This version of the form is not currently in use and is provided for reference only. Download this version of

Form GP-4

for the current year.

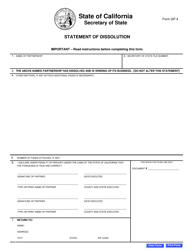

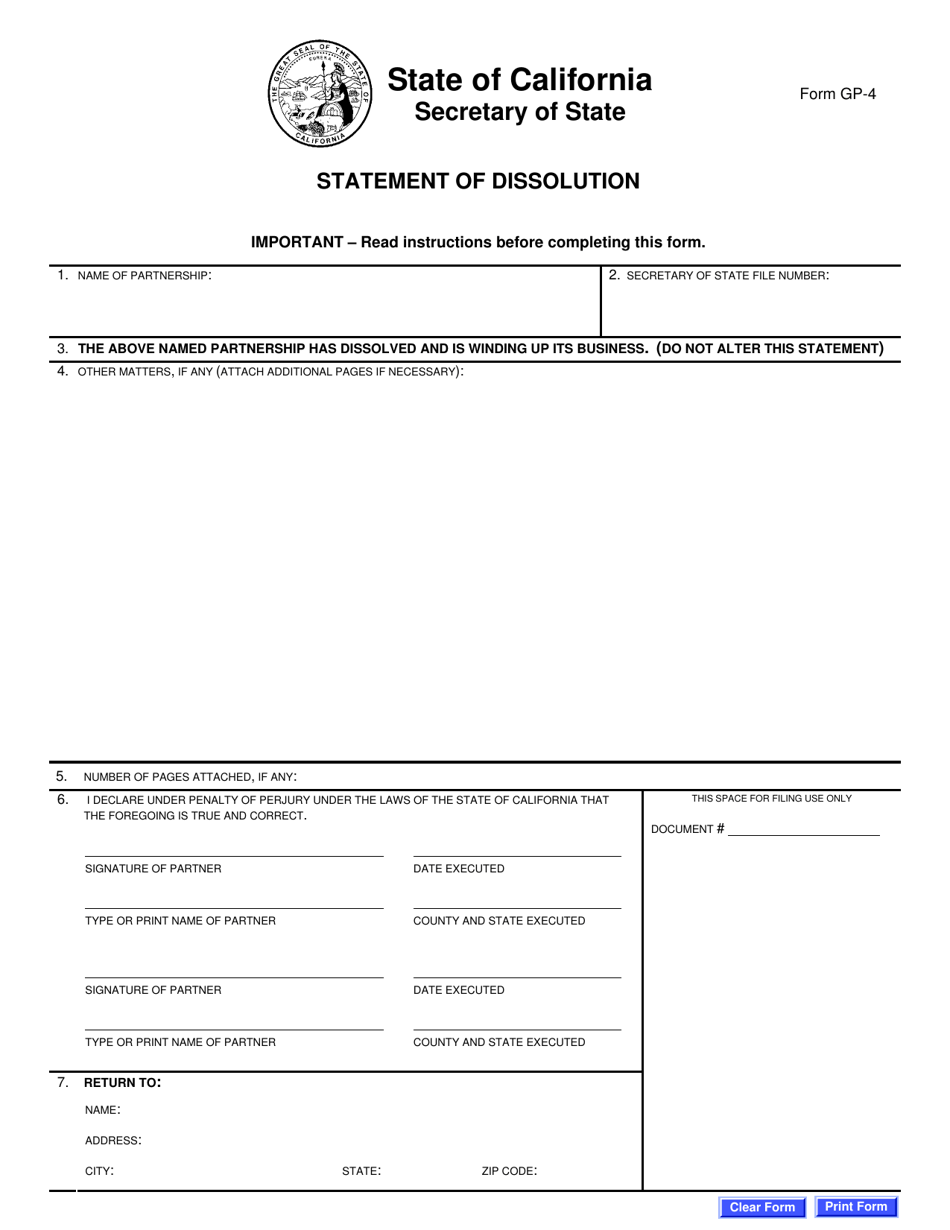

Form GP-4 Statement of Dissolution - California

What Is Form GP-4?

