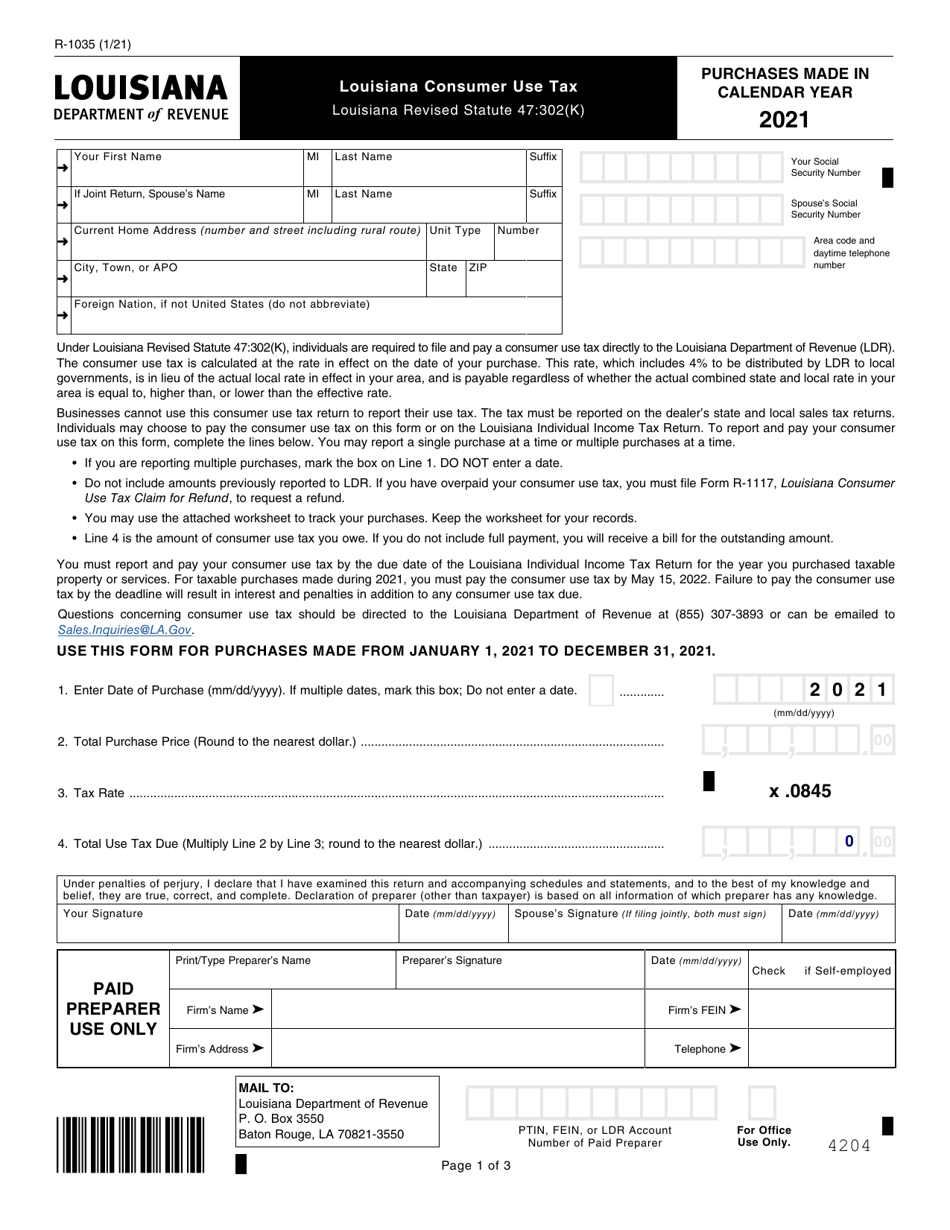

This version of the form is not currently in use and is provided for reference only. Download this version of

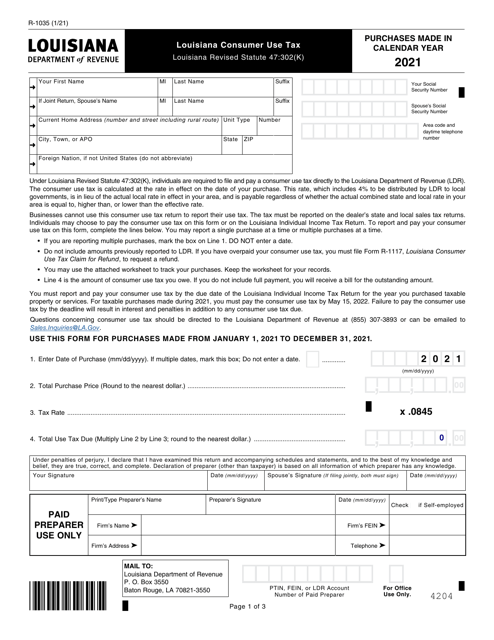

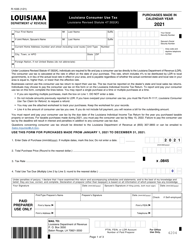

Form R-1035

for the current year.

