This version of the form is not currently in use and is provided for reference only. Download this version of

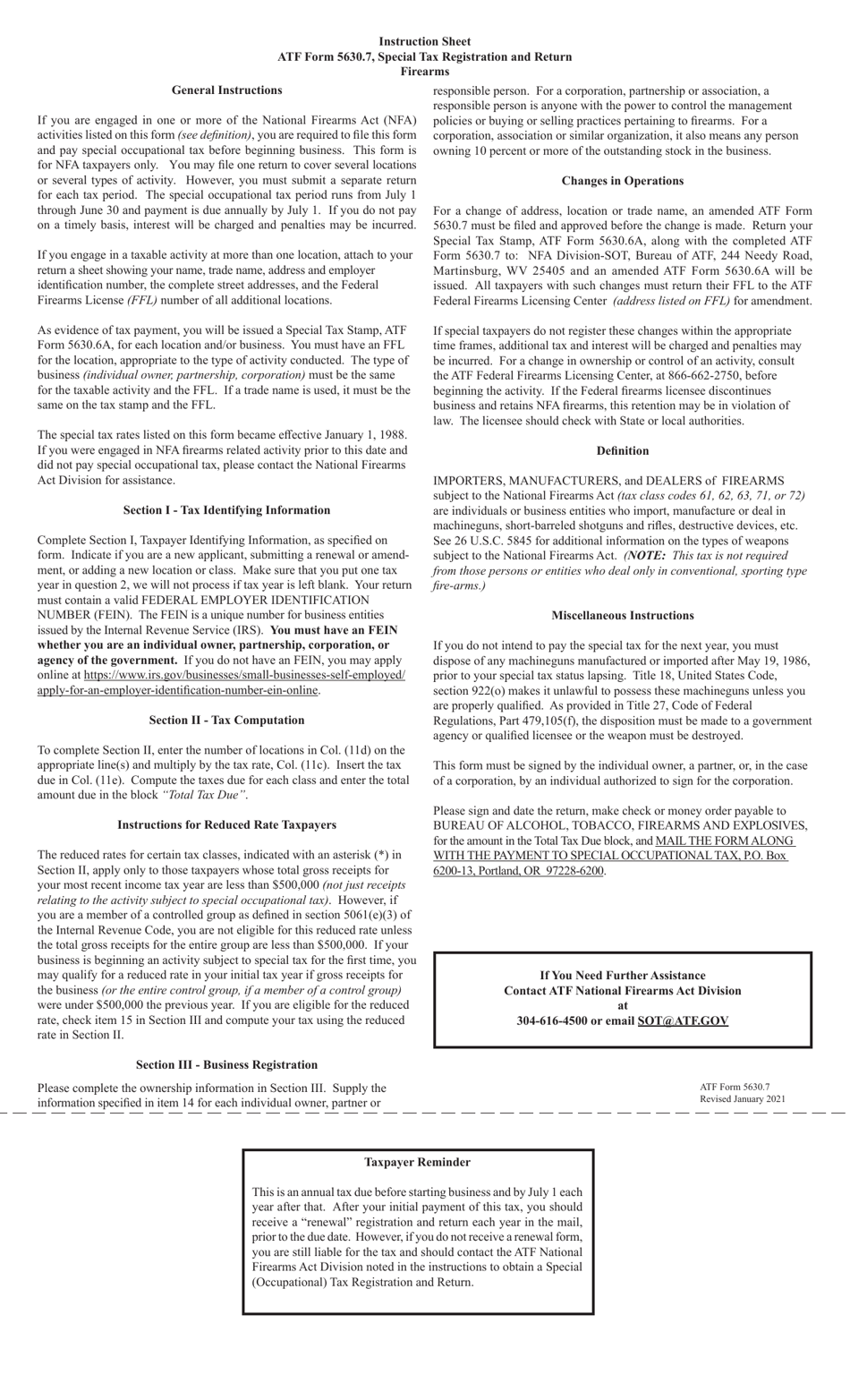

ATF Form 5630.7

for the current year.

