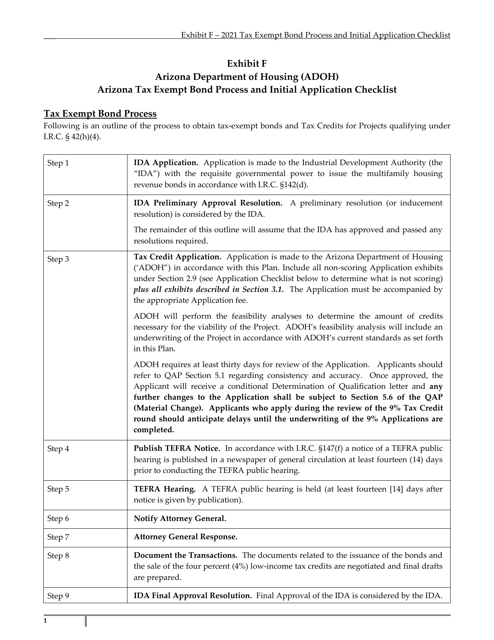

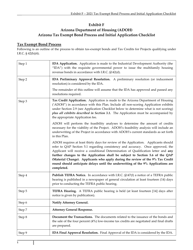

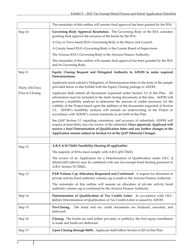

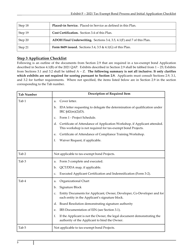

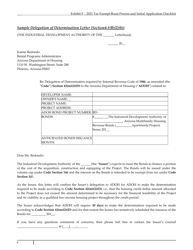

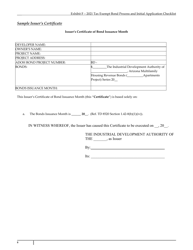

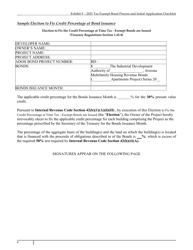

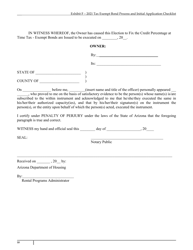

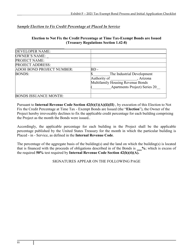

Exhibit F Arizona Tax Exempt Bond Process and Initial Application Checklist - Arizona

What Is Exhibit F?

This is a legal form that was released by the Arizona Department of Housing - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Exhibit F?

