This version of the form is not currently in use and is provided for reference only. Download this version of

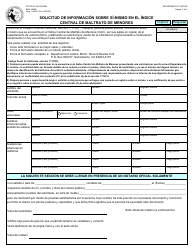

Form SI-550

for the current year.

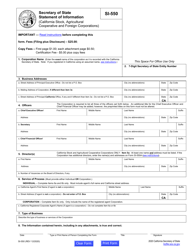

Form SI-550 Statement of Information (California Stock, Agricultural Cooperative and Foreign Corporations) - California

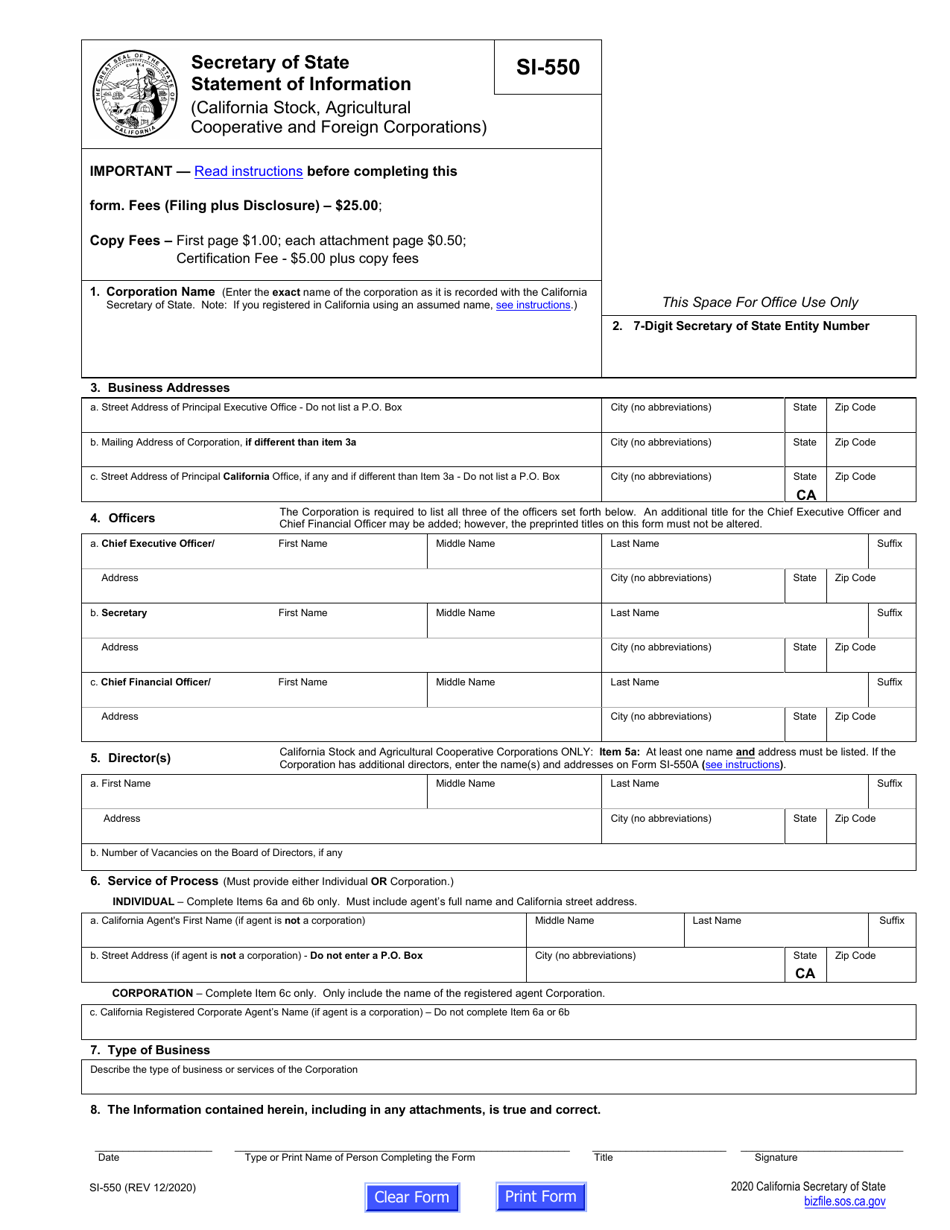

What Is Form SI-550?