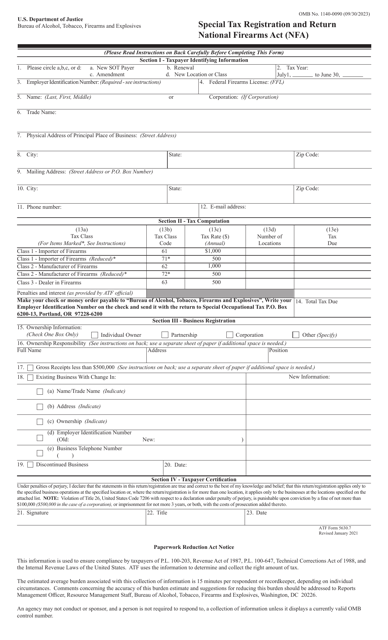

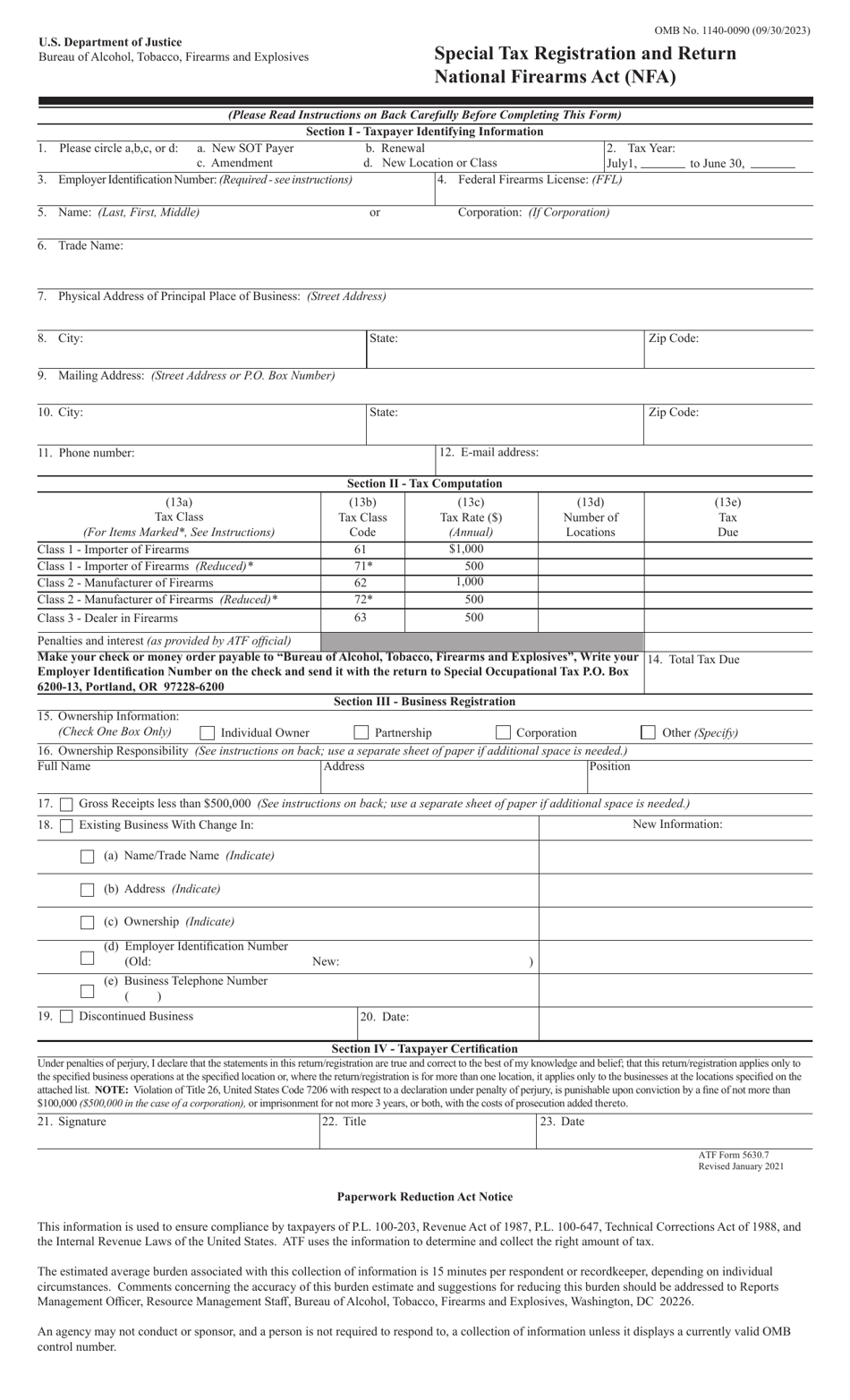

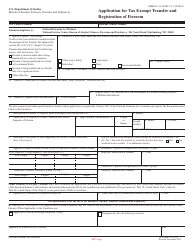

ATF Form 5630.7 Special Tax Registration and Return National Firearms Act (Nfa)

What Is ATF Form 5630.7?

This is a legal form that was released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives on January 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ATF Form 5630.7?

A: ATF Form 5630.7 is the Special Tax Registration and Return form for the National Firearms Act (NFA).

Q: What is the National Firearms Act?

A: The National Firearms Act (NFA) is a federal law that regulates the manufacture, transfer, and possession of certain firearms.

Q: Who is required to fill out ATF Form 5630.7?

A: Individuals or entities engaged in certain firearms-related business activities, as defined by the NFA, are required to fill out ATF Form 5630.7.

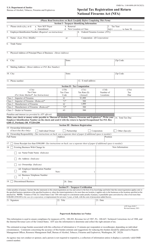

Q: What information is required on ATF Form 5630.7?

A: ATF Form 5630.7 requires information such as the applicant's personal and business details, the type of firearms-related business activity, and payment of the special tax.

Q: How often does ATF Form 5630.7 need to be filed?

A: ATF Form 5630.7 must be filed annually, on or before July 1st each year.

Q: Is there a fee associated with ATF Form 5630.7?

A: Yes, there is a special tax fee associated with ATF Form 5630.7. The amount of the fee depends on the type of firearms-related business activity.

Form Details:

- Released on January 1, 2021;

- The latest available edition released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ATF Form 5630.7 by clicking the link below or browse more documents and templates provided by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives.