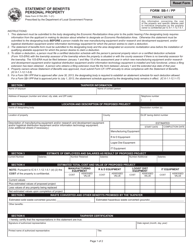

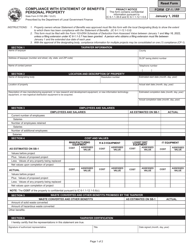

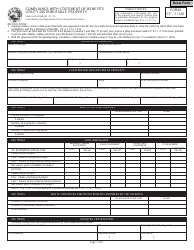

This version of the form is not currently in use and is provided for reference only. Download this version of

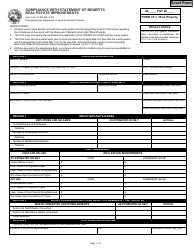

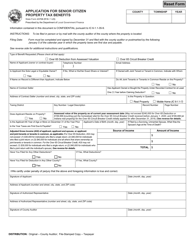

State Form 51781

for the current year.

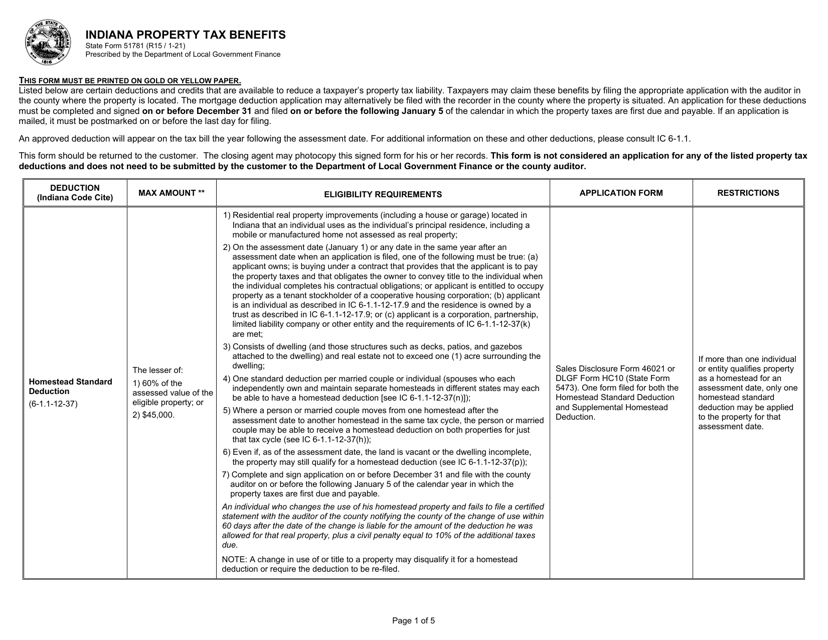

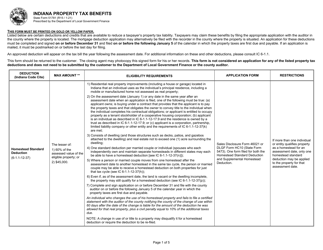

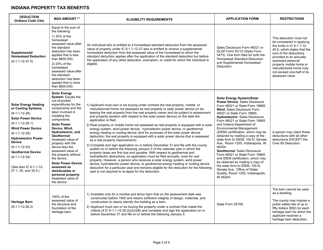

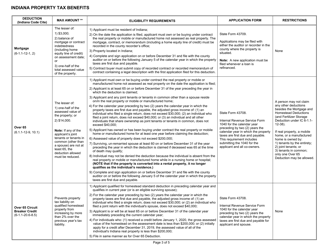

State Form 51781 Indiana Property Tax Benefits - Indiana

What Is State Form 51781?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

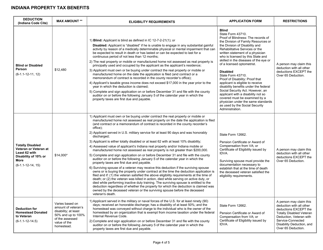

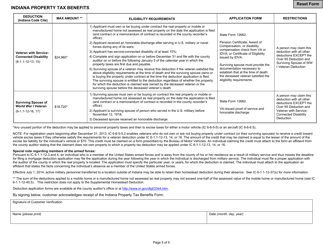