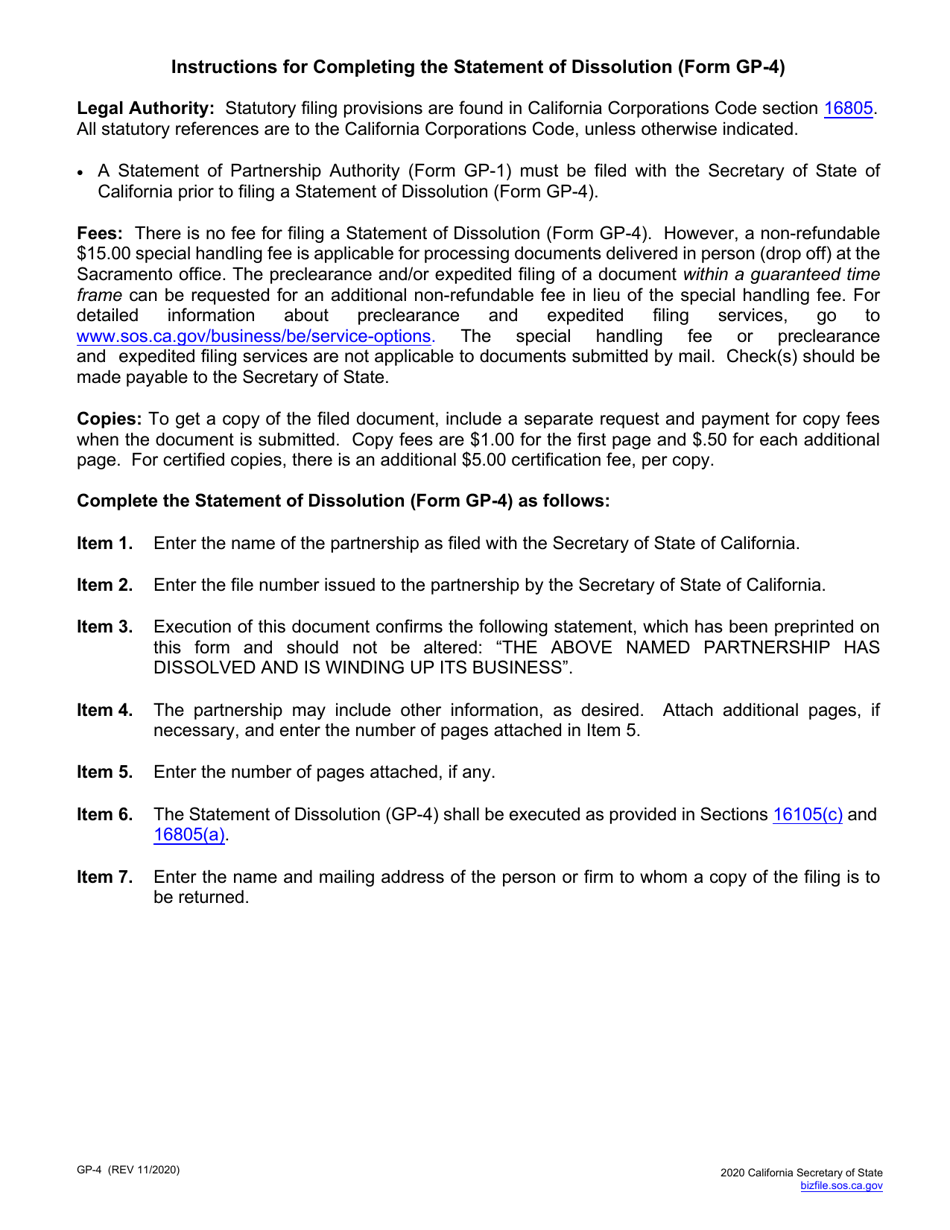

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GP-4?

A: Form GP-4 is the Statement of Dissolution for business entities in California.

Q: Who needs to file Form GP-4?

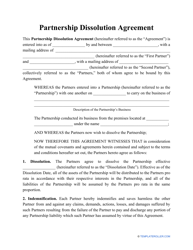

A: Form GP-4 needs to be filed by business entities in California that are seeking to dissolve.

Q: What is the purpose of filing Form GP-4?

A: The purpose of filing Form GP-4 is to officially dissolve a business entity in California.

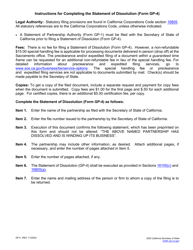

Q: What information is required on Form GP-4?

A: Form GP-4 requires the business entity's name, entity number, dissolution date, and a statement of why the entity is dissolving.

Q: Are there any fees associated with filing Form GP-4?

A: Yes, there is a filing fee associated with filing Form GP-4. The fee amount may vary.

Q: Is there a deadline for filing Form GP-4?

A: Yes, Form GP-4 should be filed within 12 months of the effective date of dissolution.

Q: What happens after Form GP-4 is filed?

A: After Form GP-4 is filed and approved, the business entity is officially dissolved in California.

Q: Are there any additional steps to take after filing Form GP-4?

A: Depending on the specific circumstances, there may be additional steps required, such as notifying creditors and distributing remaining assets. Consulting with a legal professional is recommended.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GP-4 by clicking the link below or browse more documents and templates provided by the California Secretary of State.