This version of the form is not currently in use and is provided for reference only. Download this version of

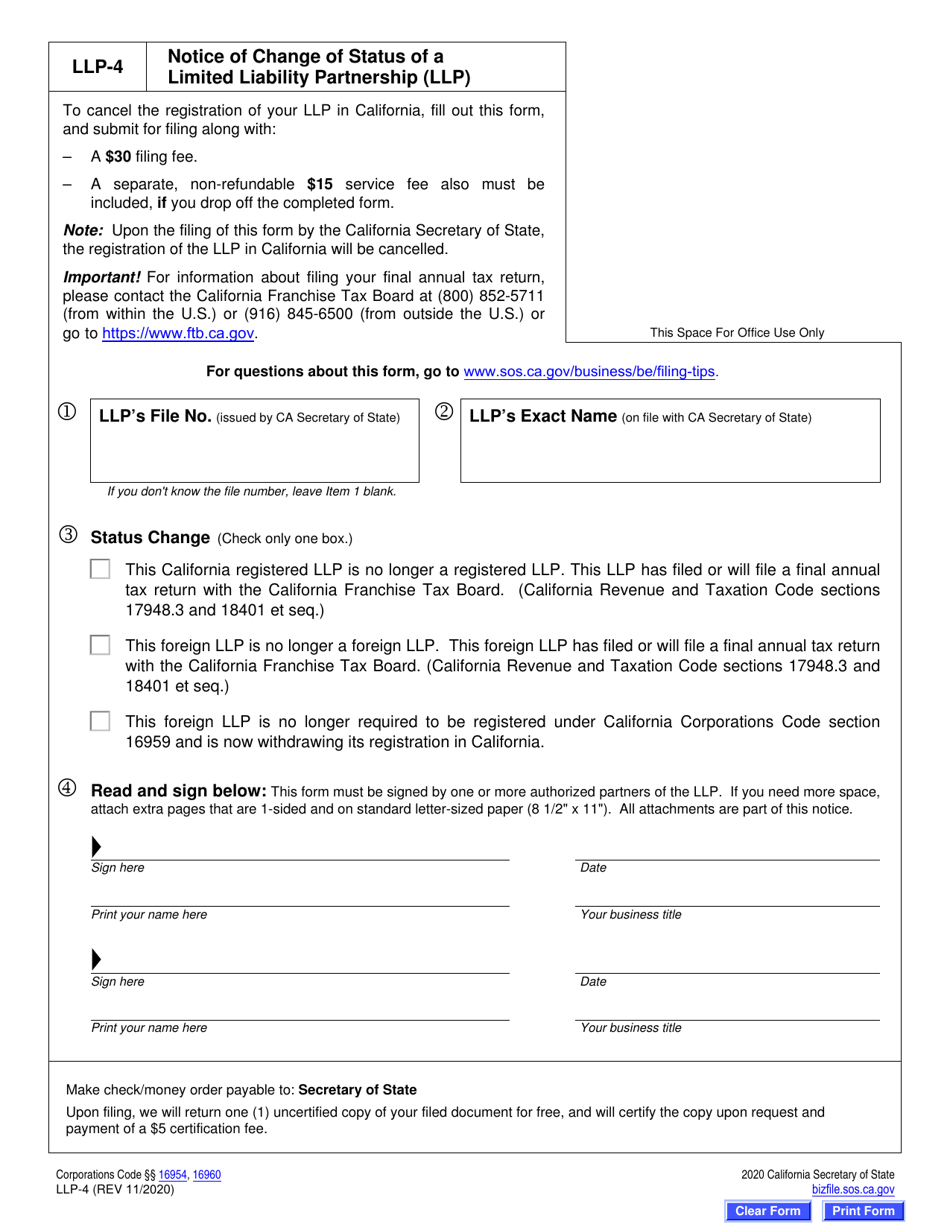

Form LLP-4

for the current year.

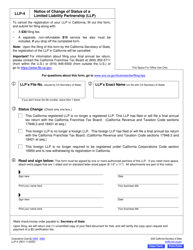

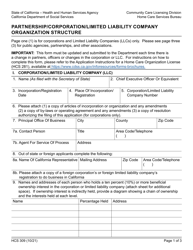

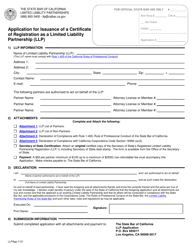

Form LLP-4 Notice of Change of Status of a Limited Liability Partnership (LLP ) - California

What Is Form LLP-4?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LLP-4?

A: Form LLP-4 is a Notice of Change of Status of a Limited Liability Partnership (LLP) in California.

Q: What is a Limited Liability Partnership (LLP)?

A: A Limited Liability Partnership (LLP) is a type of business entity that provides liability protection to its partners.

Q: Who needs to file Form LLP-4?

A: LLPs in California need to file Form LLP-4 to report any changes in their status.

Q: What changes can be reported using Form LLP-4?

A: Form LLP-4 can be used to report changes such as the addition or removal of partners, changes in business address, or changes in the status of the LLP.

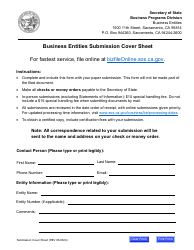

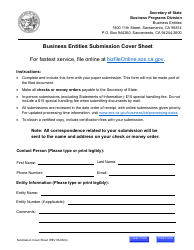

Q: How should Form LLP-4 be filed?

A: Form LLP-4 should be filed by mail or in person at the California Secretary of State's office.

Q: What is the deadline for filing Form LLP-4?

A: Form LLP-4 should be filed within 30 days of the change in status of the LLP.

Q: Are there any penalties for not filing Form LLP-4?

A: Yes, there may be penalties for not filing Form LLP-4 or for filing it late. It is important to file the form in a timely manner.

Q: Can Form LLP-4 be amended after filing?

A: Yes, if there are any errors or changes to the information provided on Form LLP-4, an amended form can be filed to correct or update the information.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLP-4 by clicking the link below or browse more documents and templates provided by the California Secretary of State.