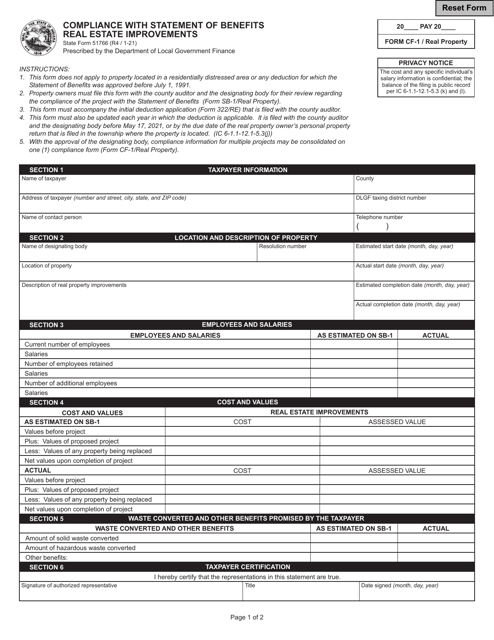

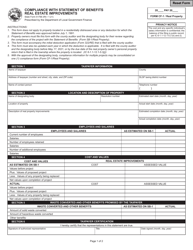

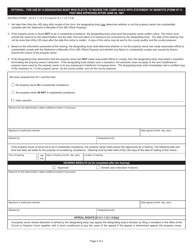

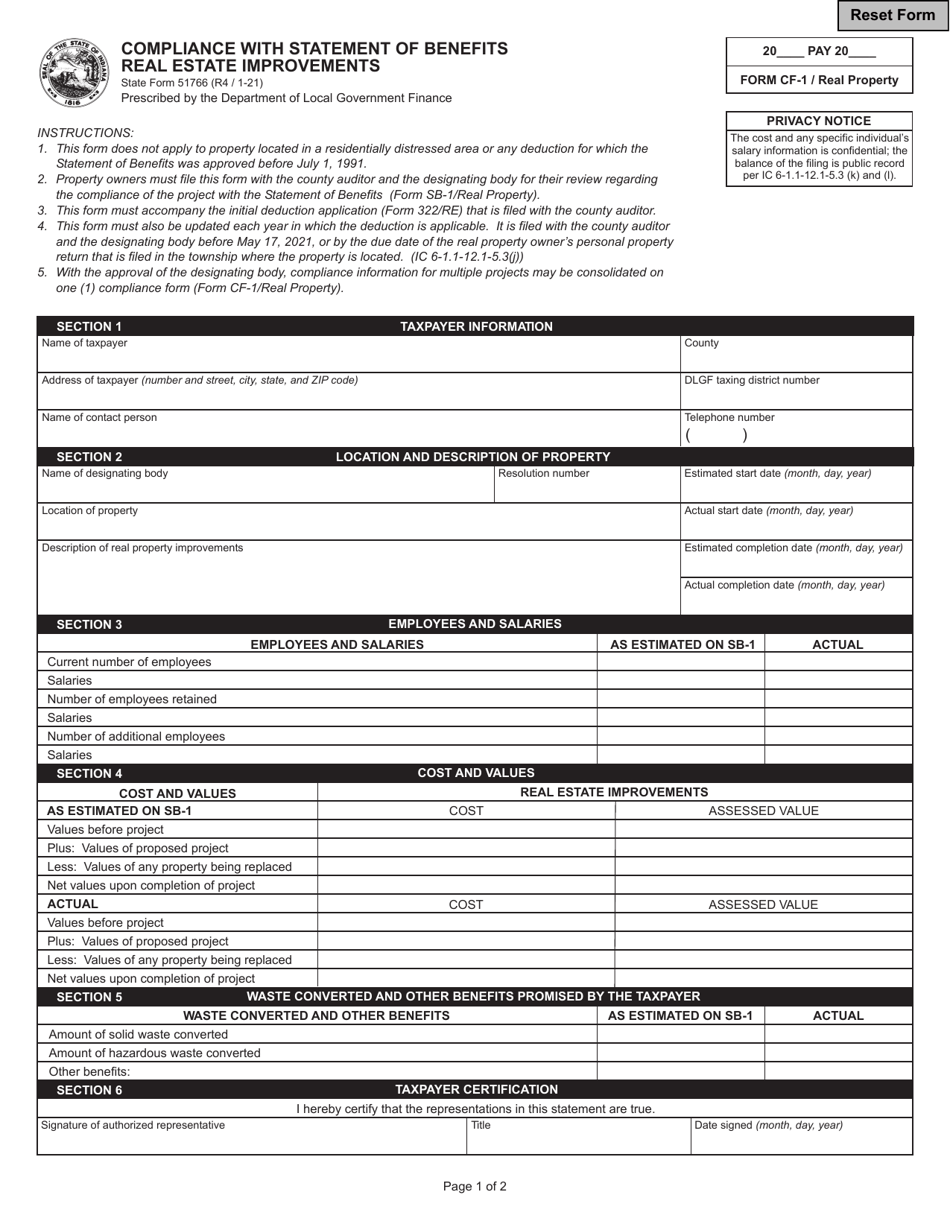

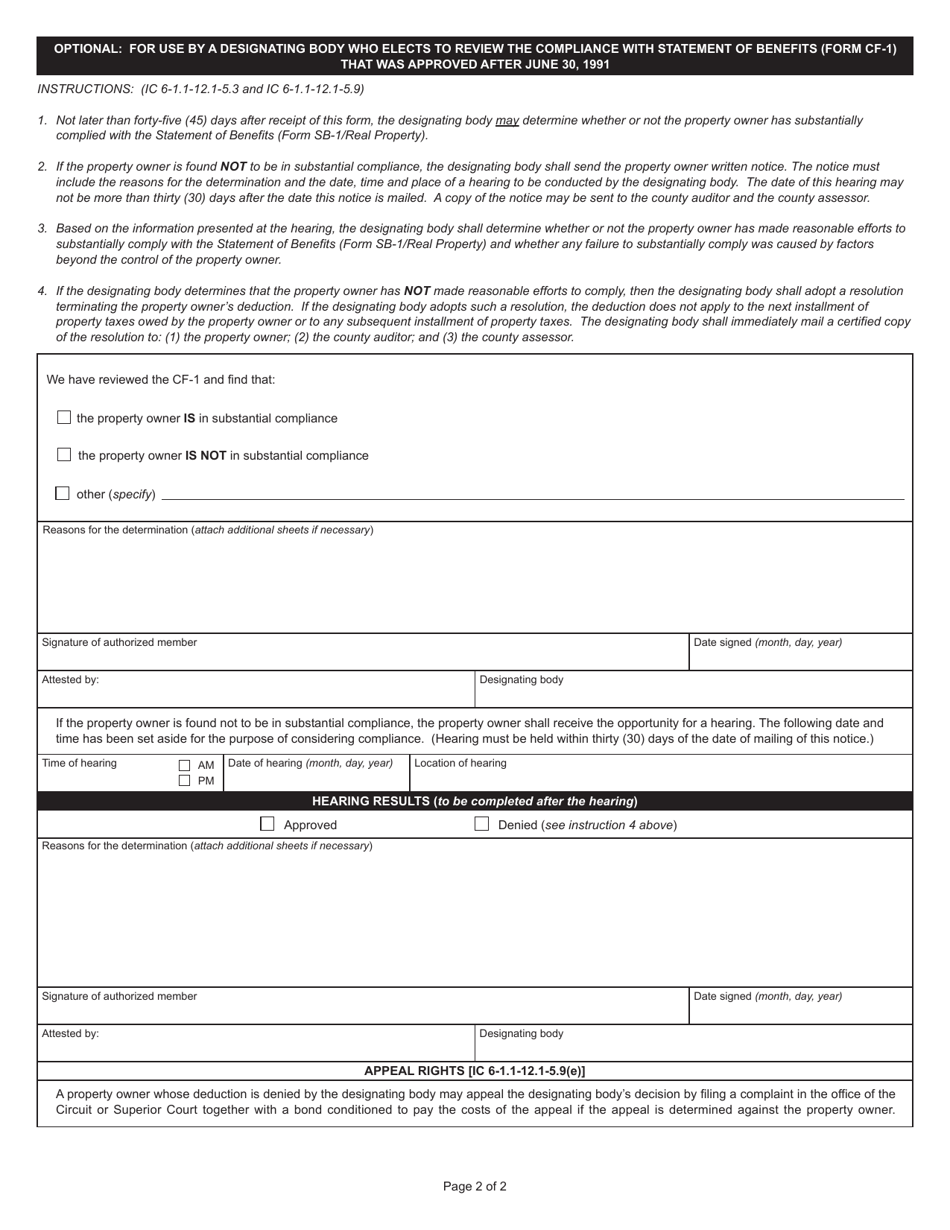

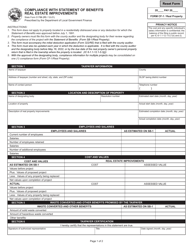

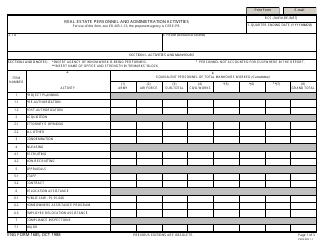

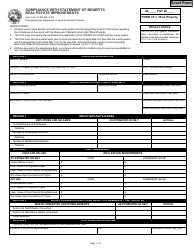

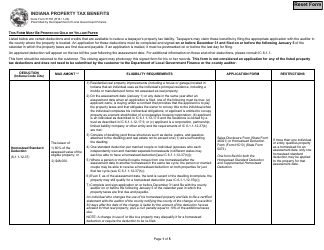

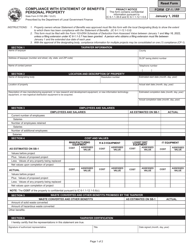

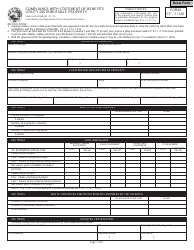

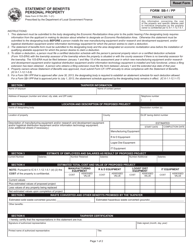

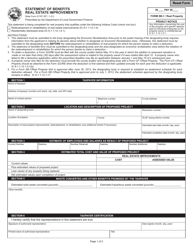

State Form 51766 (CF-1) Compliance With Statement of Benefits Real Estate Improvements - Indiana

What Is State Form 51766 (CF-1)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51766 (CF-1)?

A: State Form 51766 (CF-1) is a compliance form used in Indiana.

Q: What does State Form 51766 (CF-1) measure compliance with?

A: State Form 51766 (CF-1) measures compliance with the Statement of Benefits Real Estate Improvements in Indiana.

Q: Who is required to complete State Form 51766 (CF-1)?

A: Individuals or businesses who have made real estate improvements in Indiana are required to complete State Form 51766 (CF-1).

Q: What is the purpose of State Form 51766 (CF-1)?

A: The purpose of State Form 51766 (CF-1) is to ensure compliance with the Statement of Benefits Real Estate Improvements in Indiana.

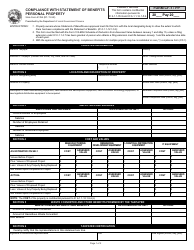

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51766 (CF-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.