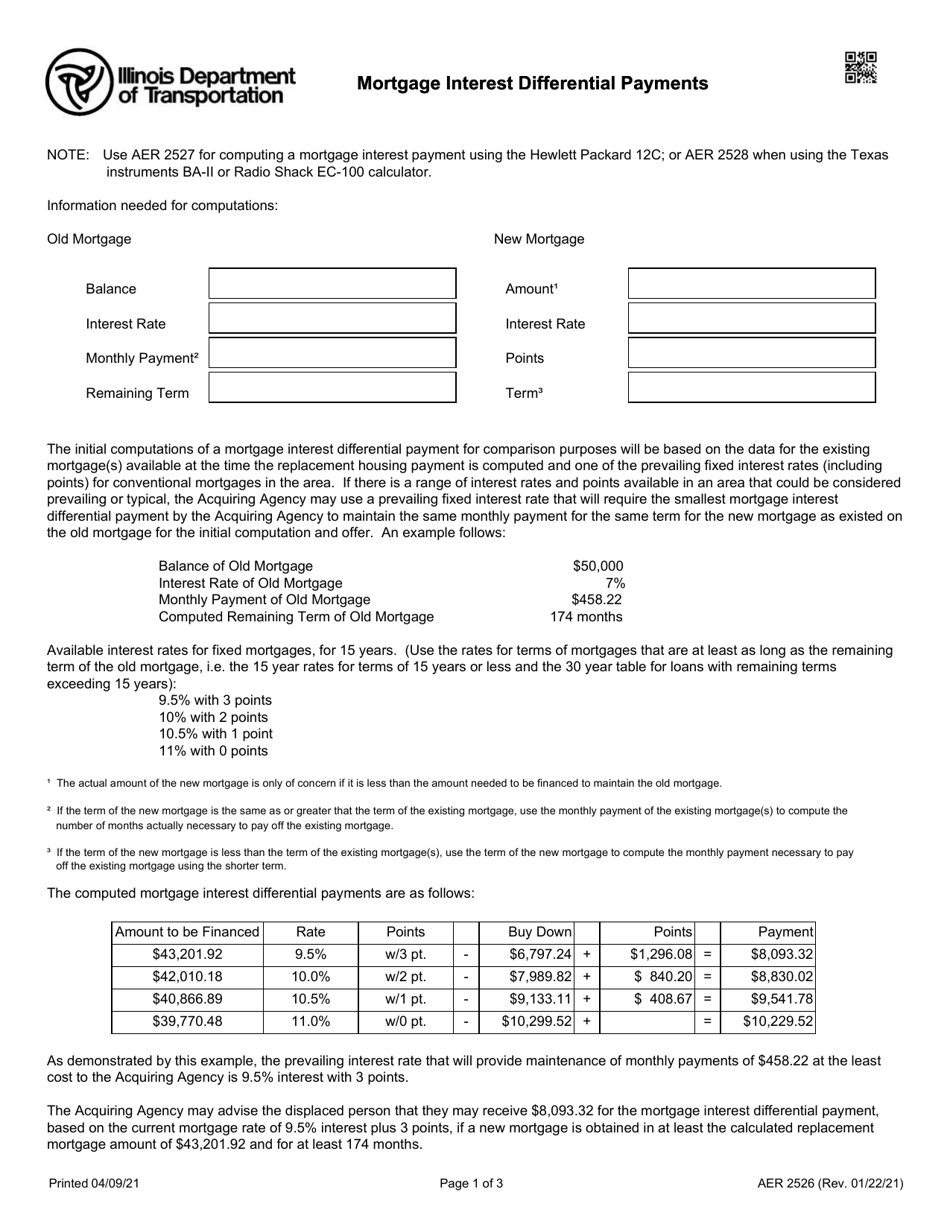

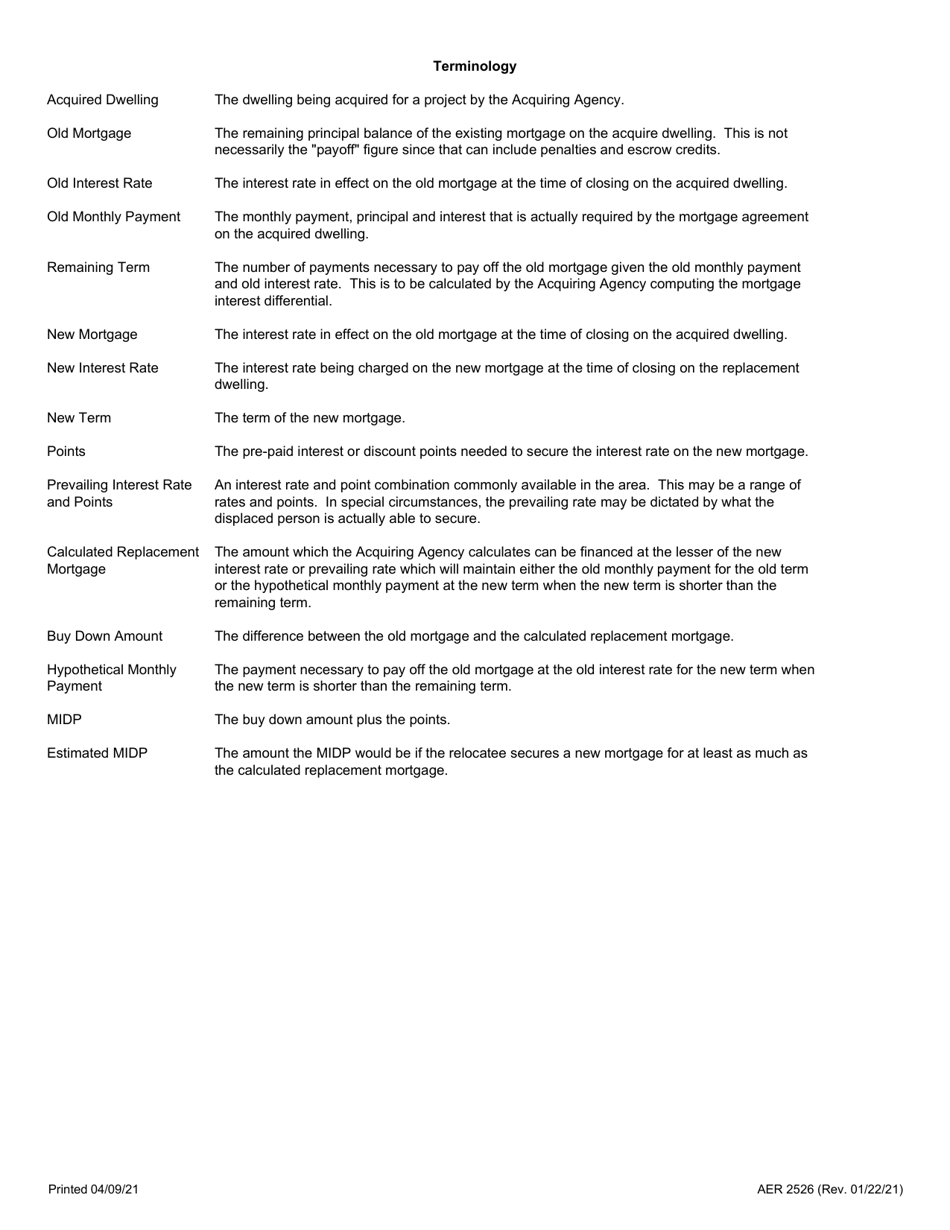

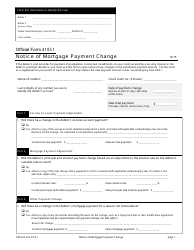

Form AER2526 Mortgage Interest Differential Payments - Illinois

What Is Form AER2526?