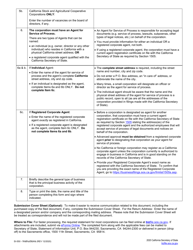

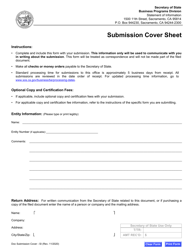

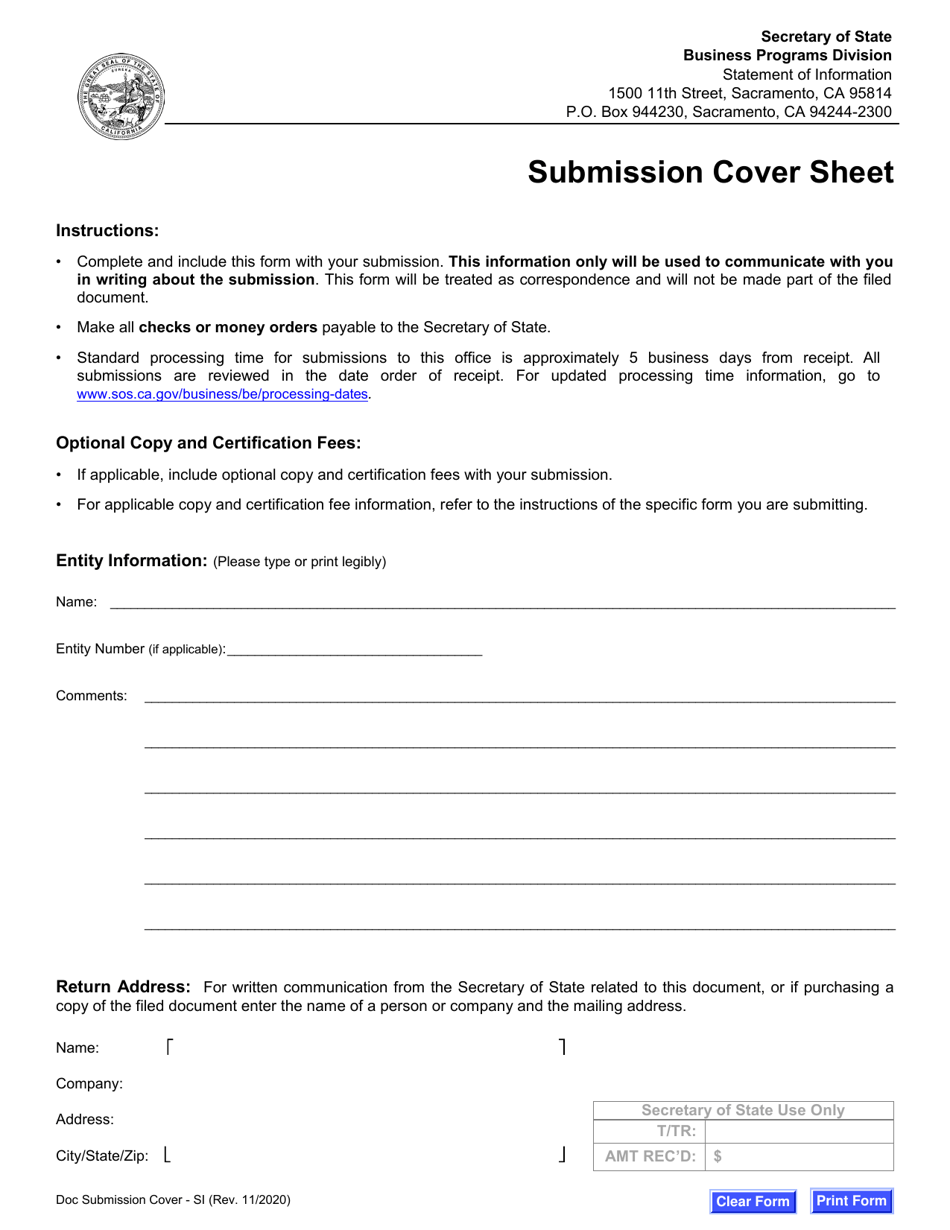

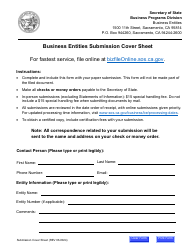

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

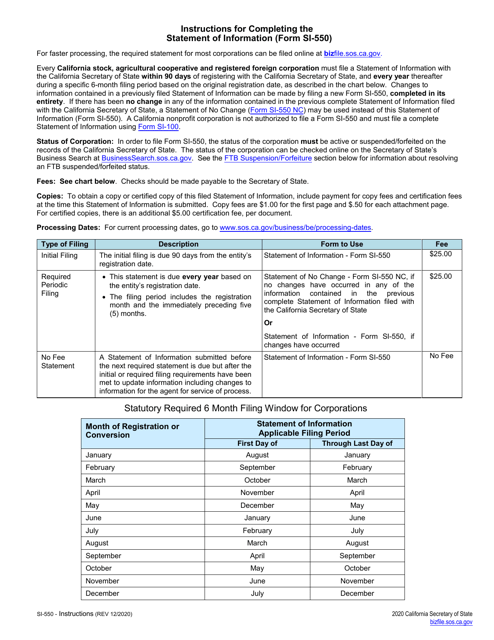

Q: What is Form SI-550?

A: Form SI-550 is the Statement of Information for California Stock, Agricultural Cooperative, and Foreign Corporations.

Q: Who should file Form SI-550?

A: California Stock, Agricultural Cooperative, and Foreign Corporations are required to file Form SI-550.

