This version of the form is not currently in use and is provided for reference only. Download this version of

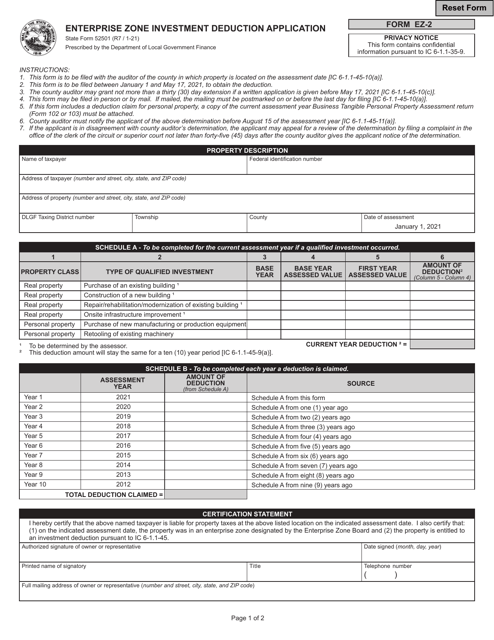

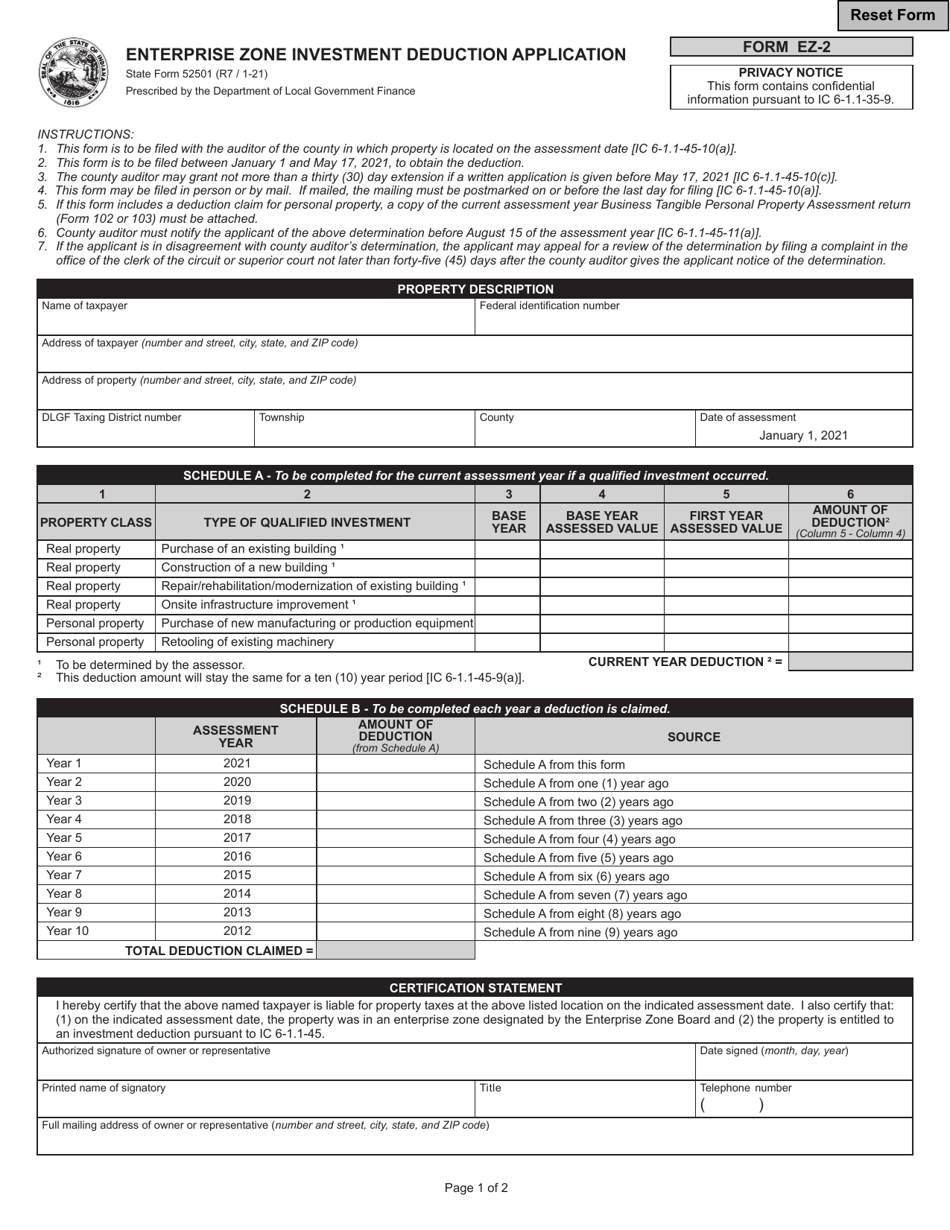

State Form 52501 (EZ-2)

for the current year.

