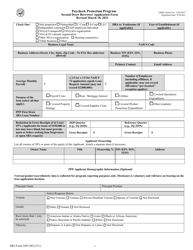

This version of the form is not currently in use and is provided for reference only. Download this version of

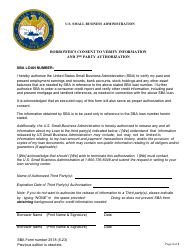

SBA Form 3508D

for the current year.

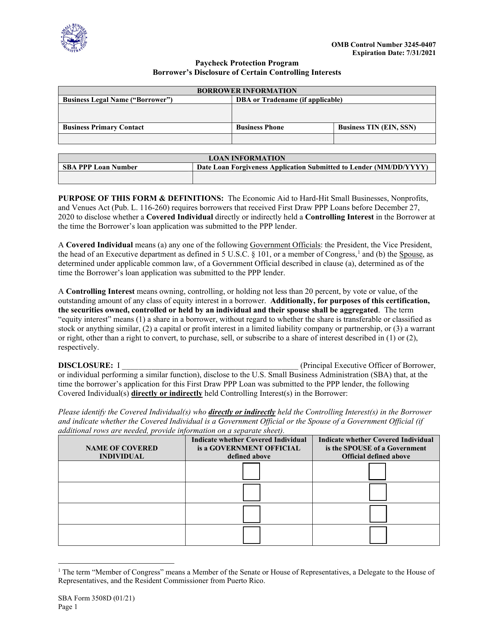

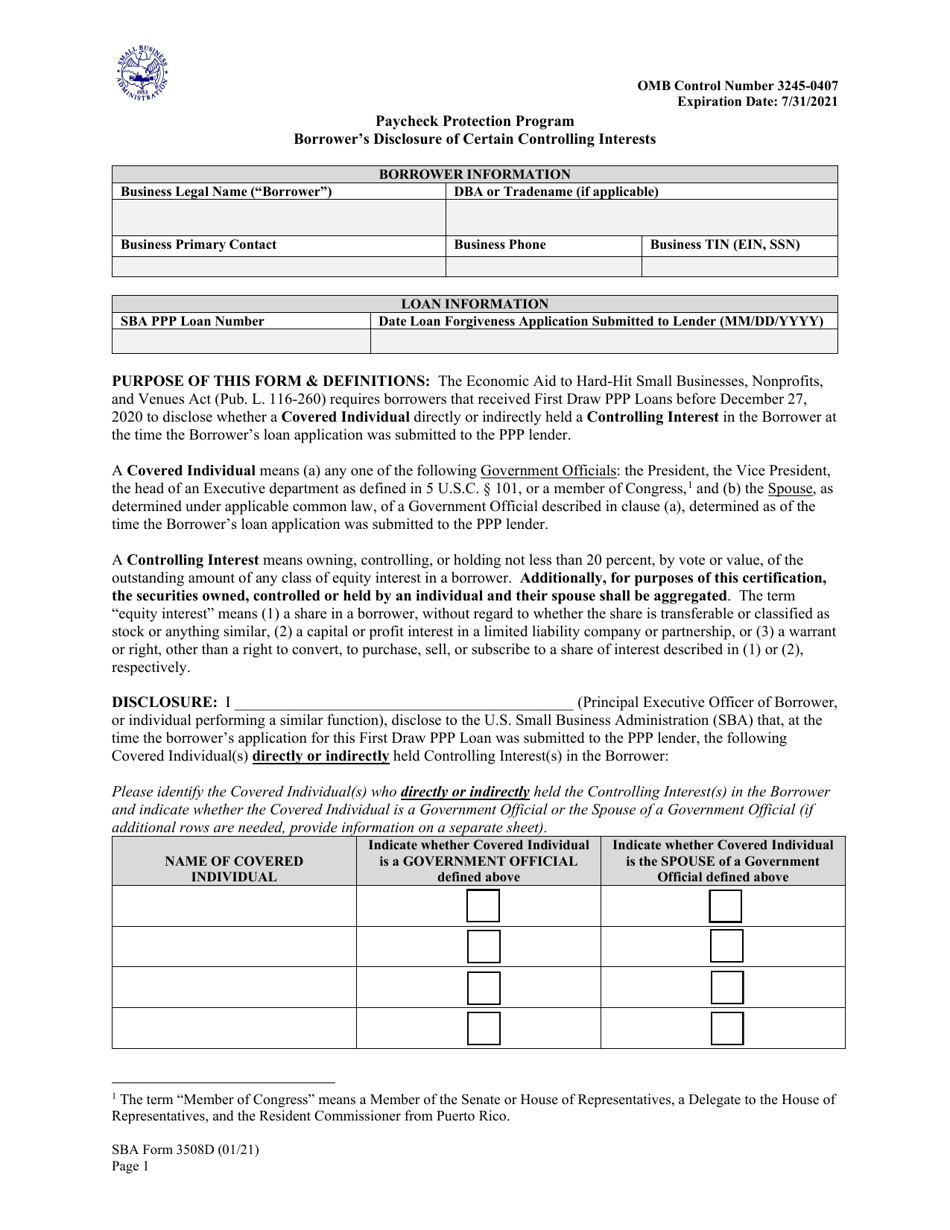

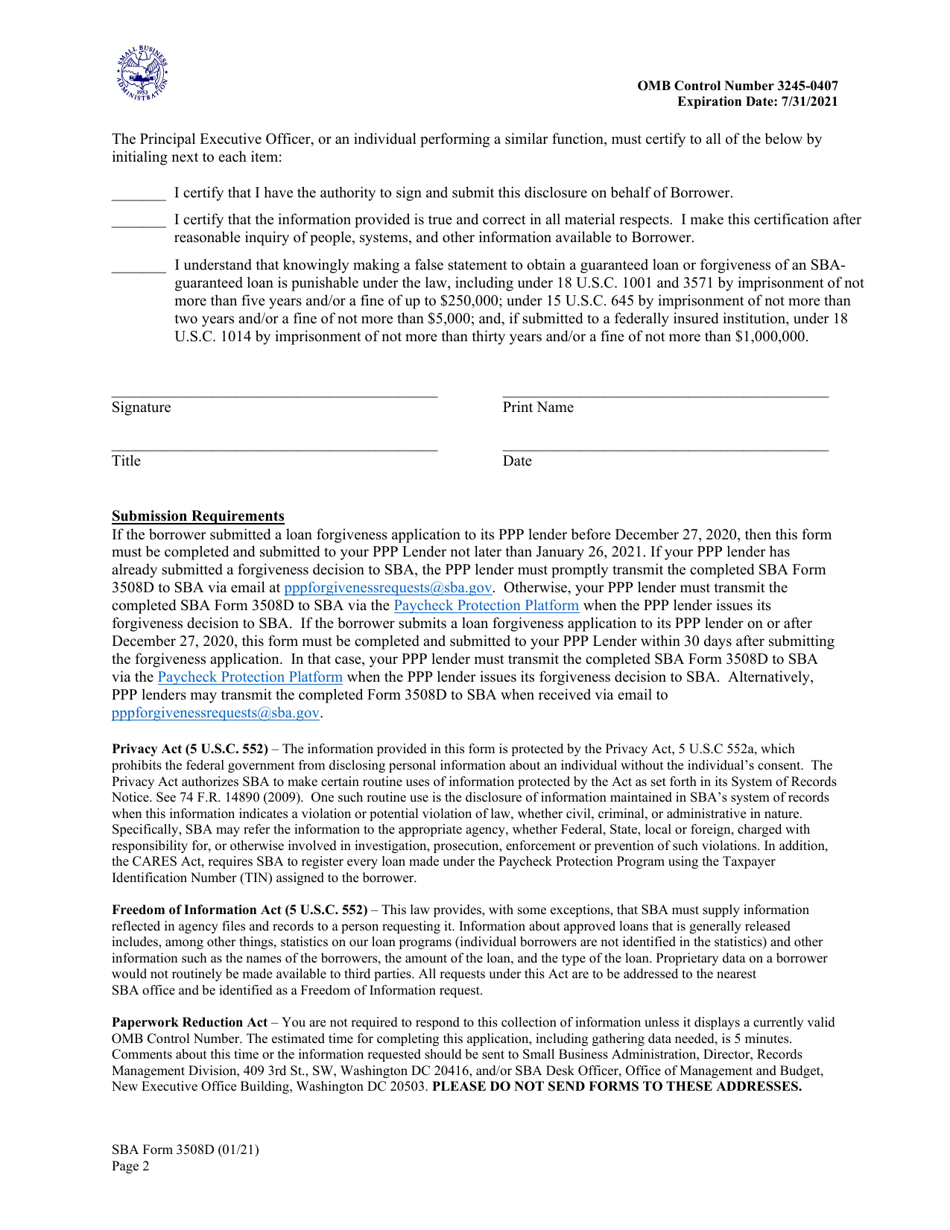

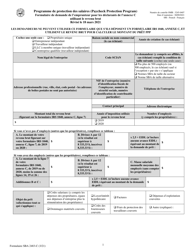

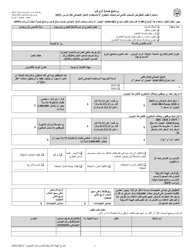

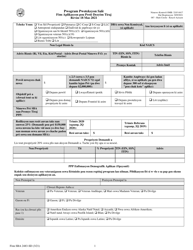

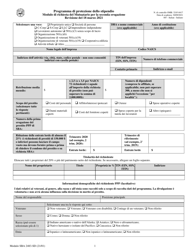

SBA Form 3508D Borrower's Disclosure of Certain Controlling Interests

What Is SBA Form 3508D?

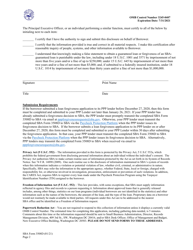

This is a legal form that was released by the U.S. Small Business Administration on January 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 3508D?

A: SBA Form 3508D is Borrower's Disclosure of Certain Controlling Interests.

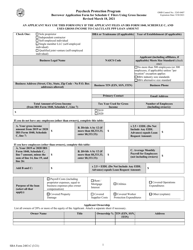

Q: Who needs to fill out SBA Form 3508D?

A: Borrowers who received a Paycheck Protection Program loan of $2 million or more need to fill out SBA Form 3508D.

Q: What does SBA Form 3508D require?

A: SBA Form 3508D requires borrowers to disclose information about certain controlling interests in their business.

Q: What information is required in SBA Form 3508D?

A: SBA Form 3508D requires information about individuals or entities that own or control 20% or more of the borrower's equity or voting rights.

Form Details:

- Released on January 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 3508D by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.