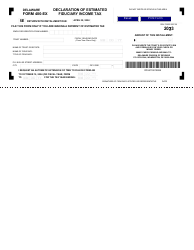

This version of the form is not currently in use and is provided for reference only. Download this version of

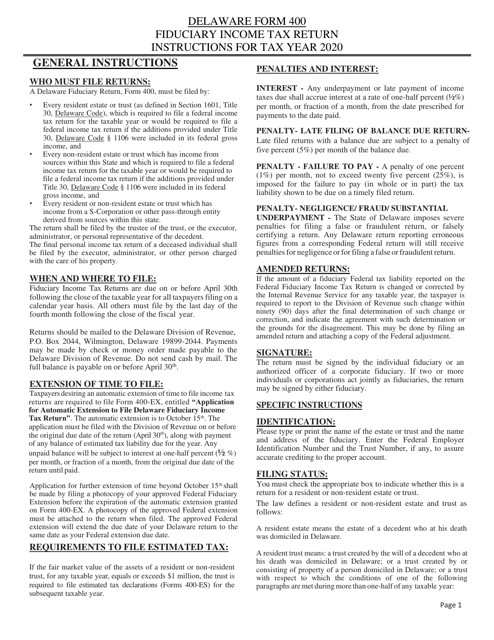

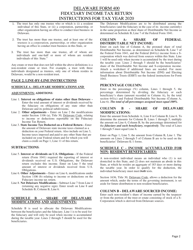

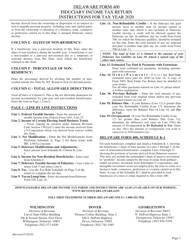

Instructions for Form 400

for the current year.

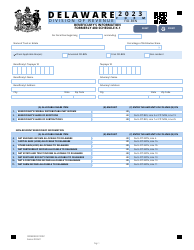

Instructions for Form 400 Delaware Fiduciary Income Tax Return - Delaware

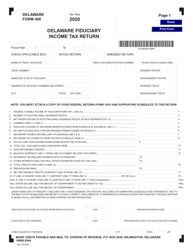

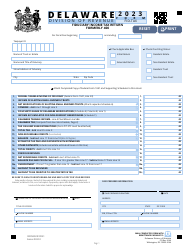

This document contains official instructions for Form 400 , Delaware Fiduciary Income Tax Return - a form released and collected by the Delaware Department of Finance - Division of Revenue. An up-to-date fillable Form 400 is available for download through this link.

FAQ

Q: What is Form 400?

A: Form 400 is the Delaware Fiduciary Income Tax Return.

Q: Who needs to file Form 400?

A: Any individual or business entity that is acting as a fiduciary and has Delaware source income must file Form 400.

Q: What is a fiduciary?

A: A fiduciary is a trustee, executor, administrator, or any person or entity that holds or manages property on behalf of another.

Q: What is Delaware source income?

A: Delaware source income includes income from sources within the state, such as rental income from Delaware properties or income generated from a Delaware business.

Q: When is Form 400 due?

A: Form 400 is due on or before April 30th of the year following the tax year.

Q: Is there a filing fee for Form 400?

A: Yes, there is a $75 filing fee for Form 400.

Q: What happens if Form 400 is filed late?

A: If Form 400 is filed late, penalties and interest may be assessed on any unpaid tax.

Q: Are there any additional forms or schedules that need to be included with Form 400?

A: Yes, depending on the specific circumstances, additional forms and schedules may need to be included with Form 400. It is recommended to review the instructions for Form 400 to determine which additional forms and schedules may be required.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.