This version of the form is not currently in use and is provided for reference only. Download this version of

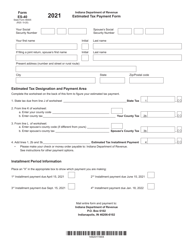

Form ES-40 (State Form 46005)

for the current year.

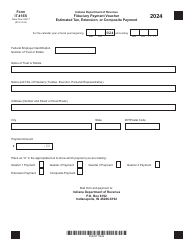

Form ES-40 (State Form 46005) Estimated Tax Payment Form - Indiana

What Is Form ES-40 (State Form 46005)?

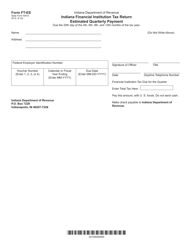

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ES-40?

A: Form ES-40 is the Estimated Tax Payment Form for Indiana.

Q: What is the purpose of Form ES-40?

A: The purpose of Form ES-40 is to make estimated tax payments to the state of Indiana.

Q: Who needs to file Form ES-40?

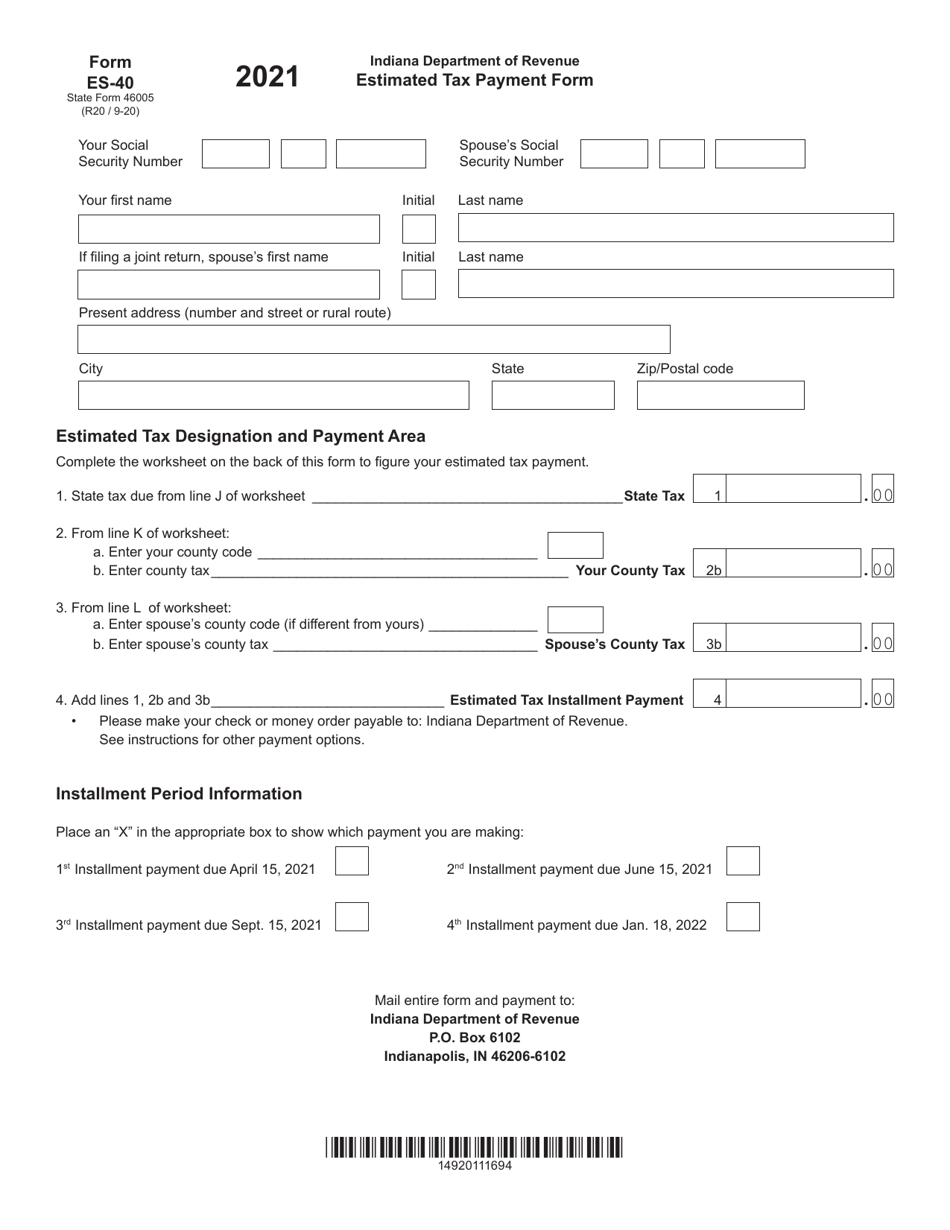

A: Individuals and businesses who have income tax liability in Indiana and expect to owe at least $1,000 in tax for the year are required to file Form ES-40.

Q: When is Form ES-40 due?

A: Form ES-40 is due on April 15th of each year, or on the same date as the federal income tax return if the federal due date is different.

Q: How do I fill out Form ES-40?

A: To fill out Form ES-40, you will need to provide your personal information, estimate your income, calculate your tax liability, and make the payment using the payment voucher provided.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ES-40 (State Form 46005) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.