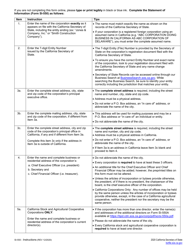

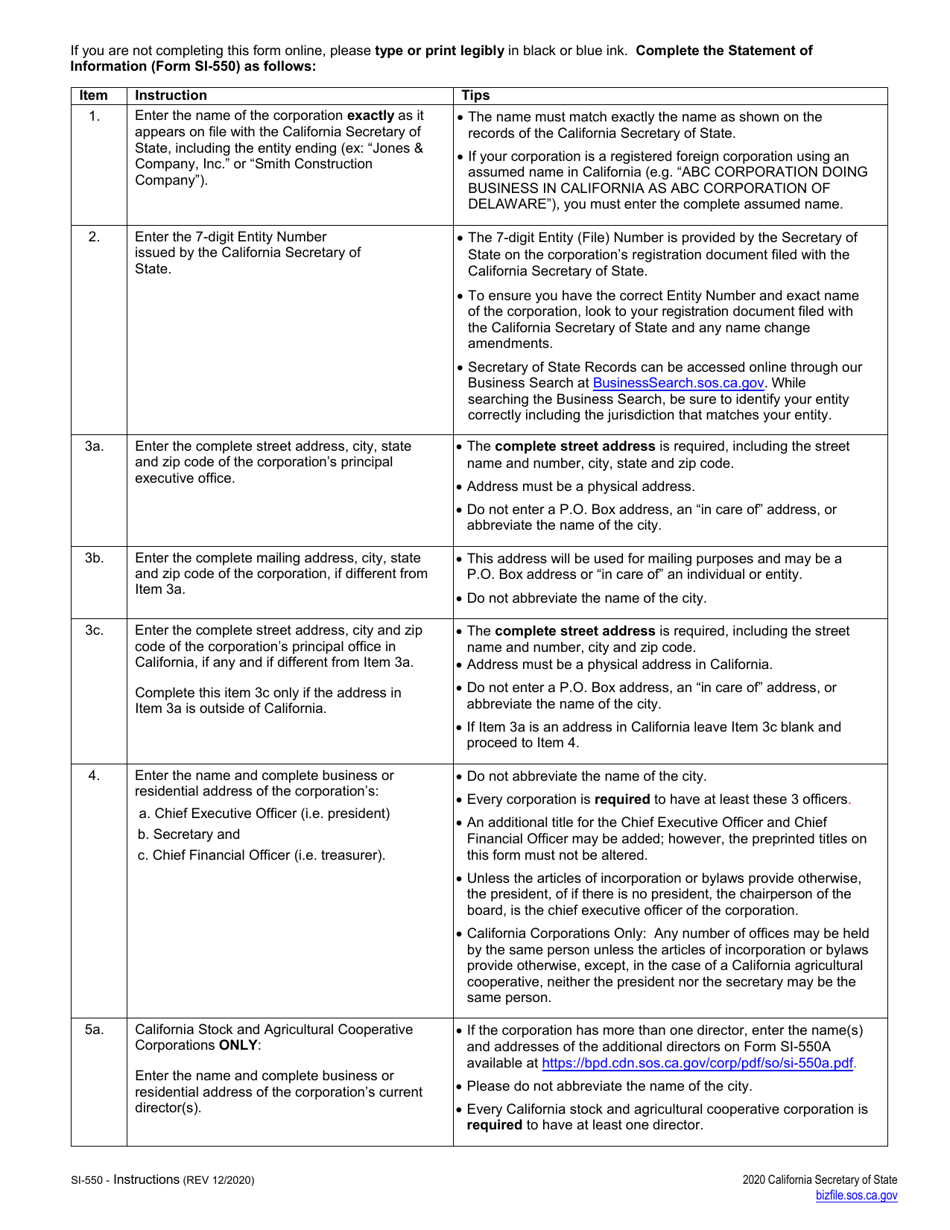

