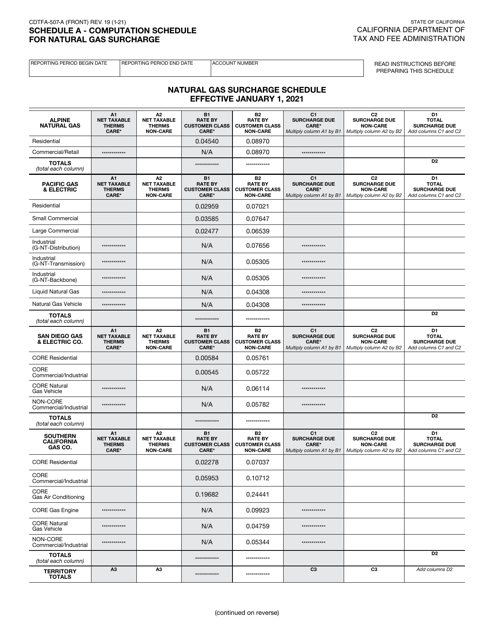

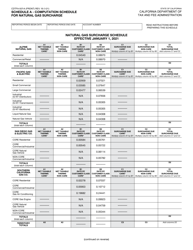

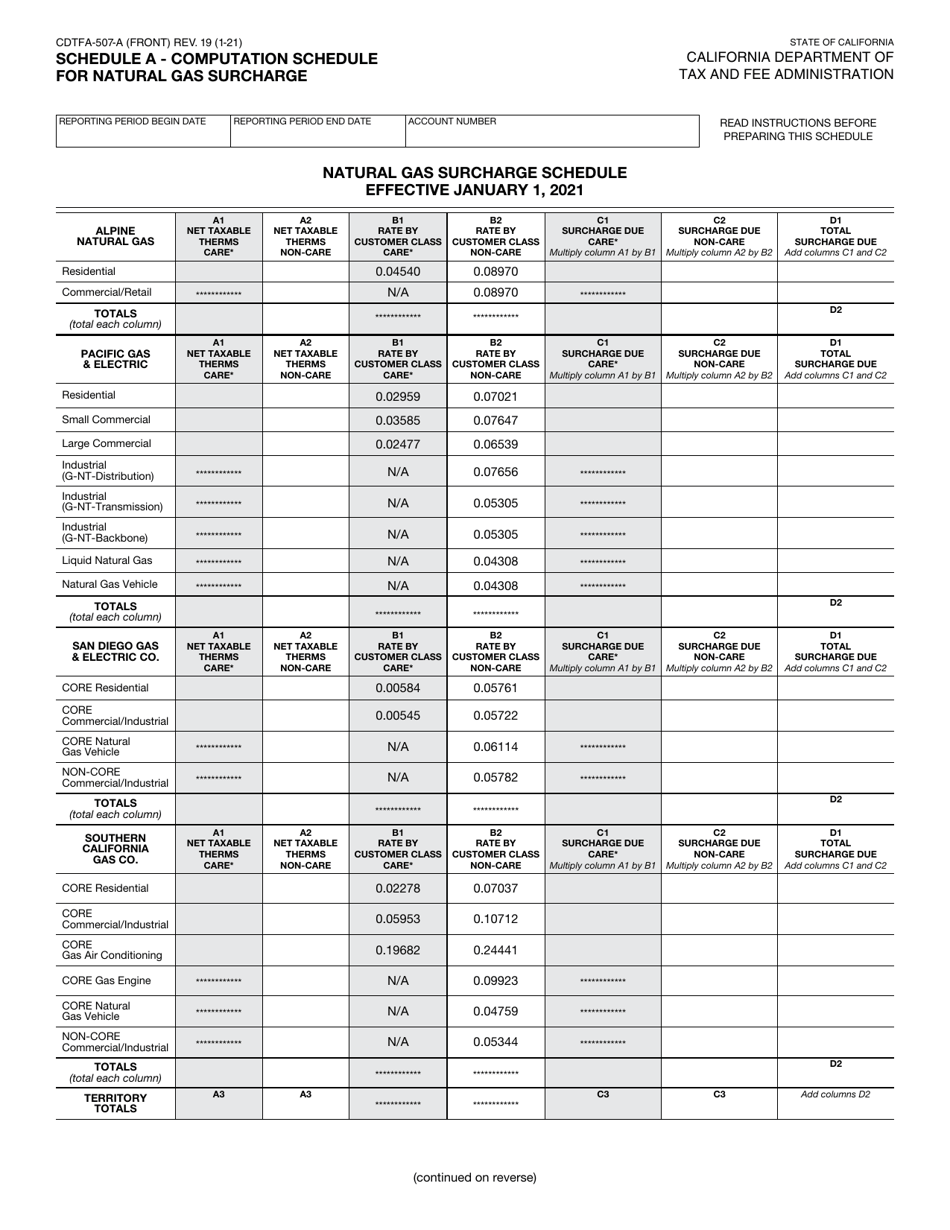

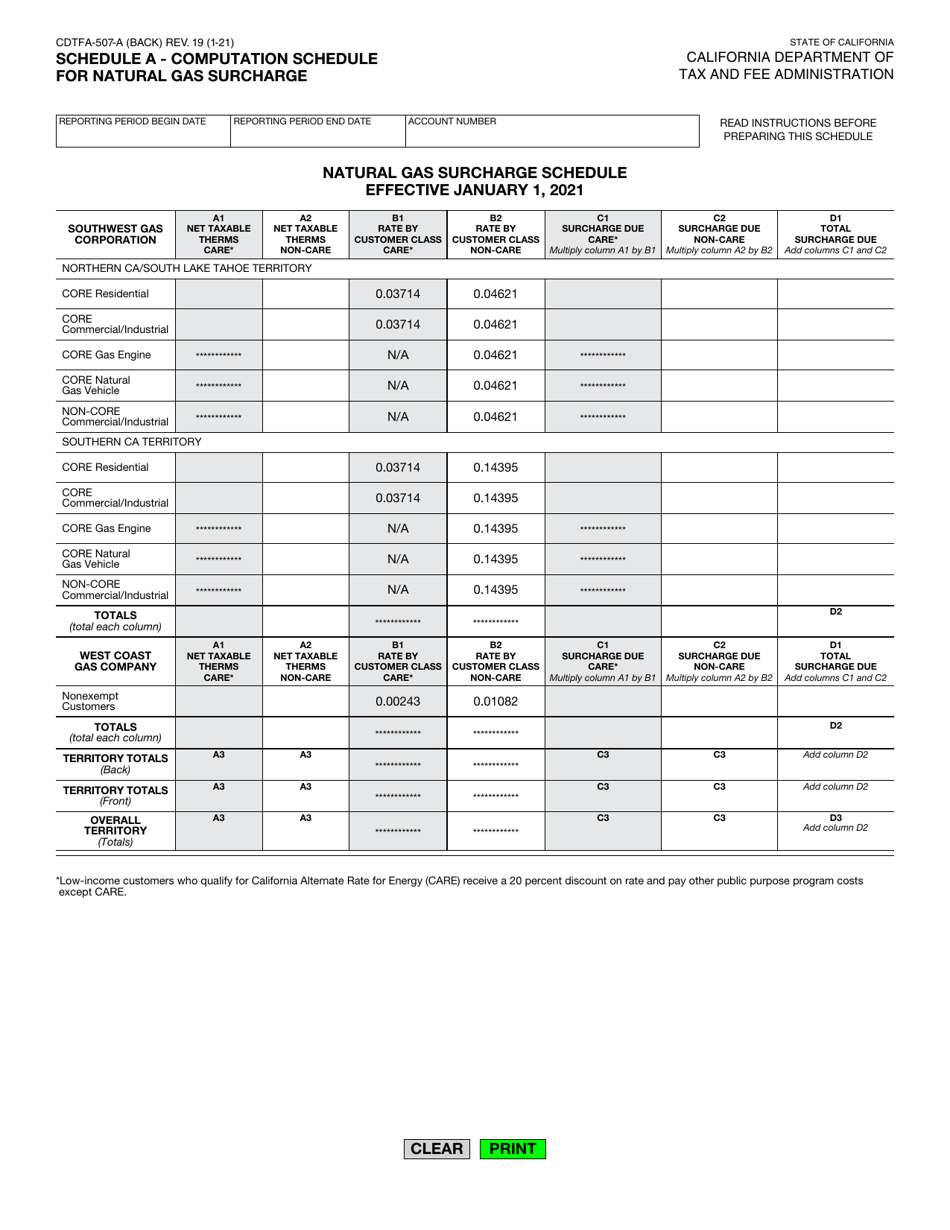

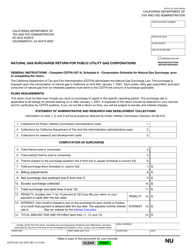

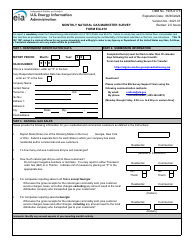

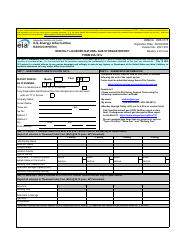

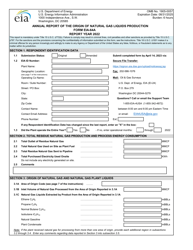

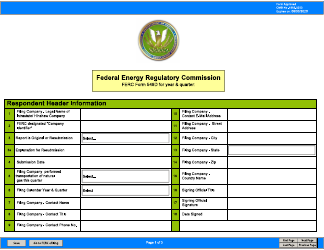

Form CDTFA-507-A Schedule A Computation Schedule for Natural Gas Surcharge - California

What Is Form CDTFA-507-A Schedule A?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-507-A?

A: Form CDTFA-507-A is a schedule used to compute the natural gas surcharge in California.

