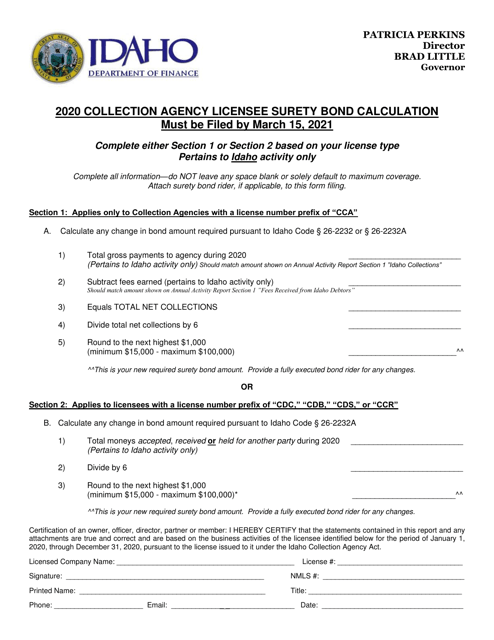

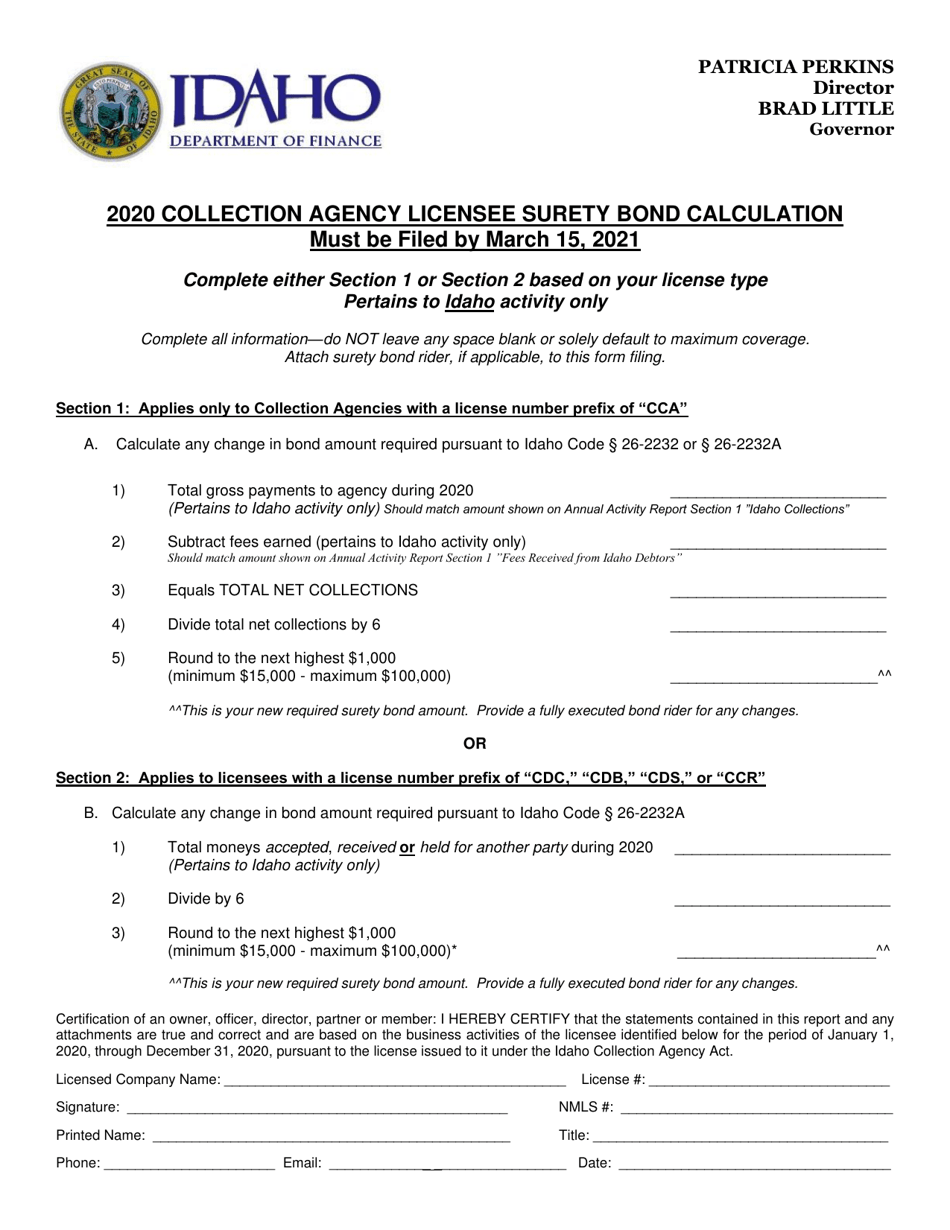

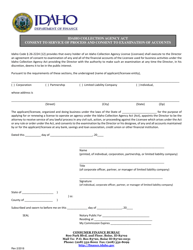

Collection Agency Licensee Surety Bond Calculation - Idaho

Collection Agency Licensee Surety Bond Calculation is a legal document that was released by the Idaho Department of Finance - a government authority operating within Idaho.

FAQ

Q: What is a Collection Agency Licensee Surety Bond?

A: A Collection Agency Licensee Surety Bond is a type of financial guarantee that collection agencies in Idaho must obtain in order to operate legally.

Q: Why do collection agencies need a surety bond?

A: Collection agencies need a surety bond to ensure that they will fulfill their obligations and follow the regulations set by the state.

Q: How is the amount of the surety bond calculated?

A: The amount of the surety bond required for a collection agency in Idaho is calculated based on the agency's annual gross collections.

Q: Who determines the required amount of the surety bond?

A: The Idaho Department of Finance determines the required amount of the surety bond for each collection agency.

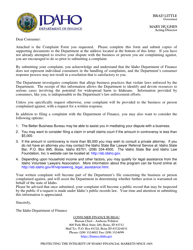

Q: What happens if a collection agency fails to obtain a surety bond?

A: If a collection agency fails to obtain a surety bond, they may be subject to penalties and their license to operate may be revoked.

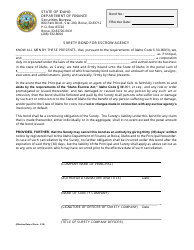

Q: Can a collection agency use cash or other assets instead of a surety bond?

A: No, a collection agency must obtain a surety bond from an authorized surety company.

Q: How long is a collection agency surety bond valid for?

A: A collection agency surety bond is typically valid for one year.

Q: Can the amount of the surety bond change?

A: Yes, the amount of the surety bond can change based on the agency's annual gross collections.

Q: Are there any exemptions to the surety bond requirement?

A: Yes, certain government agencies and charitable organizations may be exempt from the surety bond requirement.

Form Details:

- The latest edition currently provided by the Idaho Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Finance.