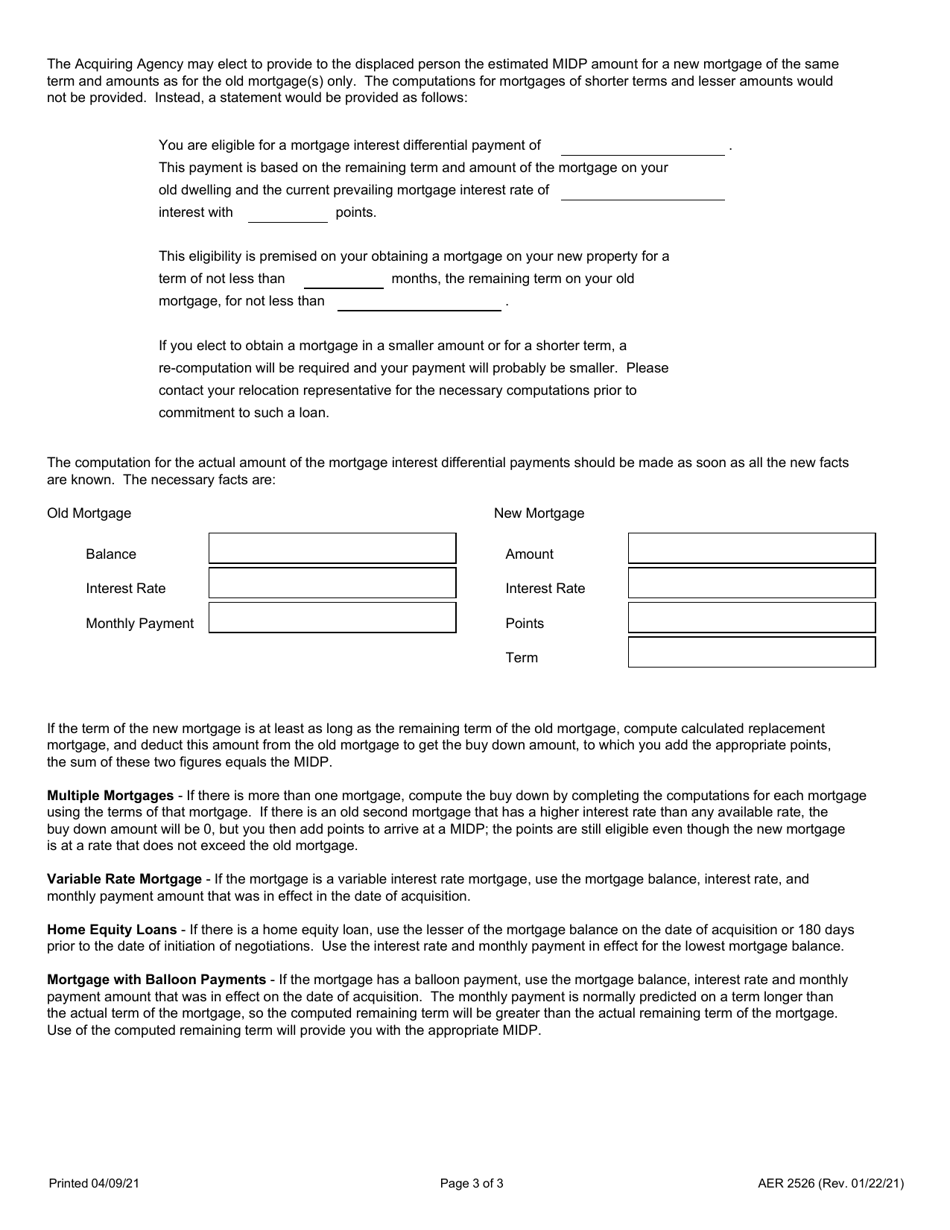

This is a legal form that was released by the Illinois Department of Transportation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AER2526?

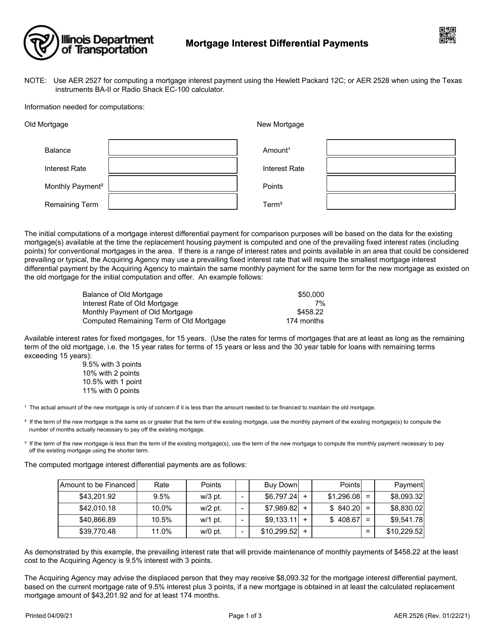

A: AER2526 is a form used for Mortgage Interest Differential Payments.