Q: What is the purpose of Schedule A?

A: The purpose of Schedule A is to calculate the natural gas surcharge.

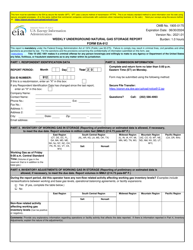

Q: What is the natural gas surcharge?

A: The natural gas surcharge is an additional fee imposed on natural gas consumption in California.

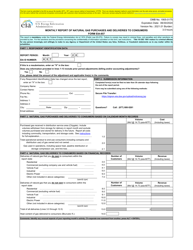

Q: Who needs to use Form CDTFA-507-A?

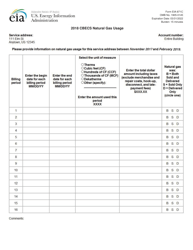

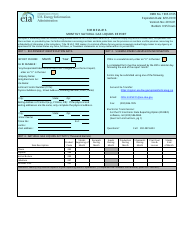

A: Businesses that consume natural gas in California need to use this form to calculate the surcharge.

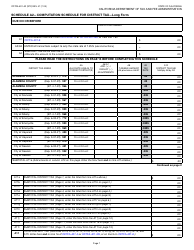

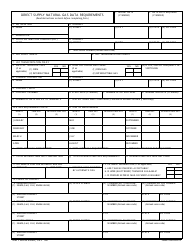

Q: What information is required for Schedule A?

A: Schedule A requires information such as gas usage by month, total surcharge, and credits.

Q: When is Form CDTFA-507-A due?

A: The due date for Form CDTFA-507-A is determined by the filing frequency of your natural gas consumption.

Q: Are there any penalties for not filing Form CDTFA-507-A?

A: Yes, there are penalties for not filing or late filing of Form CDTFA-507-A. It is important to file on time to avoid penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-507-A Schedule A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.