This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 21366 (11)

for the current year.

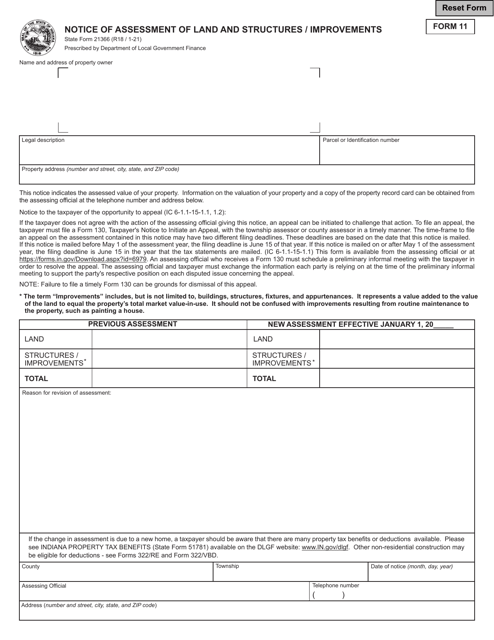

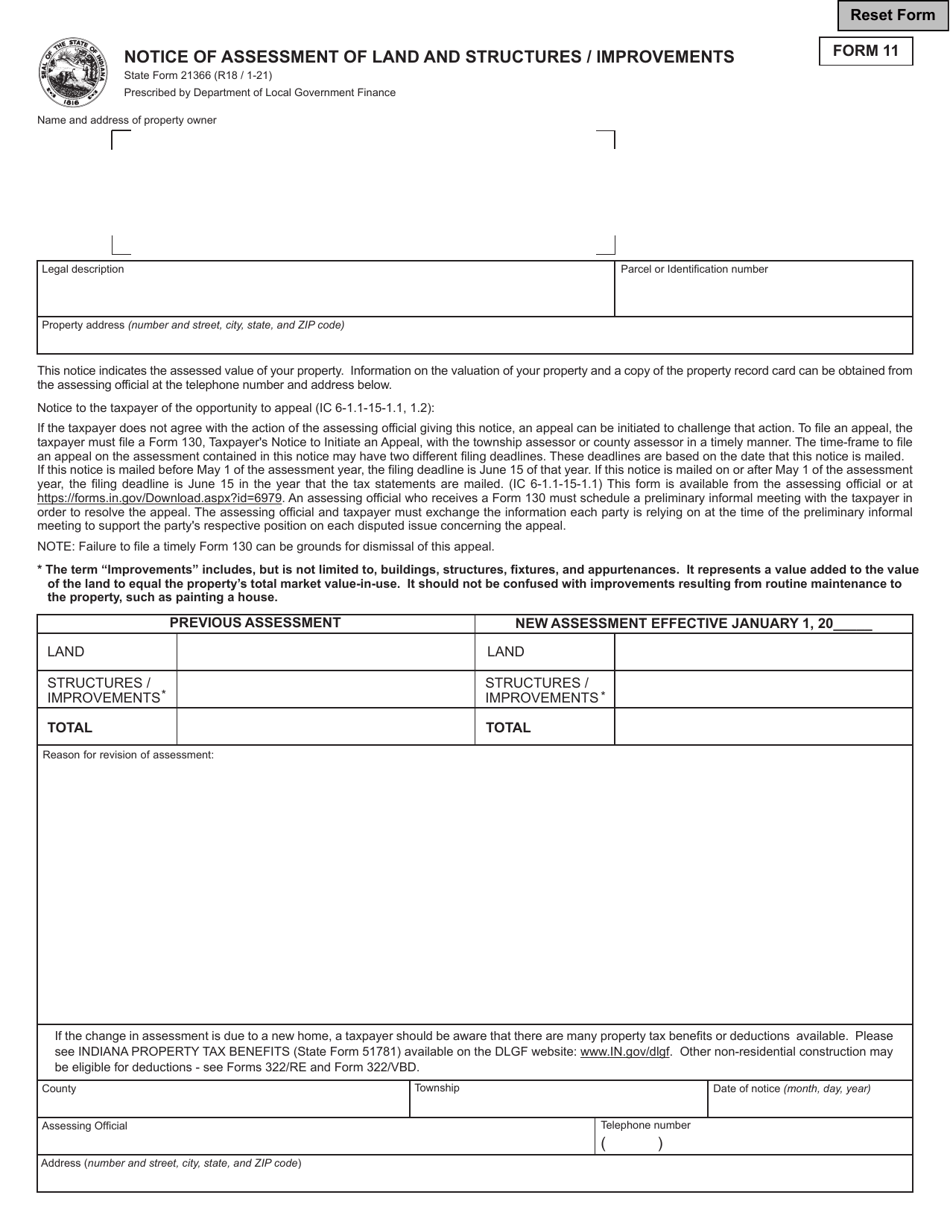

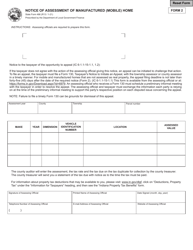

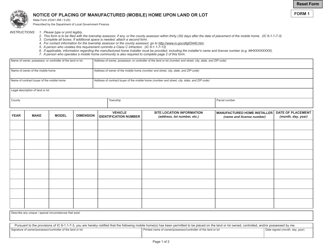

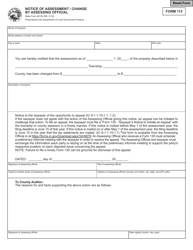

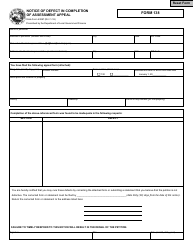

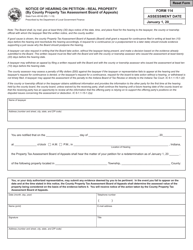

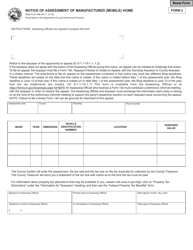

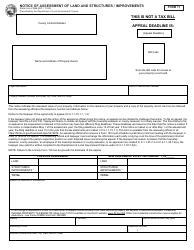

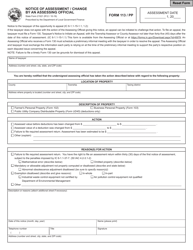

State Form 21366 (11) Notice of Assessment of Land and Structures / Improvements - Indiana

What Is State Form 21366 (11)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 21366 (11)?

A: State Form 21366 (11) is a Notice of Assessment of Land and Structures/Improvements in Indiana.

Q: What is the purpose of State Form 21366 (11)?

A: The purpose of State Form 21366 (11) is to inform property owners about the assessed value of their land and any structures/improvements on the property.

Q: Who receives State Form 21366 (11)?

A: Property owners in Indiana receive State Form 21366 (11) to notify them of the assessed value of their land and structures/improvements.

Q: What information is included in State Form 21366 (11)?

A: State Form 21366 (11) includes information such as the property owner's name, property address, assessed value of the land, assessed value of structures/improvements, and any exemptions or deductions.

