This version of the form is not currently in use and is provided for reference only. Download this version of

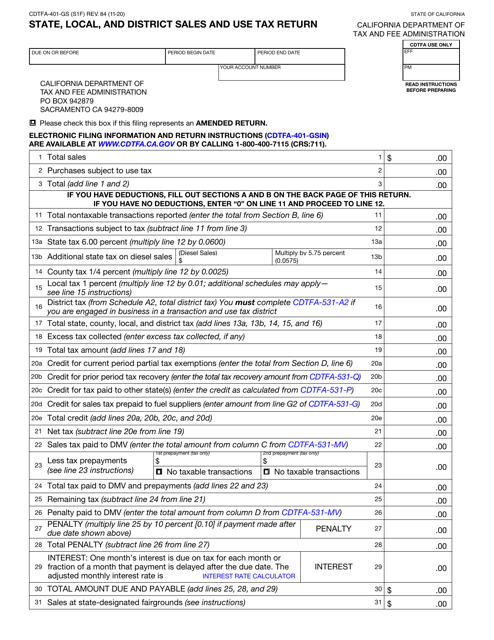

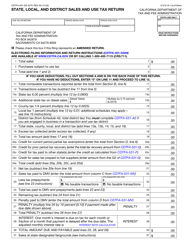

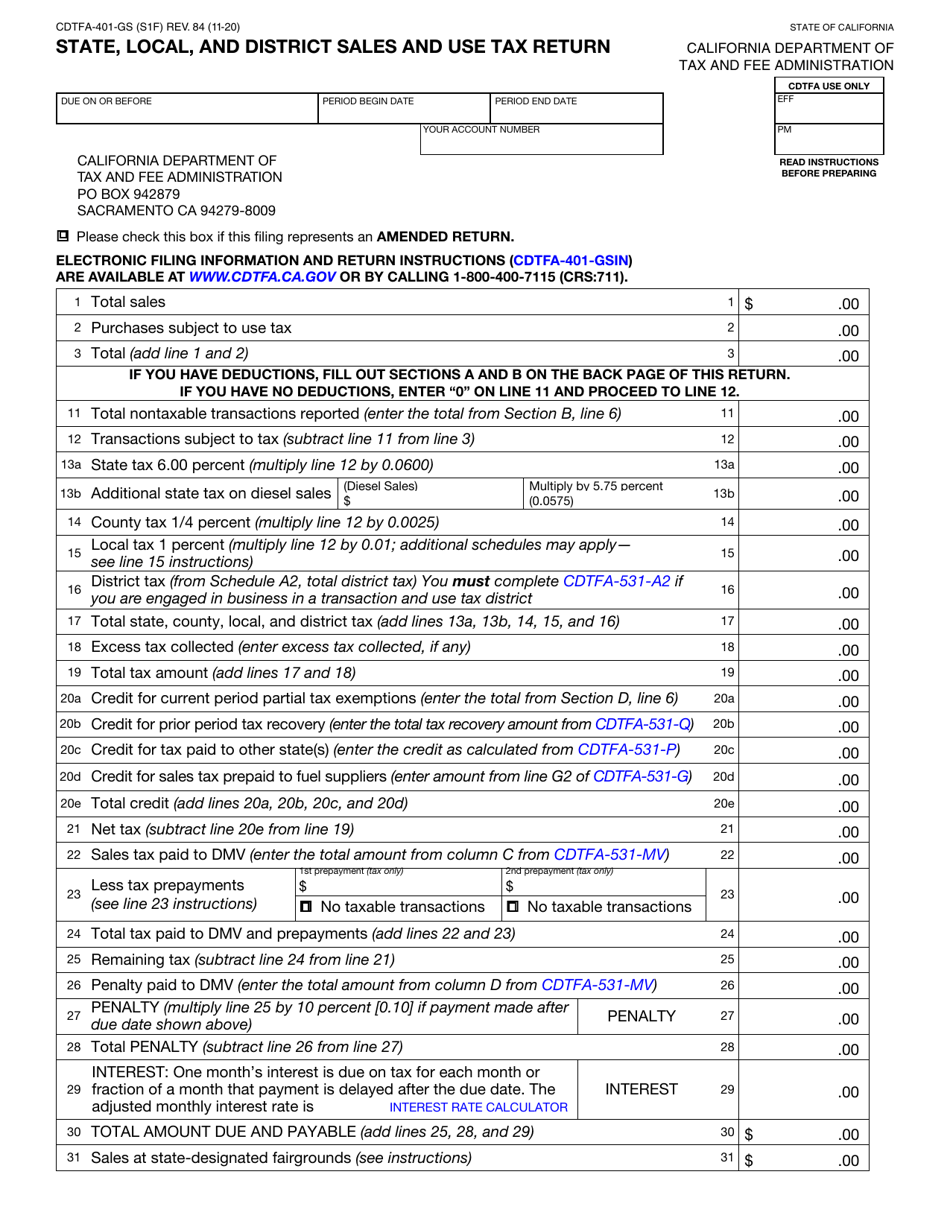

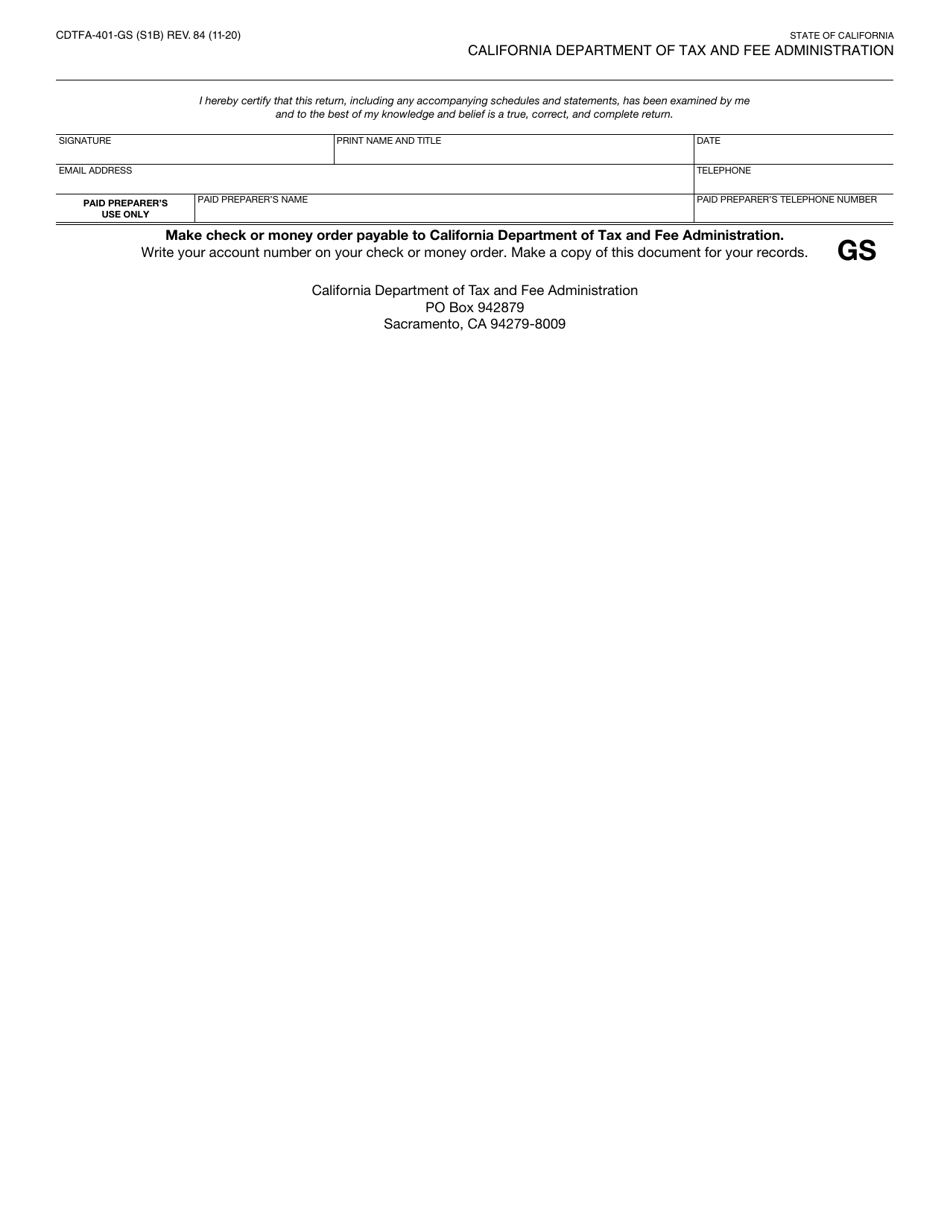

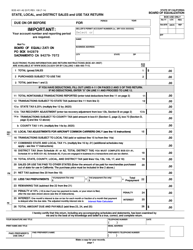

Form CDTFA-401-GS

for the current year.

Form CDTFA-401-GS State, Local, and District Sales and Use Tax Return - California

What Is Form CDTFA-401-GS?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CDTFA-401-GS?

A: Form CDTFA-401-GS is the State, Local, and District Sales and Use Tax Return in California.

Q: What is the purpose of Form CDTFA-401-GS?