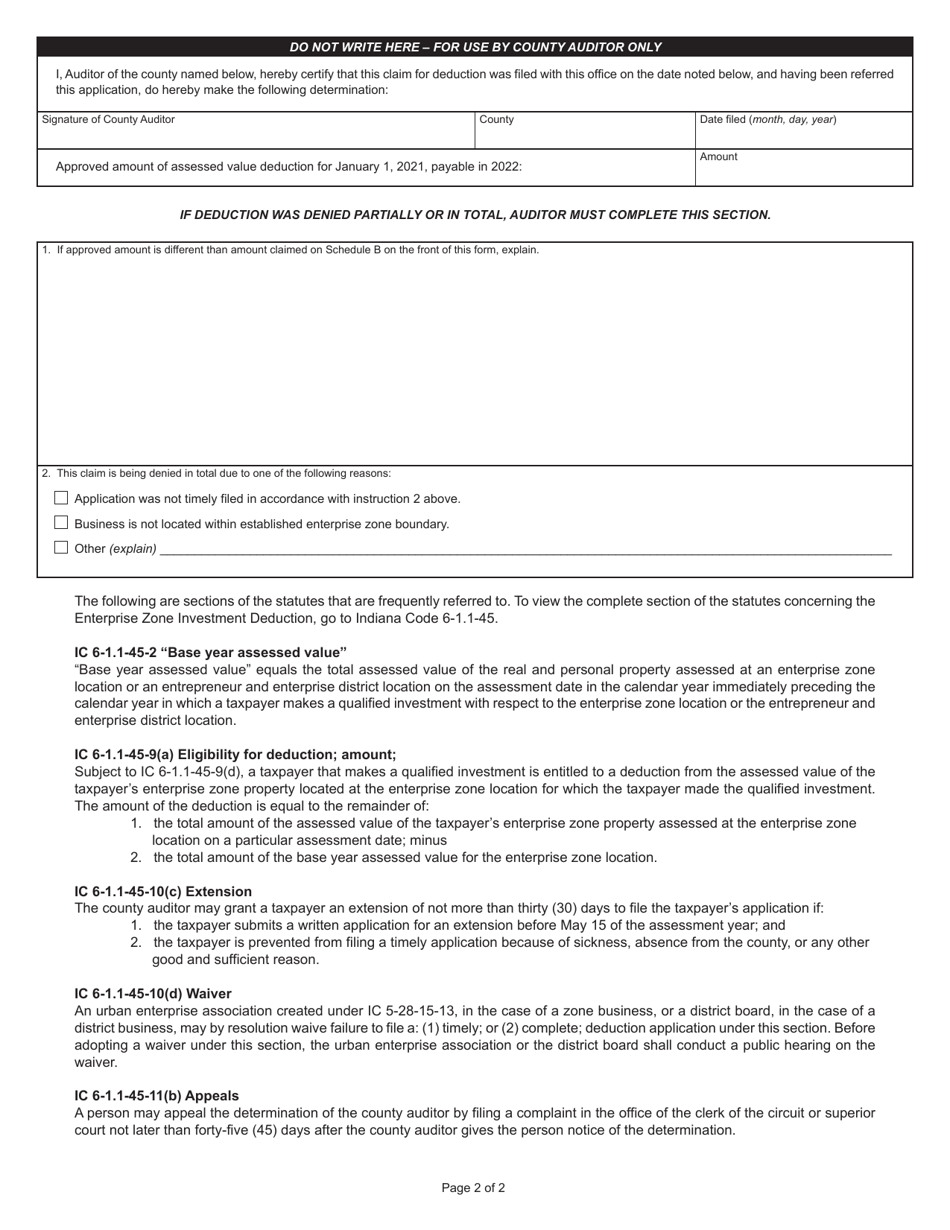

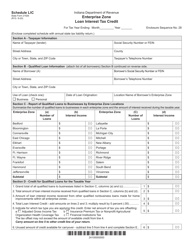

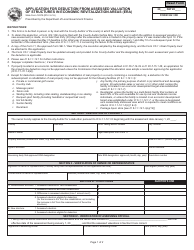

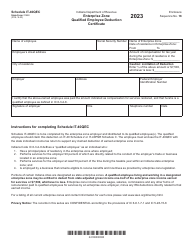

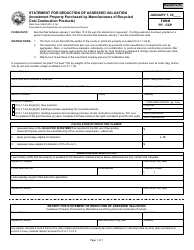

State Form 52501 (EZ-2) Enterprise Zone Investment Deduction Application - Indiana

What Is State Form 52501 (EZ-2)?

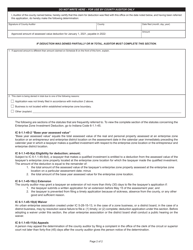

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52501 (EZ-2)?

A: State Form 52501 (EZ-2) is the Enterprise Zone Investment Deduction Application in Indiana.

Q: What is the purpose of State Form 52501 (EZ-2)?

A: The purpose of State Form 52501 (EZ-2) is to apply for the Enterprise Zone Investment Deduction in Indiana.

Q: What is the Enterprise Zone Investment Deduction?

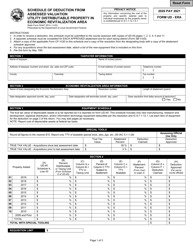

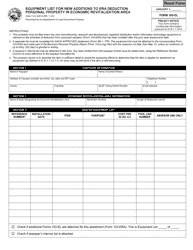

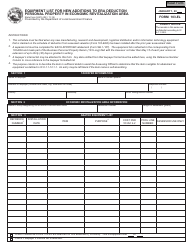

A: The Enterprise Zone Investment Deduction is a tax deduction available to businesses that make qualified investments in designated enterprise zones.

Q: Who is eligible to apply for the Enterprise Zone Investment Deduction?

A: Businesses that make qualified investments in designated enterprise zones are eligible to apply for the Enterprise Zone Investment Deduction.

Q: Are there any deadlines for submitting State Form 52501 (EZ-2)?

A: Yes, the deadline for submitting State Form 52501 (EZ-2) is usually determined by the Indiana Department of Revenue and can vary each year.

Q: What documentation do I need to submit with State Form 52501 (EZ-2)?

A: You will typically need to submit documentation such as proof of investment, proof of eligibility for the enterprise zone, and any other supporting documents as required by the Indiana Department of Revenue.

Q: Is there a fee for submitting State Form 52501 (EZ-2)?

A: No, there is typically no fee for submitting State Form 52501 (EZ-2). However, you may be required to pay any applicable taxes or fees related to the enterprise zone investment.

Q: What should I do if I need assistance with State Form 52501 (EZ-2)?

A: If you need assistance with State Form 52501 (EZ-2), you can contact the Indiana Department of Revenue's customer service for guidance and support.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52501 (EZ-2) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.