This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CIFT-620ES

for the current year.

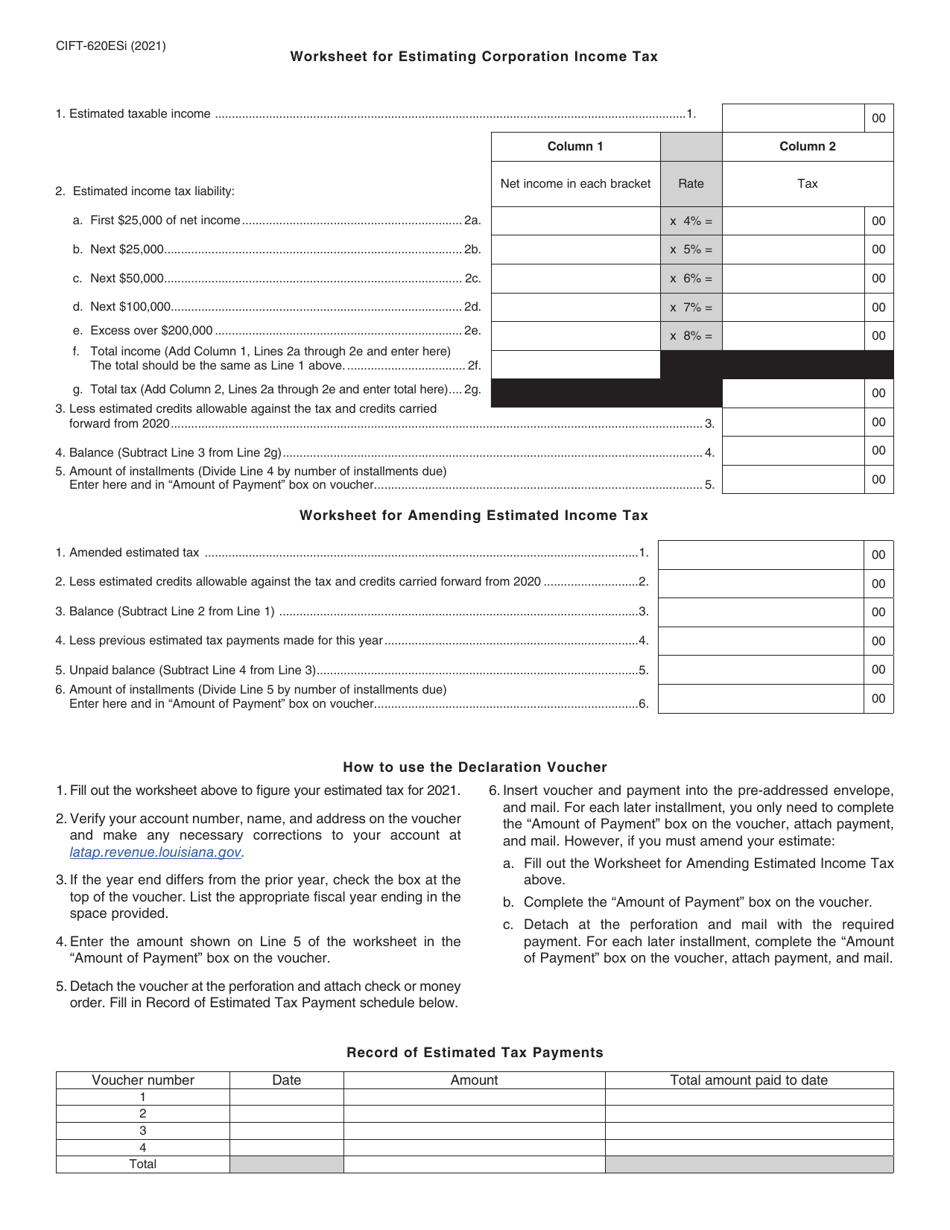

Instructions for Form CIFT-620ES Louisiana Estimated Tax Declaration Voucher for Corporations - Louisiana

This document contains official instructions for Form CIFT-620ES , Louisiana Estimated Tax Declaration Voucher for Corporations - a form released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form CIFT-620ES is available for download through this link.

FAQ

Q: What is Form CIFT-620ES?

A: Form CIFT-620ES is the Louisiana Estimated Tax Declaration Voucher for Corporations.

Q: Who should use Form CIFT-620ES?

A: Corporations in Louisiana should use Form CIFT-620ES to make estimated tax payments.

Q: What is an estimated tax payment?

A: An estimated tax payment is a prepayment of taxes that taxpayers (including corporations) are required to make throughout the year.

Q: When do corporations need to make estimated tax payments?