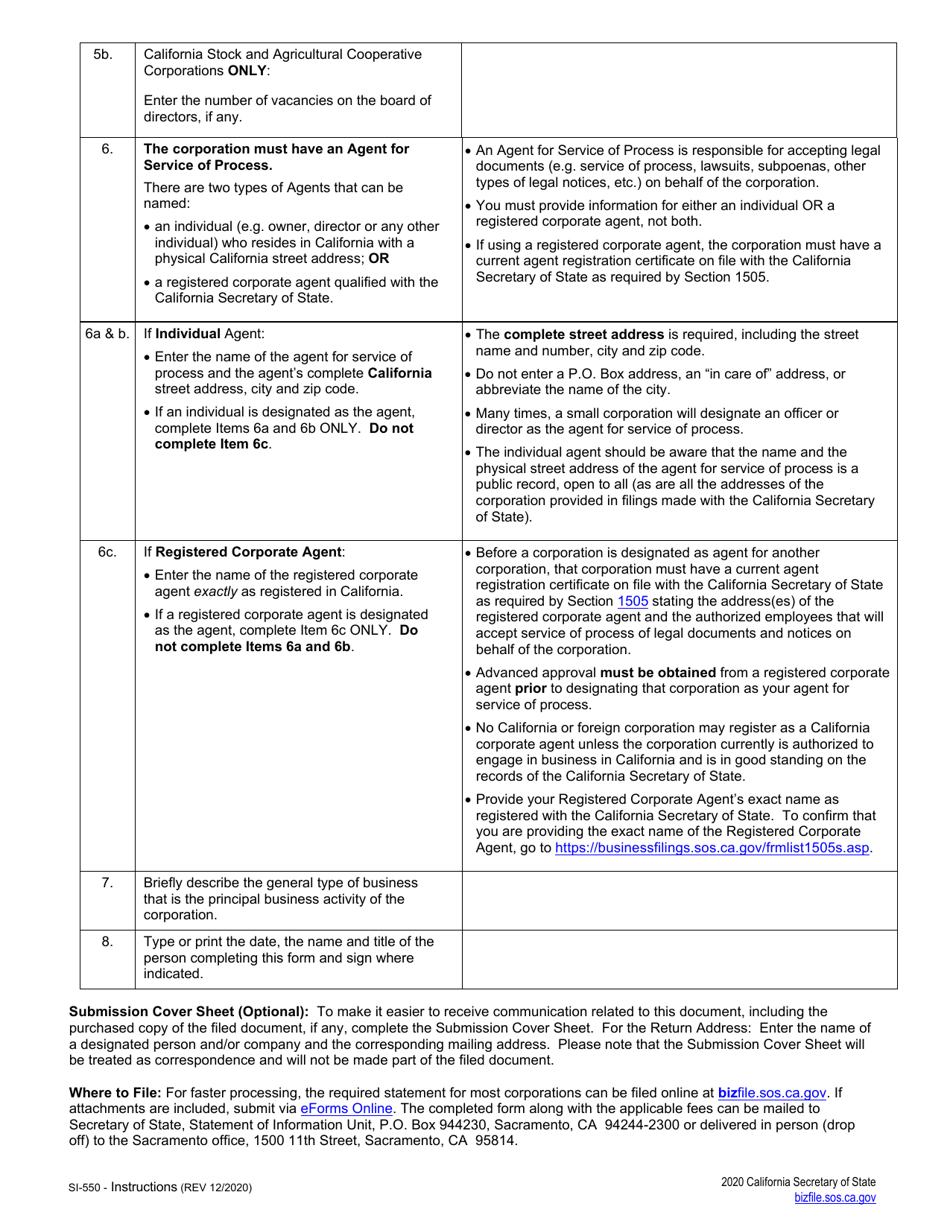

Q: What information is required on Form SI-550?

