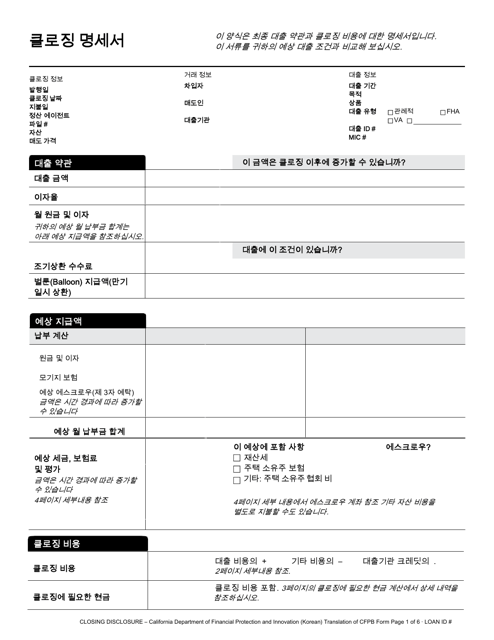

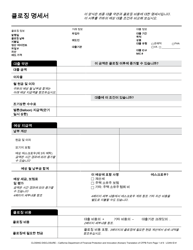

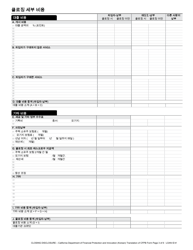

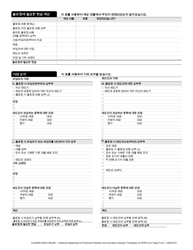

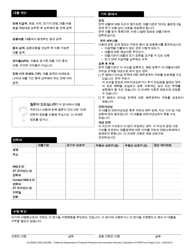

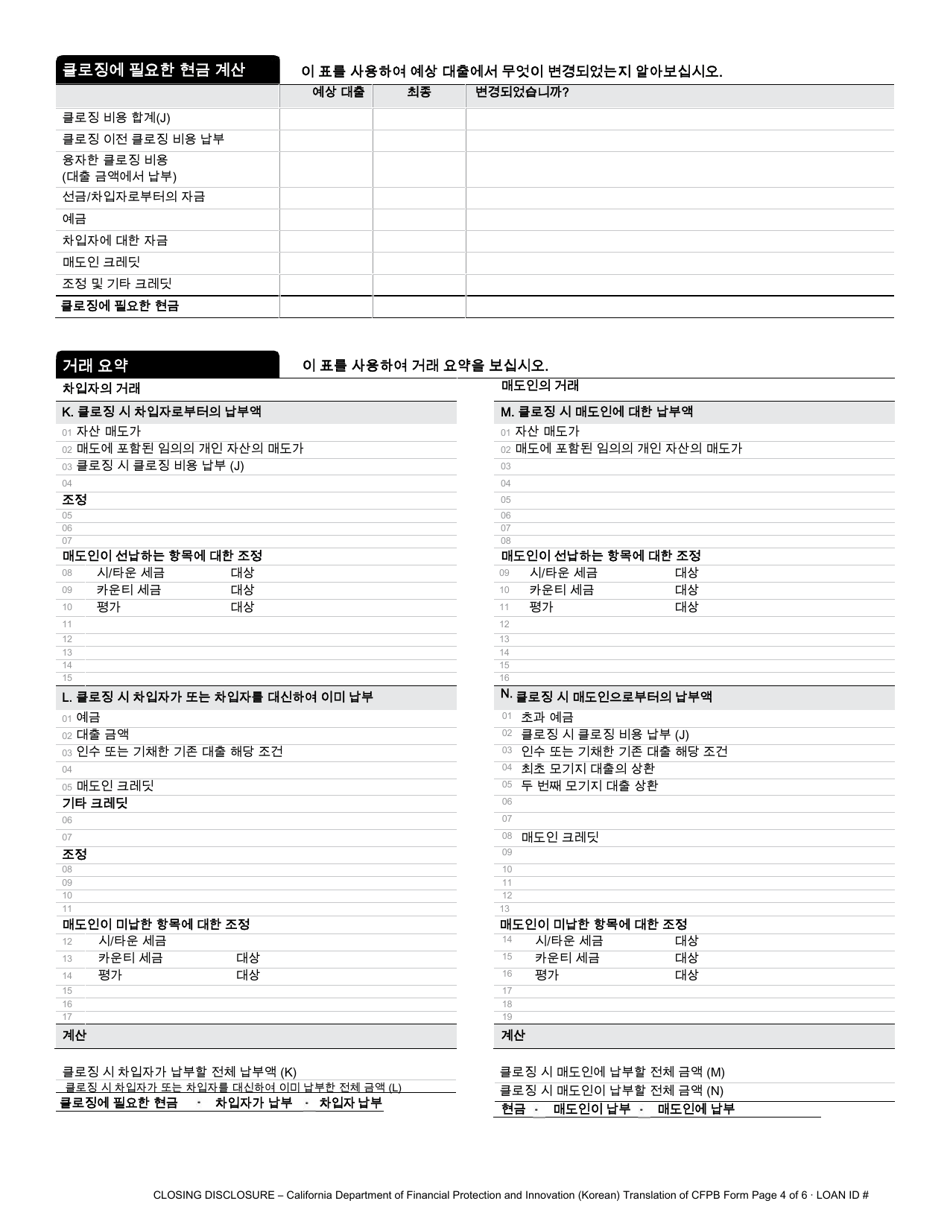

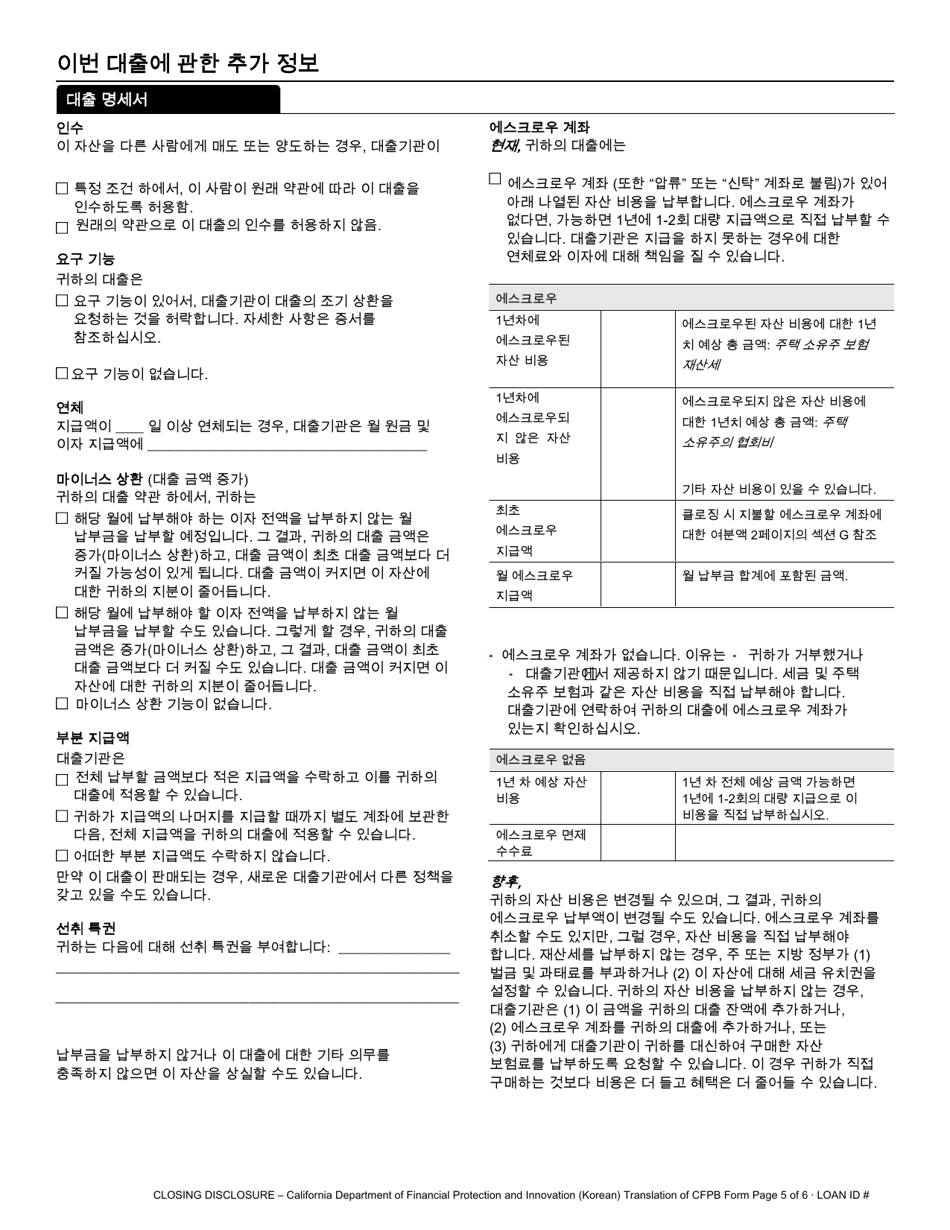

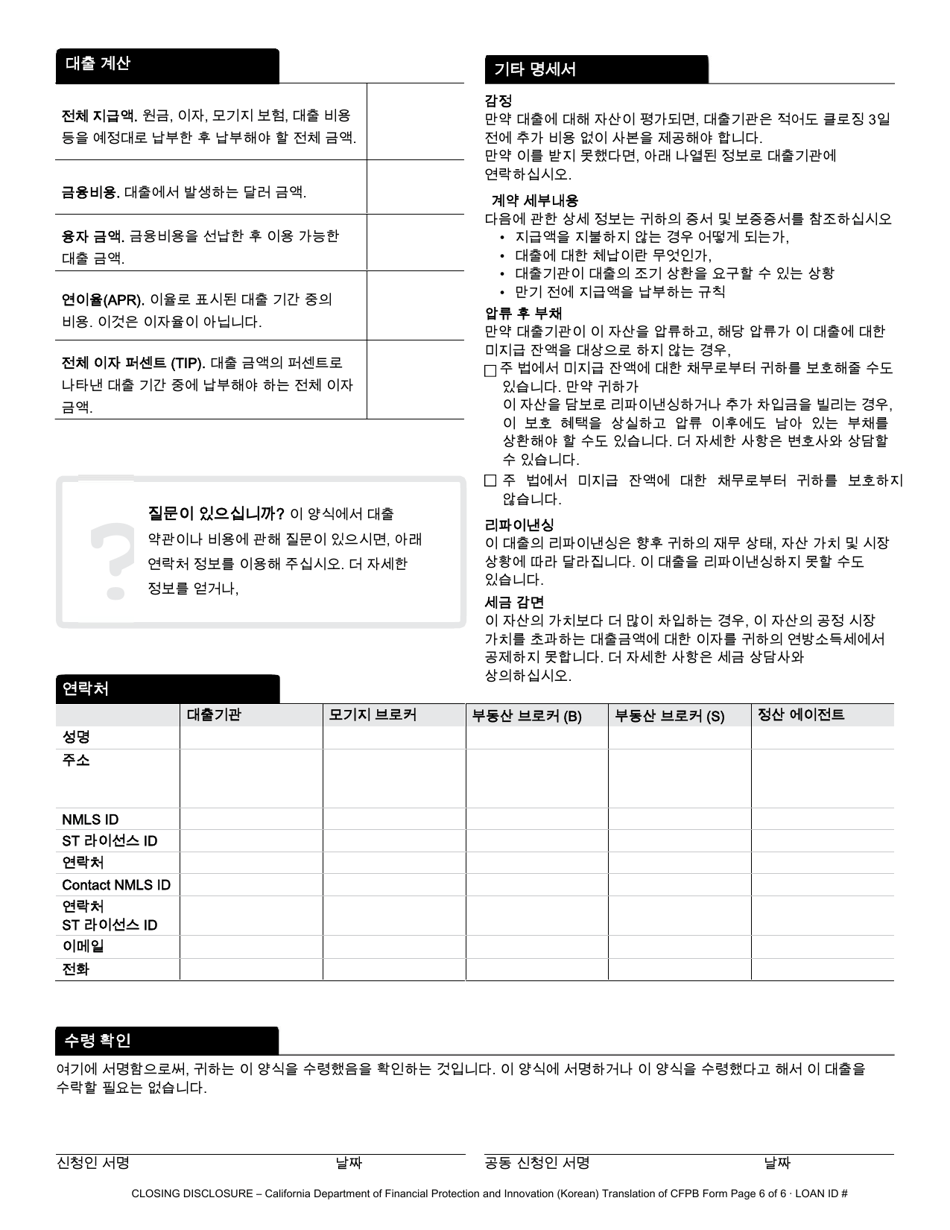

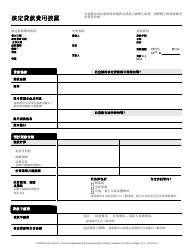

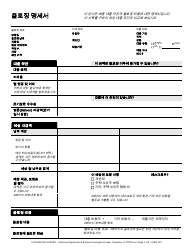

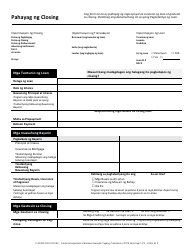

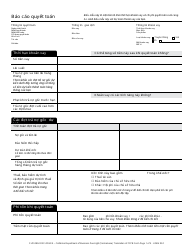

Closing Disclosure - California (Korean)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Korean.

