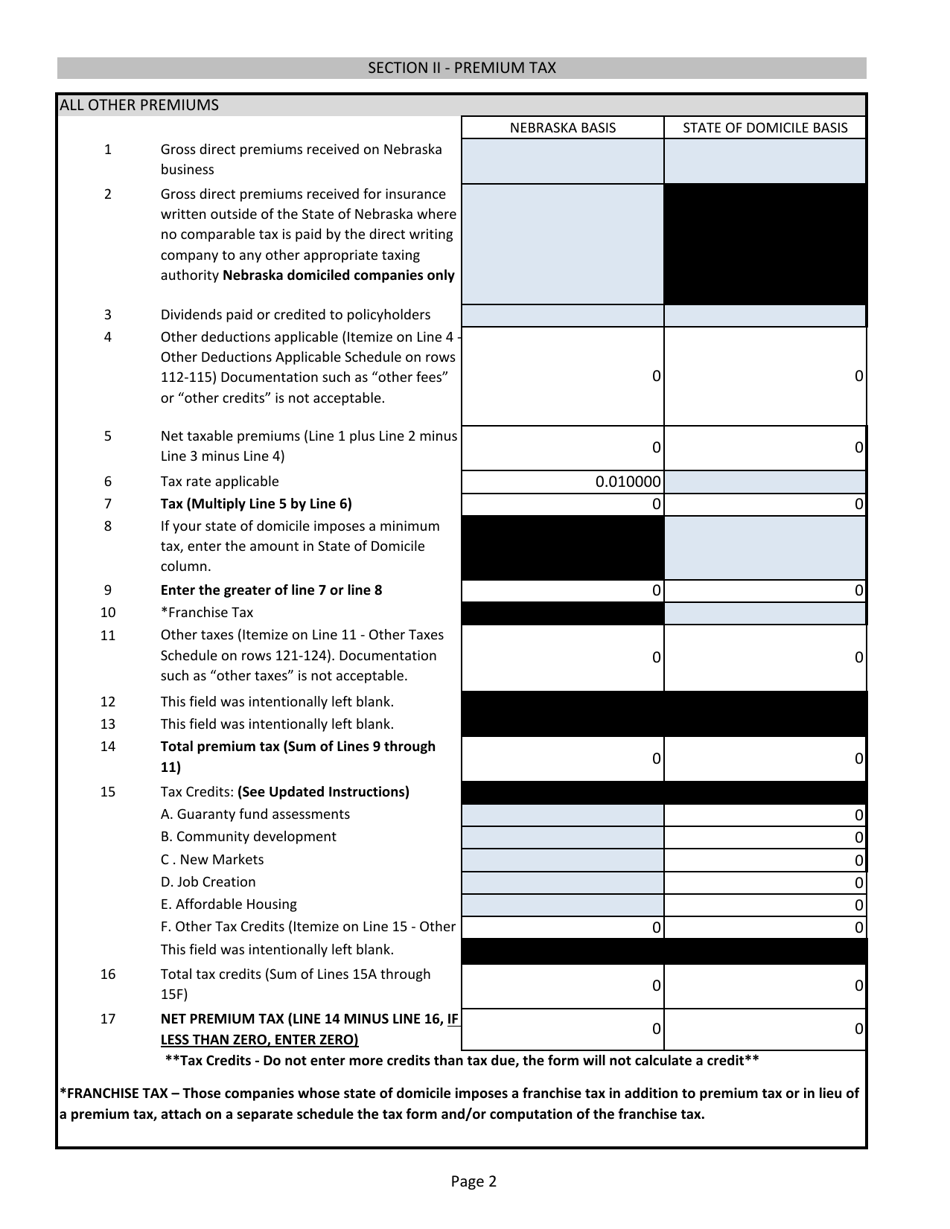

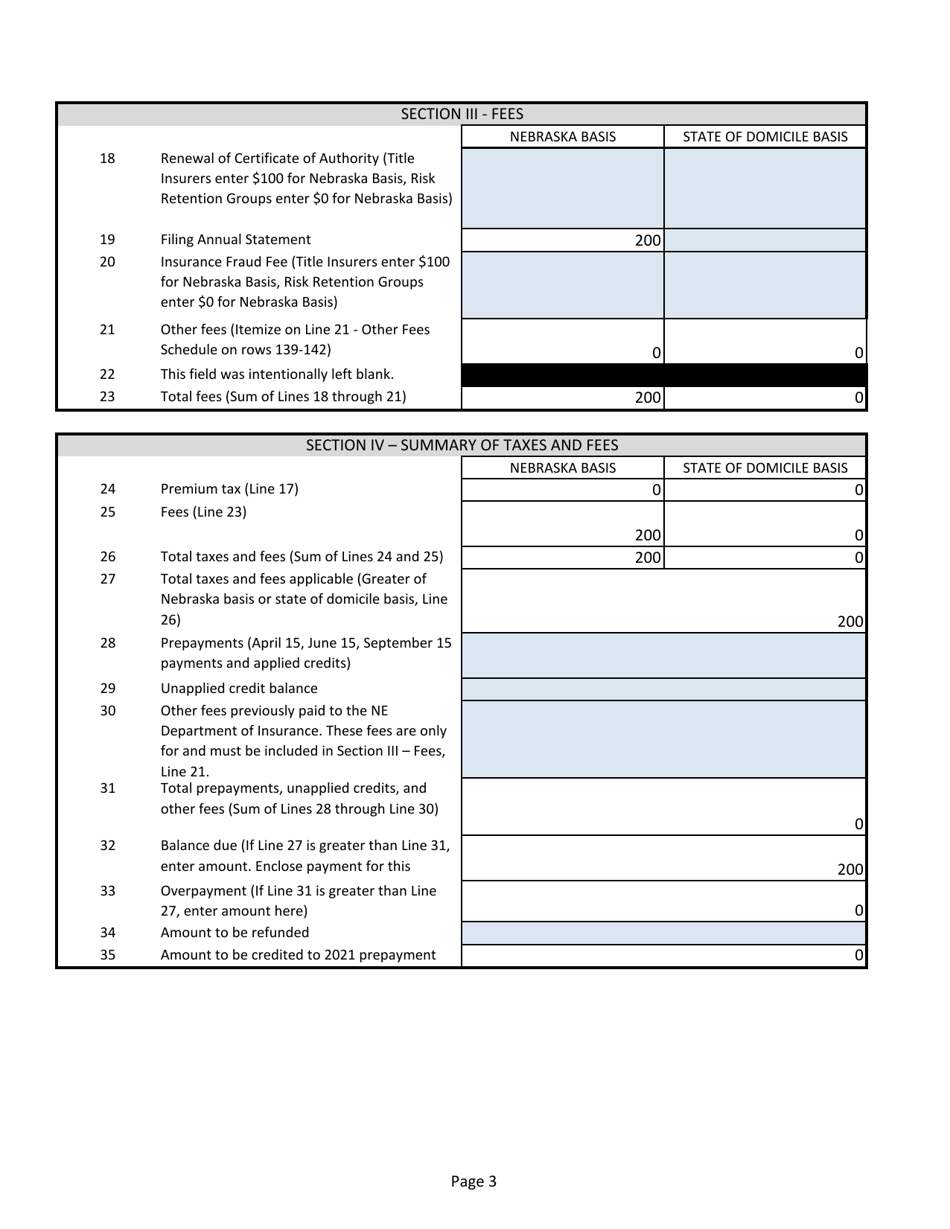

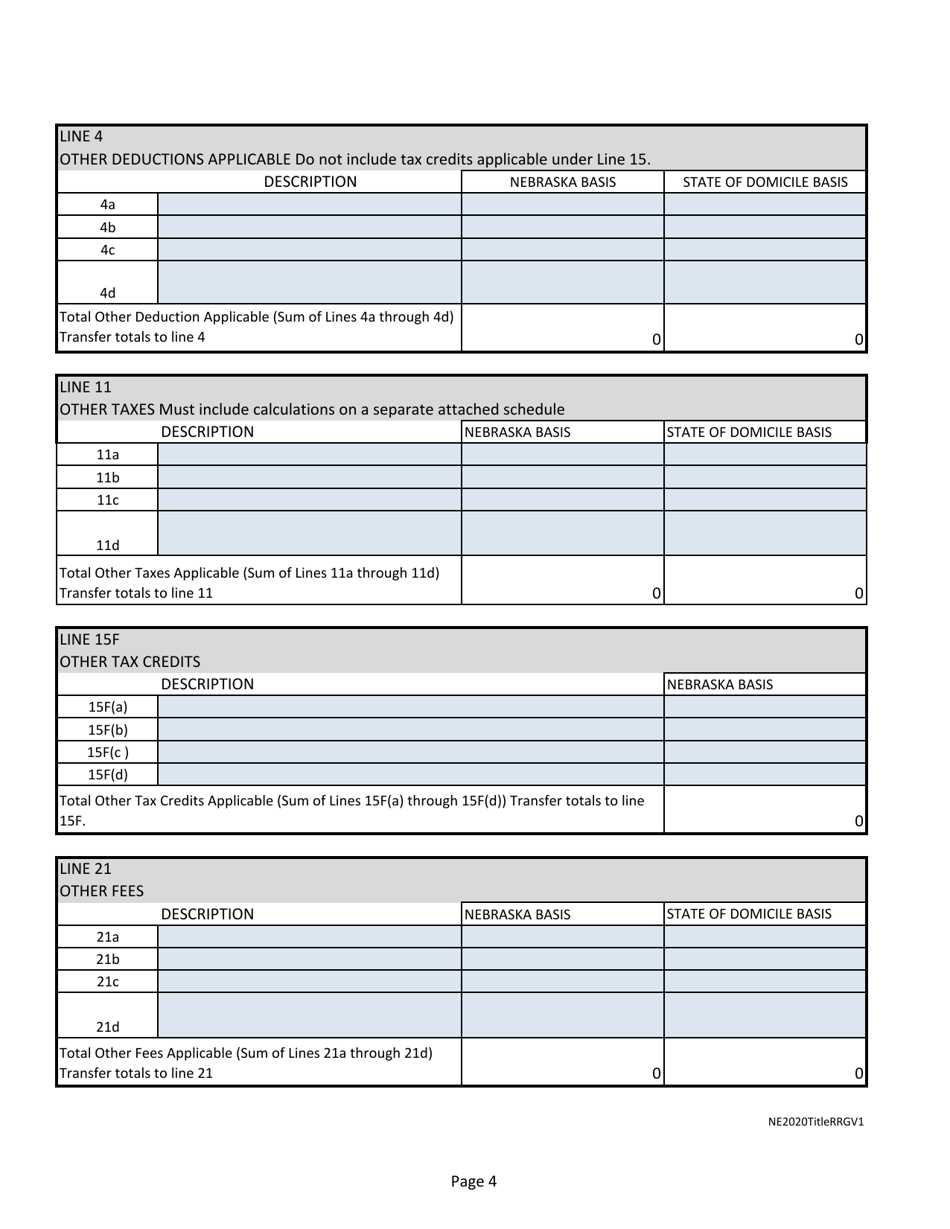

A: The annual tax return for title insurers and risk retention groups in Nebraska requires information such as gross premiums, net premiums written, and premiums returned to policyholders.

Q: Are there any penalties for late filing of the annual tax return for title insurers and risk retention groups in Nebraska?

A: Yes, there are penalties for late filing of the annual tax return for title insurers and risk retention groups in Nebraska.

Form Details:

- The latest edition currently provided by the Nebraska Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Insurance.