This version of the form is not currently in use and is provided for reference only. Download this version of

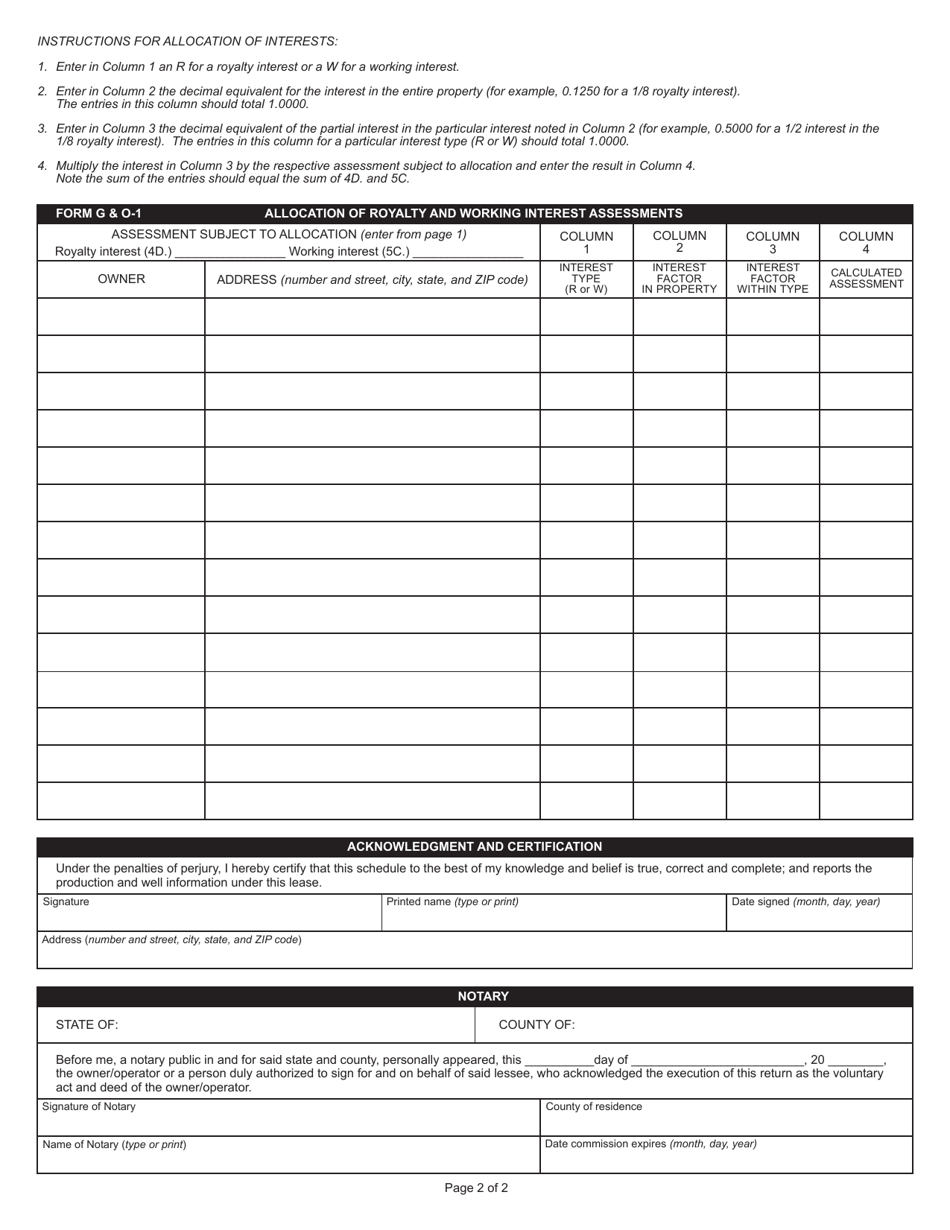

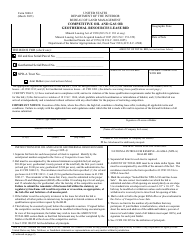

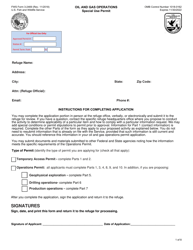

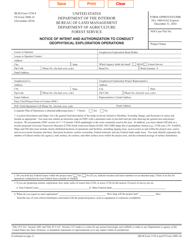

State Form 9931 (G & O-1)

for the current year.