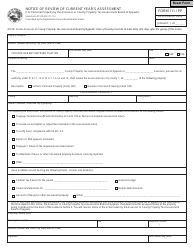

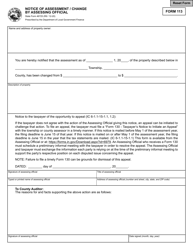

Q: Do property owners need to take action upon receiving State Form 21366 (11)?

A: Property owners do not need to take immediate action upon receiving State Form 21366 (11). However, they should review the assessed values and exemptions/deductions to ensure accuracy.

Q: What should property owners do if they disagree with the assessed values on State Form 21366 (11)?

A: If property owners disagree with the assessed values on State Form 21366 (11), they can file an appeal with the county's Property Tax Assessment Board of Appeals (PTABOA).

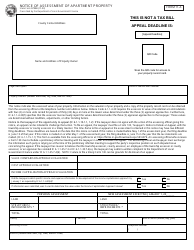

Q: When is State Form 21366 (11) typically sent to property owners?

A: State Form 21366 (11) is typically sent to property owners in Indiana in the early part of the year, before the tax assessment period.

Q: Is State Form 21366 (11) the same as a property tax bill?

A: No, State Form 21366 (11) is not the same as a property tax bill. It is a notice of assessment that informs property owners about the assessed values of their land and structures/improvements.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 21366 (11) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.