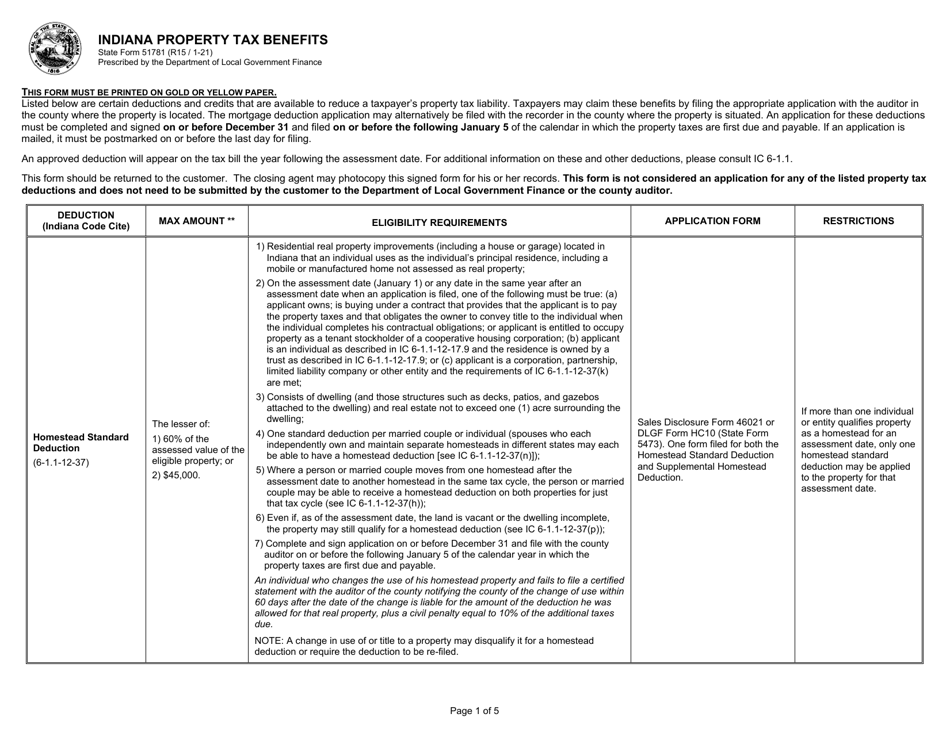

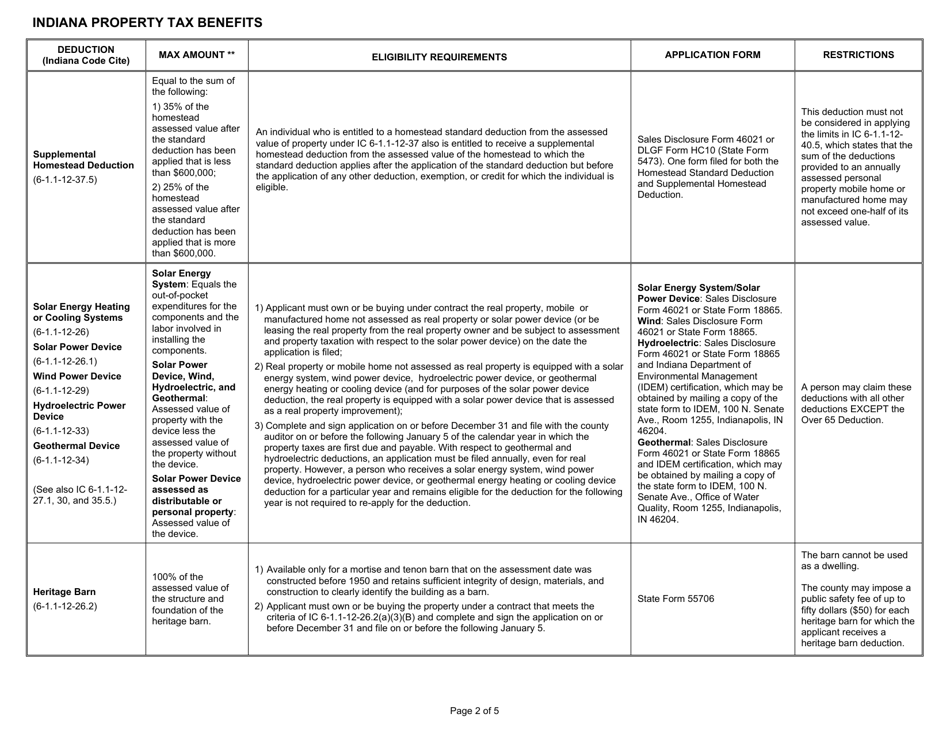

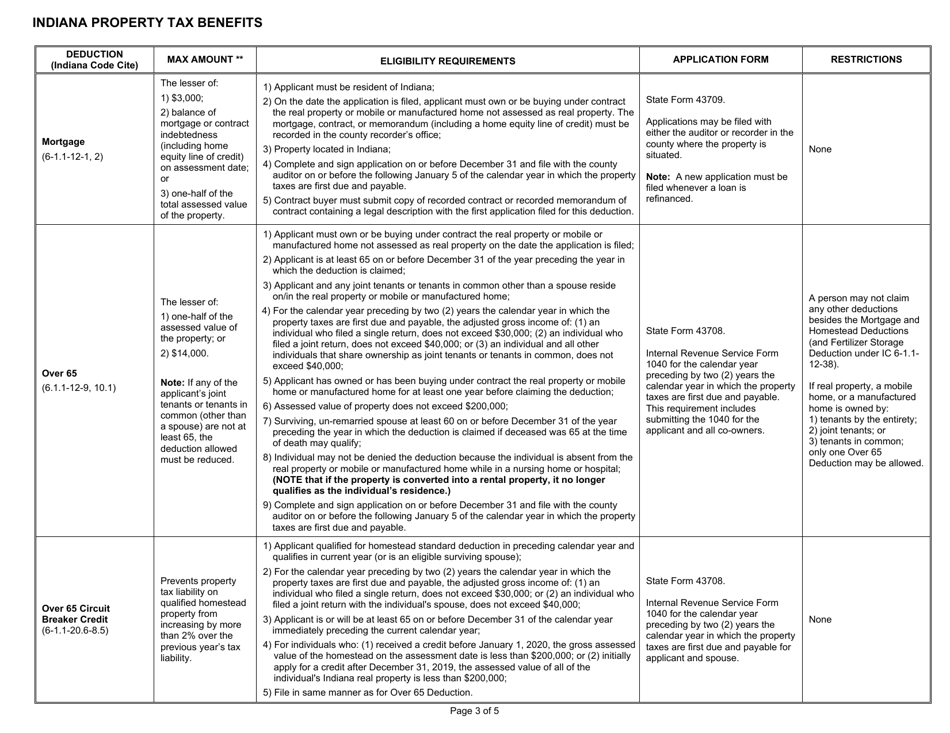

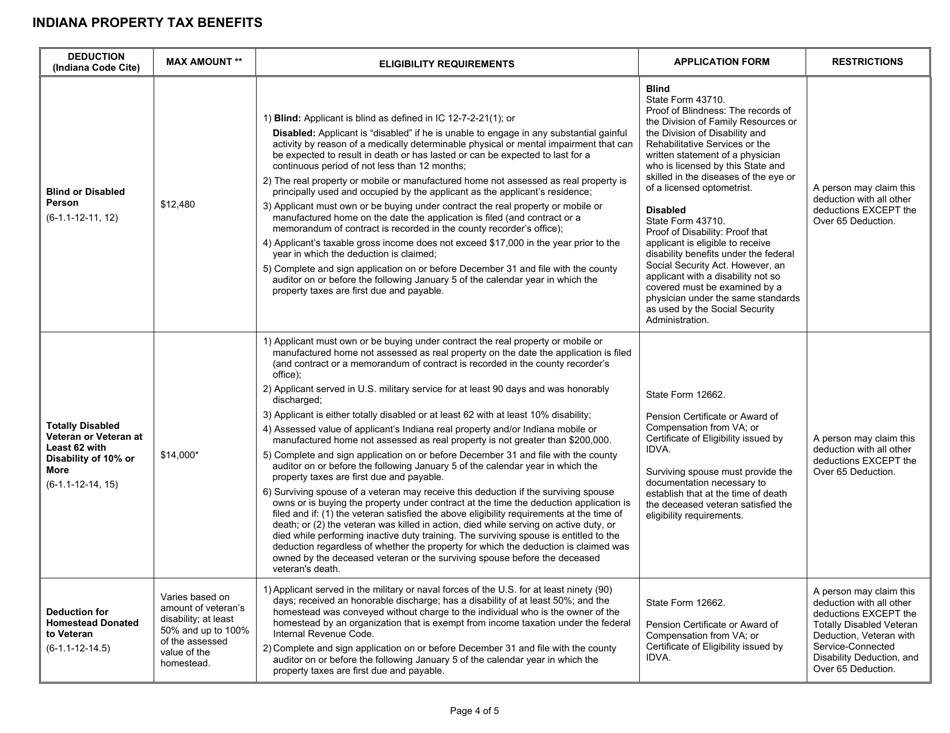

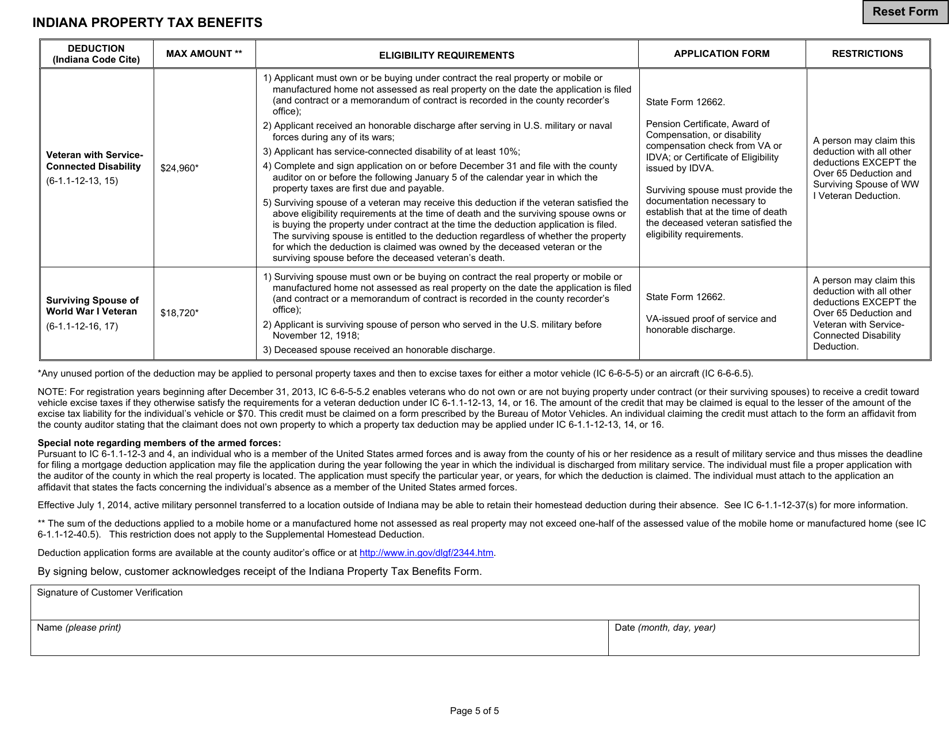

Q: What is State Form 51781?

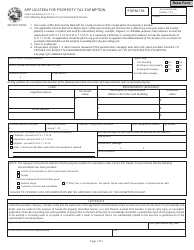

A: State Form 51781 is a form used in Indiana to apply for property tax benefits.

Q: What are property tax benefits in Indiana?

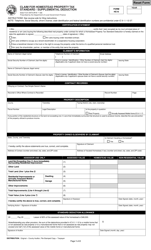

A: Property tax benefits in Indiana refer to various tax exemptions and deductions available to homeowners.

Q: Who is eligible for property tax benefits in Indiana?

A: Eligibility for property tax benefits in Indiana depends on factors such as age, income, and disability status.