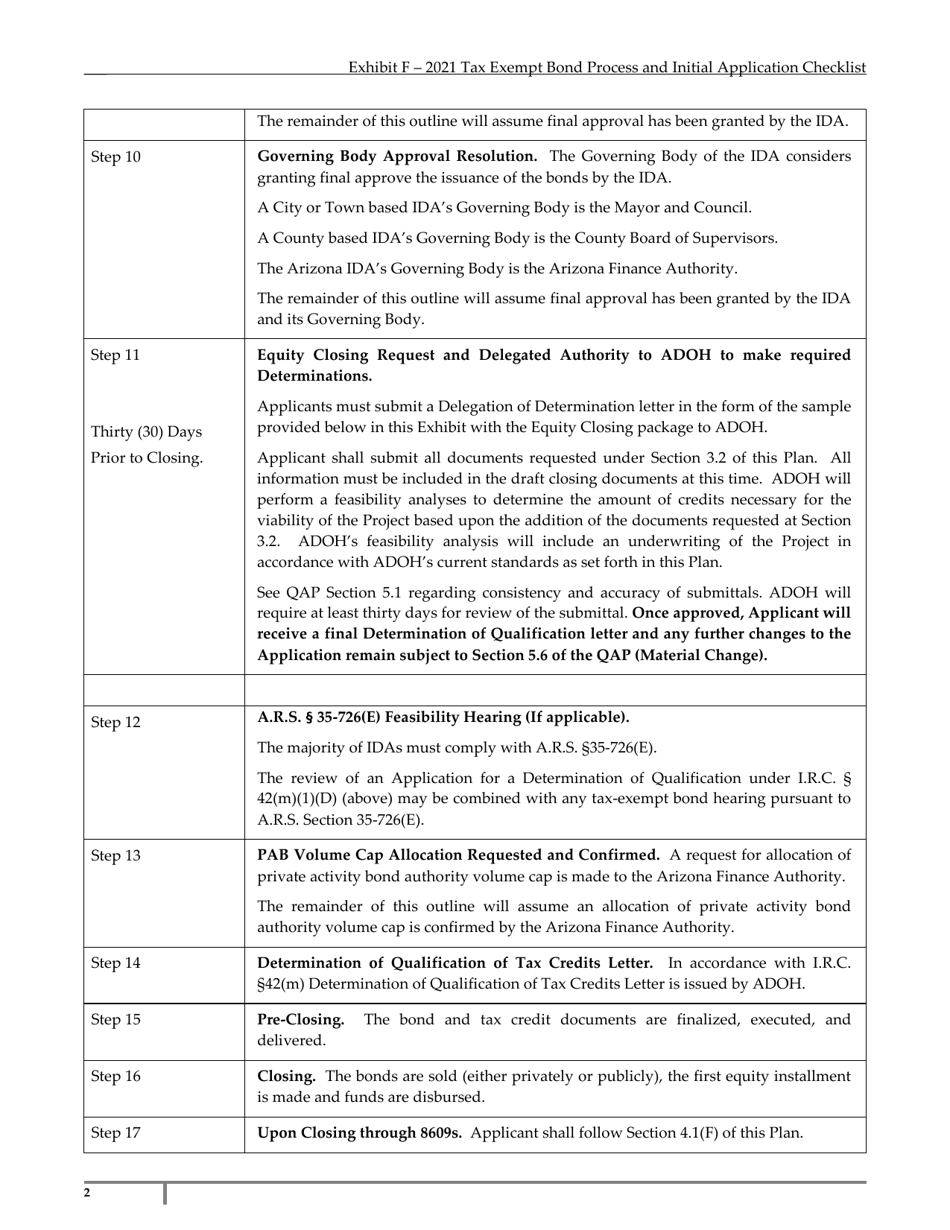

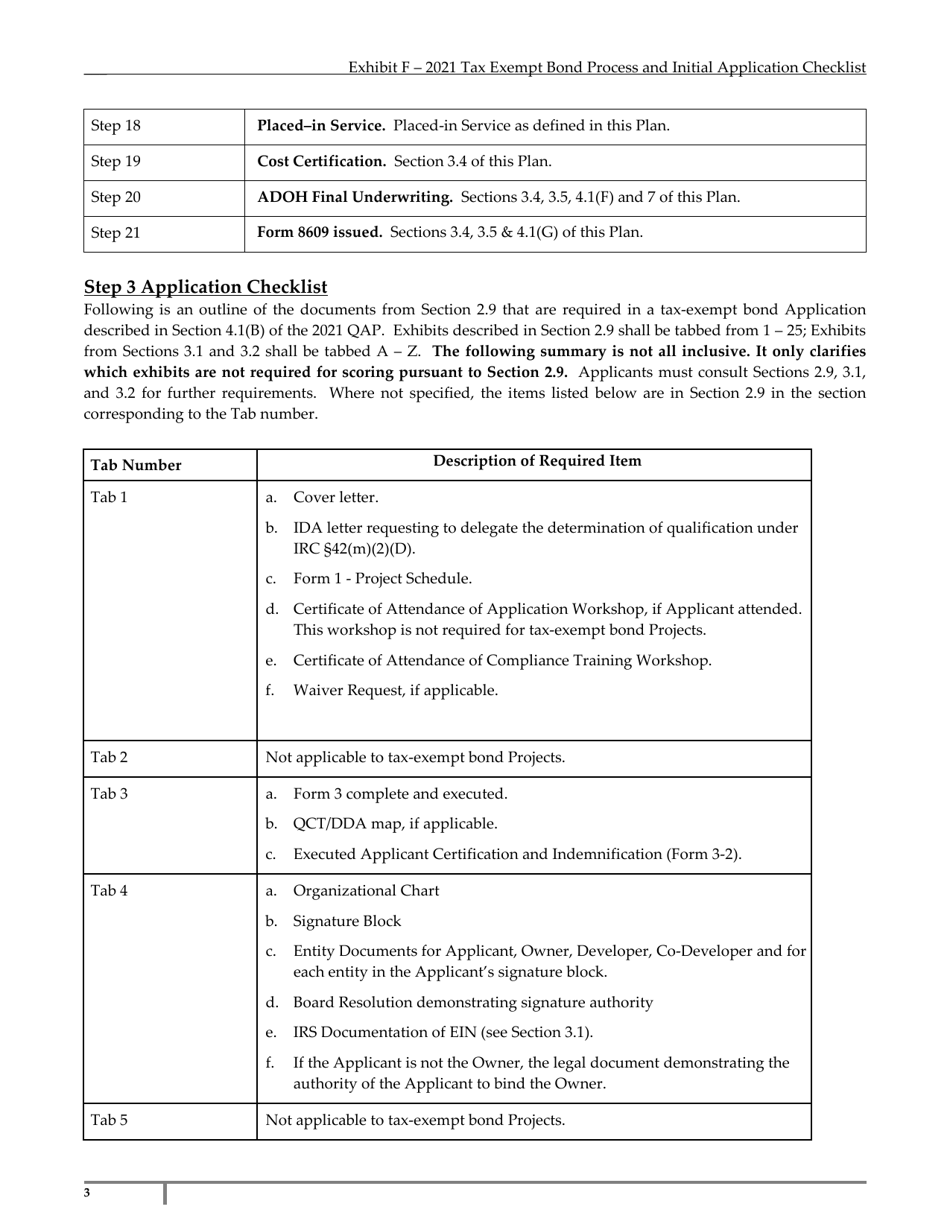

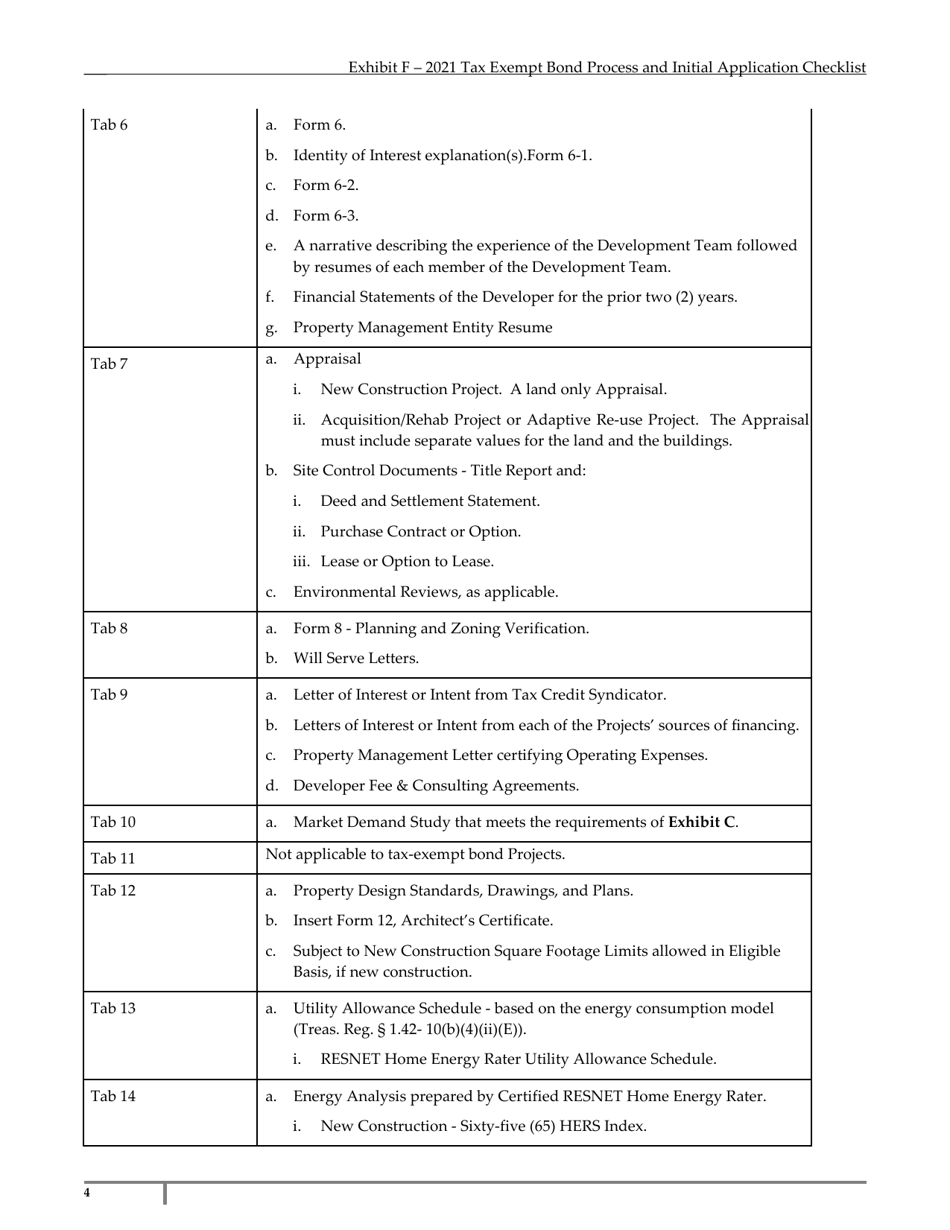

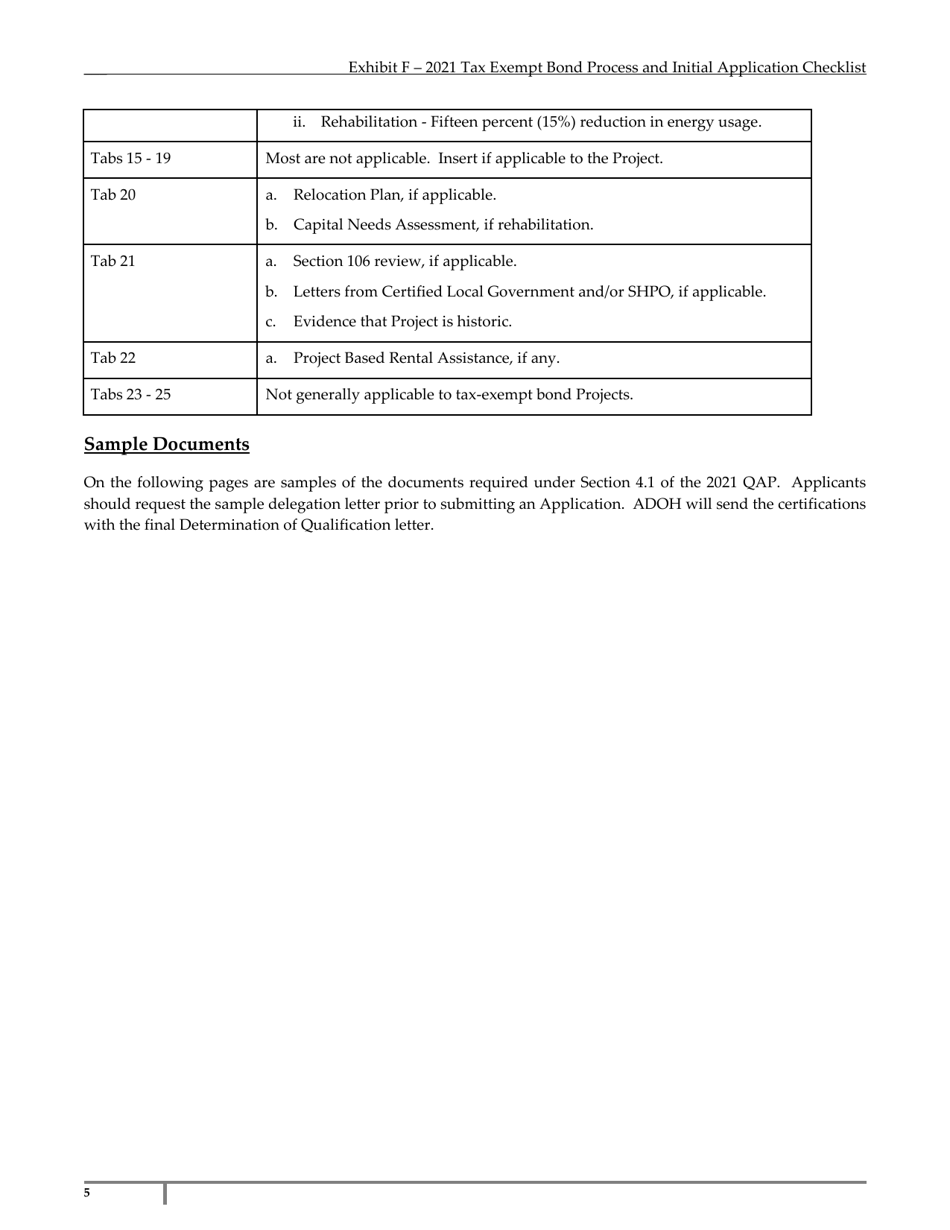

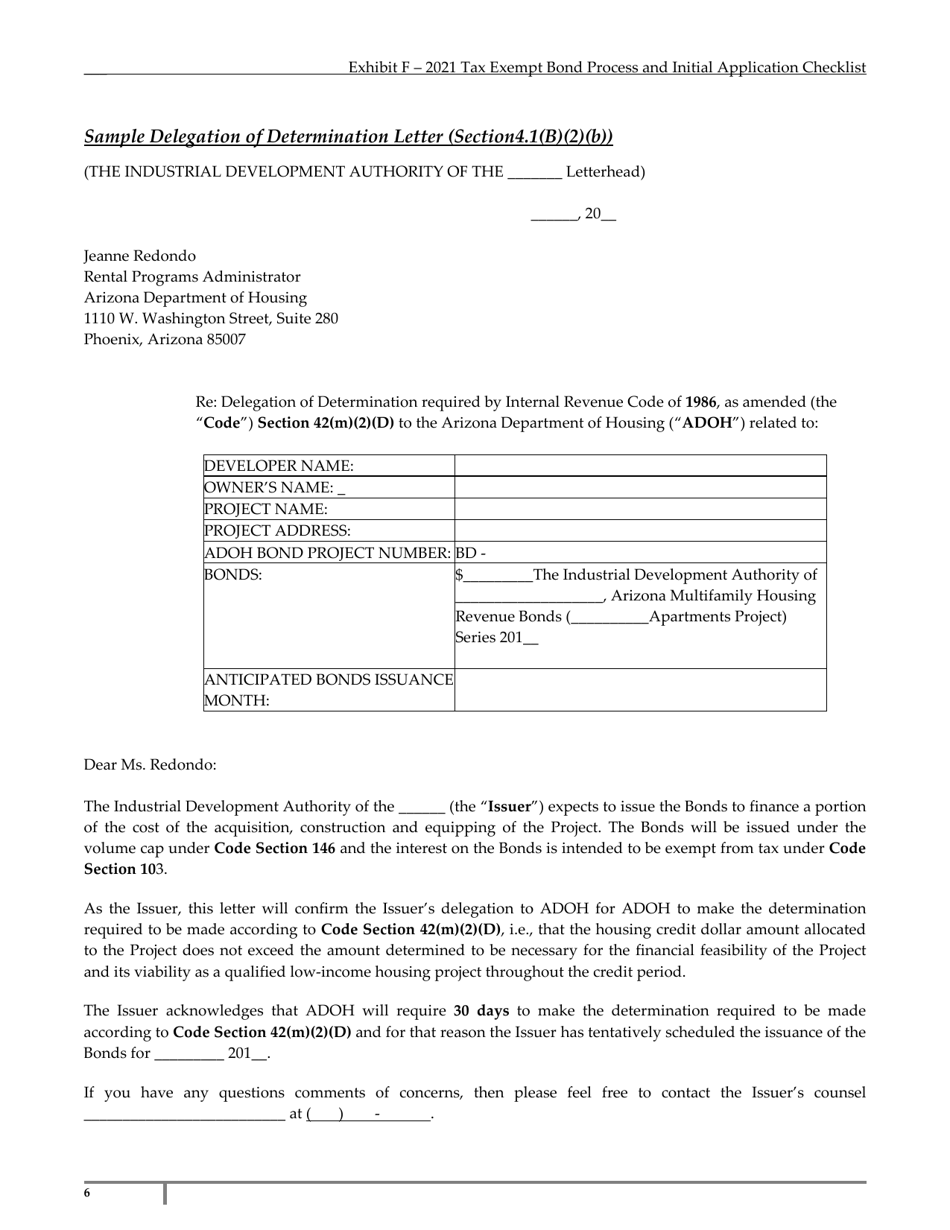

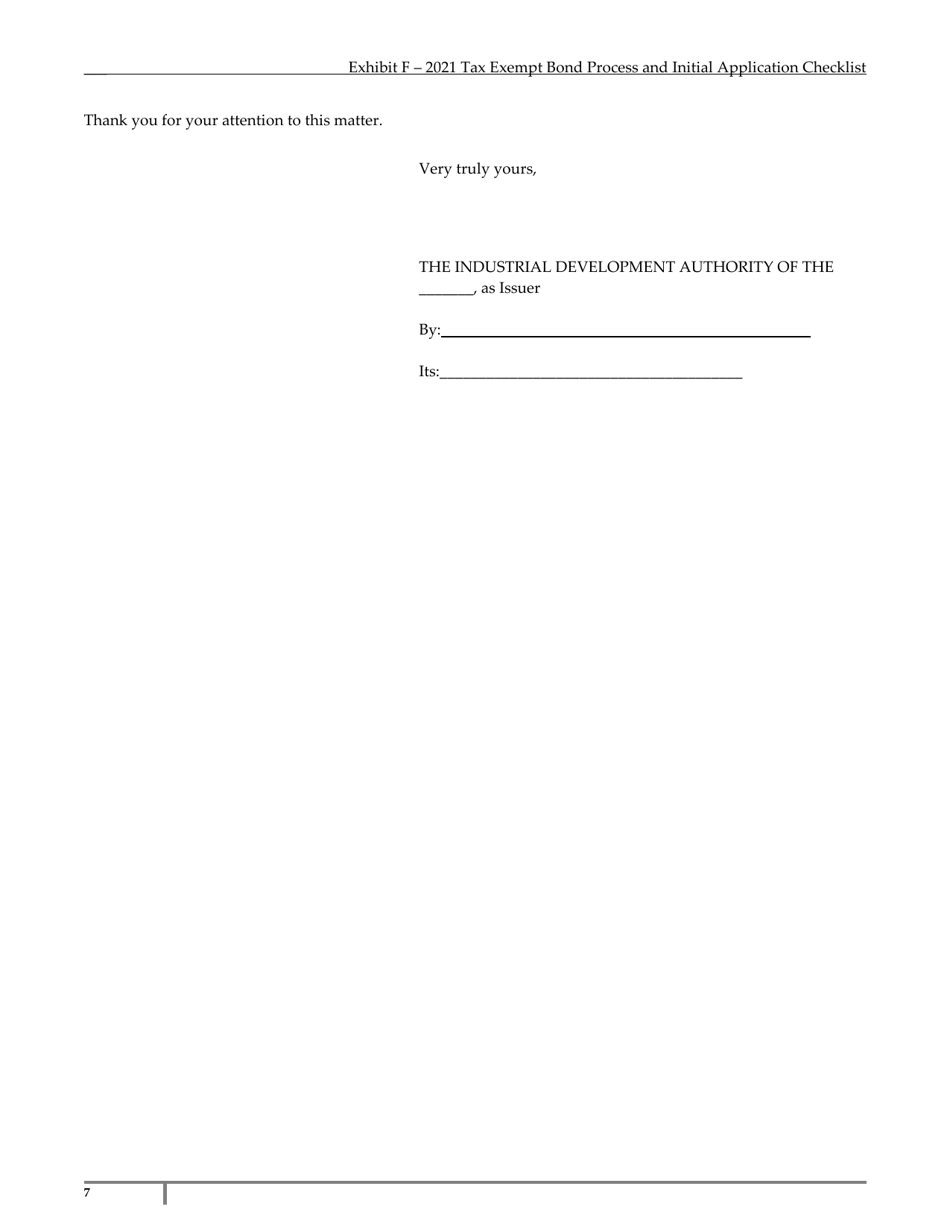

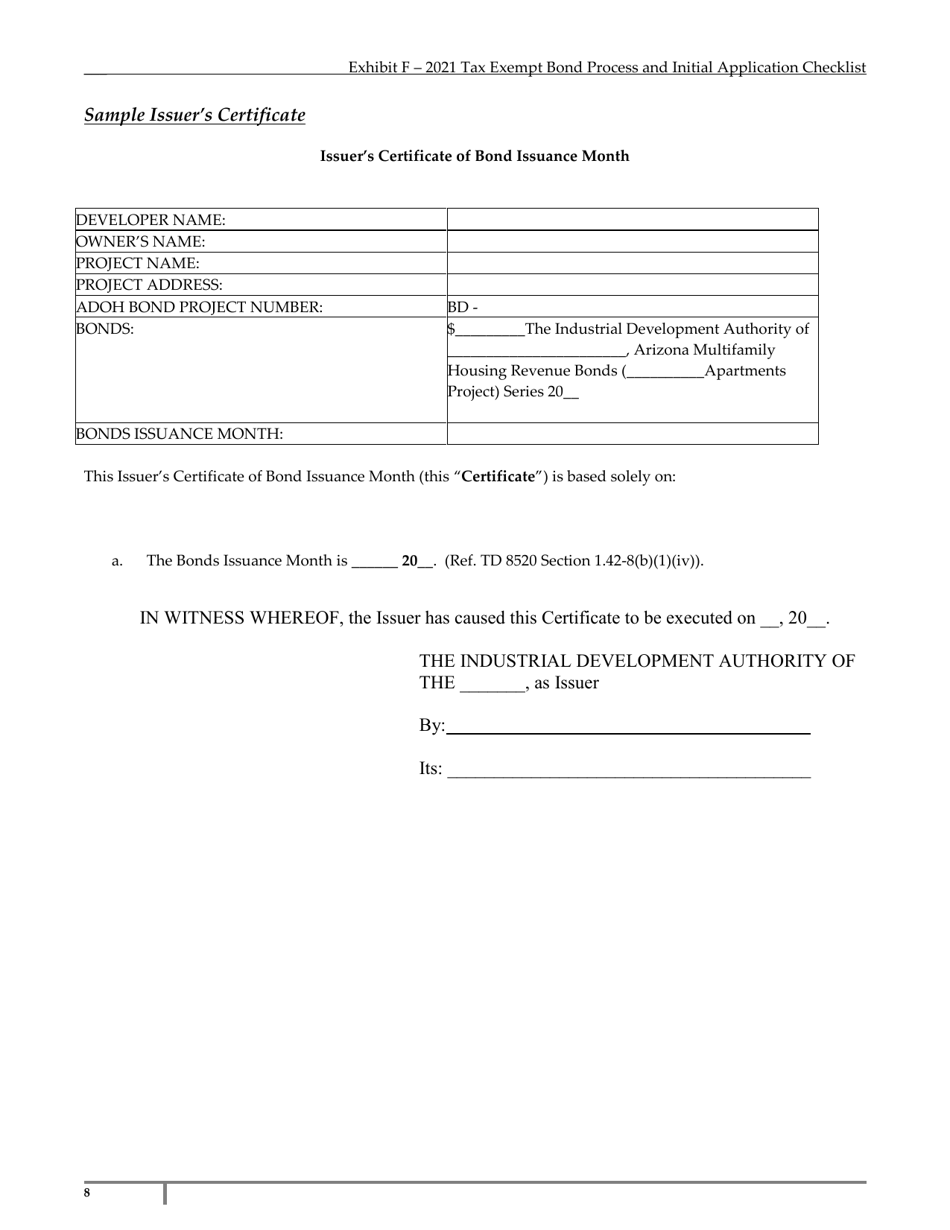