FAQ

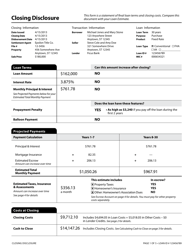

Q: What is a Closing Disclosure?

A: A Closing Disclosure is a document that provides the final details of a mortgage loan.

Q: Why is a Closing Disclosure important?

A: A Closing Disclosure is important because it outlines the terms and costs of your mortgage loan, helping you understand what you're agreeing to.

Q: When will I receive the Closing Disclosure?

A: You should receive the Closing Disclosure at least three business days before your loan closing date.

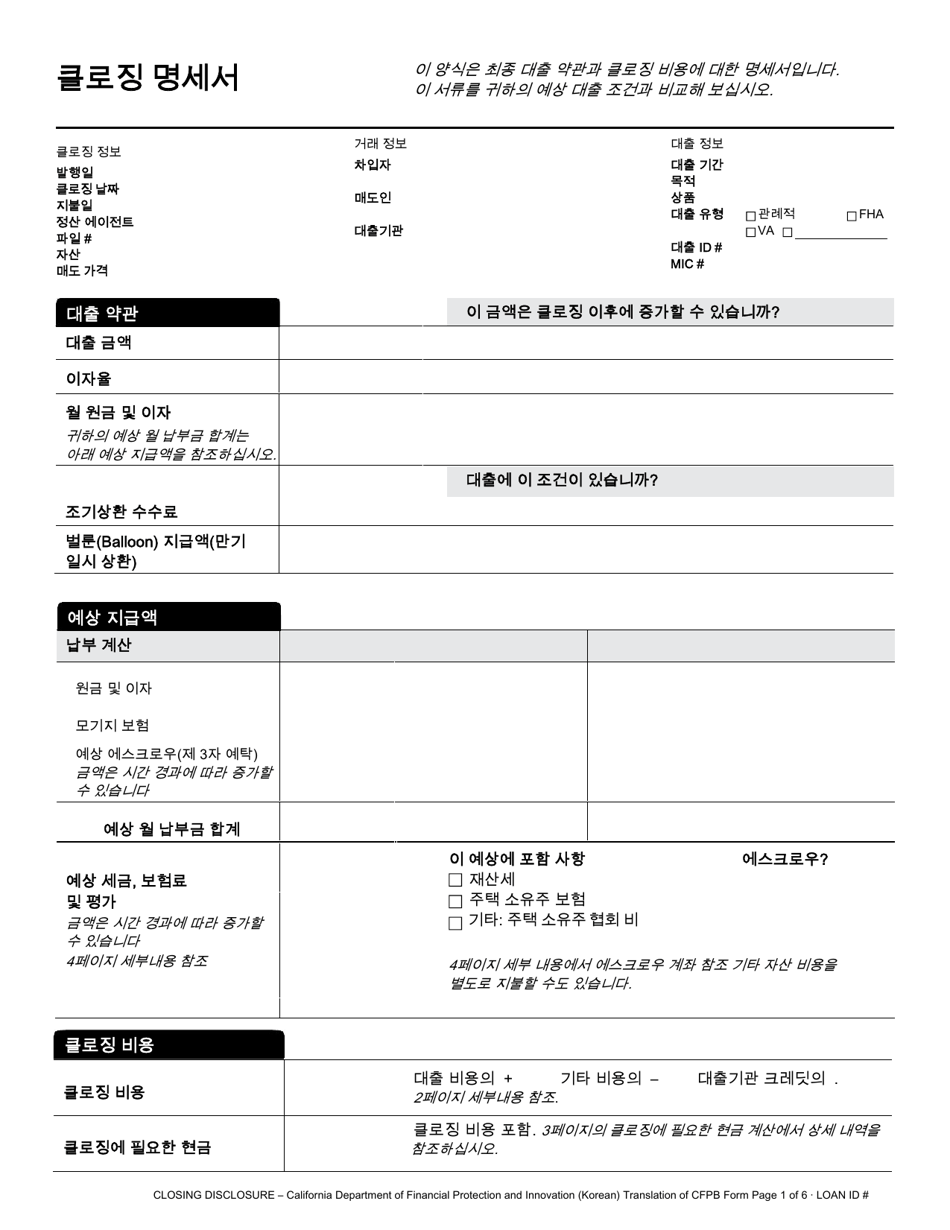

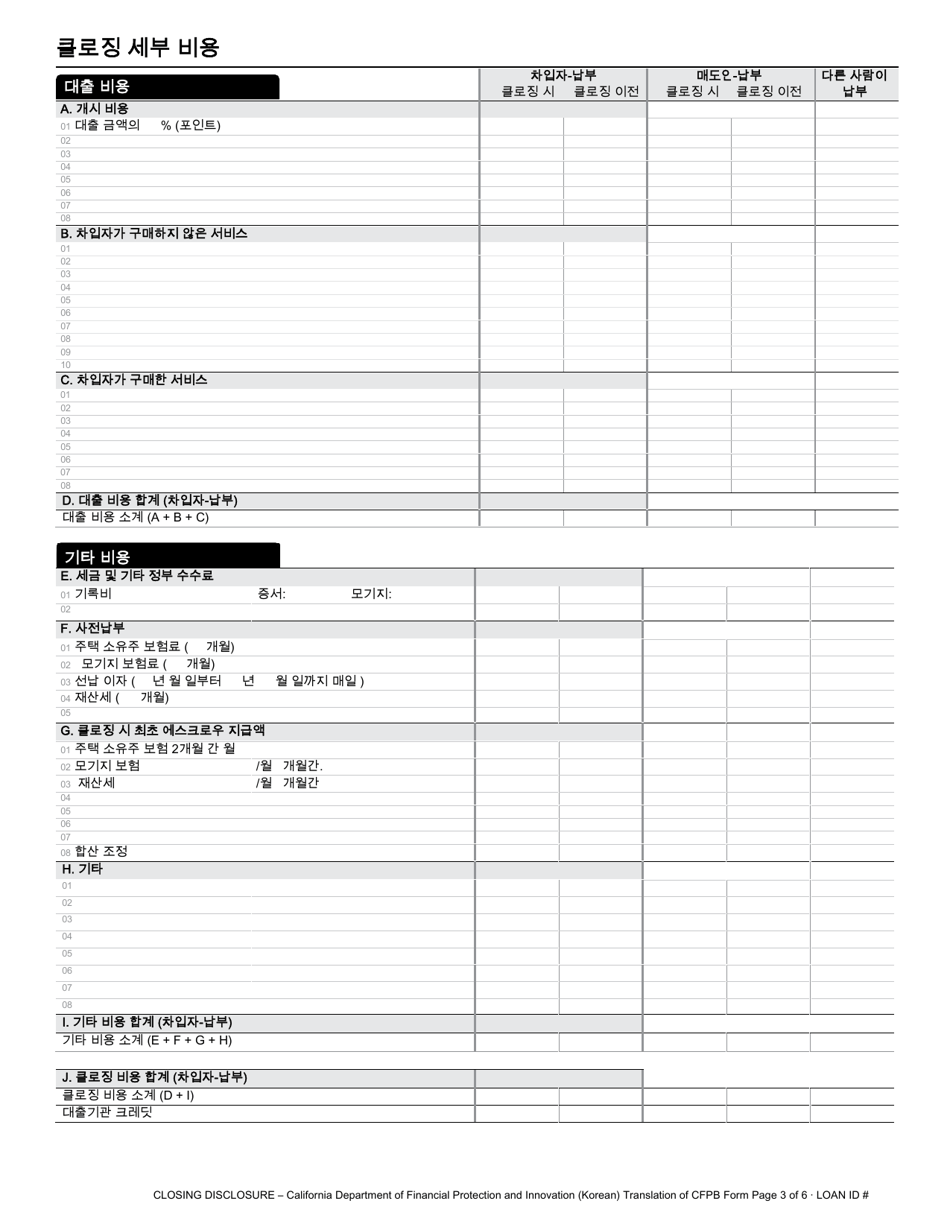

Q: What information is included in the Closing Disclosure?

A: The Closing Disclosure includes details about the loan terms, projected monthly payments, closing costs, and other fees.

Q: What should I review on the Closing Disclosure?

A: You should review the loan terms, interest rate, closing costs, and other fees to ensure they match your expectations.

Q: What should I do if I find errors on the Closing Disclosure?

A: If you find errors on the Closing Disclosure, you should contact your lender immediately to address and correct them.

Q: Can I make changes to the loan after receiving the Closing Disclosure?

A: In most cases, you cannot make changes to the loan terms after receiving the Closing Disclosure. However, if there are significant changes, a new Closing Disclosure may be issued.

Q: What happens after reviewing and signing the Closing Disclosure?

A: After reviewing and signing the Closing Disclosure, you will proceed to the loan closing where you will sign the final loan documents and officially take ownership of the property.

Q: Who provides the Closing Disclosure?

A: The lender is responsible for providing the Closing Disclosure to the borrower.

Q: Are there any fees associated with the Closing Disclosure?

A: While there may be fees associated with preparing and providing the Closing Disclosure, these should be included in the overall closing costs disclosed in the document.

Form Details:

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.