A: Form SI-550 requires information about the corporation's business address, officers, directors, and registered agent.

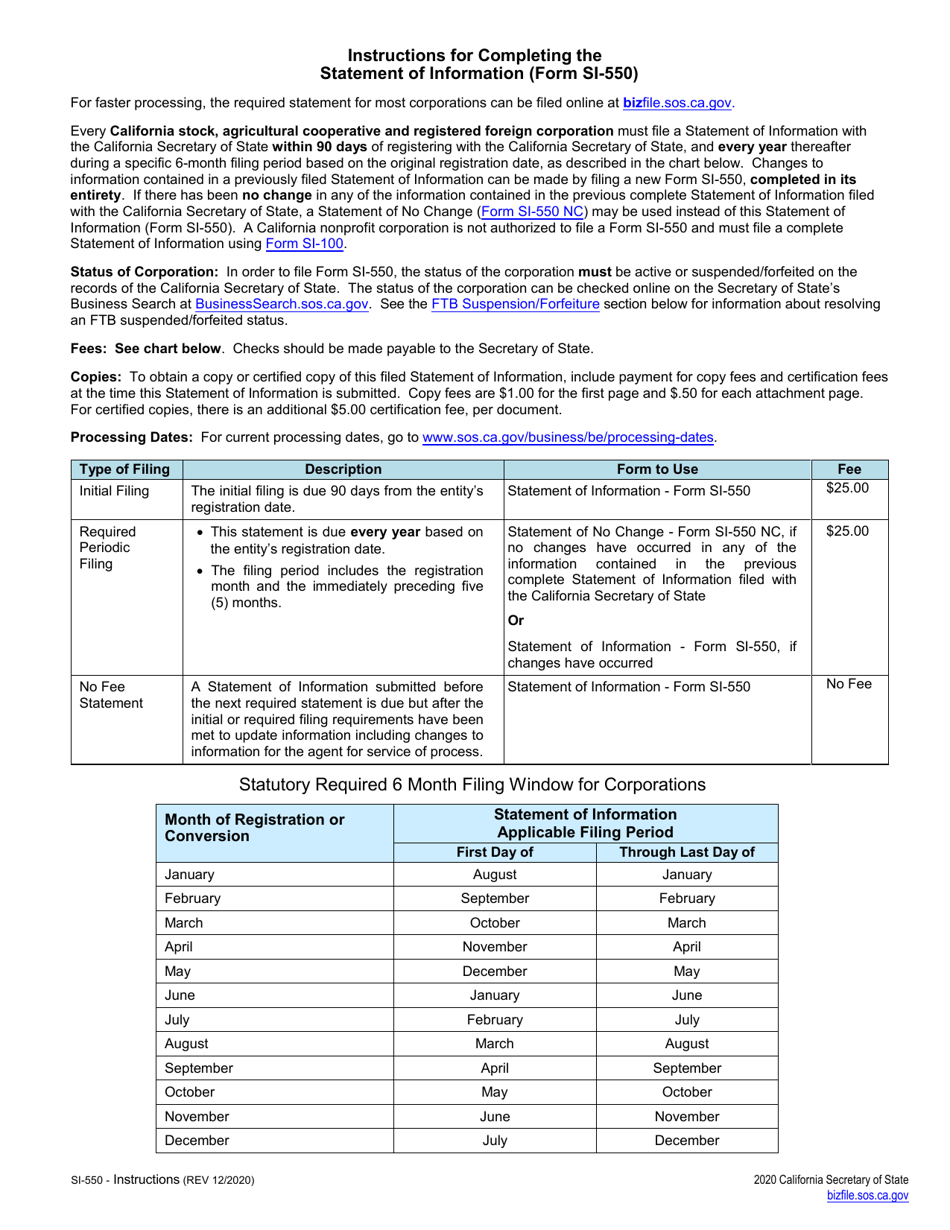

Q: When should Form SI-550 be filed?

A: Form SI-550 must be filed within 90 days of incorporating or registering the corporation, and then every year by the end of the corporation's anniversary month.

Q: What is the filing fee for Form SI-550?

A: The filing fee for Form SI-550 is $25.

Q: Are there any penalties for not filing Form SI-550?

A: Yes, there are penalties for not filing Form SI-550, including potential suspension or forfeiture of the corporation's business entity status.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-550 by clicking the link below or browse more documents and templates provided by the California Secretary of State.