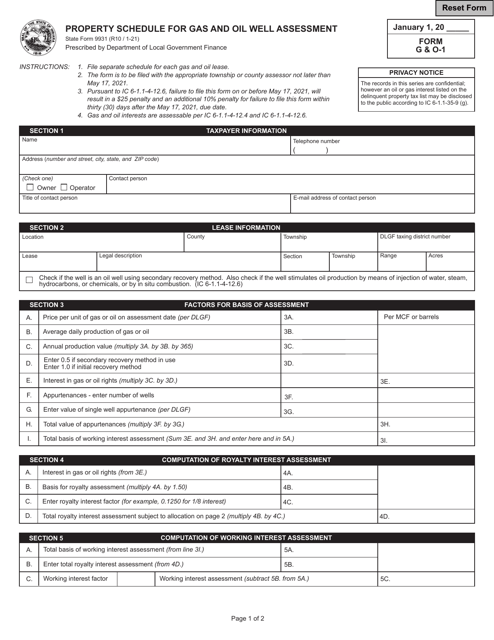

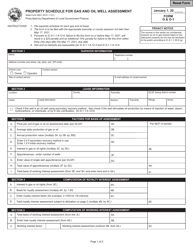

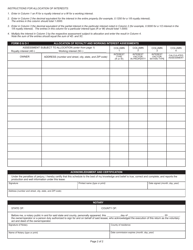

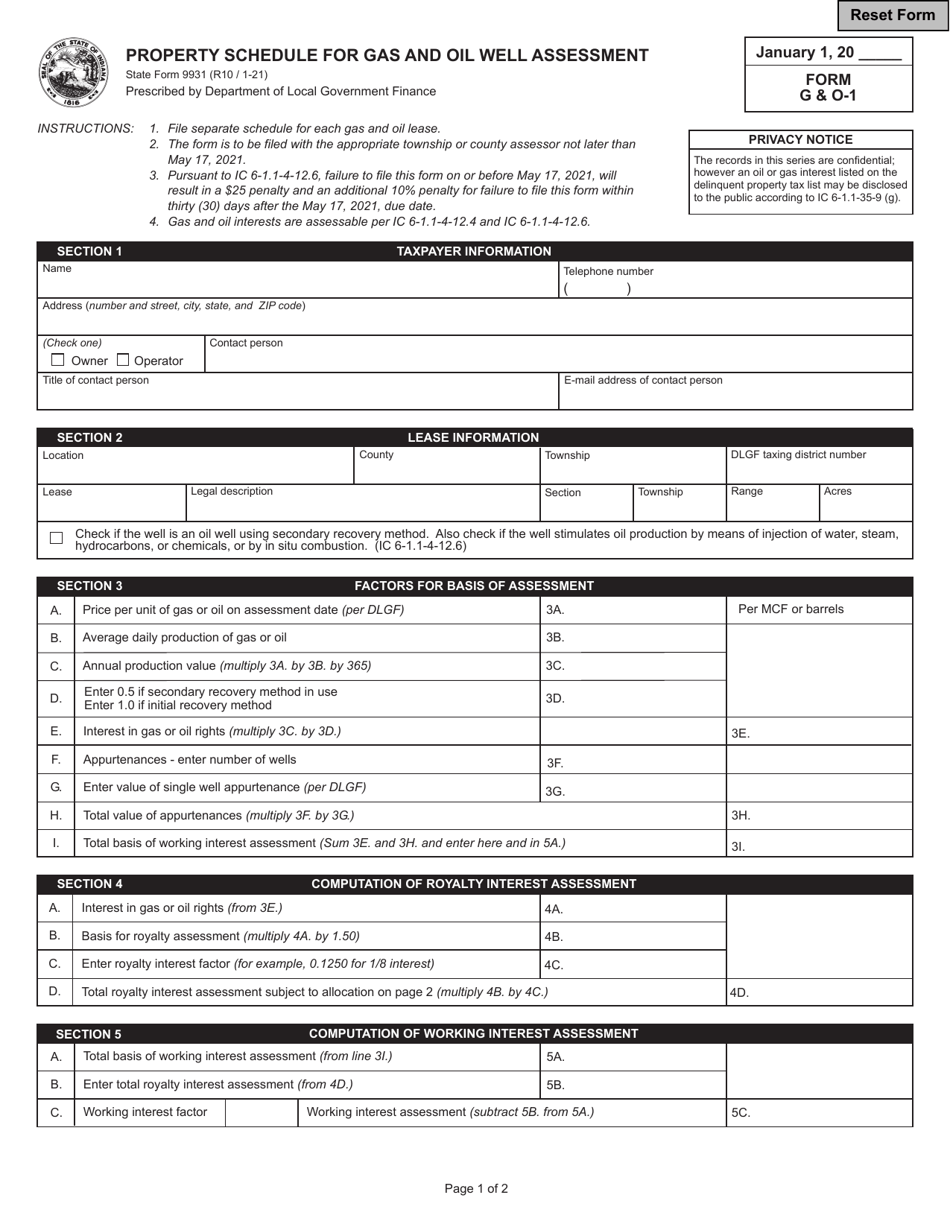

State Form 9931 (G & O-1) Property Schedule for Gas and Oil Well Assessment - Indiana

What Is State Form 9931 (G & O-1)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 9931?

A: State Form 9931 is the Property Schedule for Gas and Oil Well Assessment in Indiana.

Q: What is the purpose of State Form 9931?

A: The purpose of State Form 9931 is to assess the property value of gas and oil wells in Indiana.

Q: Who is required to fill out State Form 9931?

A: Anyone who owns or operates gas and oil wells in Indiana is required to fill out State Form 9931.

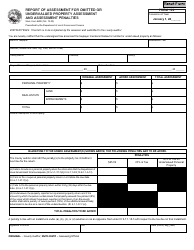

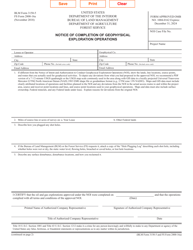

Q: What information is required on State Form 9931?

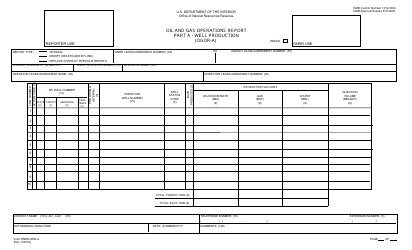

A: State Form 9931 requires information such as well location, production data, and equipment details.

Q: When is State Form 9931 due?

A: State Form 9931 is due on or before May 16th of each year.

Q: What happens if I don't file State Form 9931?

A: Failure to file State Form 9931 may result in penalties or fines.

Q: Are there any exemptions or deductions available for gas and oil wells?

A: Yes, there are certain exemptions and deductions available for gas and oil wells in Indiana. It is recommended to consult with a tax professional or the county assessor for more information.

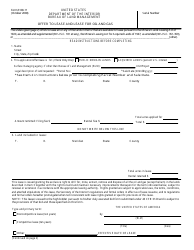

Q: Can I make changes to State Form 9931 after submitting?

A: Once State Form 9931 is submitted, changes can only be made by filing an amended form with the county assessor.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 9931 (G & O-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.