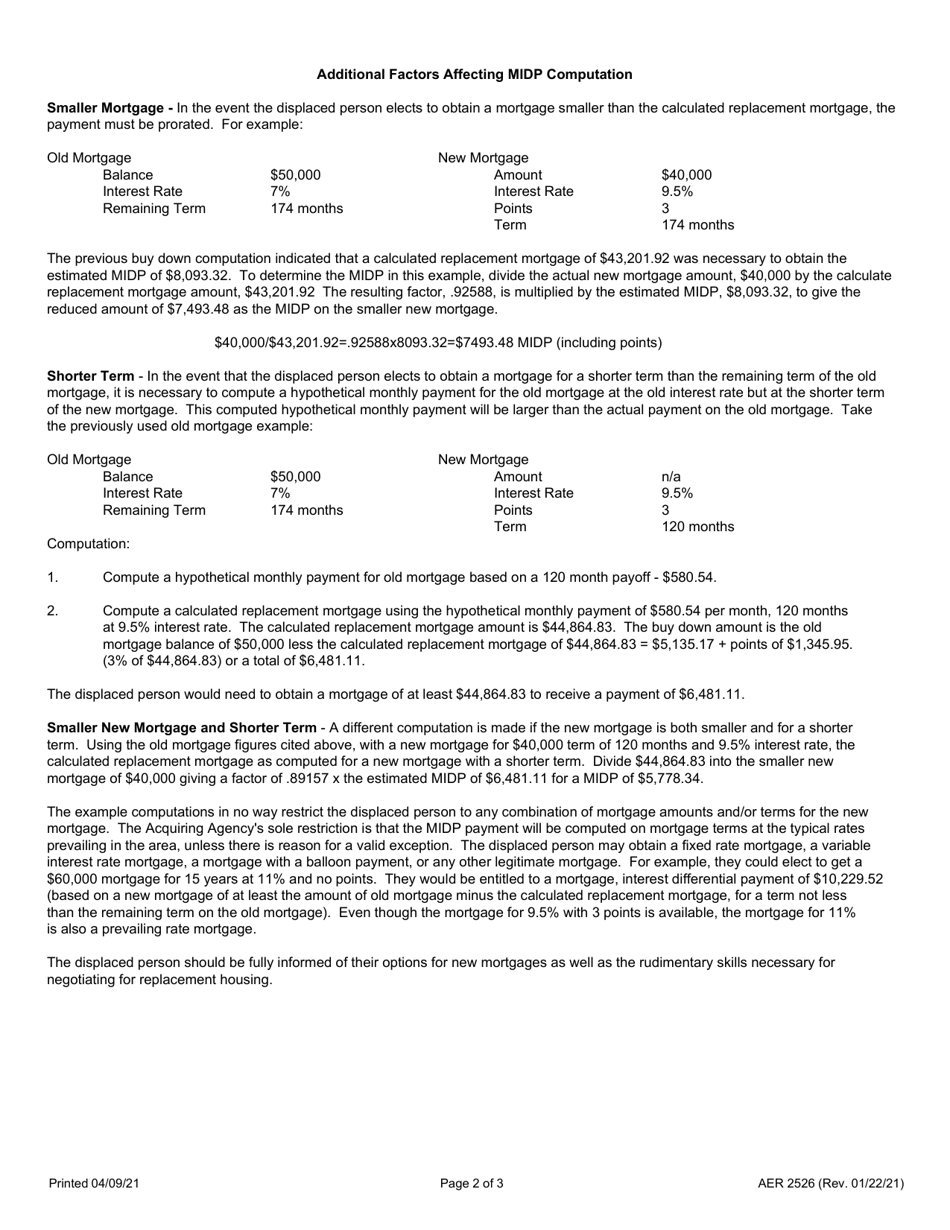

Q: What are Mortgage Interest Differential Payments?

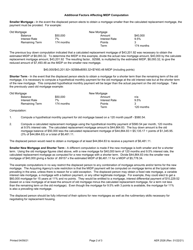

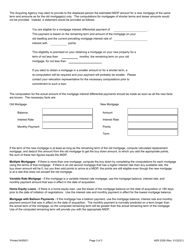

A: Mortgage Interest Differential Payments are payments made to compensate lenders for the difference between the original interest rate and the current market interest rate.

Q: Who uses the AER2526 form?

A: The AER2526 form is used by individuals in Illinois who are seeking to make Mortgage Interest Differential Payments.

Q: Why would someone need to make Mortgage Interest Differential Payments?

A: Someone may need to make Mortgage Interest Differential Payments if they have a mortgage with an adjustable interest rate and the market interest rates have decreased since the mortgage was taken out.

Q: What is the purpose of the AER2526 form?

A: The AER2526 form is used to calculate the amount of Mortgage Interest Differential Payments that an individual needs to make.

Q: Is the AER2526 form specific to Illinois?

A: Yes, the AER2526 form is specific to Illinois.

Form Details:

- Released on January 22, 2021;

- The latest edition provided by the Illinois Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AER2526 by clicking the link below or browse more documents and templates provided by the Illinois Department of Transportation.