This version of the form is not currently in use and is provided for reference only. Download this version of

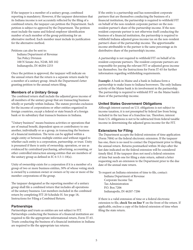

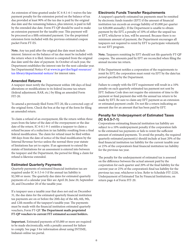

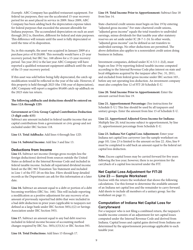

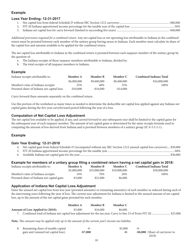

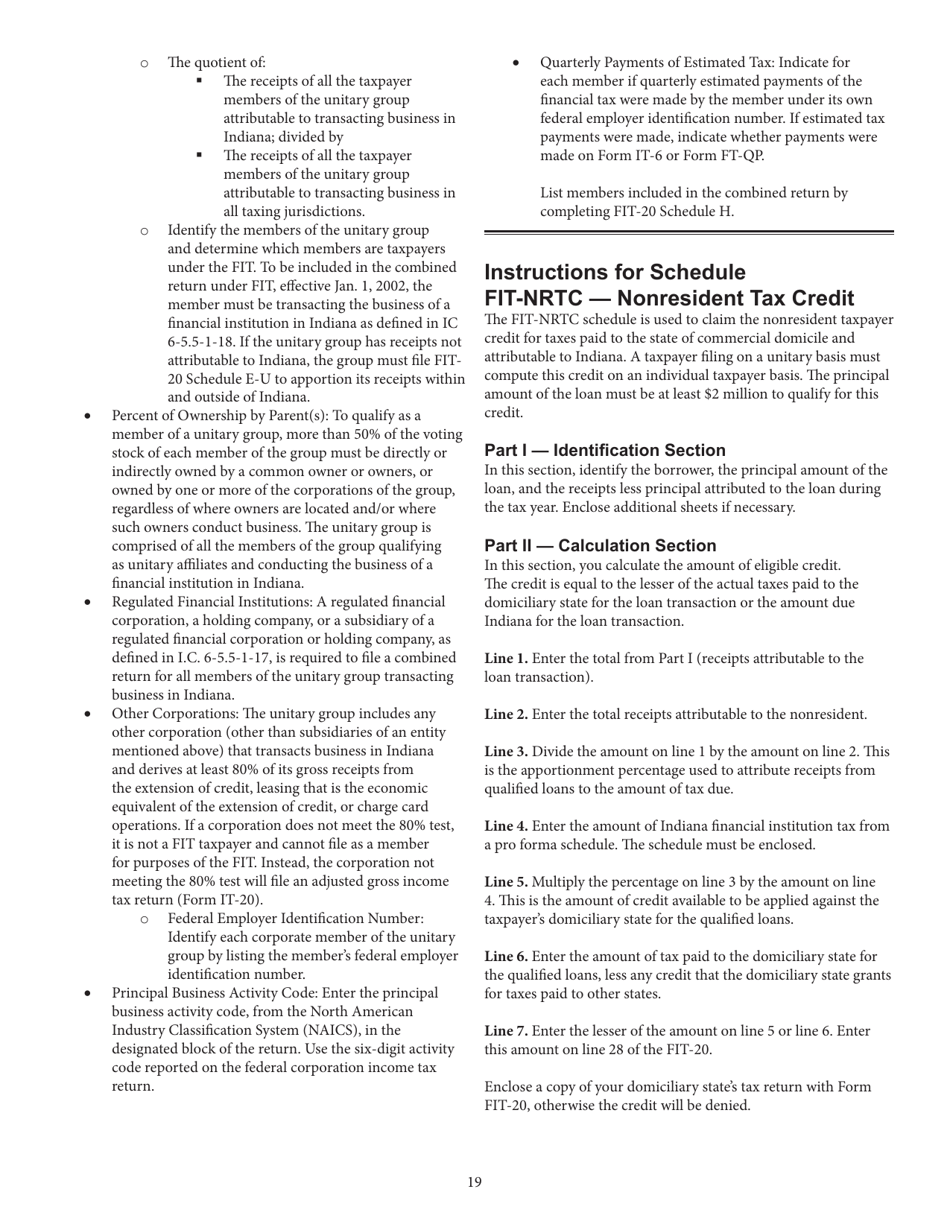

Instructions for Form FIT-20, State Form 44623

for the current year.

Instructions for Form FIT-20, State Form 44623 Indiana Financial Institution Tax Return - Indiana

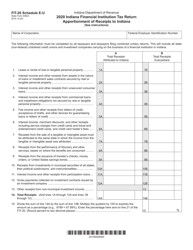

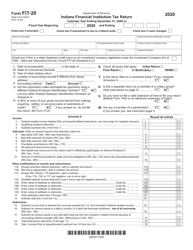

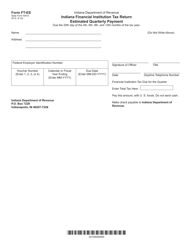

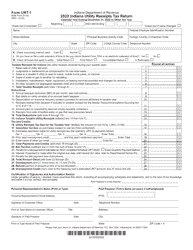

This document contains official instructions for Form FIT-20 , and State Form 44623 . Both forms are released and collected by the Indiana Department of Revenue. An up-to-date fillable Form FIT-20 (State Form 44622) Schedule E-U is available for download through this link. The latest available Form FIT-20 (State Form 44623) can be downloaded through this link.

FAQ

Q: What is Form FIT-20?

A: Form FIT-20 is the Indiana Financial Institution Tax Return.

Q: Who needs to file Form FIT-20?

A: Financial institutions operating in Indiana need to file Form FIT-20.

Q: What is the purpose of Form FIT-20?

A: The purpose of Form FIT-20 is to report and pay the financial institution tax in Indiana.

Q: What information do I need to complete Form FIT-20?

A: You will need to provide detailed financial information, including income, deductions, and credits.

Q: When is the deadline to file Form FIT-20?

A: The deadline to file Form FIT-20 is on or before the last day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form FIT-20?

A: Yes, there are penalties for late filing of Form FIT-20. It is important to file on time to avoid penalties and interest charges.

Q: Is there any additional documentation required to be submitted with Form FIT-20?

A: You may be required to submit additional schedules or documentation to support the information reported on Form FIT-20.

Instruction Details:

- This 20-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Indiana Department of Revenue.