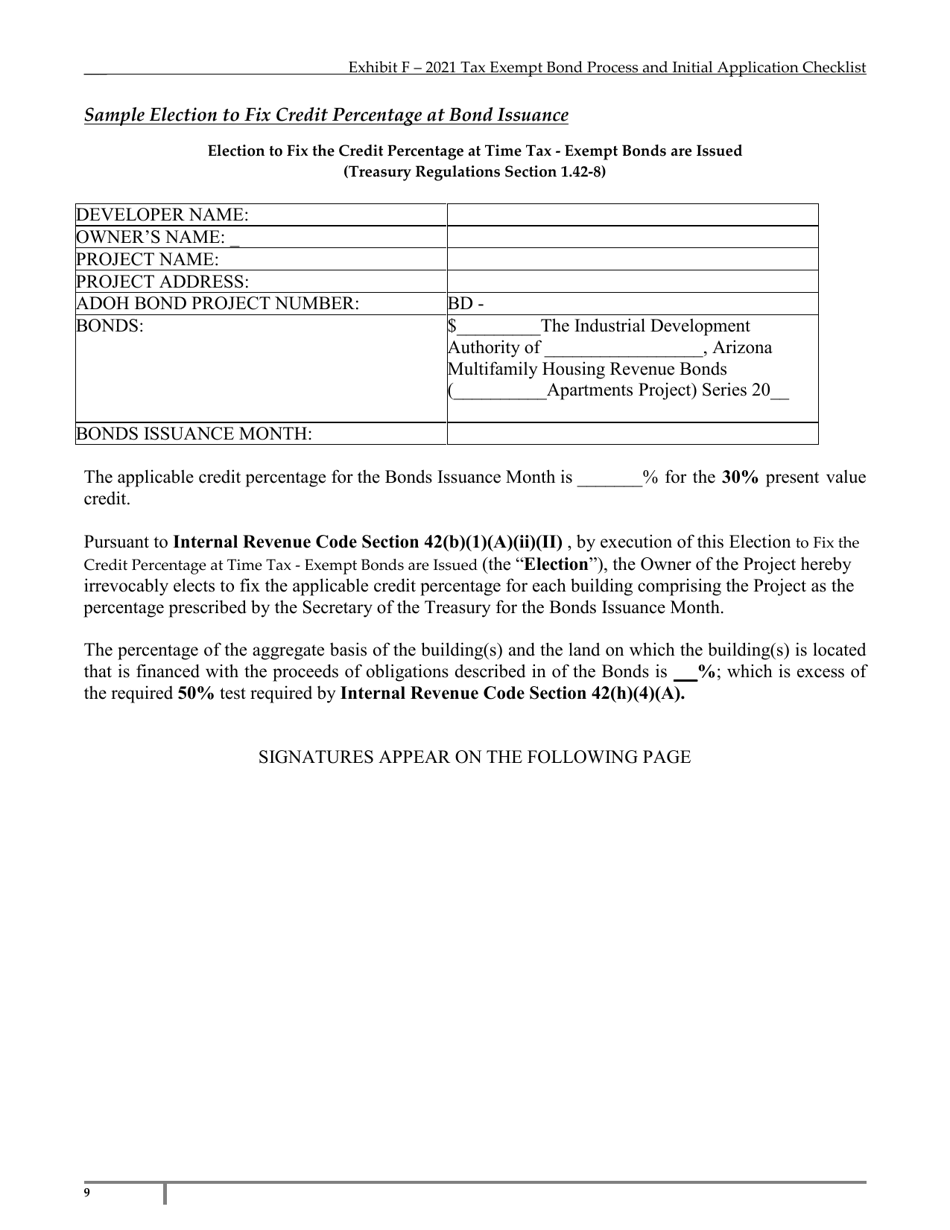

A: Exhibit F is a document that provides information about the Arizona tax exempt bond process and an initial application checklist.

Q: What does the Arizona tax exempt bond process entail?

A: The Arizona tax exempt bond process involves issuing bonds that are exempt from federal and state income taxes.

Q: What is the purpose of the initial application checklist?

A: The initial application checklist is provided to ensure that all required documents and information are included in the application.

Q: Who is required to submit an initial application?

A: Anyone who wants to issue tax exempt bonds in Arizona is required to submit an initial application.

Q: What are the benefits of issuing tax exempt bonds?

A: Issuing tax exempt bonds can result in lower borrowing costs for the issuer.

Q: Are the bonds issued under this process exempt from federal and state income taxes?

A: Yes, the bonds issued under this process are exempt from federal and state income taxes.

Q: Is there a specific deadline for submitting the initial application?

A: Yes, there is a specific deadline for submitting the initial application. It is mentioned in the document.

Q: Who should I contact for more information about the Arizona tax exempt bond process?

A: For more information about the Arizona tax exempt bond process, you can contact the relevant authorities mentioned in the document.

Q: What happens after the initial application is submitted?

A: After the initial application is submitted, it will be reviewed by the relevant authorities for approval.

Form Details:

- The latest edition provided by the Arizona Department of Housing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Exhibit F by clicking the link below or browse more documents and templates provided by the Arizona Department of Housing.