Q: How do I apply for property tax benefits in Indiana?

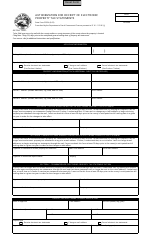

A: You can apply for property tax benefits in Indiana by filling out State Form 51781 and submitting it to the appropriate tax department.

Q: What are some examples of property tax benefits in Indiana?

A: Examples of property tax benefits in Indiana include the Homestead Credit, Mortgage Deduction, and Senior Citizen Property Tax Deduction.

Q: How much money can I save with property tax benefits in Indiana?

A: The amount of money you can save with property tax benefits in Indiana varies depending on factors such as your property value and tax rate.

Q: Are property tax benefits available in other states?

A: Yes, property tax benefits may be available in other states as well. Each state has its own eligibility requirements and programs.

Q: Are property tax benefits retroactive in Indiana?

A: No, property tax benefits in Indiana are generally not retroactive. They typically apply only to future property tax bills.

Q: Can I appeal if my property tax benefits application is denied?

A: Yes, you can appeal if your property tax benefits application is denied. Contact the tax department for more information on the appeals process.

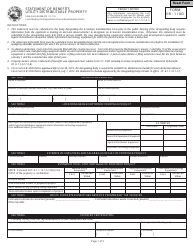

Form Details:

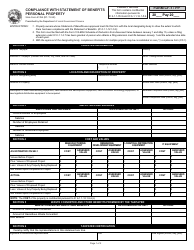

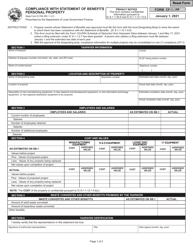

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51781 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.