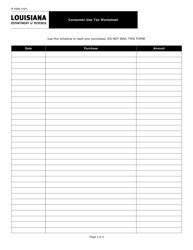

Form R-1035 Louisiana Consumer Use Tax - Louisiana

What Is Form R-1035?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-1035?

A: The Form R-1035 is the Louisiana Consumer Use Tax return form.

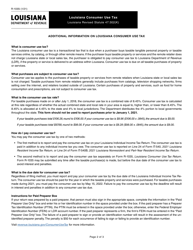

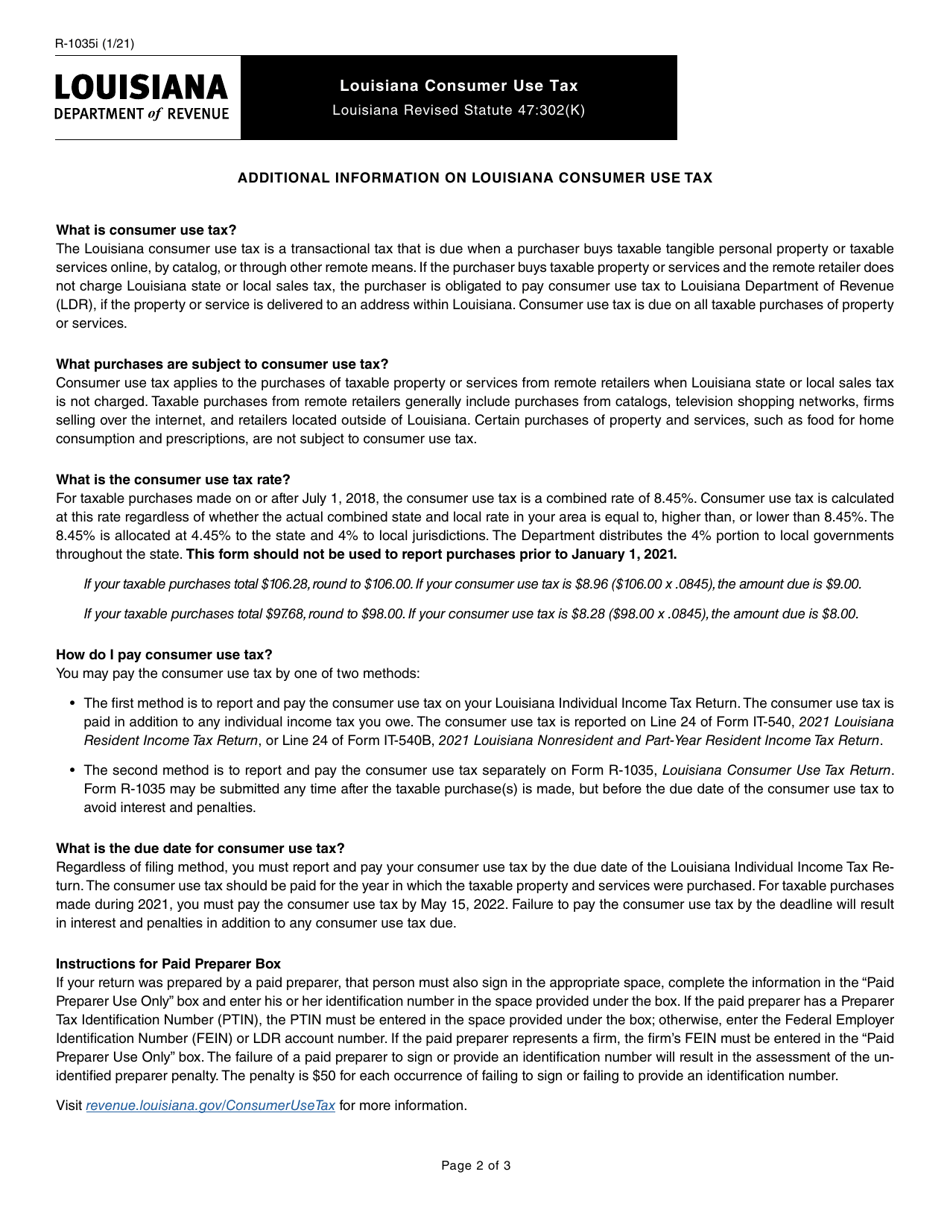

Q: What is the Louisiana Consumer Use Tax?

A: The Louisiana Consumer Use Tax is a tax on tangible personal property purchased for use, storage, or consumption in Louisiana.

Q: Who needs to file the Form R-1035?

A: Individuals and businesses that made purchases of tangible personal property for use in Louisiana and have not paid sales tax on those purchases should file the Form R-1035.

Q: When is the Form R-1035 due?

A: The Form R-1035 is due on the 20th day of the month following the calendar month in which the purchases were made.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1035 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.