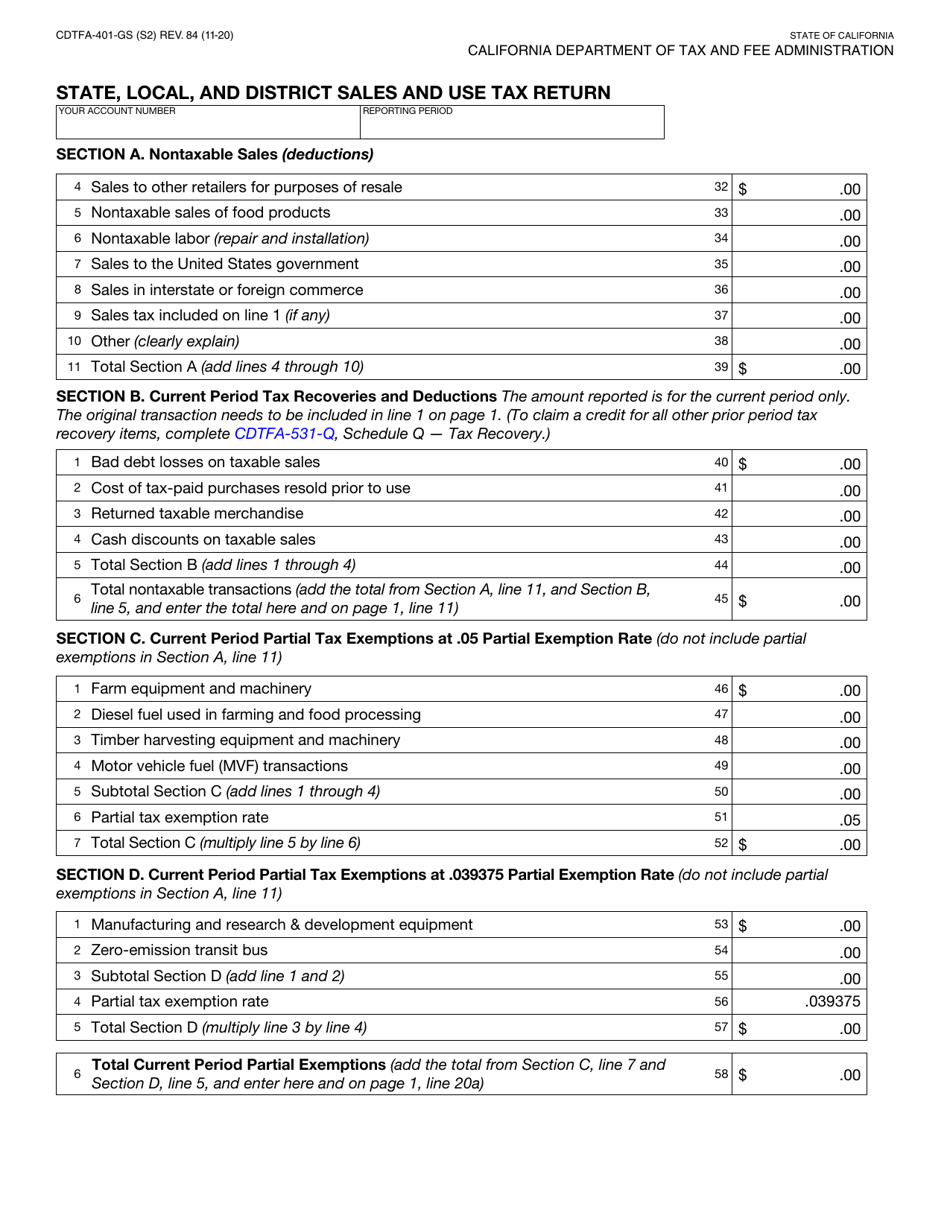

A: The purpose of Form CDTFA-401-GS is to report and pay sales and use tax to the state, local, and district tax authorities in California.

Q: Who needs to file Form CDTFA-401-GS?

A: Businesses that are registered to collect and remit sales and use tax in California need to file Form CDTFA-401-GS.

Q: How often do I need to file Form CDTFA-401-GS?

A: The frequency of filing Form CDTFA-401-GS depends on the amount of sales and use tax liability you have. It can be filed monthly, quarterly, or annually.

Q: What information do I need to provide on Form CDTFA-401-GS?

A: You need to provide information such as your business details, sales and use tax amounts collected, and any deductions or credits.

Q: Are there any penalties for not filing Form CDTFA-401-GS?

A: Yes, there can be penalties for not filing Form CDTFA-401-GS or for filing it late. The penalties can vary depending on the amount of tax liability.

Q: Is there a deadline for filing Form CDTFA-401-GS?

A: Yes, the deadline for filing Form CDTFA-401-GS depends on the filing frequency. It is usually due by the end of the month following the reporting period.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-GS by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.