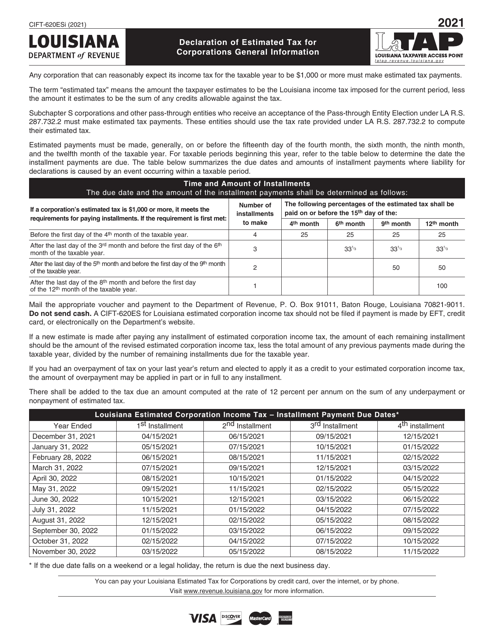

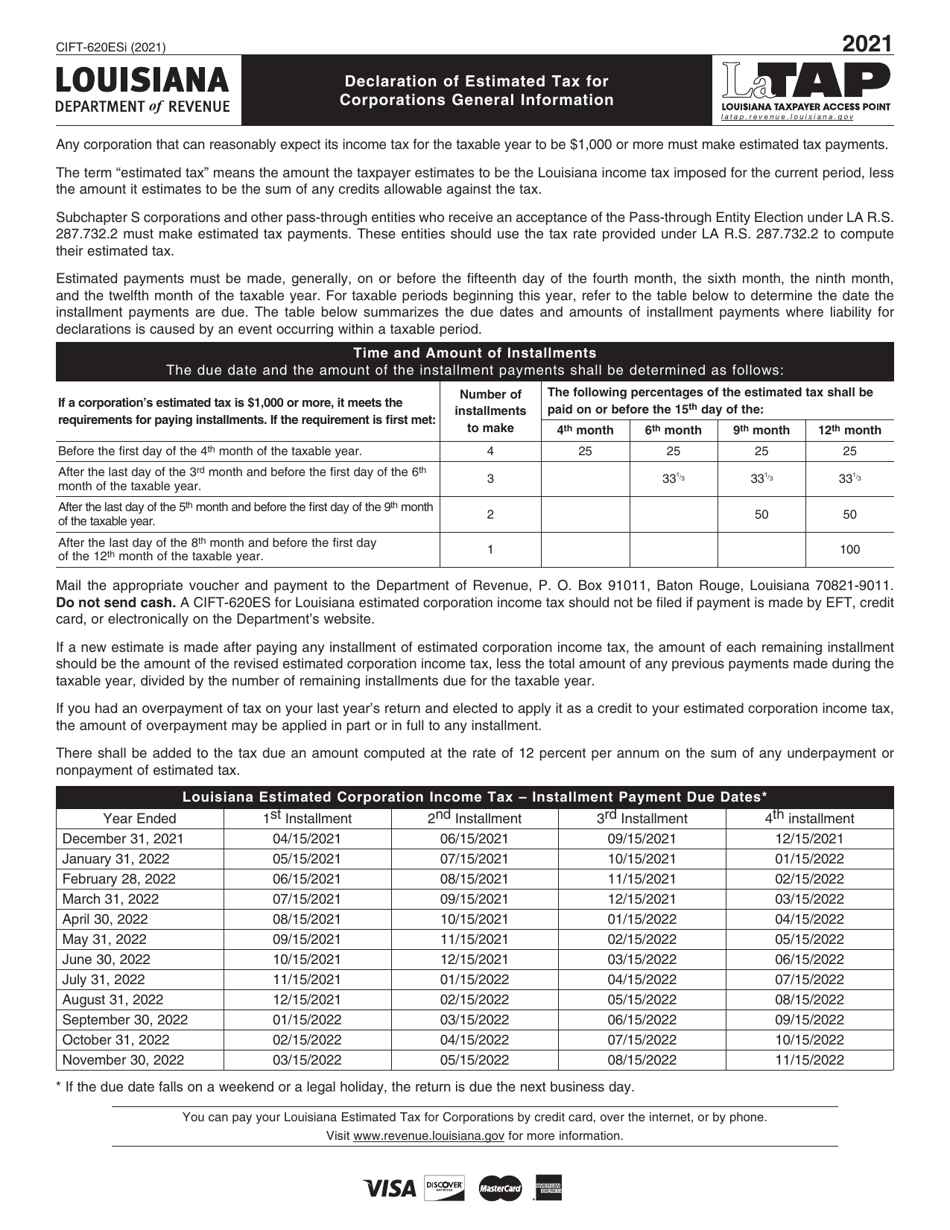

A: Corporations need to make estimated tax payments if they expect to owe $1,000 or more in taxes for the year.

Q: What information is required on Form CIFT-620ES?

A: Form CIFT-620ES requires corporations to provide their name, address, federal employer identification number, estimated tax amounts, and payment details.

Q: What is the due date for Form CIFT-620ES?

A: Form CIFT-620ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year for calendar year filers.

Q: What happens if a corporation fails to make estimated tax payments?

A: If a corporation fails to make estimated tax payments or underpays its estimated tax, it may be subject to penalties and interest.

Q: Are there any exceptions or special rules for estimated tax payments for corporations?

A: Yes, corporations may be subject to different rules and exceptions depending on their specific circumstances. It is recommended to consult with a tax professional or refer to the official instructions for Form CIFT-620ES for more information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.